Roosting chorus Friday Oct 30

Green delegates to vote tomorrow on Labour-Green 'cooperation' deal; PM seen detailing Govt makeup Sunday morning; Labour abandons cannabis reform after 'no' vote; Consumer confidence bounces in Oct

TLDR version: Green delegates are set to vote in a Zoom call tomorrow afternoon on whether their leaders should sign cooperation agreement with the Labour Government. Jacinda Ardern is expected to detail the makeup of her Government on Sunday morning. Ardern’s conservatism on publicizing her cannabis reform vote before the election was proven correct as middle New Zealand voted against the Cannabis legalisation and control bill. Just as businesses confidence in New Zealand bounced this month, consumer confidence also rebounded more in October, but is still below average and at recessionary levels. Retail investors in Hong Kong and China bid US$2.8t or the equivalent of one year’s British GDP to get in on the world’s biggest stock market float in history. Ant Financial, the Alibaba-founded Chinese online financial powerhouse, is expected to be worth US$316b when it starts trading next week.

Talks over ahead of Green delegate vote on Saturday

PR people for the Greens and Labour confirmed talks between the two sides over a Government-triggering cooperation agreement finished today.

About 138 regional Green party delegates will jump on a mass Zoom call at 4pm tomorrow to vote on the deal. More than 75% must approve to allow the Greens to sign the deal. The PM is expected to publicly release the details of the deal in a late Saturday afternoon news conference in the Beehive.

If confirmed by delegates, there is expected to be a signing ceremony on Sunday morning in Wellington. I’ll be attending the Sunday news conference in the Beehive, which is likely to include a proposed ministerial list. I welcome your questions in the comments below and ideas for angles.

Electorate votes for status quo again

Justice Minister Andrew Little announced this afternoon the Government decided to stop any further attempts to reform cannabis laws after the Electoral Commission announced preliminary results showing 53.1% of voters in the October 17 referendum voted not to continue with the Cannabis Legalisation and Control Bill. The ‘yes’ vote in the referendum on the End of Life Choice Act was 65.2% in favour.

Little said the 167,333 deficit for the Cannabis ‘yes’ vote was unlikely to be overturned after the counting of around 480,000 special votes over the next week. Green MP and Cannabis ‘yes’ vote advocate Chloe Swarbrick said she would not concede defeat until the specials were counted.

“The electorate has spoken, they are uncomfortable with greater legalisation, and I would interpret it as [also] decriminalisation of recreational cannabis. The New Zealand electorate is not ready for that, and I think we have to respect that.” Little talking to reporters.

A spokesman for Prime Minister Jacinda Ardern said after the release of the preliminary vote that Ardern voted ‘yes’ in both referendums.

“I’m in the Green Party because I have the courage of my convictions.” Chloe Swarbrick when asked about Ardern’s non-declaration of her pro-’yes’ vote stance on the bill.

Shares in NZX-listed medicinal cannabis firms Cannasouth and Rua Bioscience closed down 17% and 3% respectively this afternoon.

Consumer confidence bounces, but still low

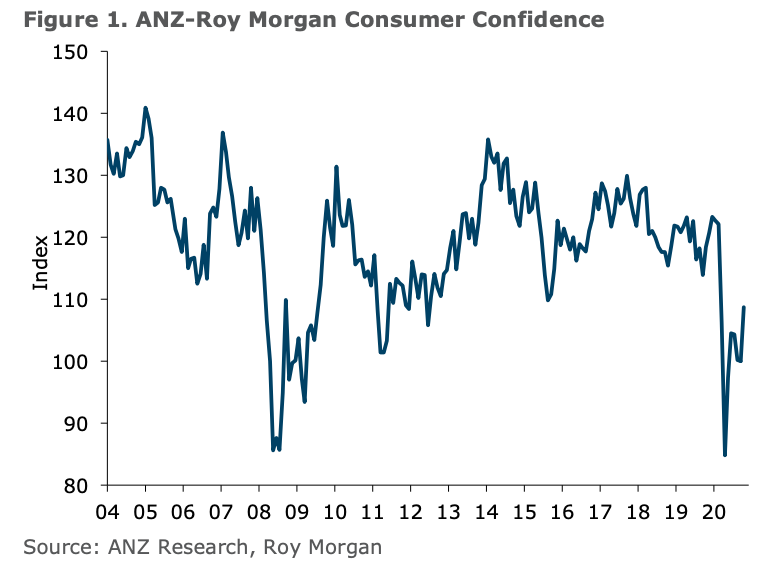

Business confidence bounced in October, and so did consumer confidence. ANZ published its monthly Roy Morgan survey of consumer confidence this morning, which showed its confidence index rising nine points to 108.7 in October from September.

