TLDR: This week the Reserve Bank warned of a rise in mortgage rates to 6% and a peak-to-trough fall in house prices of 15%, but said the economy and homeowners could handle it without forcing the economy into recession. It also rejected Opposition claims that Labour’s fiscal policy and employment mandate had forced the Reserve Bank’s faster move to higher interest rates.

Elsewhere, China launched an aggressive push for much deeper trade and security deals in the Pacific to add to the one it already has with the Solomon Islands. In response, the United States opened a new Indo-Pacific Economic Framework that it hopes will contain China, even though it doesn’t offer extra trade access into the world’s largest economy. Aotearoa-NZ and Fiji joined it.

In this week’s live hoon webinar for paid subscribers, which is in recorded form above, Peter Bale and I talk with special guests Professor Robert Patman from the University of Otago about the latest geo-political news and Green Finance Spokesperson Julie Anne Genter about monetary and fiscal policy.

This is my weekly summary and sampler of the big news of the week I’ve covered on The Kaka for both free and paid subscribers. The public interest journalism I do daily on housing unaffordability, climate change inaction and poverty reduction is possible with the support of paid subscribers. It has allowed us to make it all free for students, teachers and those working for advocacy groups and political parties in these areas. Anyone in these groups should just sign up with their work, school, university, polytechnic or advocacy group emails and we’ll convert to the full paid tier behind the scenes.

A reminder to free subscribers reading here that we have a special $30 a year deal for under 30s and that students and teachers should sign up for the free tier using their ‘school’ or ‘ac’ email addresses to get converted to the full subscription for free. And we have a new special $65 a year deal for over 65s who are reliant on NZ Superannuation.

The five things that changed this week

The Reserve Bank turned more hawkish

The Reserve Bank hiked its Official Cash Rate 50 basis points to a six-year high of 2.0% this week. That was an unprecedented second ‘double-whammy’ 50 point hike in succession, but that wasn’t the surprise. The central bank also raised and steepened its forecast track for the OCR in a way that would see mortgage rates rise to around 6% by early next year and help drive house prices down 15% from the peak in November last year to a trough late next year.

The Reserve Bank described its approach as “briskly” raising interest rates to get annual inflation down from 6.9% in the March quarter to under 3% late next year, and that it was “resolute” about getting back into its 1-3% target band.

Here’s my preview on the day and my report on the next day.

China went fishing for friends in the Pacific

China’s Foreign Minister Wang Yi embarked on a series of visits to nine Pacific Island nations this week, offering a series of deeply integrated trade, security, data sharing and police cooperation deals similar to the one it has just signed with the Solomon Islands. The depth and breadth of the proposals surprised many and alarmed the ‘western’ powers in the Pacific.

In response to China’s latest push for influence in the Pacific, the United States announced a widening of its ‘Quad’ security alliance with India, Japan and Australia to a new Indo-Pacific Economic Framework (IPEF), which Aotearoa-NZ and Fiji immediately joined. IPEF is the US-driven alternative to the Trans-Pacific Partnership, which was originally designed to include the United States in a grouping that excluded China and created a massive free trade block. But Donald Trump pulled the United States out and Joe Biden does not have domestic support for an easing of trade access to the world’s largest economy.

IPEF is largely about writing the rules for and securing supply chains and services trading arrangements that don’t include China.

Here’s what I wrote about IPEF this week.

Global recession warnings flashed red

Fresh data was reported this week showing the US and Japanese economies contracted in the March quarter because of Covid supply chain disruptions and weak consumer spending due to demand destruction from real wage deflation.

China also warned its strict lockdowns to maintain Covid elimination had reduced output in the world’s second largest economy, and Aotearoa-NZ’s largest trading partner. Here’s what I wrote about that this week.

Britain announced a 25% windfall tax

Britain’s Conservative Government made a U-turn and decided to go ahead with a 25% windfall profit tax on oil, gas and electricity companies to raise £15b to paid for energy discounts for households.

I talked in Friday’s Chorus about the prospects for a windfall tax here to claw back some of the $20b in cash payments to businesses that are now stored in company bank accounts or being paid out as dividends.

Fresh quake shocks for Wellington’s CBD

The Ministry of Education moved 1,000 staff out of its relative-new head office building on Bowen St in Wellington after it was found to have hollow-core pre-cast concrete floors that are now deemed quake prone. Another 150 buildings in Wellington’s CBD use the same flawed construction system, delivering another blow to the capital city’s economy after an awful few years dominated by Covid lockdowns, protest blockades at Parliament and brutally high rents and house prices.

