TLDR: This week in the news in geo-politics, the global economy and Aotearoa-NZ’s political economy:

Te Pūtea Matua (The Reserve Bank) hiked its interest rates again to control inflation (Thursday’s email);

the Government revealed a robust set of accounts that will allow room for competing tax cut offers in next year’s election (Thursday’s email);

local elections came to a close with a revolt against the Government brewing (Interviews with Efeso Collins and Simon Wilson);

TOP proposed a residential land tax to pay for income tax cuts for low to middle income earners (Interview with Raf Manji)

An increasingly-desperate Vladimir Putin faces growing opposition at home and more defeats on the battlefield in Ukraine; and,

the IMF and UNCTAD warned about a slowing of global economic growth, especially in developing economies, because of the rapid and concerted tightenings of monetary policy led by the US Federal Reserve (Friday’s email).

We recorded the podcast above from the weekly ‘hoon’ webinar we do for paying subscribers every Friday evening at 5pm for an hour. This week co-host Peter Bale and myself talked about the local elections, flawed plans to merge TVNZ and RNZ and the potential for tax cuts next year.

We talked in the second half of the show with regular guest, University of Otago Foreign Relations Professor Robert Patman about the situation in Ukraine, the risk Putin might use tactical nuclear weapons and Saudi Arabia’s defiance of the United States by promising (along with Russia) to cut oil output.

Five things this week

These are the five key bits of news and analysis this week that may not have crossed your radar and I thought was important, given in my focus on the issues of improving housing affordability, reducing climate emissions and reducing child poverty. I welcome the support of paying subscribers to allow me to do this work, and to share it publicly after paying subscribers see it first.

Te Pūtea Matua may hike 75 bps to 4.25% on Nov 23

Deep in the notes from the Monetary Policy Committee’s commentary with the statement on this week’s fifth consecutive 50 basis point hike in the Official Cash Rate to 3.5%, Te Pūtea Matua said the committee considered putting up the OCR by 75 basis points, which would really have thrown the cat into the mortgage rate pigeons. It argued this was partly because mortgage rates had yet to rise in line with wholesale rates (swaps rates) and it wondered if the tightening therefore needed a hurry up.

In the end, the committee decided against 75 basis points, in part because it thought the banks would get around to putting up mortgage rates more.

“The Committee expects that higher wholesale interest rates will be reflected in higher retail interest rates, particularly deposit rates, as banks compete for funding.” MPC

