TLDR & TLDL: Christopher Luxon was elected National leader and almost immediately watered down Judith Collins’ ‘Townhouse Nation’ accord with Labour by lowering the maximum building height in the accord’s Medium Density Resident Standards from 6m to 5m. Then he called for Auckland to go straight to green.

Elsewhere, global stock markets were extremely volatile because of fears of omicron and after US Federal Reserve Chairman Jerome Powell said inflation was more entrenched than originally expected and monetary policy would need tightening sooner than expected.

(This is the weekly ‘sampler’ email and podcast for both free and paid subscribers that includes the ‘Weekly Hoon’ podcast above with Peter Bale and me that was recorded last night in a webinar for paid subscribers. The links to this week’s articles go to the paywalled versions. But I’d love the free subscribers reading the detail and analysis below to subscribe fully to join our community and see all my reporting and analysis. It also makes my version of accountability, explanatory and solutions journalism about affordable housing, climate change policies and child poverty financially viable)

The five things that mattered this week

1. National’s caucus elected Christopher Luxon as leader

Simon Bridges withdrew from the National caucus’ leadership contest early on Tuesday morning, clearing the way for an uncontested vote for former Air NZ CEO Christopher Luxon to become leader after just over a year in Parliament and just two speeches in the general debate. This was the fastest rise of any leader of a major political party in New Zealand.

He was immediately questioned about his Christian beliefs and views on social issues such as abortion and conversion practices, along with his knowledge of his own wealth. His seven homes made more tax-free capital gains in 11 months this year than he made in his best year as Air NZ CEO. Luxon said he didn’t know that, but he didn’t want house prices to fall much and saw income growth as the way to improve housing affordability.

But he also signalled in his first news conference that National would support amendments to the ‘Townhouse Nation’ accord signed by his predecessor Judith Collins, which is designed to speed up and increase the supply of new houses.

Luxon talked in his first speech about increasing productivity and the ‘tide’ of economic growth, which he saw lifting all boats. He didn’t offer any policies to do that, given the current policies pursued by both parties have strangled productivity and widened inequality over the last 20 years, especially for renters.

2. ‘Townhouse Nation’ will be one metre shorter

The select committee considering submissions on the ‘Townhouse Nation’ accord reported back to Parliament for the bill’s second reading with changes to address NIMBY complaints that forcing councils to accept three three-storey dwellings on a single section would rob neighbours of sunlight and create slums.

The committee recommended cutting height standard for the three-storey homes to 5m from 6m and said they would have cut it more, but were worried it might reduce housing supply. They also changed the ‘setback’ provision at the front of properties to 1.5m from 2.5m, which is expected to allow more backyard sunlight for neighbours. But it may also give developers more freedom to improve the liveability of homes.

3. The Fed pulled out of ‘Team Transitory’ on inflation

US Federal Reserve Chairman Jerome Powell signalled the Fed would speed up its ‘tapering’ of money printing and could start hiking interest rates earlier because it appeared inflation was becoming more embedded.

He said the ‘transitory’ word to describe inflation should be retired. Stock prices slumped as much as 2% initially on fears the Fed would withdraw the money-printing support under asset prices, but rebounded the next day after the European Central Bank said it would keep printing and still saw inflation as ‘transitory.

Bond investors don’t believe inflation is out of control and are beginning to worry the Fed is tightening too soon and too much, which would slow economic growth and drive down inflation. German bond investors are happy with a minus 6% real yield at the moment.

4. Auckland raced through its first red light day

Aucklanders ventured out to cafes, bars and restaurants able to host less than 100 guests yesterday on the first day of the ‘traffic light’ system. But hospitality industry leaders say the 100 limit in ‘red’ is not financially sustainable for long. They hope the Government can move Auckland to orange when it makes its next decision on the Monday after next.

Meanwhile, Covid case numbers eased back towards 100 a day and the number in hospital has remained reassuringly under 100. Deputy PM Grant Robertson told me at the 1pm presser on Friday a move to orange for was possible in Cabinet’s Dec 13 decision.

But it was all too late for the summer’s flagship music festival. Rhythm and Vines announced on Thursday night it had postponed its three-day event just outside Gisborne until Easter next year. Gisborne is in the ‘red’ traffic light and is unlikely to go to orange any time soon because the Tairāwhiti DHB is still only 76% double vaccinated and other 5,018 doses are needed to get to 90%.

