TLDR: Bonfires can be dangerous things when they get out of control. They also create a lot of smoke and heat and burn the grass. I hate to think of the climate emissions. But sometimes, they do much more damage when someone accidentally throws on a full can of petrol and the fire burns too hot.

It turns out that’s what the Labour Government has just done with its ‘policy bonfire’ of late 2022 and early 2023. PM Chris Hipkins threw another couple of bin loads of climate policy paper on the bonfire on Monday afternoon that heated up the bonfire so much it melted the metal in that can of petrol.

The moment the bonfire went ‘boom!’

The sound of the bonfire going boom was heard loud and clear across the climate change community shortly after midday yesterday when the Emissions Trading Scheme essentially failed for the first time in its quarterly auction of containment reserve credits. The scheme’s entire future is now in doubt.

The failure also blows a hole in the Government’s Budget plans because up to $1 billion in revenue was expected from the auction. That number is now zero and has effectively wiped out all the savings from removing emissions reduction policy in one fell swoop. It is the biggest and most-expensive self-administered removal of a Budgetary foot with an explosive device in Chris Hipkins’ eight weeks in charge.

Labour just blew up the Emissions Trading Scheme, which is a key component of Aotearoa’s climate emissions reduction strategy to get to net zero by 2050. How do we know? Yesterday, the quarterly auction of new Emissions Trading Scheme (ETS) reserve credits failed for the first time because of a collapse in market confidence in the Government’s commitment to a serious ETS. This followed policy tweaks by Cabinet at the end of last year designed to stop the ETS price rising in the way the Climate Commission recommended it should. The Government wanted to stop a higher ETS price translating into higher petrol, diesel and electricity prices, given it’s relentless focus on ‘cost of living’ and ‘bread and butter’ (and petrol) issues since late last year.

Unfortunately, they didn’t realise that tweak effectively unloaded mountains of fresh carbon credits onto the market, destroying any confidence the ETS is a credible limit on emissions. The Government’s climate policy is now a black mushroom cloud with a bunch of policy wonks standing around looking at each others’ singed eyebrows.

The Government’s climate policy is now a black mushroom cloud with a bunch of policy wonks standing around looking at each others’ singed eyebrows.

Cabinet put way too many chocolate biscuits on the shelf

Late yesterday I spoke to climate policy expert Christina Hood1 from Compass Climate for an upcoming episode of my weekly podcast for The Spinoff, which is called When The Facts Change. She explained to me how the Cabinet decision to reject the Climate Commission’s advice to push the carbon price higher has destroyed confidence, and I include that part of our chat in the podcast above.

Here’s Christina’s explanation of what that cabinet decision just before Christmas has done, in part because cabinet didn’t really understand the implications of what containing the carbon price meant for the volume of reserve credits available to the market.

I’ve included her full explanation because it paints a clear and understandable picture of a complicated topic. Here’s the full transcript (bolding mine):

“So the Climate Change Commission had recommended certain settings for the ETS and the key one was the cost containment reserve, which is some extra units that the market can access in a situation where prices spike really high.

“And the commission had said ‘put that well out of the way because there shouldn't be a normal part of the functioning of the market.’ It's like, you know, the packet of chocolate biscuits. If they're sitting on the kitchen bench, you help yourself to them. (the Commission was saying) ‘shut them up in a box in the top of the pantry out of sight.’

“Officials in their regulatory impact analysis agreed with that and actually Minister (James) Shaw recommended that, but Cabinet disagreed.

“Cabinet decided instead to set that price much lower so that the market would have ready access to a much, much larger volume of units. I don't think they understood what they were doing, to be honest. Because when you go and look at the cabinet paper, the discussion was all about price. The discussion was all about ‘what might the impact on price be if prices went high or prices were low, and how do we deal with that, and what are the social impacts and so on.

“The discussion never circled back to the actual key question for meeting the targets, which is, okay, if you try and lower the price by releasing more units into the market, every unit that you release allows an extra tonne of emissions, and are you then allowing a level of emissions which is no longer consistent with the targets. And the cabinet paper and the discussion never circled back to consider that.

"So they have effectively done is allowed the market ready access to an extra 42.5 million tonnes of units2 compared to what the commission recommended.