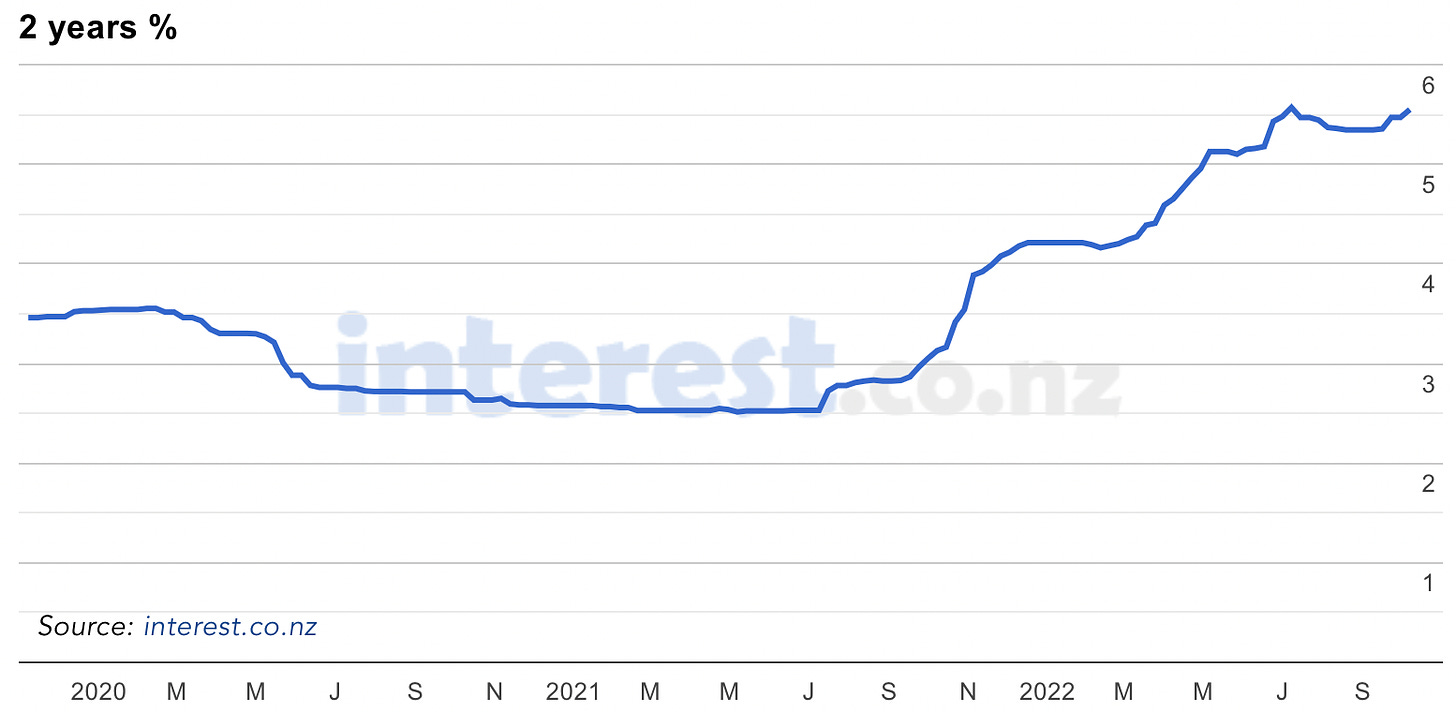

Here’s the chart for the two year swap rate, which has risen by 350 basis points from 1.25% before Covid to 4.75% now. In theory, that should have meant average two-year mortgage rates should have risen from 3.5% pre-Covid to 7% now, all other things being equal, including profit margins.

Instead, what we’ve seen is the average two-year mortgage rate has risen from 3.5% pre-covid to 5.5%, although it has risen 300 basis points from its post-covid low of around 2.5%.

Some of those average figures disguise the discounted rates that banks offer so the 7% estimate of where they ‘should’ be may not include the loss-leader discounts the banks include.

So what? - My suspicion is the Reserve Bank wants to see the banks give up some of those discounts and put the mortgage rates up to around 6% from 5.5% now. We’ll find out more on November 23 when the last full Monetary Policy Statement of the year (and the last monetary policy decision) comes out. If the banks have not put their ‘specials’ up closer to 6% by then, that may encourage the Reserve Bank to do a final 75 basis point hike for the year to 4.25%, given the next decision after that is not until February 22.

The bottom line - Brace for a 75 basis point hike on November 23 if inflation is still running hot and the banks have not nudged their retail mortgage rates up much. We’ll find out more about inflation on October 18 (the Tuesday after next) when the September Quarter CPI comes out.

The young are deserting Labour and going to ACT & TOP

The Roy Morgan opinion poll is the only long-running and truly regular monthly public poll but is not promoted or attached to a media outlet or interest group so doesn’t get much publicity. Some others also think it’s an inferior poll to the 1News-Kantar, Newshub-Reid Research, Talbot Mills (for corporate clients and Labour) and Curia-Taxpayers Union polls. The television-sponsored polls are irregular and depend on the whims and budgets of newsrooms. The monthly Talbot Mills poll is not regularly leaked and the Curia poll has not been available publicly and monthly for long. The Roy Morgan poll’s methodology is standard, but its commentary release is written from Australia and often jars, which undermines its credibility. Its numbers though are as good or bad as the others, in my view.

