TLDR & TLDL: This week we welcomed Rodney Jones onto the weekly ‘hoon’ as a special guest to talk about omicron modelling, whether inflation is here to stay, and how the global asset boom might end if central banks don’t bail everyone out again.

The hour-long discussion between Peter Bale, Rodney and myself is in the podcast above for all, including Rodney on his latest cautious (yet encouraging) modelling suggesting a peak of around 1,000 omicron cases and four hospitalisations a day by Feb 17.

Elsewhere, the five things to note this week included:

the Government’s announcement of an accelerated loosening of migration shackles to ease labour shortages and suppress wage inflation;

a toughening of the PM’s determination to open the borders over the next six months, come what may, as polls showed a softening of support for Labour and the PM in particular;

a joint Government, BusinessNZ and CTU proposal for a $3.5b income insurance scheme that would help older, salaried workers the most if they lost their jobs or got sick;

more signs housing inflation remains stubbornly high, and another defence of high house prices by a Government that doesn’t believe most voters want them to fall; and

a hardening of interest rate hike expectations globally as Europe and Australia joined the Britain, the US and New Zealand in worrying more about inflation.

See much more below the subscribe button.

In the week ahead, I’ll be covering the resumption of Parliament for the year, along with household living cost indices for the December quarter on Thursday and a fresh Reserve Bank inflation expectations survey on Friday.

This is my weekly summary sampler email for both free and paid subscribers, but I’d love you all to become full paid subscribers and join the community here fully. Paid subscribers get access to all my daily emails and podcasts, and are able to comment and join the webinars and ‘Ask Me Anything’ sessions on Fridays at midday. This community of paid subscribers supports my type of accountability, explanatory and solutions journalism on Aotearoa-NZ’s triple crises of housing unaffordability, child poverty and climate inaction.

Five things to note this week

1. The shackles on bringing in migrant workers loosened a bit

Amid the noise on the plan to reopen the border to New Zealanders, the Government also slipped in a faster and wider reopening for migrant workers that could see an extra 70,000 lower-paid workers enter the country over the next year to fill wage-inflating worker shortages threatening supply chains and the health system.

Here’s the details in my piece from the news conference in Auckland after the PM’s speech.

2. The PM laid out a plan to open the borders, come what may

After an intense couple of weeks of criticism about the family-splitting and business-stifling pain of strict MIQ limits, PM Jacinda Ardern announced a staggered reopening over the next six months that could see Australian tourists able to fly in by June or July for the ski-season, possibly even after a day or two of isolation.

Ardern was repeatedly pressed on whether this plan would stick in the face of a surging omicron outbreak. She pointed to the high and rising vaccination and booster rates as protection, and appeared much less willing to use the border as a prophylactic against Covid forever more. She played down the role of recent polls showing the Opposition catching the Labour-Green alliance and her own personal popularity falling.

3. A $3.5b income insurance plan was laid out

Grant Robertson, BusinessNZ CEO Kirk Hope and CTU President Richard Wagstaff presented their proposal for an income insurance scheme designed to strengthen the social safety net and prevent longer-term unemployment and skills ‘scarring’ in the event of a recession.

The $3.5b a year scheme would see workers and employers each pay levies of 1.39% of incomes to cover six months joblessness at 80% of salary. It’s not clear yet how contractors, freelancers and the self-employed will be covered, and of course, the already-long-term unemployed and those doing unpaid work at home aren’t covered.

The risk is it becomes yet another way to funnel money from poorer and younger renters, and especially women out of paid full time work, to fund lucrative benefits to older white home-owning men on high salaries getting laid off or sick late in their work lives. Critics also worry it will create a two-tiered welfare system that further embeds and deepens the wealth and income inequality gap that has exploded under Covid.

Here’s more detail from my report this week:

4. Housing inflation remains stubbornly high

CoreLogic reported an acceleration in the monthly rate of house value inflation in January this week, despite all the talk a credit crunch, higher interest rates and higher listings were already dragging prices down.