Confidene remains below the historical average and even though the net proportion of households wanting to a buy a major household item rose 12 points to 11 points, it is still at recessionary levels.

“Households are increasingly confident that the housing boom has legs, but they remain wary about whether it is a good time to splash the cash. Housing booms certainly create a vibe on the street, but they are not a win for everyone, and are a little nerve-wracking in an economy facing a large negative income hit.” ANZ Chief Economist Sharon Zollner

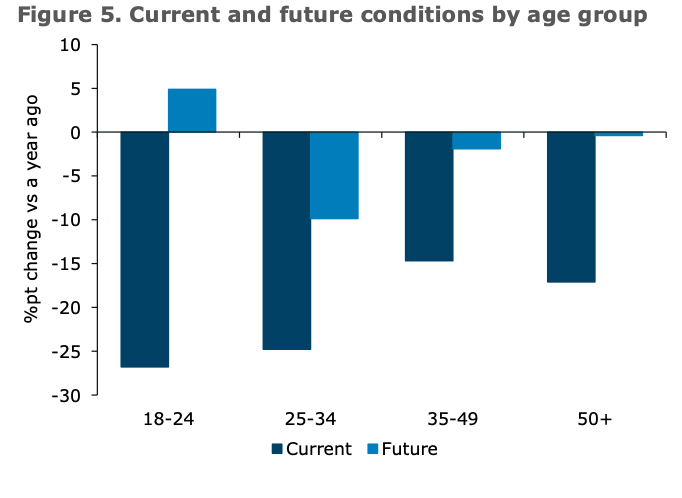

Expectations of house price inflation rose strongly in October, and young people’s views of their immediate financial future were sharply more pessimistic than those of older people, both now and vs a year ago.

“Job security has taken a hit, but not evenly – it’s primarily amongst young people and lower income earners in retail, tourism and hospitality – though the full force hasn’t been felt yet due to the wage subsidy. House price increases are making homeowners feel richer and renters/first-time buyers poorer. All up, it makes sense that perceptions of current economic conditions amongst 18-34 year olds are down far more than those aged 35 and over. There’s nothing ‘fair’ about recessions, and this one in particular is hitting vulnerable groups hardest.” Zollner

Getting ‘Ant’sy for shares

The retail portion of the share float of Ant Financial, the Chinese-based financial services firm founded by Alibaba’s Jack Ma, was confirmed this afternoon in Shanghai. The biggest share float in global history is expected to grow to US$40b from US$38b after the offer was 480 times oversubscribed. (Yes that is not a typo)

The final size will be confirmed over the weekend, but Hong Kong and Chinese retail investors bid the equivalent of US$2.8t or the equivalent of a year’s British GDP to get in on the float. (South China Morning Post)

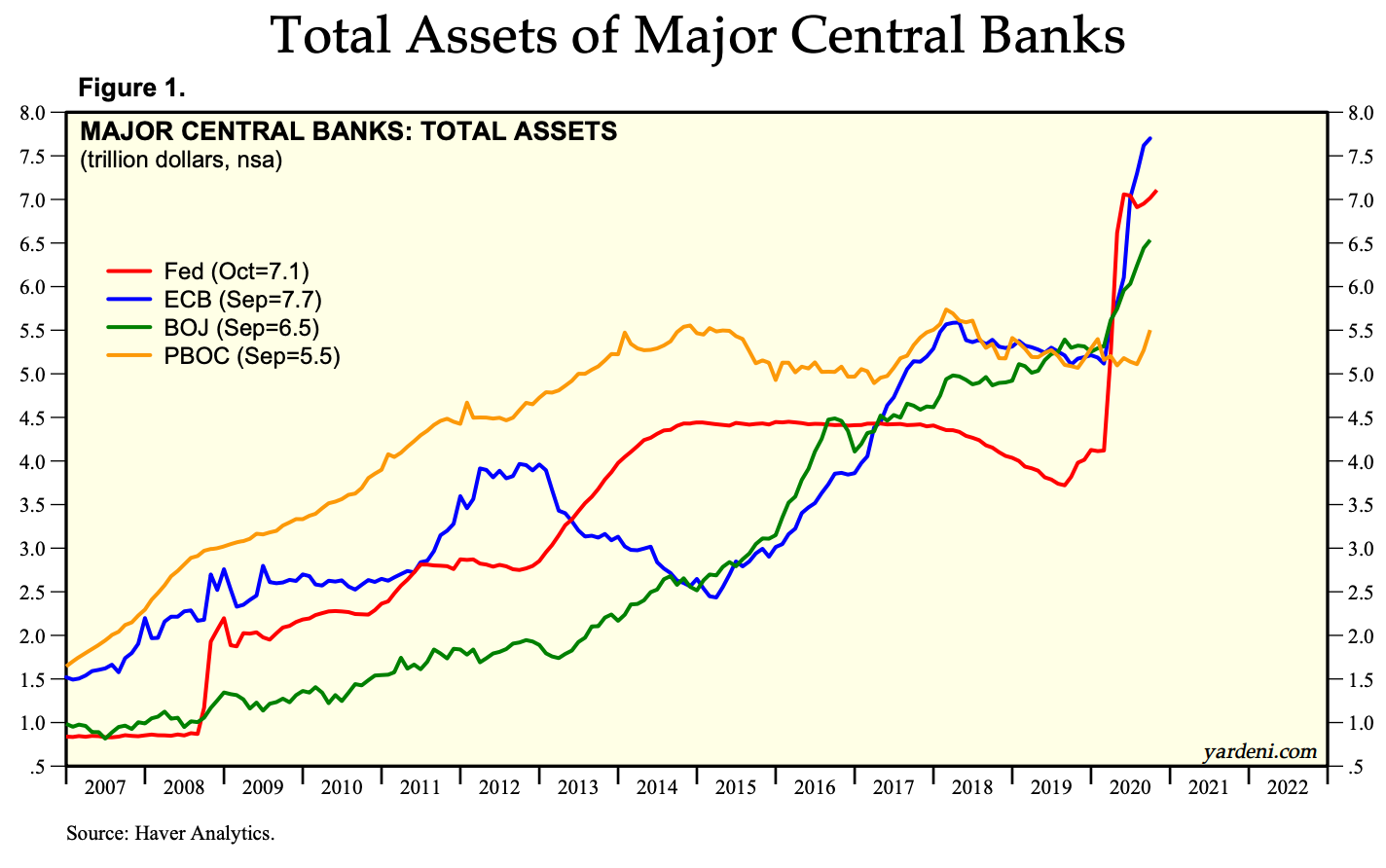

This is all about central banks globally printing US$8t since March to buy Government bonds from banks and pension funds, flooding financial markets with cash, some of which is being put into new companies and employment and productivity enhancing investments.

Most of that cash is, however, being parked back in bank accounts and other lower-risk investments such as Government bonds. This chart below via Yardeni shows how much central bank balance sheets (the assets bought with freshly invented cash) have expanded over the last 15 years, without boosting inflation (although some may argue the counter-factual would have been more disinflation or outright deflation without the printing).

(Sorry couldn’t help myself with the pun in the headline.)

Coming up…

Sat Oct 31 - Green delegates vote on deal with Labour Government from 4pm. PM Jacinda Ardern to give details of later on Saturday.

Sun Nov 1 - If approved by Green delegates, Ardern is expected to detail the makeup of second term Labour Government before midday in Wellington.

Tues Nov 3 - Reserve Bank of Australia expected to ease monetary policy

Weds Nov 3 - US Presidential elections (Nov 4 NZ Time)

Thurs Nov 5 - Ant Financial shares start trading in Hong Kong

Friday November 6 - Official final NZ election and referendum results announced after counting of special votes.

Weds Nov 11 - Reserve Bank quarterly Monetary Policy Statement (MPS) and news conference at 2pm. Details expected of the Reserve Bank’s $30-50b Funding for Lending Programme (FLP) of Reserve Bank money printing and lending to banks at or around the Official Cash Rate (currently 0.25% and expected to fall to minus 0.5% next year).

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds November 25 - Reserve Bank six monthly Financial Stability Report (FSR) scheduled for release. Central Bank expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Ngā Mihi

Bernard

PS: Hope you enjoyed the pic above from a subscriber Paul Carrad. The photo is of kākā at Rakiura and is by Henry Grayson. These kākā look like ‘yes’ voters. I welcome more contributions for sharing in these emails.