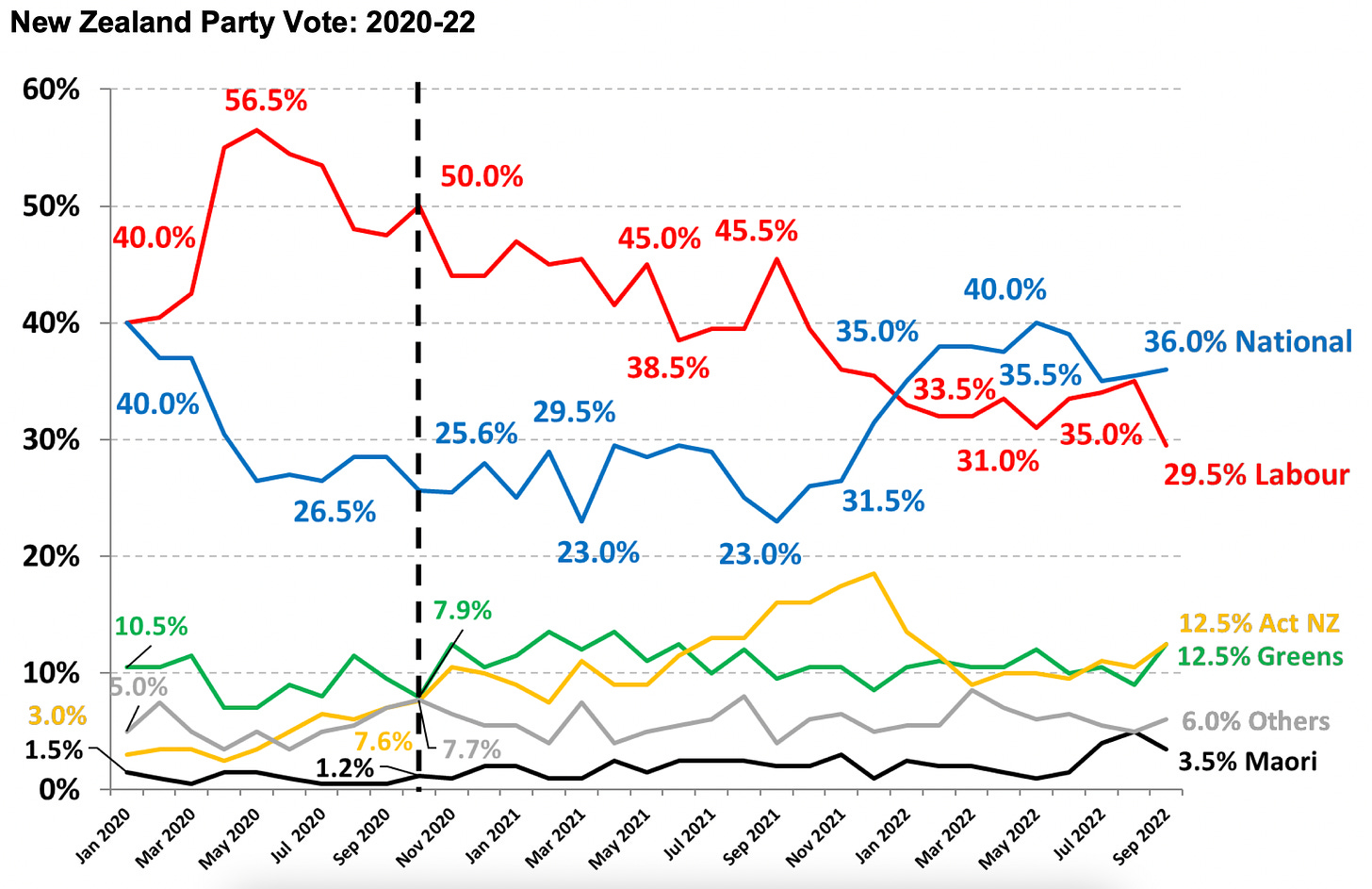

This week Roy Morgan released its September poll of 942 electors taken by landline and mobile phone. It found Labour down 5.5 percentage points to a record-low 29.5% since Labour came to power in 2017. National rose 0.5 points to 36% and ACT rose 2% to 12.5%. The Greens rose 2.5 points to 12.5%. Te Pāti Māori fell 1.5% to 3.5%, while TOP rose 1.5% to 2.5%. On those numbers, National/ACT would be able to govern alone

