TLDR: This week our Reserve Bank detailed its plans to slowly unwind its $55b of Covid-era money printing, the European Central Bank finally stopped its money printing to fight inflation of over 8%, the United Nations warned the war in Ukraine was unleashing a global hunger and poverty catastrophe, and Simplicity Living cancelled its orders to buy Gib from Fletcher Building.

Elsewhere: US inflation figures overnight was higher than expected, which triggered another slump in share prices and fears the US Federal Reserve will have to hike interest rates much faster and higher than previously thought. Meanwhile, the Reserve Bank of Australia surprised most investors and economists earlier this week by hiking a full 50 basis points. That slammed Australian bank share prices and prompted ANZ to put up its mortgage rates here.

In this week’s live hoon webinar for paid subscribers, which is in recorded form above, Peter Bale and I talk with special guests Professor Robert Patman from the University of Otago about the latest geo-political news and Simplicity CEO Sam Stubbs about financial market ructions and Simplicity Living’s decision to cancel its orders to buy Gib from Fletcher Building.

This is my weekly summary and sampler of the big news of the week I’ve covered on The Kaka for both free and paid subscribers. The public interest journalism I do daily on housing unaffordability, climate change inaction and poverty reduction is possible with the support of paid subscribers. Come and join our community by subscribing in full. Our full subscribers have allowed us to make The Kākā fully free for students, teachers and those working for advocacy groups and political parties in these areas. Anyone in these groups should just sign up to the free tier with their work, school, university, polytechnic or advocacy group emails and we’ll convert you to the full paid tier behind the scenes.

A reminder to free subscribers reading here that we have a special $30 a year deal for under 30s and anyone on a benefit. We also have a new special $65 a year deal for over 65s who are renting and reliant on NZ Superannuation.

The five things that changed this week

The Reserve Bank confirmed a slow unwinding of its money-printing

The Reserve Bank detailed on Thursday its plans to unwind its $55b programme of money printing relatively slowly over the next five years to avoid disrupting the economy and asset markets. It also says it might have to print again and wants to sideline the issue of growing inequality between renters and home owners in its current review of monetary policy.

I argued in Friday’s Dawn Chorus that the Reserve Bank decisions in early 2020 to unleash a credit boom that inflated the housing market by 45% to save the economy should be reviewed with an eye on the long-term effects of money printing on inequality. Right now, both the Government and the Reserve Bank are hoping few will notice or care about the $1t transfer of wealth to asset owners engineered during Covid without debate.

Finally, the Europeans stopped printing

The European Central Bank took a hawkish turn against inflation on Thursday night, announcing after its monthly monetary policy meeting it would stop printing money later this month and hike next month by 25 basis points. That would be the ECB’s first hike in 11 years. Its main deposit rate is actually still -0.5%. The ECB said it expected to hike by more at its September meeting, which markets saw as meaning a 50 basis point hike is likely. It forecast inflation wouldn’t fall from 6.8% this year to its 2% target until well into 2024.

So what? - It’s astonishing to think that the ECB still hasn’t stopped quantitative easing yet, which means it is still creating its own cash to buy European Government bonds, especially the ones from the PIGS (Portugal, Italy, Greece and Spain). Remember the PIGS? And the ECB pledging in 2012 to do ‘whatever it takes’ to stop the euro zone breaking up? It’s still doing that, partly because that last rate hike in 2011 was premature and destabilised the euro zone economies. So that’s why the pivot to stop printing and start hiking overnight matters.

Behind the curve - For comparison’s sake, our Reserve Bank stopped printing money and buying bonds in the middle of last year and started hiking in October. Our official cash rate is now up to 2.0% and is expected be hiked by another 50 basis points on July 13. Our inflation is about the same as Europe’s, but our unemployment rate is half that of Europe’s at 6.8%.

Brace for fallout - Even the anticipation of this ECB pivot from very dovish to slightly hawkish has caused ructions in financial markets. That’s because the euro zone economies remain much weaker than others in the developed world and its banking system is still under-capitalised. The ECB also has to extricate itself from being the largest owner of PIGS bonds and avoid another Greek-style meltdown in financial markets. That’s why the ECB went out of its way in its statement overnight to reassure investors it would keep buying Greek bonds to stop another collapse.

Mamma Mia - Italy’s 10 year bond yield jumped 27 basis points to 3.68%. It has tripled in the last year. It has also risen sharply relative to Germany’s 10 year yield at 1.51%, which has itself risen faster in the last 90 days than at any time in this century. This gap or ‘spread’ between Italy’s 10 year yield and the German ‘bund’ is a key indicator of stress and fear inside Europe’s financial system. It rose to a two-year high this week. And then there’s the not-so-small matter of the most destructive war since World War Two raging on the edge of the euro zone…

On meltdown alert - Plenty of players in financial markets have feared some sort of repeat of the Global Financial Crisis at various points since the Covid pandemic broke out in February 2020. Central banks acted preemptively and globally to throw all sorts of money-printing kitchen sinks to avoid a repeat of the 2008 GFC, which forced central banks and Governments to bail out US banks and UK banks, and to prop up European banks. The US and British banks have since been reorganised and recapitalised, but the European banks have mostly just staggered on without having to have proper cleanouts.