I talked about this in Friday’s Chorus too.

Chart of the week

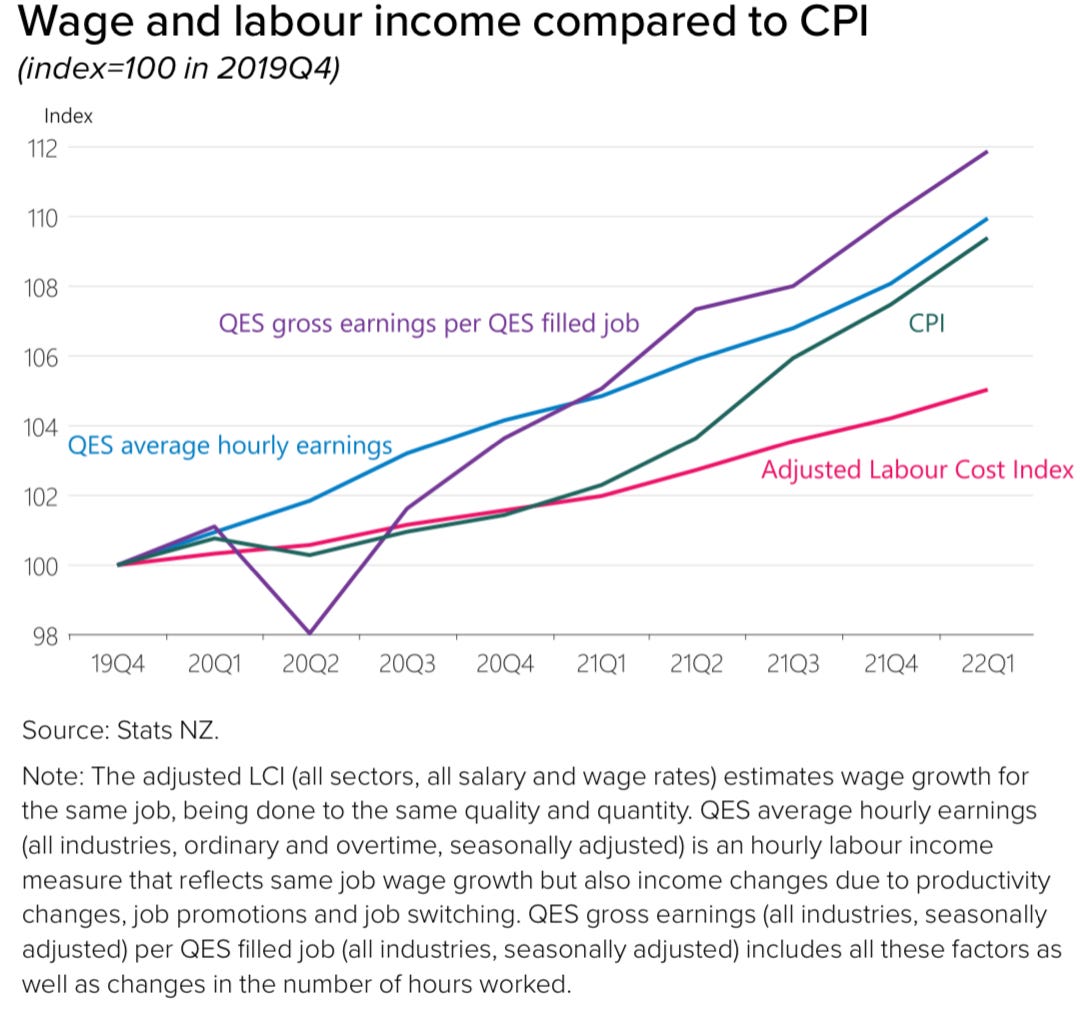

Real wages deflated, but real household incomes still rose

Here’s the Reserve Bank’s summary from its MPS this week:

“A strong labour market and higher costs of living have driven wages higher in recent quarters. The share of annual wage increases greater than 5 percent is near its peak prior to the global financial crisis (GFC). Despite this, wage growth for those staying in the same job has not generally kept up with inflation.

Overall, household incomes have been supported by workers switching jobs for higher pay, promotions with the same employer, and working longer hours (figure 2.10). Once these factors are taken into account, aggregate labour income growth has been stronger than consumer price inflation over the course of the pandemic – albeit to a much lesser extent in the past year.” Reserve Bank May 25 MPS

Have a great weekend

Ka kite ano

Bernard

Share this post