But the most interesting trend for me was the continued desertion of Labour and National for ACT, Te Pāti Māori and TOP by young men and women. Support for Labour among young women (18-49) fell to 26.5% from 30.5% a month ago and fell for National to 30.5% from 31% a month ago. Support for Labour among young men fell from 30.5% to 27% and fell for National to 25.5% from 35%. Young men increased their support for the Greens to 16% from 9.5%, to 5% from 3.5% for Te Pāti Māori and others (including TOP) to 8% from 4%.

The other thing to watch is whether support for the Government, and therefore Labour, bounces in line with consumer confidence as the summer arrives and passes without more Covid drama, as the economy opens up more and as inflation fades. Consumer and business confidence have bounced in the last couple of months and their may be a lagged effect to boost Labour over the summer.

So what? - TOP/Te Pāti Māori are now regularly polling at 5-6% overall and over 10% for the young. Disillusion with National and Labour’s addiction to untaxed capital gains is beginning to grate among the young, who have much lower home ownership rates.

The bottom line - If TOP leader Raf Manji can win the Christchurch electorate seat of Ilam (where he polled second in 2017 when up against then-National-MP Gerry Brownlee) and drag in one or two more TOP MPs, alongside another three or four Te Pāti Māori MPs, then there is the prospect that TOP and Te Pāti Māori could extract some form of wealth, land or capital gains tax out of Labour or National for either to form a Government.

The bottom bottom line - TOP and Te Pāti Māori need electorate polls done in early 2023 to show they are viable prospects to coat-tail in votes under 5% to win more support from the young who don’t want to ‘waste’ their votes.

The early global inflation indicators are falling fast

We all tend to watch our own inflation figures in the rear-vision mirror, which means here we still think inflation is 7.3%. That was actually four to seven months ago and since then the leading indicators for inflation globally for later this year and early next year are blowing cold as the European and Chinese economies are slowing rapidly because of the Ukraine war, Covid lockdowns and China’s apartment development collapse respectively. The US economy is also slowing.

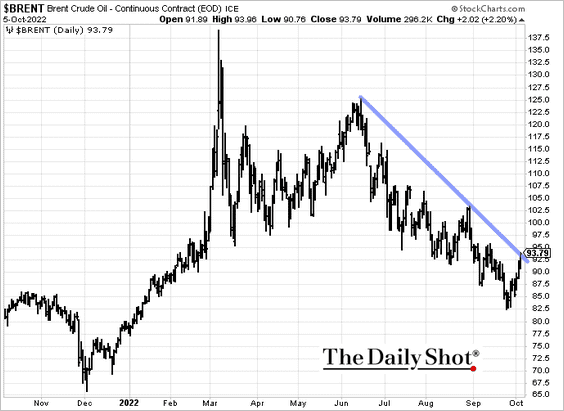

That means shipping costs and input costs for businesses are falling in Europe and the United States. Chinese inflation hasn’t been nearly as high as elsewhere throughout the last year either. Here’s the charts for Brent Crude (down 25% since June) and the Freightos Global Container price index (down 50% since June)

It will take a while for these to feed through, but the chances are rising that inflation will ‘cure itself’ without central banks having to put up their official cash rates much beyond 4.25% in the next three or four months.

