Roosting chorus Tues Nov 3

Now Adrian Orr is not alone. Australia's Reserve Bank pulls out a 'whatever it takes' bazooka to print well over A$100b to try to get inflation up from 1% to between 2-3%. But is all this QE working?

Australia ‘fangs it’ with A$100b-plus money printing plan

For a long time this year, Reserve Bank Governor Adrian Orr has been out on his own in this part of the world, printing money to buy NZ$100b of Government bonds, lower long term interest rates and (accidentally on purpose) firing up another housing boom.

Some economists think he’s doing too much now, but he is following his Act’s mandate to do whatever he can to get inflation back up to around 2.0% and support employment. That housing boom was helpful to a Labour Government campaigning for a second term, although Finance Minister Grant Robertson now seems a tad more concerned about the housing boom and the boom in low deposit lending to landlords that is contributing to it.

Up until now, Australia’s Reserve Bank has been slightly more restrained, printing in a more limited way to keep Australia’s three year Government bonds around 0.25%, and lending cheaply directly to banks to lower their borrowing costs and encourage them to get loans out into the economy. But it had held back from declaring a big hairy number for its programme of Quantitative Easing (QE) and was much less friendly towards negative interest rates than their colleagues across the Tasman.

That restraint ended today, and with a bang.

The Reserve Bank of Australia announced this afternoon it would launch a A$100b QE programme to buy Government bonds maturing in 5-10 year time over the next six months. It also lowered its target for three year bond yields to 0.1% and said it would do ‘whatever it takes’ over and above the A$100b to defend that three year yield target.

It also cut its cash rate from 0.25% (which is where ours is at the moment) to 0.1% and cut the interest rate it charges big banks there to 0.1% from 0.25%. The RBA calls this lending facility its ‘Term Funding Facility’, which is similar to the Funding for Lending Programme (FLP) that the RBNZ is expected to detail next Wednesday.

The RBA also did something we should keep an eye on: it cut the rate paid on deposits held by commercial banks at the Reserve Bank to 0% from 0.1%. This is designed to encourage to get the money out the door, rather than leaving it in an account at the Reserve Bank. This ‘dual rate’ system could allow the Reserve Bank to cut the interest rate in its settlement accounts for banks to below the cash rate.

That matters because the bank promised in March it wouldn’t take the OCR below 0.25% for a year. It is not expected to move the OCR next Wednesday, but it could cut its deposit rates for banks to below 0.25% without breaking that promise.

‘Just floor it Phil’

A feature of today’s decision, which was largely anticipated but still remarkable in its size and breadth, was the RBA fired its ‘bazooka’ after upgrading (bolding for effect…) its economic growth forecasts and indicating Australia was now out of recession.

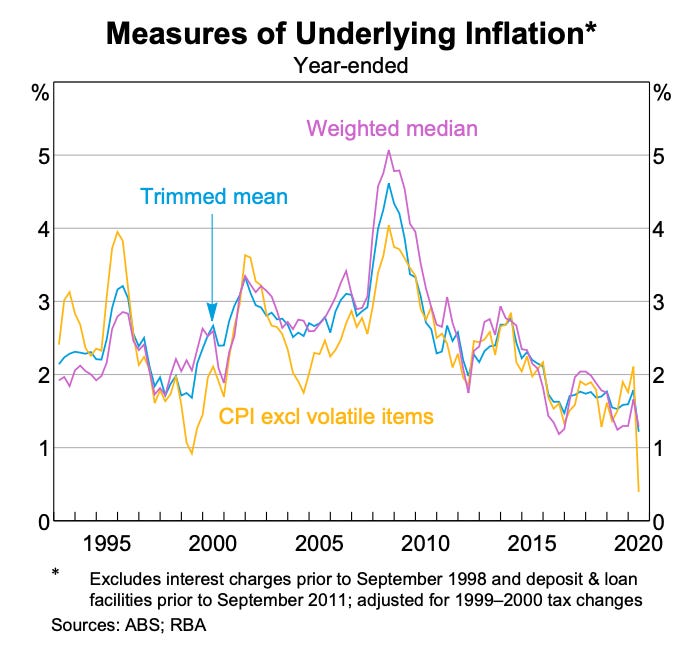

The key thing is the RBA is now forecasting inflation of 1% in 2021 and 1.5% in 2022. That’s is too low to be comfortable. The RBA has promised to ‘fang it’ with monetary policy to get that inflation running hotter than it normally would in order to blast clear of the danger zone of 0-1% where consumers and businesses start planning for deflation. That is an ugly place where people stop spending in the hope of getting cheaper things later, and workers fearing wage cuts stop spending. Deflationary expectations can quickly become a self-fulfilling prophecy, as Japan found out through the 2000s and 2010s.

Last month, the RBA indicated this pivot towards a more expansionary stance by saying it would look at actual inflation rates now when setting policy, rather than looking at forecast inflation. It essentially meant it would be more trigger happy when inflation was low.

The RBA said it would buy around A$5b a week in bond markets and could increase the size of its money printing programme.

“Given the outlook for both employment and inflation, monetary and fiscal support will be required for some time. For its part, the Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. Given the outlook, the Board is not expecting to increase the cash rate for at least three years. The Board will keep the size of the bond purchase program under review, particularly in light of the evolving outlook for jobs and inflation. The Board is prepared to do more if necessary.” RBA Governor Philip Lowe.

This sets the scene for an interesting meeting early next week between Grant Robertson and Adrian Orr. It’s happening a couple of days early because Robertson said he wanted to stay close to Orr. Some economists and market watchers are calling on the Reserve Bank to reintroduce LVR controls for landlords, and many question the big QE programme.

Now Orr is not alone in this part of the world with what some would say are extreme policies. They’re actually not that extreme for central bankers globally right now.

The bigger issue is whether any of it is working. Just as the money supply is expanding, the velocity of that money is slowing down. Earlier today, even the IMF said Governments should step up and do more fiscal policy to help central banks, who are running out of things that work.

Why not try QE for the people?

I am a bigger fan of QE for the people, where the money is printed and simply granted equally to residents, similar to the way America and Australia sent cheques to everyone at the start of Covid-19. Just as our Government found direct grants to businesses (wage subsidies) as very effective, our Government would find a QE for the people more effective than what the RBNZ is doing right now. It is printing money to hand it over to banks and fund managers in exchange for Government bonds. Those banks and fund managers are either plonking that cash straight back on deposit with the Reserve Bank, or pumping up the value of existing assets. The printed money is being given to already-rich and often-older people who are risk averse and more focused on wealth protection than wealth creation.

That money is not being lent out by banks to businesses for investing in job-creating expansions or projects. Instead, it is being lent to rental property investors to use with already plentiful equity to buy more existing houses, or at least compete against first home buyers and push prices higher.

New Zealand bank lending to home owners has risen $10b to $290b since February, while lending to businesses has fallen $4b to $117b and lending to farmers is flat at $63b.

This issue will get bigger before it gets better because the Reserve Bank will drive down mortgage rates towards 1.5% over the next year. Robertson has unfortunately ruled out lifting spending beyond the existing debt track, meaning the Government is leaning on monetary policy a lot more than it should.

Tweets of the day (because I better get something useful out of the time I spend doom scrolling… :))

Kia kite ano

Bernard

PS: Hope you love this Kākā pic below courtesy of Nic. He looks a slightly grumpy bugger. The Kākā that is…

And yes you should all vote for The Kākā in Bird of the Year.