TLDR & TLDL: The Government has announced it will add almost half a billion to the $19.5b pile of cash grants to businesses already given to asset owners during Covid, further widening inequality and reinforcing the unfairness and counterproductive nature of its Covid recovery spending and actions.

I go into detail on the winners and losers of the ‘K’ shaped nature of the Government’s recovery policies and results below the fold.

Elsewhere in the news overnight and this morning:

markets bounced this morning on easing fears about omicron, which appears not to hospitalise many cases (CNBC);

NZME announced it would buy BusinessDesk for $5m or about $500 per subscriber;

Australia announced last night it would delay its border reopening due tomorrow for two weeks because of omicron, and Japan joined Israel overnight in closing its borders completely (CNN) (The West Australian);

summer festivals planned for Gisborne and Northland are in doubt after the regions were included in the ‘red’ zones, which limit events to 100 – Rythm and Vine organisers said last night they would announce a decision this morning on whether to go ahead;

the National caucus have yet to find a clear choice for its new leader with just a few hours to go before its 3pm caucus meeting and reports suggesting Christopher Luxon holds a small lead over Simon Bridges, but not enough to find a clear winner, and not enough to avoid a contested vote;

Watch out today for:

ANZ’s publication of its first cut of its Nov business confidence survey at 1pm;

the Reserve Bank's release of bank lending and deposit figures for Oct at 3pm; and,

a National Caucus leadership decision due after 3pm.

FYI for free and paid subscribers, I’ve decided to open this one especially because of the deep dive below into the way the Covid recovery is widening inequality, and how it is proving counter-productive for social cohesion, child poverty and the next public response to a crisis. To support my independent journalism and analysis on housing unaffordability, child poverty and child poverty, subscribe here to this one-day 50%-off special of $95 for a year, or $9.50 a month.

That gives you full access to the archive, all articles, podcasts and emails, and access to webinars and Ask Me Anything sessions for subscribers, who are able to comment below.

Our counterproductive and unfair Covid ‘rekovery’

It’s now the oldest trick in the history of democratic governments captured by the wealthiest voters: privatise the gains from economic growth and socialise the losses of economic shocks.

The response to the Global Financial Crisis set the template of big business and bank rescues, cash grants and subsidies to asset owners and money printing to pump up the asset values of the already-wealthy. Now the Covid recovery is using that template, but at a larger and faster and more brazen scale. Asset owners now believe taxpayers should bail out their companies and pump up their asset prices whenever there’s a crisis.

They’re now so sure it will happen, they ‘buy the dips’ whenever there is a slight fall in prices, knowing a central bank can and will intervene, or that a Government will ensure their businesses don’t fail. Moral hazard is now baked into the DNA of global capitalism, and even more so here because our housing market is bigger relative to incomes and GDP than anywhere else, and has risen faster than anywhere else over the last 20 years.

It is happening all over the world in a variety of Covid responses, but the Labour Government’s response here is the worst in the world in terms of widening wealth inequality relative to GDP, and through the counter-productive and wasteful of use taxpayer funds to not ‘Build Back Better’. It is also much bigger than the bailouts and central bank support delivered to asset owners here during and after the 2008/09 GFC.

Time for a stocktake

Now it’s becoming clearer what the total bill for the Government will become once the support ends for businesses and the Reserve Bank continues reducing stimulation early next year, it’s worth doing a stocktake.

Since the onset of Covid in March 2020, the Government of Aotearoa-NZ has delivered one of the biggest fiscal and monetary policy responses in the OECD in terms of taxpayer money spent and central bank money printed relative to GDP. It also unleashed the strongest economic recovery, the fastest asset price inflation and delivered the lowest unemployment rate in the OECD.

Surely that’s all good? The Labour Government certainly paints its response as a kind and progressive one that has not left the most vulnerable behind. It has touted the success of its wage subsidies and regularly highlighted the various dollops of funds paid to food banks and for emergency housing and special needs grants.

But what was the scale of the support and who is better or worse off as a result? The headlines look good, but what are the bottom lines?