Some scenarios for our political economy in the year ahead

So what? - I’m still in Team Transitory and see mortgage rates falling again late next year as the global economy cools and these big energy and shipping costs surges wash out. If National/ACT remain on track to govern alone from September next year onwards, expect the housing market to take off again in late 2023 in expectation of the repealing of Labour’s tax tweaks for landlords and the effects of lower mortgage rates.

The bottom line - Our housing market’s fundamental over-valuation relative to incomes and rents, will remain in place, and potentially worsen again because the fundamental problems of the non-taxation of residential land value appreciation and the under-investment in infrastructure for new housing and public transport would remain unsolved, especially after that potential election result.

Aotearoa-NZ’s political economy would still be little more than a housing market with bits tacked on that embeds a two-tier society split between the landed gentry families of older, Pakeha home owners and the families of younger (and older) Maori and Pasifika renters.

The bottom bottom line - First home buyers shouldn’t wait for more price falls in the ‘bleeding edge’ markets of Auckland and Wellington, and should get in as soon and as much as they can to ensure they get their share of the leveraged and untaxed gains in land values to come.

The even thicker bottom line - Young renters and old owners who want to change that status quo and grow their own families in Aotearoa-NZ would need to campaign and vote for Te Pāti Māori and TOP in the next election to have a hope of extracting land and/or capital gains taxes out of either National/ACT or Labour. Votes for the Greens are effectively wasted because the Greens would never transfer their deciding votes to anyone other than Labour, which means Labour can ignore any Green demands.

So what will determine which scenario happens?

So what now? - The key things to watch over the next year in these calculations are:

what happens to polling support for Te Pāti Māori and TOP;

whether Raf Manji and Te Pāti Māori co-leaders Rawiri Waititi (Waiariki) and Debbie Ngarewa-Packer (Te Tai Hauāuru) are on track to win their electorate seats;

whether National/ACT remain in the polling position of being able to form Government alone;

whether Jacinda Ardern resigns as PM in late December or late January to hand over to Grant Robertson (a small chance in my view), which could boost Labour in the polls;

whether inflation globally and here comes off the boil as expected, and if not, whether the world’s central banks carry on cranking up interest rates (which would keep driving house prices down), or are forced to bail out markets to avoid another financial crisis (which would force house prices up);

whether, as I expect, Labour eases migration settings to restart population growth in response to demands from businesses and promises of the same from National/ACT, which would support house prices and possibly help Labour in the polls; and,

whether Australian PM Anthony Albanese confirms a faster pathway to residency in late April next year, which could unleash a flood of those young renters migrating to Australia.

The best-case scenario to achieve better housing affordability, lower climate emissions and lower child poverty? These things would need to happen in combination:

TOP and Te Pāti Māori would have to win electorate seats and more than 5% in the election, and are able to extract some form of land or capital gains taxation pledges out of either Labour or National;

Inflation stays uncomfortably high or worsens, which would drive interest rates up and force house prices down; and,

Labour chooses not to unleash more migration, or does ease settings and the migrants don’t turn up, which I think would be unlikely.

The worst case scenario, which is my current base case, is that:

National/ACT win Government without the need for TOP/Te Pāti Māori, cut taxes for home owners and repeal the interest deductibility, ring-fencing and brightline tests that are helping to repress house prices at the moment;

Inflation is clearly dropping by early next year and mortgage rates are dropping through late 2023;

Migration and population growth is surging by late 2023/early 2024 because both Labour and/or National/ACT have released the restrictions and the temporary work migrants (work visa, students, backpackers) show up because they haven’t worked out how to get into TradeMe property or realestate.co.nz to see the rents and house prices; and,

This population growth overwhelms the exodus of young renters seeing a future for higher wages, lower rents, more secure and healthy housing and bigger pensions in Australia because the fear of being a second-class non-citizen living there is removed.

Your thoughts? Flaws in the logic or facts you can point out? I welcome comments from paying subscribers below.

Ka kite ano

Bernard

The week that was to Oct 7