TLDR: Briefly, for an hour or two yesterday, the Labour Government looked to have been given an off ramp to abandon Three Waters for a much less politically divisive alternative that would have allowed for more investment in and consolidation of water assets, but without the compulsory co-governance or councils losing control.

Instead, Prime Minister Jacinda Ardern and Local Government Minister Nanaia Mahuta drove right on past, smiling and waving politely, seemingly unable to disconnect the self-driving software built for them by the policy wonks at Treasury and the Department of Internal Affairs, and powered by Labour’s Māori caucus.

Surprisingly for a median-vote-hugging group that usually course-corrects with the help of focus groups and polling, the sixth Labour Government has decided to barrel on and to hope the anti-centralisation and anti-co-governance backlash from the regions has subsided before next year’s elections.

In my view, ignoring the alternative for a much-less-disruptive set of reforms will cement in the loss of provincial and suburban votes that fueled the ‘red wave’ of 2020. Ardern and Mahuta may yet execute a big U-turn to take the off-ramp, but yesterday, the ladies were not for turning.

Paying subscribers saw and heard more analysis and detail on the Three Waters alternative below the fold here and in the podcast above earlier. The audio includes my questions and answers to the PM and Nanaia Mahuta in last night’s post-cabinet news conference. This article is updated with a full podcast, including my commentary for all to see, hear and share. Many thanks to paying subscribers for permission.

Three Waters plan effectively rejected by PM within hours

The new mayors of Auckland and Christchurch yesterday proposed an alternative to the four water entities being created under Three Waters, but it was all but rejected within hours by a Government that sees no alternative to complete ‘balance sheet separation’ and co-governance for all water assets.

The mayors’ alternative plan put forward yesterday afternoon would see councils retain ownership of water assets and not have to adopt co-governance with iwi, but would have access to Government investment and Government-guaranteed loans. Any consolidation and form of co-governance would be driven and decided by councils, rather than legislation.

Here’s the difference in how it could look, with the current Three Waters map first, and the suggested alternative below that.

The idea launched by Auckland Mayor Wayne Brown and Christchurch Mayor Phil Mauger was also backed by Waimakariri Council Mayor Dan Gordon and was put out for other councils to consider.

Here’s the key details:

the creation of Regional Water Organisations (RWOs) that couldn’t be sold outside local authority ownership and would be directly controlled by councils in their region, without the need for an intervening committee, as proposed under Three Waters;

the RWOs would have access to investment capital through a new Water Infrastructure Fund (WIF), administered by the Government’s Crown Infrastructure Partners (CIP), which funded the ultra-fast broadband rollout;

CIP would act as the lead facilitator of financing and investment and could manage the balance sheet risk at the national level;

the RWOs would form their own co-governance arrangements at regional level, if opted for by councils, rather than being made compulsory from the centre;

the RWOs would be subject to regulation by the already-created regulator Taumata Aromai; and,

smaller rural schemes not in RWOs would be able to apply for capital subsidies via the Water Infrastructure Fund, the Ministry for the Environment and Te Whatu Ora.

The Mayors said the election results effectively gave them a mandate to argue for another alternative and that the promises by the Opposition to repeal Three Waters undermined certainty for everyone in the long run.

“Everyone agrees tens of billions of dollars need to be invested over several decades to upgrade New Zealand’s freshwater, storm-water and waste-water infrastructure – and that requires maximum political consensus to deliver policy stability.

“As a nation, we need to find a way move forward in a positive and consensus manner - and stop the ugly and angry Three Waters debate that is dividing our county.” Mayors Brown, Mauger and Gordon in a statement.

Here’s their full news conference:

‘Talk to a very empathetic and smiley hand’

But any hopes the proposal might be a useful off ramp for the Government lasted barely 90 minutes before Prime Minister Jacinda Ardern and Local Government Minister Nanaia Mahuta politely ruled out any alternative that did not include ‘balance sheet separation’ and the ‘economies of scale’ of the four entities. Ardern said ‘balance sheet separation’ was a bottom line for the Government, which is currently driving Three Waters legislation through the consultation process in select committee.