The effects now evident in asset values and bank accounts nearly two years after the outbreak of Covid are simply astonishing. They show asset owners, who have been the beneficiaries of almost all the Government’s direct support and central bank actions, are now astoundingly more wealthy.

Working families and beneficiaries who pay rent are now mostly worse off or barely treading water since the first lockdowns in March 2020. Food banks are seeing record demand and the waiting list for public housing has risen 65% to 24,475 since the beginning of Covid. It has trebled in the last three years.

The rich’s wealth rose by $872b or 50%

In short, by my calculations from Reserve Bank figures on term deposits, household financial assets and house and land valuations, asset owners’ wealth is on track to rise by $872 billion or 50% to $2.63 trillion within two years of the outbreak, including:

a $45b increase in cash in bank deposits to $319b, which incorporates a $21b rise in non-financial bank deposits to $110b and a $24b increase in household deposits to $209.1b;

a $608b increase in housing equity due to a $648b rise in the value of houses and land to $1.74t and a $40b rise in home loans to $318b; and,

a $257b increase in the value of shares, bonds and other non-bank financial assets to $954b.

All of that increased wealth and cash on hand is due to Government payouts and the actions of central banks here and overseas. Yet the money keeps flowing to those who already have it.

Here’s another chunk of change

The Government announced yesterday it would pay up to another $490m of cash grants to business owners as a transition payment going into the ‘traffic lights’ system, extending taxpayer support at large to the owners of capital and assets to $20b in cash since the onset of Covid.

Just to be clear: wage subsidies were not paid to workers. They were paid to business owners to offset the wages of the employees they would otherwise have made redundant, although that willingness to fire staff or the ability to use their own existing buffers was never tested.

Meanwhile, the cash balances of transaction and term deposit bank accounts of non-financial businesses and households owning property have risen by a net $45b since Feb 2020 to $319b at the end of September. Significant increases in cash deposits can be seen in March and September soon after the Govt payments, and have continued increasing since then.

None of the wage subsidies, resurgence payments and the new transitional support payments were ever means tested or given as loans for repayment. An assumption was made in March 2020 that there was not enough time to check and business owners needed a shot of confidence to keep employing people. Somehow, that assumption was not challenged or revisited in August 2020 or August 2021 when fresh resurgence payments were made, even though the experience after March 2020 was of quick economic and spending recoveries, and a strong labour market.

Why no means testing or clawbacks?

There was never any suggestion of clawing it back if, in the event of a strong recovery, businesses ended up with cash surpluses, which is indeed what happened.

The desperate situation forecast in March 2020 of double-digit unemployment meant the first handouts of cash labelled as wage subsidies were forgiveable and certainly worked spectacularly to stabilise the situation, largely due to the speed and lack of conditions with the cash.

But it was clearly abused in retrospect, and then the Government failed to follow up and pull back funds through the end of 2020. By then the Government had given $14b in cash to businesses and less than $1b had been paid back. MSD did not even send letters to businesses asking them to check if they had indeed needed the money and whether to pay it back. Auditor General John Ryan criticised the MSD’s lack of proper audits and follow-ups with subsidy recipients.

Many companies, including Hallensteins Glassons, Fletcher Building, Harvey Norman, the Norman family’s James Pascoe Group (Pascoes the Jewellers, Stewart Dawsons, Goldmark, Whitcoulls and Farmers), NZME, and Fulton Hogan took the cash and did not repay any or all of it, even though they quickly returned to profit and are again paying dividends to shareholders.

Some refused to pay the money back on both sides of the Tasman, including Michael Hill Jewellers, Kathmandu and Harvey Norman. Then there were the luxury product and services businesses, often owned by rich-listers, that took the money and never repaid it, including The Wellington Club, The Northern Club, the Kauri Cliffs golf course and the Millbrook resort and golf course in Queenstown. The luxury lodges, wineries and golf courses owned by US hedge fund billionaire Julian Robertson claimed more than $1.2m in subsidies and didn’t return them, despite making hefty profits by the end of the year.

