TLDR: The five signals I picked out from the noise this week were:

The Fed scared markets a bit

US Federal Reserve Chair Jerome Powell said in his hotly-anticipated speech at Jackson Hole at 2am this morning that the Fed must keep hiking interest rates “until the job is done,” which would probably lower economic growth for “a sustained period.” This was seen as tougher than traders and investors had expected so the S&P 500 fell 3% by 10 am. The 2-year Treasury bond yield, which is the one fixed mortgage borrowers here in Aotearoa-NZ should watch, rose only 3 basis points to 2.07%. The 10-year yield rose just 1 basis point to 3.03%.

So what? - Clearly Powell’s hawkishness has unnerved share investors a bit, but bond investors, who are the ones who forecast inflation and interest rates for a living, were more relaxed. The bond market moves were not enough on their own to force big moves up in our fixed mortgage rates, but our stocks are likely to fall a bit on Monday morning. Meh.

Europe’s gas shock deepened

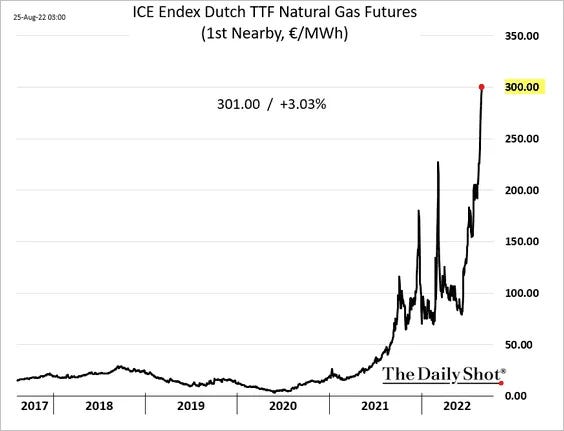

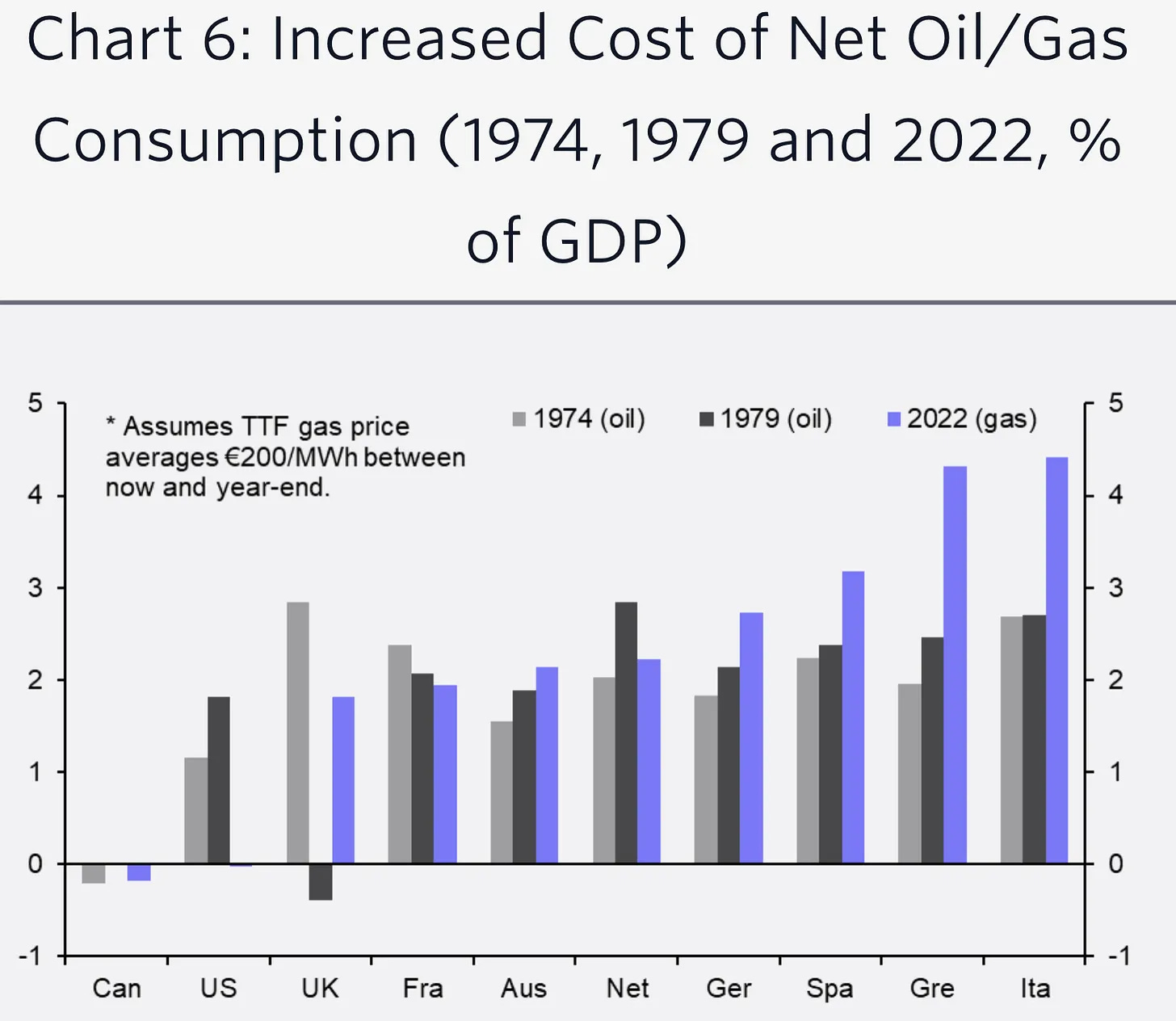

European gas prices jumped another 10% overnight to a fresh record-high over €343 per megawatt hour because of fear Russia will turn off its gas completely. This is more than ten times pre-war prices. Heating bills in Europe in the coming winter will be brutal and the political pain of Europe’s support for Ukraine is deepening. Putin is applying the screws hard.

This chart from Capital Economics this week shows just how serious the shock is for Europe.

The 20% fall in house prices won’t wipe out many at all

Some people are worried a lot of recent first home buyers will be wiped out by the 20% fall in house prices that is now rippling out from Auckland and Wellington. I wrote in Wednesday’s email about why very few people are likely to lose their houses and deposits. As in less than 10. I was then invited on to 1News’ Breakfast show to talk about it and on RNZ’s The Panel on Friday.