Ardern told her weekly post-Cabinet news conference the Government’s bottom line was there would have to be balance sheet separation and economies of scale to get the benefits needed to avoid the higher rates and water bills projected with the status quo. (Hear more above in the podcast or see the exchanges in the video below)

Ardern and Mahuta were asked what they thought of the Mayors’ proposal in last night’s post-Cabinet news conference.

“We're at a juncture now where we've been receiving public feedback. And of course, we've said we're open to making refinements and changes that improve the reforms here that are just so necessary.

“But our bottom line is, we don't want to change those matters, which are focused on keeping cost of living in check. Without reform, ratepayers will see increases in their water bills. So we don't want to change the fundamentals of these reforms that are designed to make sure we don't see escalating bills.” PM Jacinda Ardern.

The video above is lined up to the beginning of the exchange, which includes RNZ’s Jane Patterson asking if the Mayors’ proposal to keep the assets and not make co-governance compulsory meant it did not comply with the Government’s bottom lines.

“Correct. That is key,” Jacinda Ardern said in reply.

The PM then followed up with this:

“But, look, I don't want to shut down what is, I think, in good faith, an offer here for us to keep working together, because I think the Mayors do have a focus on making sure that their rate payers don't experience that spike in cost of living. We've got the same focus, so let's see how we can keep working together.” Ardern.

Challenged again on whether the proposed plan breached her bottom lines, she said:

“We'd both rather not traverse a negotiation in this manner, but actually talk directly. But so long as, at its heart, we are all focused on making sure rate payers don't experience those large projected increases, we have common ground.” Ardern.

I then challenged the PM on how open the negotiation would be given she had just ruled out the basic structure of the Mayoral plan.

“Bernard, they’ve made a range of suggestions, and they’ve made them in good faith, and I’d rather us just have conversations with the Mayors directly, rather than traversing it here about their proposals.” Ardern

‘Just wait for the select committee report’

Both Ardern and Mahuta pointed to the ongoing select committee process, which is expected to produce a report to Parliament next week with any changes after the committee stage. If any changes are planned, this is where they would be made.

So what’s actually going on here? Why is the Government persisting with a policy that clearly is not supported by the bulk of councils and became the subject of a ‘backlash’ referendum in council elections this month. With Labour around 10 percentage points behind National in the polls and on track to be replaced outright by National and ACT late next year, it’s somewhat surprising the Government has yet to throw Three Waters under the bus and move on.

The dirty little secret of infrastructure financing is that it’s in the interest of residential land owners and the politicians who need their votes to do nothing to fix our infrastructure deficits.

Both the Mayors and the Government knows there is a real problem to solve. There is at least $100b worth of infrastructure under-funding built into our system from the last 30 years, before another $100b needs to be spent over the next 30 years to handle a population growth rate projected to be less than half what the 1.6% growth we actually saw over the last decade.

Water infrastructure is a crucial part of this. Without the pipes, there are no houses or roads or railways or offices or factories built. The Three Waters process has estimated up to $185b has to be invested over the coming 30-40 years to both fix existing infrastructure, handle fresh population growth and improve the quality of our drinking water, storm water and waste water.

The Government is currently planning $61.9b of infrastructure spending, which does not nearly fill the $200b hole already identified by the Infrastructure Commission. The investment is also needed to kick-start the housing and public transport investments needed to have any hope of solving our housing unaffordability, climate change inaction and child poverty problems. See more on that here in my analysis earlier this month about infrastructure and population.

Why Three Waters matters so much

Three Waters was the Government’s solution to this problem in a way it hoped satisfied the major constraint that both parties have effectively agreed to for the last 30 years. Both believe central Government taxes should be limited to around 30% of GDP and debt should be limited to 20-30% of GDP over the long run. That effectively means neither Labour nor National Governments can significantly increase taxes or create new taxes that generate net extra revenue, or use the Crown’s balance sheet, to borrow for a sustained and permanent increase in public investment in infrastructure.

Any party advocating for higher taxes and debt would get slaughtered by the other, so the status quo remains, although it is also a very lucrative policy for the median voters that both parties need to govern. That’s because these voters largely own standalone homes in suburban and provincial areas and have made $1t of tax-free and leveraged capital gains on their residential land values in the last 30 years. That, in turn, is largely because this infrastructure inaction and dysfunction between central and local Government has limited the land available for new housing.