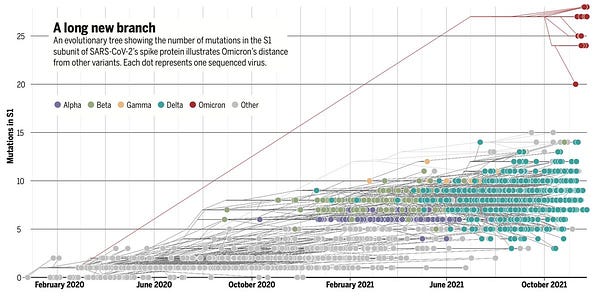

5. Omicron spread like wildfire in South Africa

Omicron multiplied with an R rate of over 6 in South Africa this week, unnerving those who were initially less worried it will spark fresh waves of hospitalisations and deaths around the world. (Guardian)

It’s too early to say yet whether it is more lethal than delta, but it’s certainly more infectious and the early signs are that is able to get past the defences of those who have previously had Covid.

‘A study published yesterday as a preprint suggests Omicron is causing more infections in people who have recovered from an earlier bout with the virus, one sign that the new variant is able to escape at least some of the immune system’s defenses. “This does not bode well for vaccine-induced immunity,” says virologist Florian Krammer at the Icahn School of Medicine at Mount Sinai.’ Science.org

Quotes of the week

‘He has no idea’

"I have no idea. I haven't thought about the number, or thought about that at all. What I have to say to you is….Yeah, I get where you're coming from...You can attack me for being successful. I can't defend that.” Christopher Luxon when asked in an interview how much he thought his seven homes were worth.

‘Time to tighten’

“It's probably a good time to retire that word (transitory) and try to explain more clearly what we mean” when talking about inflation.” Jerome Powell this week when saying the Fed would need to tighten faster.