The excuses evaporate - The ECB’s ‘whatever it takes’ interventions in 2012 helped the European banking system stave off its ‘Minsky Moment.’ Here’s a useful Enda Curran backgrounder via WaPo on what a Minsky Moment is. But those interventions through money printing to buy the weakest European government’s bonds and hold up their values on bank balance sheets was only possible because European inflation was painfully low and the ECB knew it could stimulate through money printing without having to worry about a damaging inflation breakout. Now there is nowhere for the ECB, European banks and the PIGS to hide. That’s why many fear this pivot to rate hikes and the end of ECB money printing could trigger a European version of the 2008 GFC. As if we (and the Europeans in particular) don’t have enough to worry about…

UN warns of global food and poverty catastrophe

‘A food catastrophe’ - The United Nations warned on Wednesday that the war in Ukraine and the after-effects of the Covid Pandemic had turned into a perfect storm of higher food, energy and finance costs for 1.2b workers. It issued a briefing note showing how higher energy and food costs, along with blockades on fertiliser and wheat exports via the Black Sea, could turn a food crisis this year into a food catastrophe next year.

UN Secretary General Antonio Guterres called again for a lifting of the blockades in the Black Sea and said the developed world would have to ensure emerging market debt crises can be resolved. See more below in chart and quote of the day.

“The cost-of-living crisis could spark a cycle of social unrest leading to political instability.” UN trade chief Rebeca Grynspan in a briefing note on what the UN calls the greatest cost of living crisis of the 21st Century.

The note explains the negative feedback loops and spirals of prices and supply that are worsening the situation, driving more than a third of a billion people into starvation territory. The bolding is mine.

“Countries and people with limited capacity to cope are the most affected by the ongoing cost-of-living crisis. Three main transmission channels generate these effects: rising food prices, rising energy prices, and tightening financial conditions.

“Each of these elements can have important effects on its own, but they can also feed into each other creating vicious cycles - something that unfortunately is already starting. For instance, high fuel and fertilizer prices increase farmers’ production costs, which may result in higher food prices and lower farm yields. This can squeeze household finances, raise poverty, erode living standards, and fuel social instability.

“Higher prices then increase pressure to raise interest rates, which increase the cost of borrowing of developing countries while devaluing their currencies, thus making food and energy imports even more expensive, restarting the cycle. These dynamics have dramatic implications for social cohesion, financial systems and global peace and security.” UN briefing note.

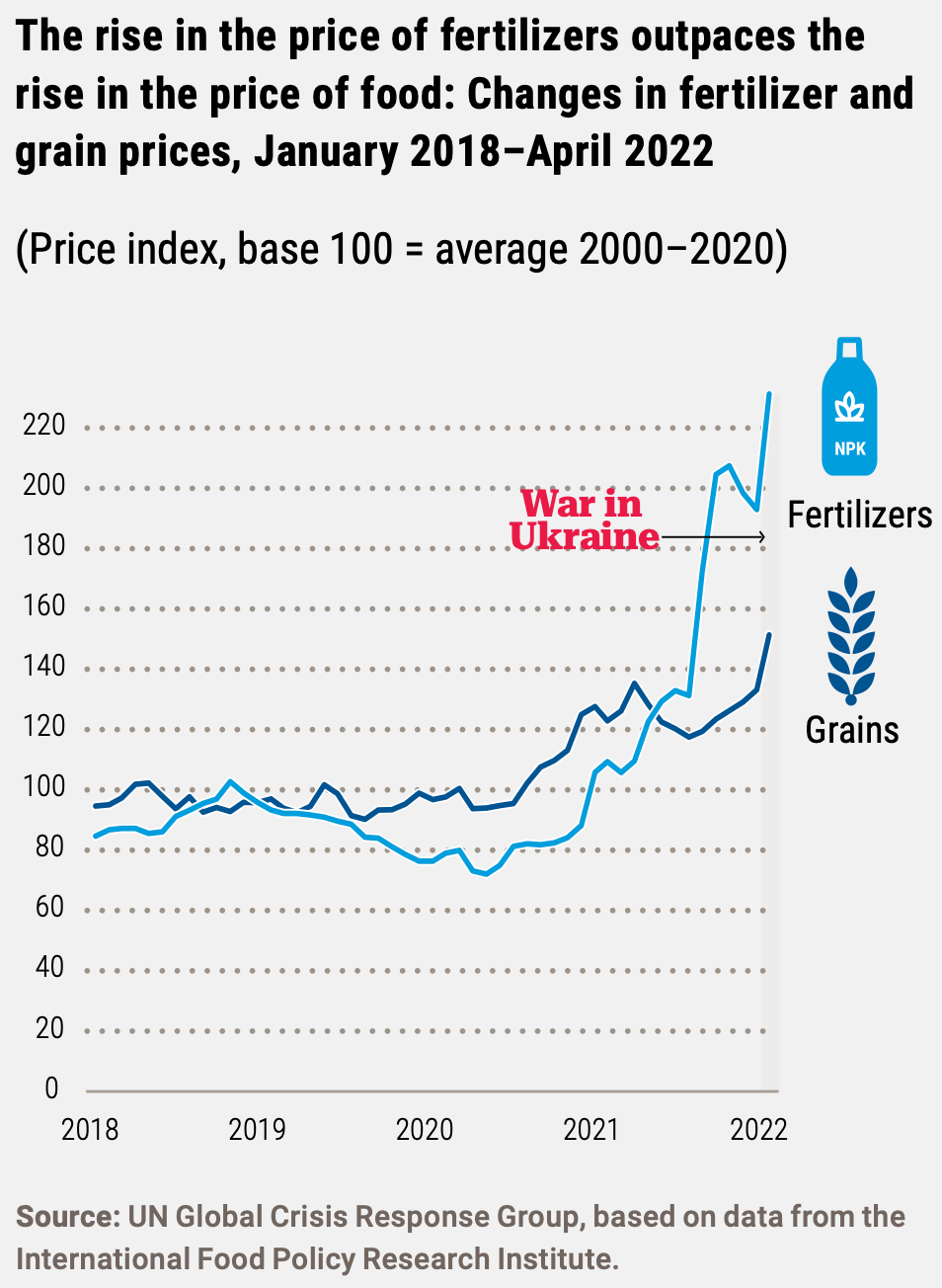

I think the note is this week’s must-read. It includes this chart showing how even-faster-rising fertiliser prices were worsening the feedback loops.

Simplicity Living cancelled its orders for Gib from Fletcher Building

‘We’re not taking it any more’ - Simplicity Living, which is building 550 build-to-rent- homes in Auckland, announced on Thursday night it had cancelled its orders for Gib plasterboard from Fletcher Building and was importing an alternative from Thailand for 40% cheaper per-sheet of plasterboard board, even after shipping costs.

Simplicity Living MD Shane Brealey blasted Fletcher Building over the Gib crisis.

"It's tragic that it takes only eight weeks to get much needed plasterboard from South Asia, but eight months from south Auckland. By looking at building consents, Fletchers must have known there would be a shortage of plasterboard at least 12 months ago. So why aren’t they doing what we’ve just done?” Simplicity Living MD Shane Brealey in a statement

We asked Simplicity CEO Sam Stubbs onto the weekly hoon to talk in more depth about the decision and he explained how the Gib shortages were hammering so many small builders, who were too dependent on Gib-driven building techniques and too fearful that using an alternative would mean their homes weren’t approved by Council building inspectors, who are themselves hyper-focused on avoiding any new products that might expose councils to ‘last-man-standing’ building quality claims (as happened with leaky buildings that used James Hardie’s Hardietex cladding).

The discussion is fascinating. I’d recommend listening to the start, where Peter explains the origin of the Gib brand name, and from 44:18 onwards where we discuss the Gib crisis and the way it is scuppering large sections of the building industry.

Don’t expect a grocery duopoly breakup pre-election…or maybe ever

High bar for breakup - MBIE released a Cabinet paper on Wednesday that it prepared for Commerce Minister David Clark on The Government’s response to the Commerce Commission’s recommendations on dealing with (or to…) the supermarkets duopoly. MBIE’s advice included slightly more detail on the breakup option including talking about retail divestment rather than structural separation, but noted there would be a high bar for action and hardly any preparatory analysis had been done. Consultation would not begin until early next year.

Here’s the key details in the cabinet paper on Clark’s actions and officials’ timelines (bolding mine):

“Retail divestment would involve divestment of existing retail stores or banners by major grocery retailers to establish new grocery retailers. There is a high burden of proof to be met before decisions on retail divestment can be taken as the Commission did not carry out a detailed cost-benefit analysis.

There are several considerations to be worked through further, including: considering possible implementation options in detail; undertaking policy design and a detailed cost-benefit analysis of retail divestment options; considering potential risks and issues; understanding the potential impacts of retail divestment on retailers’ operations, economies of scale, property rights and supply models; and, determining how interventions would be enforced. MBIE on Page 15 in the paper

Officials will consider these matters in detail between now and September 2022. I will then report back to Cabinet in October 2022 with a detailed cost benefit analysis on retail divestment options and to seek decisions on whether to proceed with further steps on retail divestment. Based on this work, implementation options could then be developed for public consultation in early 2023.” David Clark on Page 15 in the paper.

So what? I’d be surprised if any concrete breakup plans or action emerge before the next election. The grocery duopoly can happily stall action ahead of a likely change of Government. National has said it supports the creation of a regulator and mandatory codes for wholesale access and suppliers, but has been cautious about supporting a breakup. I think that would be highly unlikely, given National stalled Section 36 reform from 2009 to 2017 that would have given the Commerce Commission more powers.

The hoon about the week that was to June 10