Extra demand in the form of a higher population and lower interest rates turned into spectacular gains in land prices because land supply for new housing stagnated or was reduce. Any increase in Government debt or increase in taxes would increase interest rates (and therefore reduce land values) and/or reduce disposable income available for leveraging up into ever larger mortgages.

So voting to block new taxes and/or debt to stop infrastructure keeping up with population growth has been very profitable for land-owning voters and the politicians who need them. Meanwhile, old renters and their kids, are toast. All they can dream of is a ticket to a higher paid job, cheaper housing costs and a better life in Australia, albeit as a second-class citizen who pays full taxes but gets second-class benefits.1

The (very) dirty (not so) little secret of our infrastructure mess

The dirty little secret of infrastructure financing is that it’s in the interest of residential land owners and the politicians who need their votes to do nothing to fix our infrastructure deficits. It’s also in their interests not to plan for population growth, and/or unleash massive population growth that is further stretches supplies of land available for housing. It’s the perfect combination when you realise your pathway to a comfortable retirement and leveraging up plenty of equity to help your kids into housing is to ensure no new land is available, migration is strong, taxes stay low and interest rates stay low.

Under our political economy’s dual 30/30 constraints on tax and debt, any large new infrastructure has to be funded privately through private debt or private equity, or at least far enough away from Crown and/or council balance sheets to avoid putting Aotearoa-NZ’s AA+ sovereign credit rating at risk. This is the whole point of Three Waters. It shifts the council-owned assets into new balance sheets that are also separate from the Crown’s, which would then be able to borrow against streams of water charge revenues unconstrained by politicians trying to avoid ratepayer revolts against water meters, water charges and higher council debt.

Three Waters was a way to allow ‘someone’ to borrow and apply water charges without having to get specific permission from either general election voters or council voters for higher charges, taxes and debt.

Unfortunately for the Government, the debate got meshed up with schemozzle about co-governance, which I think is a red herring. Anyone deeply involved in local Government, infrastructure and resource management and who understands co-governance has no great fear of it. For example, former National Treaty Minister Chris Finlayson thinks co-governance should be embraced, not feared. E Tangata.

But is Three Waters actually the best idea?

The debates around the actual merits of Three Waters as a vehicle for doing the necessary investment should be shorn of co-governance and judged on the cost, the logistical viability and the political sustainability of it. The off-balance-sheet structure adds hundreds of millions of costs in the form of higher borrowing margins and undermines its long-run politicial sustainability because it is at least a couple of arms lengths away from both sets of voters.

As soon as National and ACT said they would repeal it, Three Waters was in trouble. As soon as many of the councils said they were opposed, and the biggest ones were luke-warm, it was in deeper trouble. The local election results should have been the nail in its political coffin. But that hasn’t been the case yet.

‘But we’ve done what you want. What’s your problem now?

The latest counter-proposal from Auckland and Christchurch appears to have called the Government’s bluff. It addresses the investment financing issue, but still allows local control and does not force centralised co-governance. The PM’s dismissal-with-a-smile appears to have dug the Government even deeper into its mess.

If only it had been up front about what it wanted to do to start with, which was to unleash the infrastructure investment needed to underwrite housing growth for decades, then it would be in a stronger position. Then we would have had a proper debate about what amount of population growth we want, what level of taxes and debt we’d need to properly underpin that growth, and what type of direct governance we wanted. But that would have involved challenging and then changing the underlying shibboleth of the last 30 years: the 30/30 rule designed in an era of stagnant population growth to perma-starve the beast of Government

The bottom line: The Government has strapped itself to the Three Waters ship and can’t seem to untie itself from the orthodoxy hard-wired into it by Treasury and DIA. A captured Government is going to stay well under the water in the polls well while it holds on to Three Waters. The Opposition are now licking their lips, although they too will have to come up with their own solution before next year’s election.

We await next week’s (after Nov 11) select committee report with bated breath, but only for tweaks. It’s now unlikely there will be the wholesale change of approach demanded by our infrastructure needs and the inter-generational politics that will eventually come home to roost.

Here’s an interview I did this morning on TVNZ’s Breakfast programme with Water NZ Gillian Blythe on the proposed alternative and the political economy around that.

Banks pass super-stress tests with flying colours

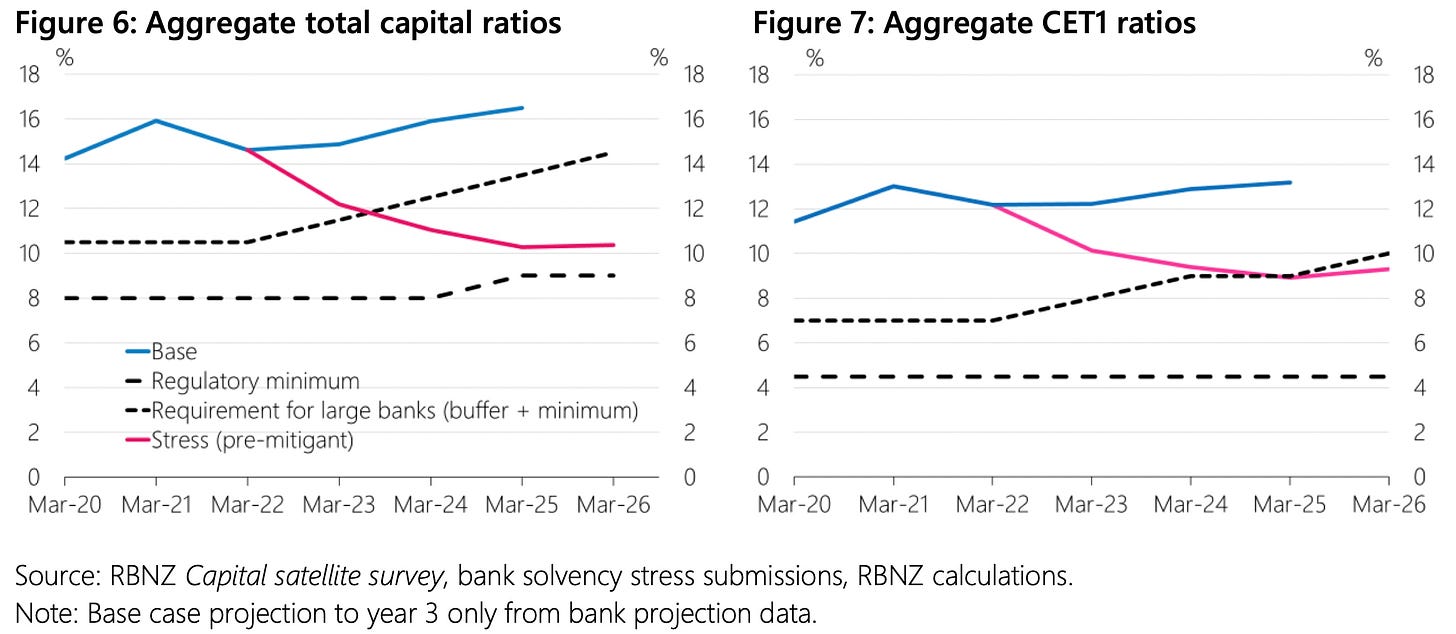

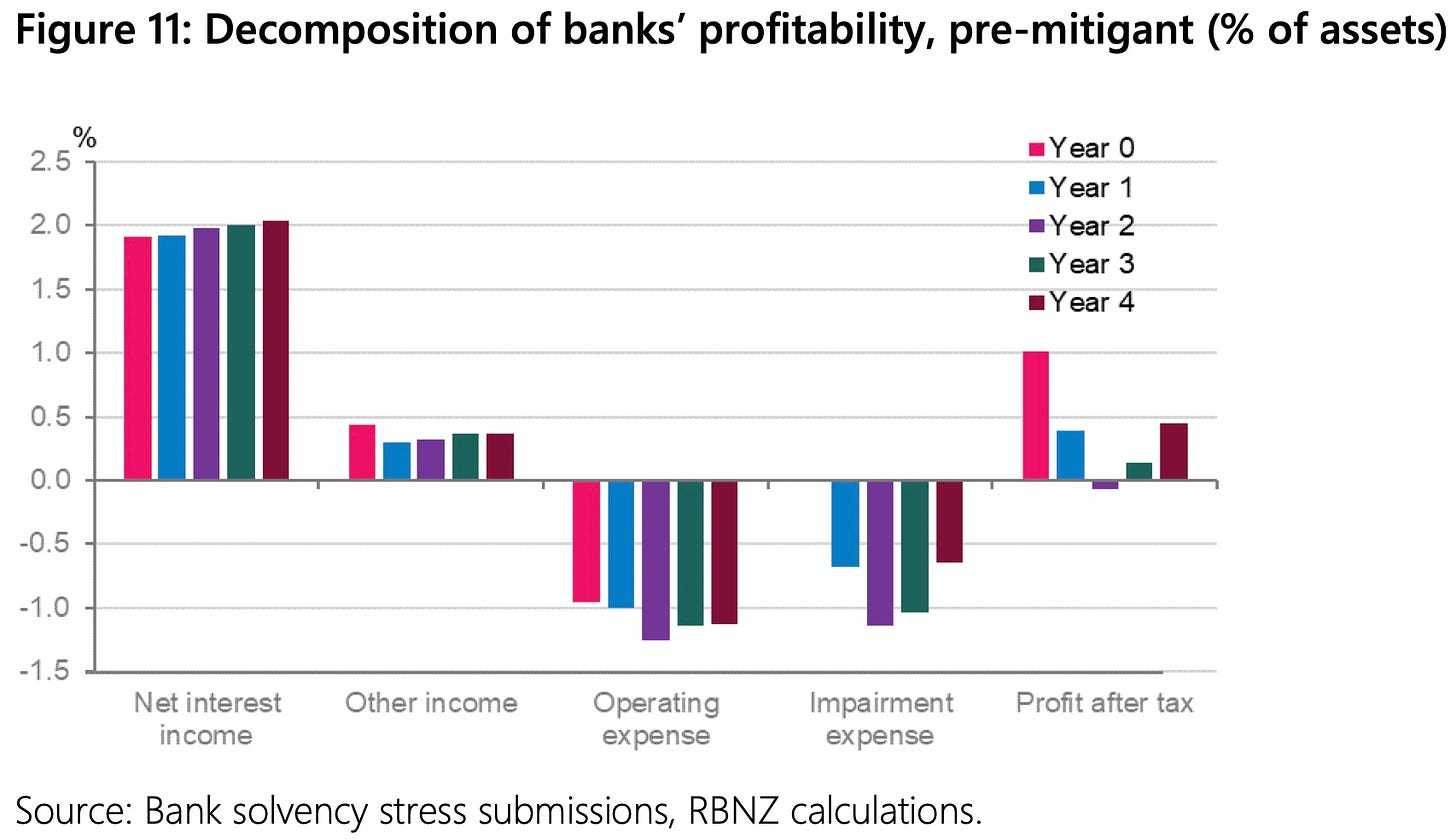

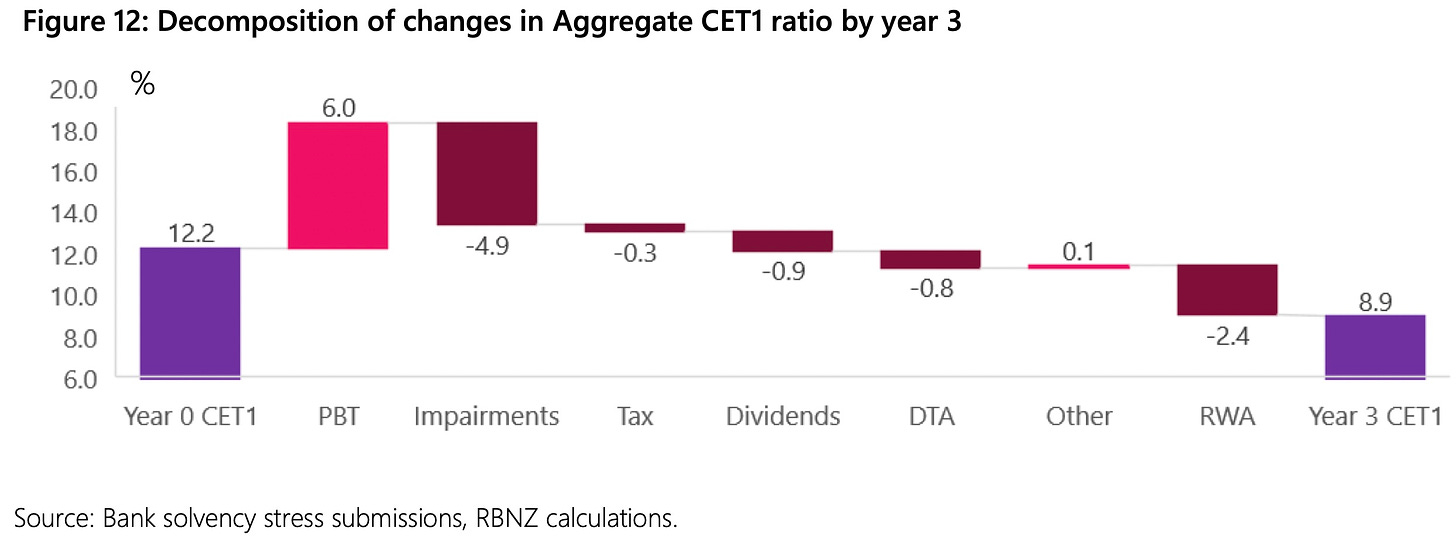

‘No worries’ - Te Pūtea Matua (RBNZ) published results this morning of bank stress tests modelling a 47% fall in house prices, an unemployment rate rising to 9.3% and mortgage rates as high as 8.4%. It found the banks’ capital ratios only fell by 3.3 percentage points to 8.9%, almost double the regulatory minimum.

‘Seriously. No worries. Not even with a cyber-attack too’ - The stress tests found that even though they would have to book $6.81b worth of losses on their mortgage books and $20.85b of losses overall over four years, they would only be loss-making in one of those years and still book collective profits of $5.45b over the four years modelled.

The stress test threw in a 1-in-25 year cyber ‘event’ costing $1.3b and the banks still passed with flying colours. That result of only being barely unprofitable in one year also assumed the banks still paid their parents’ dividends and still paid taxes.

Reserve Bank Stress Test results for 2022 - Briefing Paper