Charts of the week

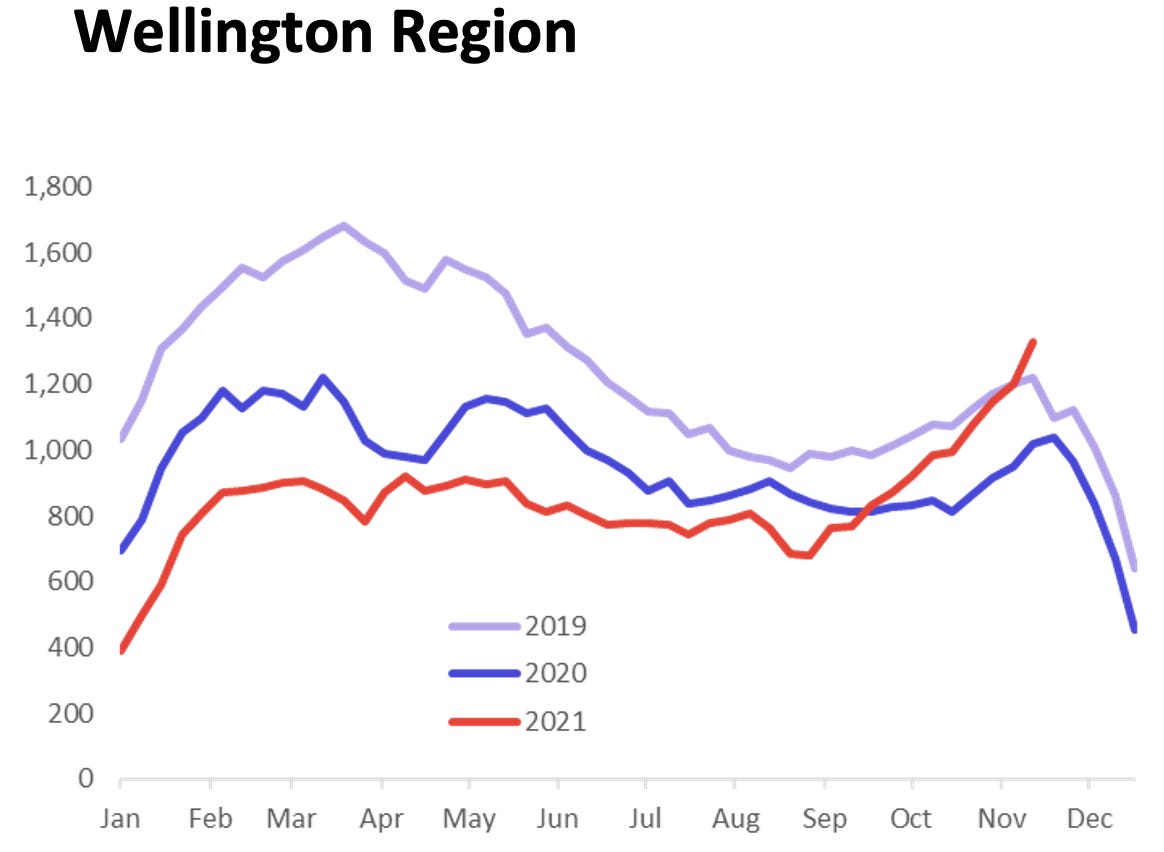

Wellington home owners eye the exits, increasingly listings in Nov

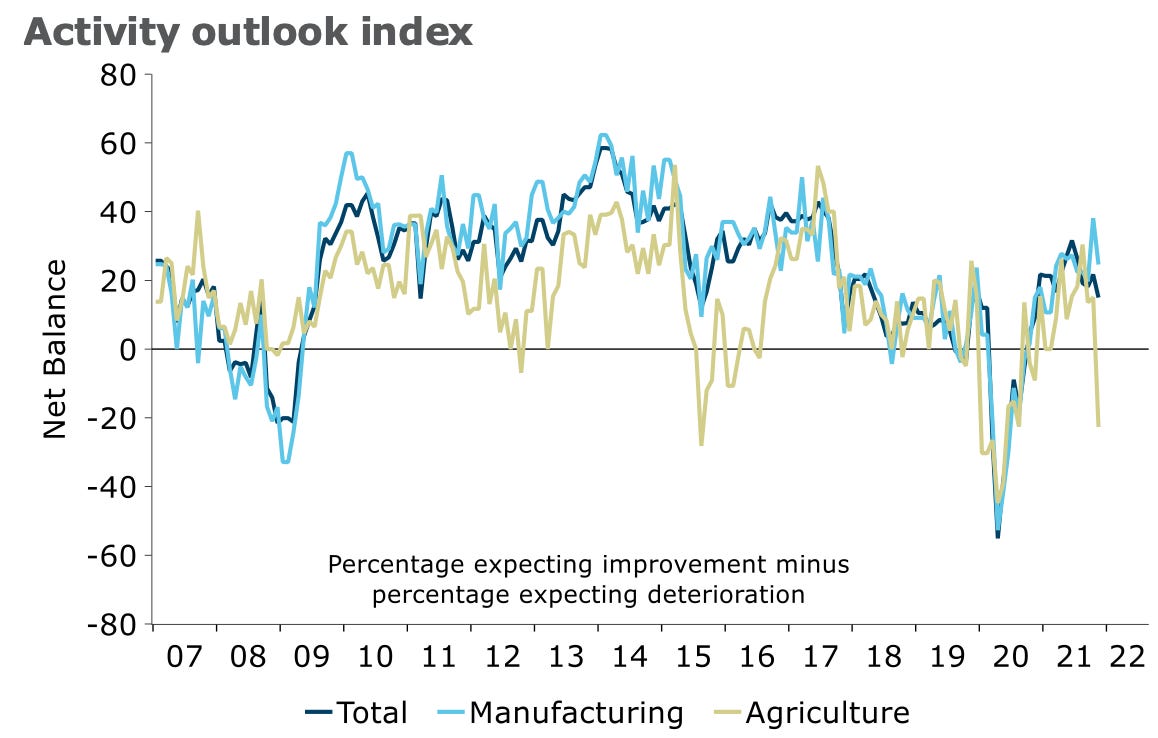

Farmer confidence crashes despite record high prices

Numbers of the week

28.4% - Annual house price inflation in November from a year ago, Core Logic reported. That’s the first fall in annual inflation since August and below the 28.8% seen in October.

$44b - Owner occupier borrowing rose by $2.0b or 0.9% the month of Oct to $234.9b, while lending to residential property investors rose 0.3b or 0.4% to $86.7b. Total housing lending has risen $44b to $321.6b since the onset of Covid.

Must reads and listens for the weekend

Some fun things

Have a great weekend

Bernard

PS: