Roosting chorus: Interest free for longer

As promised, the first Labour-only Cabinet under MMP doubles the length of interest-free loans for small businesses and extends the scheme until the end of 2023; How about QE for the people instead?

The TLDR version: Jacinda Ardern has started as she signalled: cautiously. The first Labour-only Cabinet under MMP did the small thing it promised in its manifesto in its first Cabinet meeting.

Watch out on Wednesday for the Reserve Bank to stay the course too with its ‘QE for the Rich’ policy of pumping up house prices to improve the confidence and spending of property owners by handing over cheap money to banks and investors. It would be much better, along with Labour, to distribute that printed money much more directly and widely to people who would spend 100% of it via a ‘QE for the people’ policy, which some people call ‘Helicopter Money’.

Watch out tomorrow for National’s Caucus to switch Gerry Brownlee for Shane Reti as Deputy Leader and Simon Bridges for Paul Goldsmith as Finance Spokesman. Judith Collins is safe as leader for now because no one else wants a job she has described as a hospital pass.

News that broke today…

Interest free for longer: The second-term Labour Government announced this afternoon its first Cabinet decision was to extend its Small Business Cashflow Loan scheme for three years to December 2023 and to double the interest free period to two years from one year. This was foreshadowed in Labour’s manifesto and in PM Jacinda Ardern’s speech last Thursday.

About 100,000 businesses have already borrowed $1.6b through the scheme, which has proven popular given banks rarely lend to small businesses, unless guaranteed by the business owners’ home. The scheme was set up in part because banks were demanding personal guarantees.

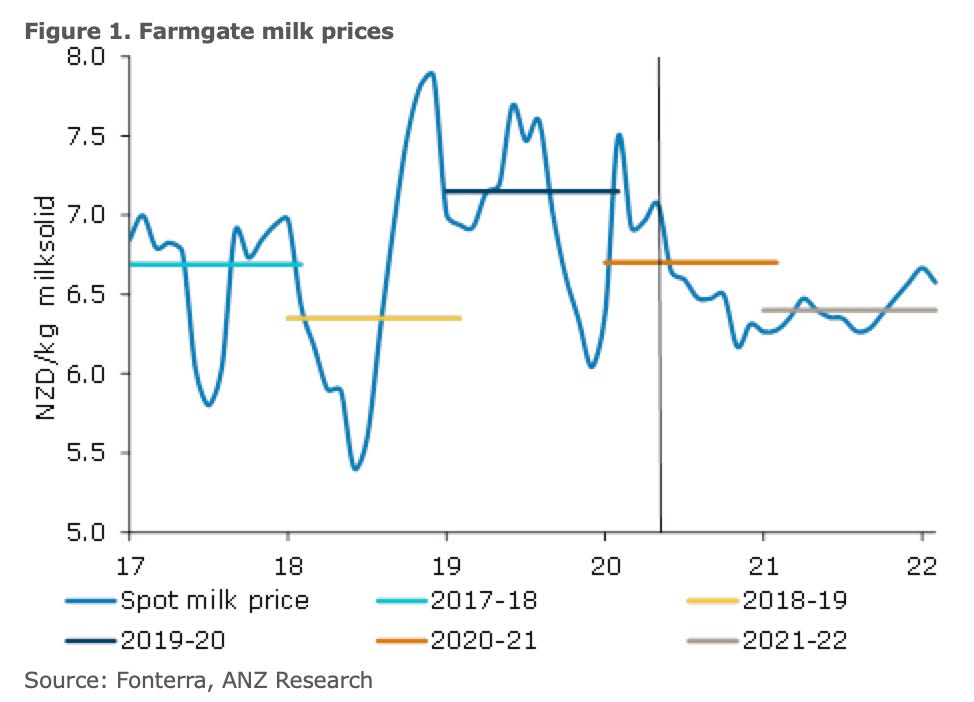

Up then down: ANZ, which is still the largest lender to dairy farmers, upgraded its milk payout forecast for the 2020-21 season by 20c to $6.70/kg of milk solids, but its first forecast for the 2021/22 year was for a fall back to $6.40/kg, partly because of continued subsidies in America encouraging supply. The bolding is mine. So much for the American ‘free’ markets and the dangers of socialism…

“It is estimated that approximately a third of dairy farm incomes in the United States is being derived from the government support packages. These support packages won’t last forever and now that voting in the US Presidential Election is complete there is reduced incentive to keep the packages in place, no matter which party is in power. But it will take some months before the effects of this stimulus package start to unwind. Therefore, in the shorter term we are seeing steady expansion in US milk production. We do expect to see some easing in prices in in 2021 as larger volumes of milk are produced in the global exporting nations and the larger importing nations.” ANZ Economist Susan Kilsby.

No room at the Inn: New Zealand’s MIQ system is essentially full up now until well into next year. The pressure is intense from businesses wanting to bring in temporary workers and from up to 125,000 New Zealand citizens wanting to come home permanently over the next two years, yet alone those New Zealanders who want to come back to visit families.

Here’s one idea:

Other places I said and wrote things…

Other interesting bits and bobs

I have couple of core ideas around our economy, politics and society. Everything is always about housing and interest rates, and in many ways New Zealand’s economy is just a housing market with bits tacked on.

Here’s another report on why it matters. It turns out kids don’t learn well when they have to live in unstable, expensive and unhealthy homes. Who would’ve thunk it.

Fire up the helicopters for the people: The Reserve Bank will announce on Wednesday plans to print up to another $50b and hand it over to banks via a ‘Funding for Lending’ programme. Those banks are likely to either park it back at the Reserve Bank, or simply use it to further pump up house prices through loans to landlords and/or bolster their own profits by replacing other more expensive funding with these near-zero-percent Reserve Bank loans.

It is effectively the Government’s bank printing pallet loads of cash, wrapping it in plastic and flying it over the heads of the people to the big mansions on the edge of town. Those pallets are being rolled into the garages of the richest residents to increase the value of the mansions, and are likely to remain there unspent. Critics call this process of Quantitative Easing ‘QE for the rich.

The Reserve Bank would be much better pushing the cash out of the door of the helicopter (unwrapped) to let it flutter down equally onto the street for the broad populace to pick up the notes and spend 100% of the freshly minted cash. It would be much better doing ‘QE for the people.’ In reality, this would mean Government cash handouts to everyone, or at least to all beneficiaries in a one-off payment, similar to the one-off cash payments made by the Australian and US Governments at the beginning of Covid-19.

Useful longer reads

Unlike Donald Trump, Joe Biden cares about foreign policy and is soaked in the devil in the detail. (Bloomberg) This vignette of a meeting attended by the author, James Stavridis, stood out:

“Biden walked around the large table and was able to comment in depth on any number of the countries, from huge Germany to tiny Iceland, with a short vignette about a visit to this or that city, or a telling anecdote concerning a head of state, or a comment on current policy. This was not the result of memorized crib sheets from his staff: Biden did it off the top of his head, and it was a natural and unforced demonstration of his long term of service not just domestically, but also in the larger world.” James Stavridis

Coming up…

Tomorrow at 10.45 am - Stats NZ to publish electronic card transactions data on retail spending in October 2020.

Tomorrow at 10am - The National Party’s Parliamentary Caucus will meet to elect a deputy leader. Gerry Brownlee is set to resign, opening the way for Shane Reti, who is considered the favourite, or Michael Woodhouse. Leader Judith Collins is also expected to name a new shadow cabinet, including changing out Finance spokesperson Paul Goldsmith, possibly for Simon Bridges or Andrew Bayly. (Stuff)

Weds Nov 11 at 9am - Contact Energy AGM

Weds Nov 11 at 2pm - Reserve Bank quarterly Monetary Policy Statement (MPS) and news conference at 2pm. Details expected of the Reserve Bank’s $30-50b Funding for Lending Programme (FLP) of Reserve Bank money printing and lending to banks at or around the Official Cash Rate (currently 0.25% and expected to fall to minus 0.5% next year).

Thurs Nov 12 at 10.45 am - Stats NZ to publish travel and migration data for September.

Thurs Nov 12 around 8.30 am - Sanford to publish full annual results to NZX, but it gave an early indication on Nov 5 of a 46% fall due to Covid-19.

Fri Nov 13 at 10 am - Business NZ-BNZ Purchasing Managers Index for October

Fri Nov 13 at 10.45 am - Stats NZ to publish rental price indexes for October.

Mon Nov 16 at 10.45 am - Stats NZ to publish wellbeing statistics for September quarter.

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds Nov 25 2pm - Reserve Bank to publish six monthly Financial Stability Report (FSR) . Expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Weds Nov 25 - Opening of Parliament for 53rd term, including swearing in of new MPs

Thurs Nov 26 - Speech from the throne in Parliament outlining Government’s agenda

Ngā Mihi

Bernard

PS: I corrected Thursday’s Dawn Chorus to reflect that the $1.1b Jobs for Nature scheme is expected to have contracted $297.5m of work by the end of November. I had written it had not started yet. Many thanks to my eagle-eyed readers inside the Government.