Elsewhere, a poll showed nearly 80% of voters wanted house prices to fall “a lot” (47%) or “a little” (29%). I asked Grant Robertson about that. He didn’t think home owners really wanted their own prices to fall and again refused to say he wanted prices to fall to achieve affordability. He said first home buyers priced out of the market would have to wait a while for an affordability problem created over decades to be solved.

Here’s a deeper look at that exchange:

5. Interest rate hike expectations hardened globally

This week high inflation figures in Germany, very strong US jobs growth and a series of central bank statements emphasised a hardening of interest rate hike expectations globally. The European Central Bank and the Reserve Bank of Australia both pivoted towards more hawkish views on inflation, admitting they may have to hike interest rates later this year.

The ECB and RBA have both shifted towards the stances adopted since November by the US Federal Reserve, the Bank of England and the Reserve Bank of New Zealand in first warning of rate hikes and then starting them. The Bank of England hiked for a second time this week and the RBNZ is expected to hike for a third time in just over three weeks time, possibly by 50 basis points to 1.25%.

The Fed is expected to hike for the first time on March 16, with a small but growing market expectation that it could start with a bazooka-sized 50 basis point jump in the Fed Funds Rate (the US version of our Official Cash Rate) to a range of 0.5-0.75%.

So what?: The next couple of months could be very ugly on global stock and bond markets. The decades-long assumption about low and ever-falling interest rates pumping up asset values is being challenged. We’ve already seen US tech stocks drop (briefly) into correction territory (deemed to be a fall of 10%) so far this year. Some sort of market-wide slump or crash is more possible, which could derail the global economic recovery and force central banks to intervene again.

The key questions are whether inflation stays high, and whether central banks are really serious about getting it back down to about 2%, even if it means sparking a financial crisis and a halving of asset values. My current base case is they’ll blink, or more importantly, a slump will kill off the inflation pressures, which would allow the central banks to stop tightening, or even ease again.