So what? - This is the ultimate riposte to anyone who might say that the housing market and the economy is so indebted and the banking system so vulnerable to a housing market bust that such a bust would bring down the banking system. It’s not even close.

The bottom line: The banks have become so profitable that even the most gi-normous of shocks could not shake them. It’s either a good thing, if you main aim is a stable banking system. Or the banks make too much profit in normal times. If they made lower profits and reinvested their dividends in their capital buffers they would

Ka kite ano

Bernard

Elsewhere in the news yesterday, overnight and this morning here and overseas:

Blitzed it - Our banking system passed a Reserve Bank stress test released yesterday with flying colours, even though it assumed a toxic combination of unemployment at 9.3%, a 47% house price collapse and 8%-plus mortgage rates (see more below);

‘We’re sailing anyway’ - Ukraine said overnight 12 grain-exporting ships would sail through the Black Sea today, in defiance of Russia’s decision to reimpose its blockade on shipments and creating a risk of more direct clashes between the UN-authorised backers of Ukraine and Russian warships;

The wrong sort of record - The pressure remains on the European Central Bank to keep hiking interest rates after the Euro zone’s inflation hit a record-high annual rate of 10.7% in October, which was above September’s 9.9% and the 9.8% consensus forecast;

Economic chills - In another sign China’s economy is slowing under the weight of ongoing Covid lockdowns and an imploding apartment development sector, it reported its official manufacturing sector purchasing managers’ index was 49.2 in October, below the 50-point threshold separating contraction from expansion, and below economists’ forecasts for about 50.0; Reuters

B-52s to roam to Australia2 - The United States and Australia have agreed to station six nuclear-capable US B-52s in a fresh display aimed at deterring China, ABC’s Four Corners reported, and which China reacted badly to (see Quote of the day below); Reuters

By the way. That could change soon if the Australian Government follow through with their agreement earlier this year to accelerate full residency rights for New Zealanders in Australia, in part because Australia has even more intense labour shortages than we do.

Share this post