TLDR: Despite warnings from China of a military response and Joe Biden’s advice that she not go, Nancy Pelosi was confirmed overnight to be planning to visit Taiwan on Wednesday.

Also, recessionary winds kept blowing through the global economy overnight, with weaker factory output reported in the United States, Europe and the United Kingdom overnight, along with a cratering of German retail sales.

But there was good news on the food and energy inflation front with Ukraine’s first grain shipment leaving its Black Sea port since Russia invaded in February and crude prices falling 3-4% overnight on the growing talk of less demand in recessions. And in European financial markets, fear about Italy’s debt receded somewhat as it became clear a far-right party likely to be in Government would abide by fiscal rules.

Paid subscribers can see more detail and analysis below the paywall fold and in the podcast above.

Nancy decides to go there

Various news outlets reported this morning that US Speaker of the House of Representatives, Nancy Pelosi, will visit Taiwan’s President Tsai Ing-wen in Taipei on Wednesday, risking the wrath of China’s military, which is conducting live firing drills in Taiwan Strait and has threatened to act if she goes.

China’s ‘wolf warrior’ diplomat Zhao Lijian said the visit of the third-ranked US leader to Taiwan would “lead to egregious political impact.”

"We would like to tell the United States once again that China is standing by and the Chinese People's Liberation Army will never sit idly by, and that China will take resolute responses and strong countermeasures to defend its sovereignty and territorial integrity." China’s Foreign Office Spokesman Zhao Lijian via Xinhua

Recessionary winds gather

Purchasing Manager Indices out overnight from surveys of factories in the United States, Europe, Asia and the UK in July show output and orders slowing across most of the global economy.

The US Institute of Supply Management reported its overall index fell to 52.8 in July from 53 in June, which was its lowest reading since June 2020, although any reading above 50 indicates factory output is still expanding. However new orders fell for the second consecutive month. The Euro zone’s PMI fell below 50 in July for the first time since June 2020. Reuters

Elsewhere, German retail sales fell in the first half of 2022 by the most in nearly 30 years . Real retail sales were down 8.8% in June from a year ago, which was also worse than economists’ expectations for a fall of about 8%. Reuters

When bad news is good news

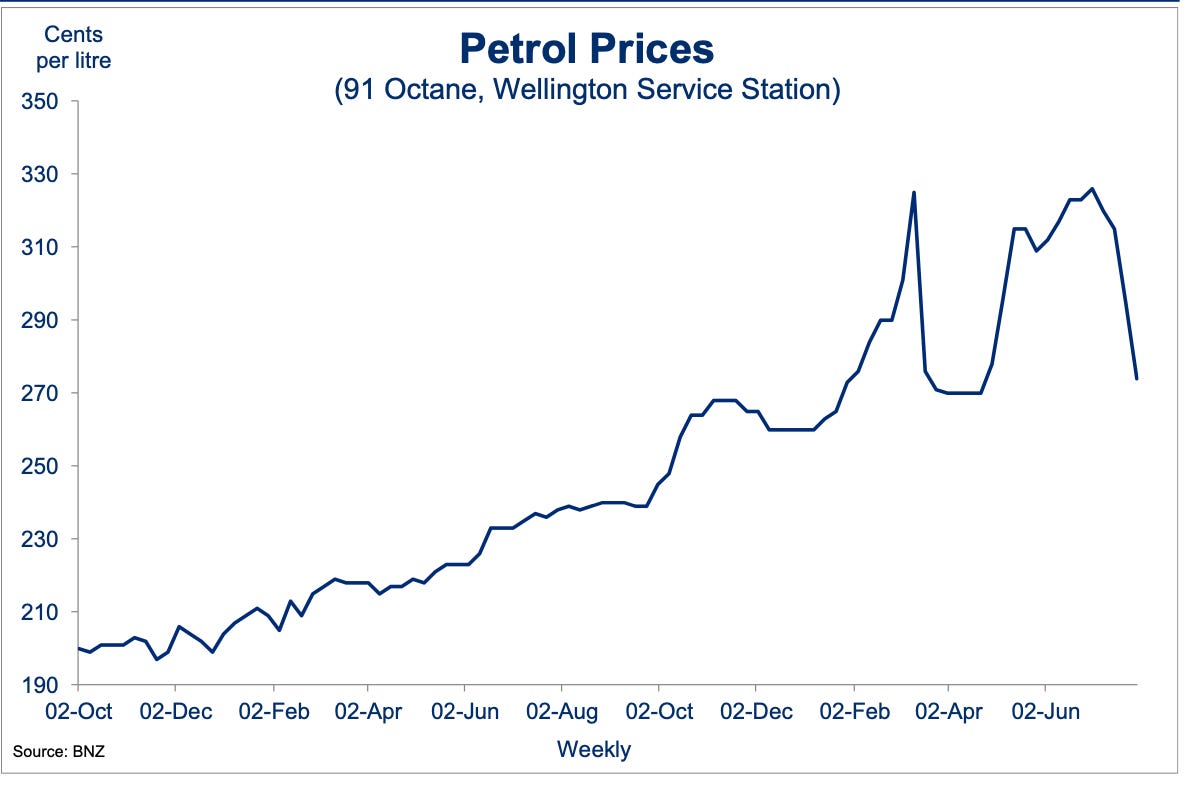

However, all the talk of recession was good news for buyers of petrol and diesel. Oil prices fell 4-5% overnight, with West Texas Intermediate down 5% to just under US$94/barrel and Brent crude down 4% to US$100/barrel.

These falls in crude prices and the removal of a temporary rise in profit margins here in Aotearoa-NZ has seen petrol prices drop sharply in recent days, although the fuel tax levy cuts introduced ‘temporarily’ have been extended into next year.

These signs of lower commodity prices have also allowed longer-term wholesale interest rates to ease, including the US 10 year Treasury yield falling a further five basis points overnight to a four-month low of 2.59%.

European interest rates also fell. The yield on Italy’s 10-year debt fell below 3.0% for the first time since May after Giorgia Meloni, who heads the right-wing Brothers of Italy party and may become Prime Minister, said she would comply with EU budget rules. The key spread between Italian and German bonds, which measures fear of Italian default, fell to 220 basis points.

Better news on food inflation too

Food supply fears may also be about to ease. A grain shipment left the port of Odessa overnight as part of a deal to resume movements of bulk grain from Black Sea ports in an effort to reverse higher food prices in the Middle East and Africa. The Razoni, carrying 26,000 tonnes of Ukrainian corn, embarked early this morning NZ Time after weeks of negotiations brokered by Turkey and the UN.

It was the first shipment from Odessa since Russia invaded Ukraine in late February.

Chart of the day

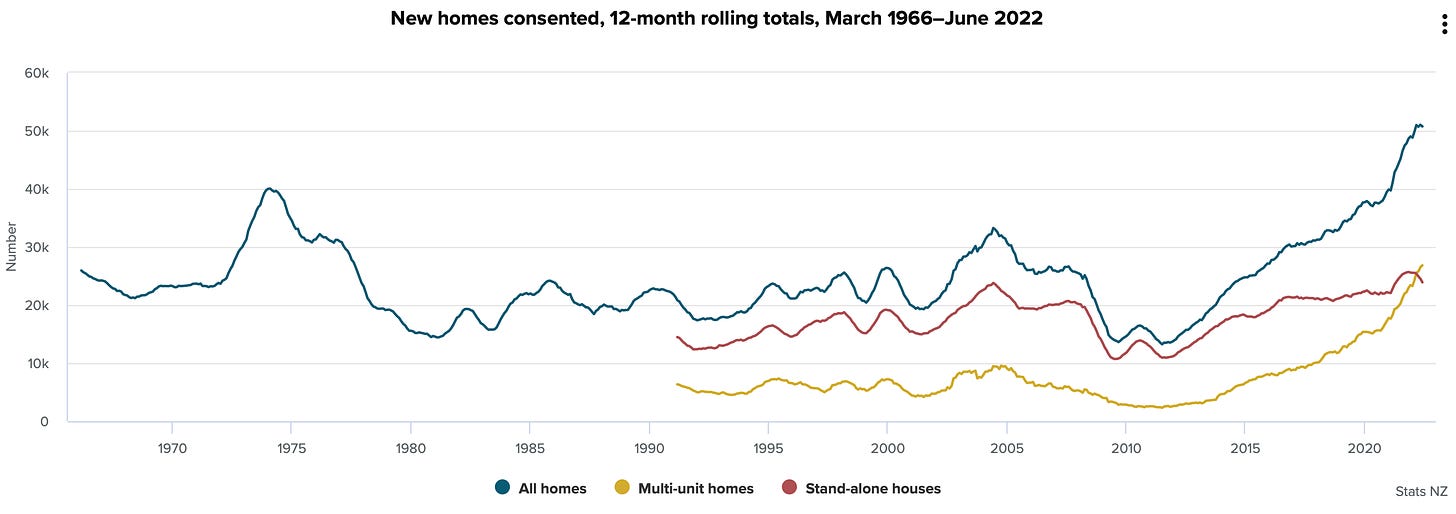

More units than standalone homes

Statistics NZ yesterday reported building consent figures for the year to the end of June, including the first ever June-year total where consents for units, townhouses and apartments were greater than for stand-alone homes.

There were 26,823 multi-unit homes consented in the year ended June 2022, up 36% from the year ended June 2021, while there were 23,913 stand-alone houses consented, down 3% from a year ago.

Number of the day

Not back to 1973 highs yet

9.9 per thousand - Also in the Statistics NZ report, the number of dwellings consented per 1,000 residents across New Zealand was 9.9 for the year ended June 2022, compared with 8.7 in the year ended June 2021. The record number of new dwellings consented per 1,000 residents was 13.4 in the year ended December 1973.

Quote of the day

Chris Bishop vs NIMBY protestors in Auckland on Sunday.

“I became a father a month ago, and I don’t want my son to grow up in a country and turn 30 in a country where the average house is not $1 million, but $2m, and he doesn’t have any hope of getting on to the housing ladder.” National’s Housing Spokesman Chris Bishop to a rally in Auckland on Sunday, via Stuff.

Some fun things

Ka kite ano

Bernard

Pelosi to visit Taiwan