Chart of the week

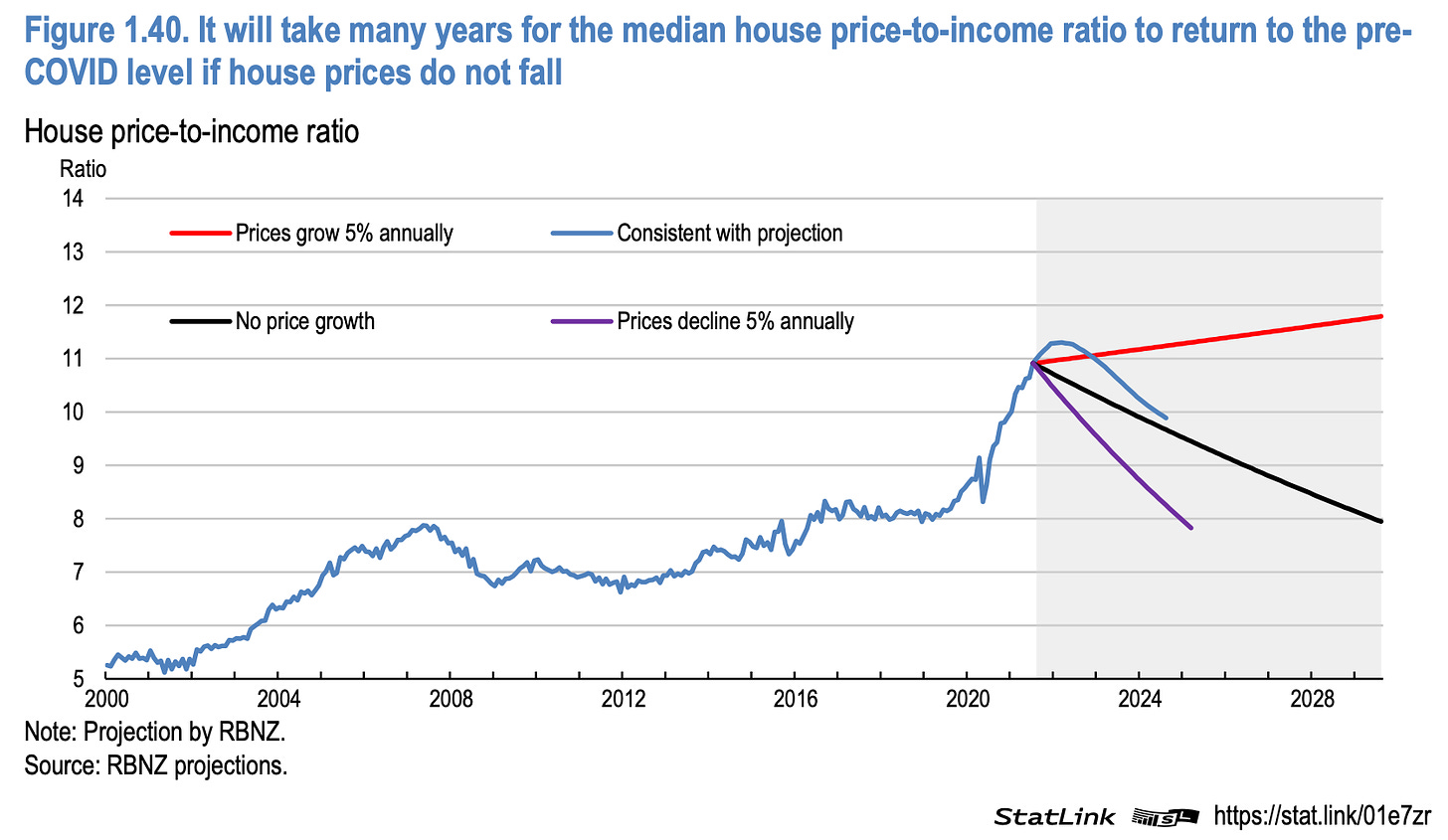

This from the OECD’s survey of NZ published this week is its riposte to the magical thinking that Labour and National have adopted that housing affordability will solve itself with moderate or no house price inflation.

Number of the week

76% - This is the total percentage of voters in a 1News/Kantar poll released this week that said they wanted house prices to fall a lot or a little. There were 47% of voters in this week’s 1News/Kantarwho said they wanted house prices to fall “a lot”. A further 29% wanted prices to fall “a little,” while only 18% wanted no fall.

Quote of the week

A tweet doing the rounds after Boris Johnson’s latest performances.

A fun thing

Ka kite

Have a great longer weekend

Bernard

"the Government’s announcement of an accelerated loosening of migration shackles to ease labour shortages and suppress wage inflation" - has the government actually said that they are aiming to suppress wage inflation? It still hasn't risen anywhere near above inflation, that seems an awful thing to try to achieve!

The govt hasn’t said out loud that’s what they want, but they face complaints from businesses worried about profit margins and a Reserve Bank worried about a wage/price spiral. The main aim of any National/Labour government is to keep interest rates low to support asset prices of home-owning median voters, who are often also employers of said migrants. Win, win, …

So despite close to 500,000 people migrating into NZ in the 10 years pre-COVID-19 we have a labour shortage? God’s breathe, who the hell have we been letting in then? Uber drivers, ethnic cooks and cleaners? Epic fail with our immigration policy.

Agreed. Productivity Commission doing research on this.

Just caught up on this, but wished I hadn't TBH. Valient effort to 'rein in the reckons' Bernard, but I found this a painful listen due to Peter's constant interruptions.

Some great and insightful comments on this podcast from Rodney Jones in particular. Please have him back on a regular basis! Where else can we go to hear more from him?

I was a little disappointed that he wasn't asked the question as to whether other nations can pick up China's manufacturing baton and run with it to maintain deflationary pressures in the West, eg, India, Bangladesh, etc.

It was also very refreshing that Rodney was able to take a lot of the covid hysteria out of the other commentators... his argument was so powerful that -shock horror- he compared omicron to flu and he wasn't cancelled.

It seems that Australia flinging open their border some six months ahead of NZ to tourists, depending on how you look at it, post-dated this podcast. It would have been very interesting to hear Rodney's take on this and the detrimental long term effects of this on NZ's economy.