‘We feel a balance was hit’

Some surprising figures have even defended board decisions to pay the cash to shareholders rather than hand it back to the Government, including Kathmandu chair David Kirk. Kathmandu was given A$20m in grants through Australia’s JobKeeper wage subsidies and wage subsidies in NZ, but decided in March to pay A$14m in dividends to shareholders rather than pay the cash back.

“Kathmandu has raised a lot of capital and our shareholders have suffered quite significant (earnings per share) dilution. There have been no dividends paid to shareholders for a year, which is a loss that will never come back.

“So when you think about our stakeholders, we think the pain has been pretty fairly shared. A repayment of JobKeeper at this point would be a transfer from shareholders funds to the government, and we feel a balance has been hit.” David Kirk quoted in the SMH.

Kathmandu received $6.1m in wage subsidies from the NZ Government last year. It has so-far received a further $2.7m during the delta outbreak this year.

Some were embarrassed into paying

Some businesses were effectively shamed into repaying their wage subsidies through mid-2020, including The Warehouse, Briscoes, Ryman Healthcare and Vector. Others hastily repaid the money slightly earlier when they realised their customers, staff, regulators and competitors could find out here the names of which large companies were paid and how much. There were some embarrassingly high-end names who had to scramble to give the money back, including blue-chip law firms such as Bell Gully, Simpson Grierson, MinterEllisonRuddWatts, Meredith Connell and Lane Neave. Some, including the private equity-owned and heavily-indebted TradeMe only repaid after revolts from embarrassed staff.

So far, only one reported prosecution has been launched by MSD against those who took the money without justification, out of over 1,000 cases referred for investigation. During that time, MSD has launched dozens of prosecutions against beneficiaries.

Various advisers, including in a detailed report from the auditor general’s office, recommended someone in the government simply ask those who received cash to prove with GST receipts that they needed the money and if not, repay the money. Neither has happened. There has also never been proper audits of how the money was sent, used, and not repaid. Newsroom’s David Williams, who has been doing some excellent reporting on this, reported earlier this month that MSD had asked for about $6.8m of repayments from the 10 largest companies it had requested repayments from.

Meanwhile, here’s the list compiled via Newsroom of the top 30 recipients of wage subsidies, who received a total of $842m, most of who are large overseas-owned or listed companies. Newsroom reported last month that MSD had done sample checks on 339 of the 396,817 businesses that received the subsidy last year.

Yet here is some more money

So far in this latest series of wage subsidies, the Government has paid out over $5.5b during the delta outbreak, on top of the $14b paid last year. The latest resurgence payments will take the total to $20b.

In the podcast above I include my exchange with Finance Minister Grant Robertson about the fairness of the payments and the lack of clawbacks, given beneficiaries and recipients of special needs payments are often subject to clawbacks.

He argued that the $24,000 cap on the transition payments limited the number of large companies benefiting from the payments, although many still are receiving ongoing wage subsidies, including SkyCity with $14.2m since August this year.

Not nearly as much or as fast for the working poor

The biggest losers in the Covid recovery have been those in itinerant work or piecemeal work, who have lost income, along with those renting. Last year those on benefits and the working poor received benefit increases that were not enough to cover rent increases. Last year they received a doubling of the winter energy payment, but not this year.

The Government announced earlier this month it would lift the incomes of 346,000 families by an average of $20/week with various increases in best start payments and higher tax credits, but only from April next year. The PM said it would lift 6,000 children out of poverty. It is costing $68m/year for the next four years. Just imagine what $20b worth of cash paid to increase benefits, let alone to invest in housing and infrastructure, would have done to reduce child poverty.

Last month, MSD Minister Carmel Sepuloni announced an extra $9.6m in hardship assistance for low income workers, although some of it can be clawed back at a later date.

Child poverty activists have described the recent one-off grants and tax credits, some of which are clawed back as recipient incomes rise, as disappointing and out of touch.

That has been reflected in massive increases in demand for food parcels and a rise in debt owed by beneficiaries to MSD. As of March 2020, 67% of beneficiaries owed an average of $3,600 in debt to MSD, with debt rising $150m to $750m in the year to March, 2020. The Govt has rejected suggestions of an MSD debt moratorium or writeoff.

So in summary…

Due to Government policies for cash payments and money printing to create a wealth effect and rescue the economy and jobs:

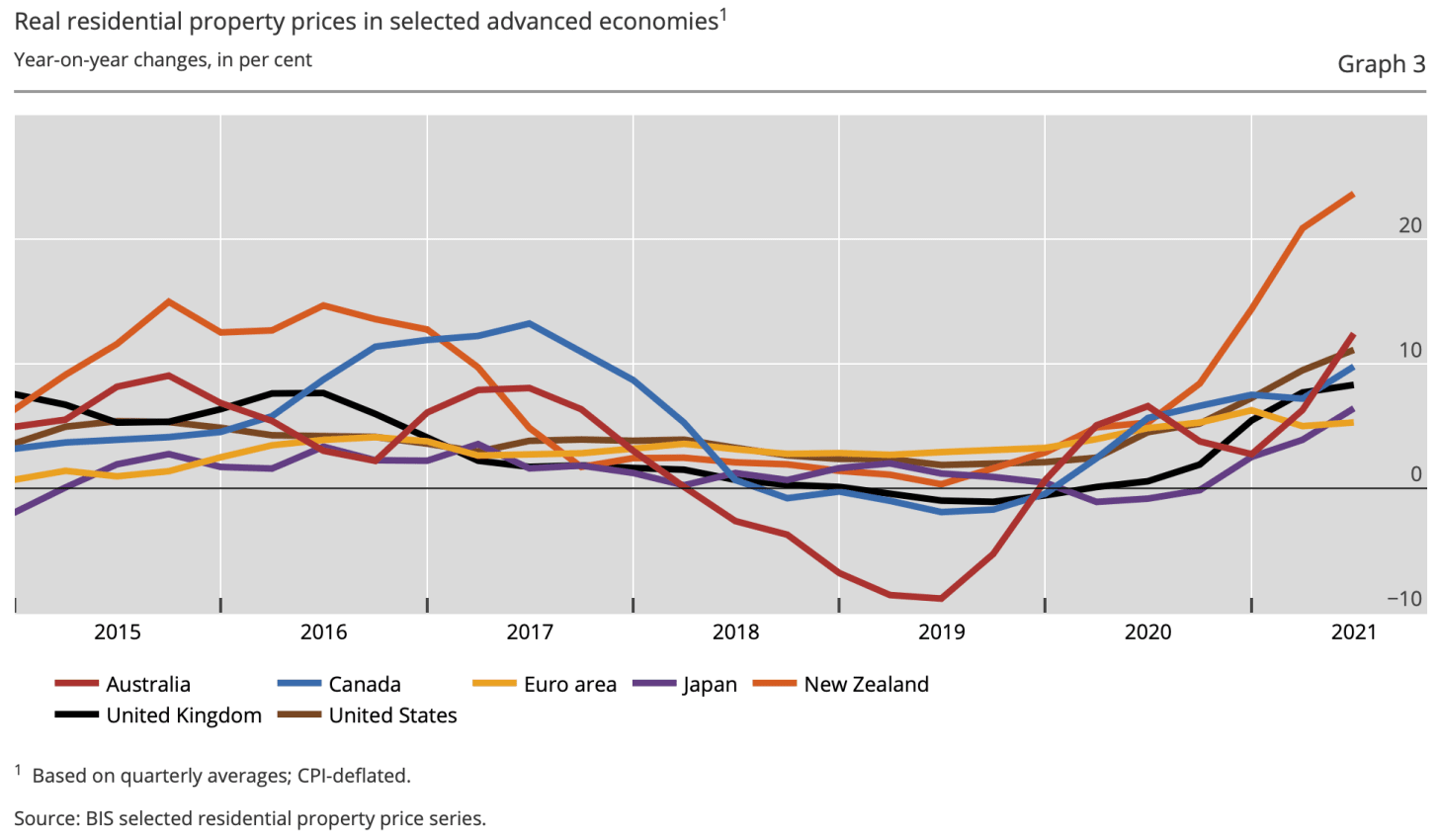

the wealthy were made $872b richer, largely because of a 54% rise in house prices forecast in the two years (the RBNZ sees another 10% rise over the next year) after the onset of Covid;

the Government will have given at least $20b in cash to business and asset owners in a period when those asset owners have increased their cash savings accounts by $45b to $319b;

the even-wealthier recipients of those cash grants have largely refused to repay the money, even though it is considered normal for the recipients of benefits to repay money deemed not necessary to overpaid; and,

workers and beneficiaries who rent are worse off because of part time and extra hour job losses, along with rent increases and inflation in costs of petrol and food.

Yet many boards and leaders talk about ‘Building Back Better’ and just transitions. Some have even said workers should be grateful for low unemployment and that the measures taken have made New Zealand a model for the rest of the world.

Treasury, Reserve Bank and Finance Minister Grant Robertson have even denied that the response has worsened inequality in recent weeks.

A counterproductive erosion of social cohesion

One feature of the double standard when it comes to the Government helping businesses with no-questions-asked cash grants while clawing back special grants and benefits from the poor, is that the poor notice and, understandably, are not very cooperative when the Government needs them to physically do something for society as a whole. Such as get vaccinated.

Essentially, the social contract is broken.

The clearest sign of that inevitable loss of social cohesion can be seen in vaccination rates, which are closely aligned with the most deprived and vulnerable suburbs, as can be seen in this Stuff chart showing which towns have the highest number of unvaccinated people.

When business leaders and asset owners express surprise and disappointment when poorer voters and citizens are uncooperative or vote for the ‘wrong’ candidates, they should look first at whether they seriously think the last two responses by Government to crises were just and effective.

The strategy of bailing out businesses and making the wealthy wealthier has worked for the wealthiest during the GFC and Covid, but it has further deepened the societal divisions in the process, storing up yet more social and political conflict for the next crisis.

Comments of the day in the The Kākā community

‘Is anyone looking at my email?’

“Is the government aware of the confusion and issues overseas kiwis are apparently having trying to provide proof of vaccination? Some have apparently sent the proof using the appropriate process but have not got a response (not even confirmation of receipt). The various online communities have constant posts and questions about this, so makes me wonder how big the problem is and whether the MOH are being proactive enough at following up on these potential issues? Omce vaccine certs are required, I can just see an endless stream of stories in the media from people that haven't got their vaccine certificate because of some hole in the process that they fell into.

“For any overseas kiwis seeing this: you should be getting an automated response to your email. If you haven't got a response (usually instantly), something has probably gone wrong somewhere and you should follow up on it. It's usually a problem with your email getting caught in their security settings.” Josh in yesterday’s traffic lights announcement article.

‘When are the young going to revolt?’

“I wasn't free to look at the AMA on Friday, but I'm struck by today's comment from David Martin. It's hard to gauge numbers, but it seems very plausible there are a lot of economically privileged people who want a path towards giving up some of their privilege in exchange for a fairer society, which would be a happier, safer and better society. Government could do this for us any number of ways -- a land tax, a wealth tax, a capital gains tax, so many options for taking more from us and then giving it to the people currently paying us rent. What I want -- what we all want? -- is lower house prices. Right now I have massive wealth on paper, but the minute I sell my house I'll need every cent of it if I want to buy another. Who does this benefit? If my house was worth a tenth as much and everyone else's was too, I'd be precisely as well off as I am now in real terms, and my children and their friends wouldn't be locked out of the market -- so actually, I'd be much, much better off. How do we fix this? (My daughter's answer: we need a revolutionary overthrow of the state. My daughter, before you laugh, is not kidding. How many years before this stops being a fringe position?)” Leaflemming on yesterday’s Dawn Chorus.

A fun thing

Ka kite ano

Bernard

PS: My apologies for yesterday reporting in the first draft of the traffic lights decision that all of the North Island north of Whanganui was in ‘red’. A map made available after I sent the email showed Waikato, Bay of Plenty, Taranaki and Coromandel were orange. I corrected the article online immediately and thank you to subscribers for pointing out the error.

Share this post