Landlord loan spree pumping up prices

Low deposit lending to landlords more than doubles; Banks scrambling to deal with massive volumes; ASB economist sees return of high LVR restrictions as inevitable

The TLDR version: Reserve Bank figures for September showed low deposit mortgage lending to landlords more than doubled from a year ago as they geared up their equity in other rental properties to take advantage of surging prices and untaxed capital gains. Banks are being swamped with applications and delays are growing. Banks are prioritising lower risk landlords over first home buyers without much equity. ASB’s economists now see high LVR lending restrictions returning soon.

Landlords gearing up their equity to buy up large

The Reserve Bank’s position between the rock of low inflation requiring ever lower interest rates for ever longer and the hard place of exploding asset values just got tougher, as its own figures out this afternoon showed.

It released new mortgage lending figures for September showing landlords who were using investment property collateral and borrowing more than 70% of the value of a home borrowed an extra $1.1b in September, up from $952m in August and more than double the $445m of high-LVR lending to landlords in September a year ago.

Overall, new mortgage lending surged to a new monthly record high of $7.323b, up from $6.785b in August and up a third from a year ago. Overall new lending to landlords in September rose to $1.661b from $1.452b in August and $1.074b in September a year ago.

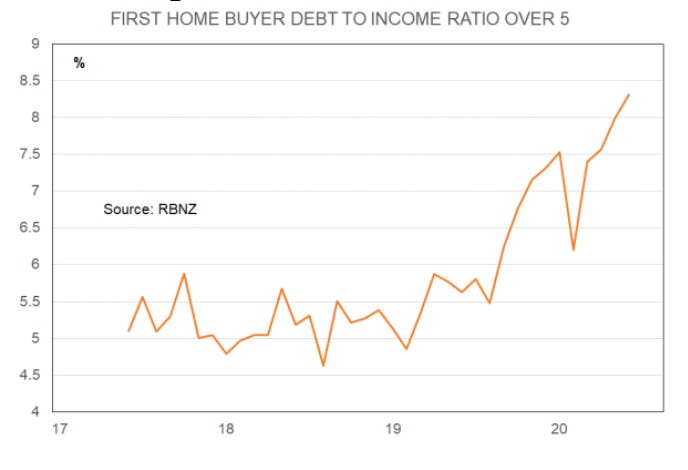

First home buyer lending was rose only slightly to $1.396b in September from $1.344b in August, but is up from $967m in September a year ago. Much of the lending is at very high loan to income multiples, as this Tony Alexander chart shows.

Banks snowed under with applications

This morning former BNZ Chief Economist Tony Alexander published the results of a survey of mortgage advisers showing the frenzied activity as landlords and first home buyers try to get their applications through banks and approved before auctions.

“Prices are rising strongly, and many buyers are desperate and frustrated at missing out, with pre-approved bidding limits breezed through easily at auctions.” Tony Alexander

Alexander said landlords had grown in confidence since the end of the second lockdown, but there were problems with increasing delays from banks, and that landlords were finding it easier to get loans through the system than first home buyers, often because landlords had plenty of equity and were used to the checks involved.

He cited comments by mortgage advisors in answering the survey.

“(It’s) still hellishly slow to get approvals from banks, if anything it is the worst it has been, at least two weeks in a queue to even be looked at.” Unnamed adviser quoted by Alexander

One adviser said banks were still taking 10 to 15 working days to assess applications, “which is just far too long, but they don't seem too concerned by it. No sense of any urgency or priority given to broker-submitted applications.”

Landlords beating first-home buyers for loans

Alexander cited one broker finding it easier to work with landlords than first home buyers.

“Unfortunately, prices of property in Auckland keep rising and also first home buyers’ expectations are rising with it! It's insane the amount of lend these first home buyers are wanting and they're trying to get that little bit more of a lend, but in the meantime prices of houses are going up 5 x the amount of increase in lend.

“Literally talking to a brick wall. In the meantime, the late-50yr olds are buying rentals and it's great dealing with this crowd as they've done their time so to speak.” Adviser cited by Alexander

Banks were particularly wary of first home buyers, some advisers said.

“The banks’ turn-around times are the single biggest problem we face. The first home buyers are facing massive scrutiny, making it very difficult to get lending approved for low deposit buyers.” Adviser cited by Alexander.

Some landlords and first home buyers were also scrambling to get in ahead of the now expected re-imposition of high LVR lending limits.

Investors concerned that LVR restrictions are going to return for them, so are anxious to buy something before 1 May. Adviser cited by Alexander

Some borrowers in Wellington were particularly frustrated with a lack of new listings.

A number of first home buyers are not renewing their pre-approvals, citing that they are now priced out of the market and want a break from continuously missing out on properties. Savvy first time investors see this is their last chance to buy an investment property as LVRs will come back into play. Adviser cited by Alexander

ASB economist calls for return of high LVR controls

Meanwhile, ASB Senior Economist Jane Turner called in a note this morning for the Reserve Bank to look at bringing back high LVR lending controls, which were suspended for a year in May at the height of the first Covid-19 lockdown.

“The RBNZ needs to recognise that the housing market risks have shifted dramatically – no longer are they facing the risk of falling house prices, but that of strongly increasing house prices. And by doing nothing, the RBNZ faces the risk of fuelling the fire of a housing market bubble, which, if underpinned by highly leveraged buyers, can increase financial stability risks down the line. The subdued inflation print last week will likely support the RBNZ’s conclusion that additional monetary support will still be needed for some time.

“Which means the RBNZ’s needs to consider reinstating the LVR lending restrictions at the November 25 Financial Stability review – even if it means going back on its previous forward guidance.” Jane Turner

Your views? Comments and questions below please

It seems inevitable now the Reserve Bank will at least talk about an early return of LVR controls at its November 11 Monetary Policy Statement, with more details at the November 25 Financial Stability Report.

Also: watch out for speeches scheduled for tomorrow from Reserve Bank Adrian Orr and Assistant Governor Christian Hawkesby, in case they talk about this conundrum and the chances of LVR controls returning.

Enjoying your commentary Bernard. This is beyond any measure of insane, if you look at Monthly borrowing figures compared to the size of the economy it's just... I don't have words to describe it.

Our GDP figures don't accurately represent the ability to generate wealth or 'ability to repay debt'. What I think everyone is missing is that our GDP figures are obviously measuring transactions of goods and services but these very transactions are enabled by the massive household debt that is being taken on each Month. So the economy is feeding of the debt.

The GDP figures are not representative of true demand from earned money (or created wealth).

Ultimately this had to be massively deflationary, the more debt the more deflation and the lower they try and drop rates and so it continues. NZ house ‘values’ at 6.4 times the size of the entire economy are obviously a giant illusion. The answer is less state meddling, not more regulation to try and control price rises. The market is SCREAMING for deflation but no, the central bank knows better. The market will always win.

Let the market set rates for 5 minutes and see what happens. Houses are FAR easier to build than they were 30 years ago and our massive abundance of land is far easier to carve up around the edges of all our provincial towns than it ever was before.

The Labour government need a comprehensive housing affordability package that takes into account the systemic effects of the housing, transport and land-use system. There is some recommendations in the following paper based on this sort of analysis.

https://medium.com/land-buildings-identity-and-values/if-not-now-when-f995dd596c1