Climate Change is hitting the economy from all directions

Climate change feedback loops hammered the global economy this week, adding to the inflationary and recessionary pain of Covid and the war in Ukraine. Europe’s drought was declared the worst in 500 years as German and French factories hit by higher electricity costs reported output in recessionary territory.

Meanwhile, China closed shopping centres, turned off light displays and ordered factory closures because of hydro-electric power shortages from the worst drought it has experienced in 50 years.

That water seemed to head straight for us in an extension of the ‘Atmospheric River’ that caused extensive damage in Nelson and Marlborough this week. I wrote in Tuesday’s email about how these climate changes are affecting our economy.

Migration settings are being loosened

I wrote in Monday’s email about how the Labour Government was loosening migration settings and in Tuesday’s email I wrote about how this loosening reinforced that all roads towards a real improvement in investment and productivity would lead to an annual levy or tax on residential land values.

I hosted our weekly live ‘hoon’ webinar for over 100 paying subscribers on Friday night to talk about these events of the week. The audio from the webinar is in the podcast above for all subscribers immediately as part of this weekly summary and sampler of the week’s news and my work this week on The Kaka.

We talked about:

why a 20% fall in house prices isn’t too big a problem for NZ Inc;

how consumers are feeling about spending (a bit better), even those with mortgages;

why all roads lead to a tax or levy on residential land values;

how accelerating climate change is shunting the global economy around;

why Labour’s loosening of migration settings shows how hard it is to kick our economy’s basic business model; and,

what might happen next with inflation, interest rates, asset prices and jobs markets.

The week that was to Aug 27