“By setting the threshold so low that the market could easily reach it, they (the markets) know that those biscuits are just there if they want them. That volume is, in my view, inconsistent with meeting the budgets. And there is a test in the law that says you're supposed to align it with the (carbon) budgets.

“I don't think it is aligned with the budgets. So the reaction from the market has been really interesting. So if you make a few extra units available, the market might say, ‘okay, that's good. You know, we'll, that might moderate the price a little.’

“But what's happened here is that they've turned on the fire hose and the market is sort of staring open mouthed and saying, ‘but that's more units than is consistent with these targets — what the hell?

“And it has undermined confidence that the government is actually committed to meeting these targets because they're releasing or allowing the market access to so many units. And so that has actually crashed the price in the market.

“So the market price has fallen from over $80 to around $65 lately in trading. And that just reflects the expectations of participants of where the price is going to be in the future. So in the auction (yesterday), the bids that were put in did not meet the confidential reserve price, which is based on how the market's been trading over the last period. That's confidential.

“We don't know how they set it, but that price was not met and the auction failed and no units were released. It's the first one that has failed. So in the past, not only have they succeeded, but all of these extra units from the cost containment reserve have been released in the last two years.

“So it's a complete flip around — going from a perception last year that prices were going to climb quickly, that constraints were going to bind, that units were valuable. To a perception this year of ‘we don't know where things are headed. Is it worth buying these things?’

“So that one decision from Cabinet in December has had a really, really, guge impact on confidence in the market.

“Confidence in the future price path is only as good as participants confidence that current and future governments are gonna stick by it and keep it tight and make it tough. And if they start to doubt that, then the, then it starts to unravel.” Christina Hood in an interview with Bernard Hickey in the podcast above.

The shock behind the scenes yesterday

Here’s a bit of the reaction online just to reinforce this is a big deal behind the scenes.

Up to $1b lost in an afternoon, with billions more now in doubt

BusinessDesk reporter Ian Llewellyn covers the market regularly and wrote this piece, which was published this morning for all via Farmers Weekly.

Cabinet papers show that ministers were more concerned about the cost pressures from a rising carbon price than they were about sending stronger price signals to reduce greenhouse gas emissions.

Secondary market operators have reported stagnant interest from buyers and sellers since then, largely due to political and regulatory uncertainty.

There had been predictions that buyer wariness could lead to a no-show at the auction.

The auction’s failure to raise any money for the government compares to the last auction in December (just before Cabinet’s decisions, made in November, were made public) which cleared at $79 and reaped $381m.

There were 4.475 million NZ Units (NZUs) offered with another 8 million NZUs available in the cost-containment reserve if the trigger price of $80.64 was reached.

If all the reserve credits had been sold at that trigger price, the Government would have received $1.005 billion. That is now gone and the future of billions more of assumed income from credits is now in doubt.

A market commentary from market operator Carbon Market also captured the mood. The bolding is mine. The capitalisation is Carbon Market’s.

"After much anticipation, the first NZ ETS auction of 2023 took place today. No units were sold as the auction clearing price FAILED3 to meet its minimum price settings - i.e. the confidential reserve price, which remains undisclosed.

“We think that today's auction result reflects the considerable uncertainty around specific regulatory settings and the fact that this an election year, alongside recent backpeddling on specific policies in the climate space.” Carbon Market’s commentary email yesterday.

Climate Change Minister James Shaw commented obliquely about the failure yesterday, saying to reporters in Wellington (bolding mine):

“The price has come down pretty substantially, since before that cabinet decision last year, and that has led to a price which is lower than the replacement cost of coal.” James Shaw answering reporters’ questions yesterday.

For more background reading, here’s a commentary from Christina Hood from last week on the five things wrong with the ETS at the moment via LinkedIn. Hat tip to

in his Substack.I have decided to open this one up immediately for sharing and subscribing to all. Many thanks to paying subscribers to The Kākā who support my work covering housing affordability, climate change and poverty reduction. Join us to help me do more. And feel free to share this one around. It’s open for all.

Elsewhere in the news

‘Help. I need a bail out too!’

Kicked in the Saudis - Global financial markets are in turmoil again. It’s all about Credit Suisse, which asked overnight for a show of support from its central bank and regulator after its shares slumped as much as 30%. It has created mayhem on European and US financial markets, with bank shares down sharply and market interest rates dropping too.

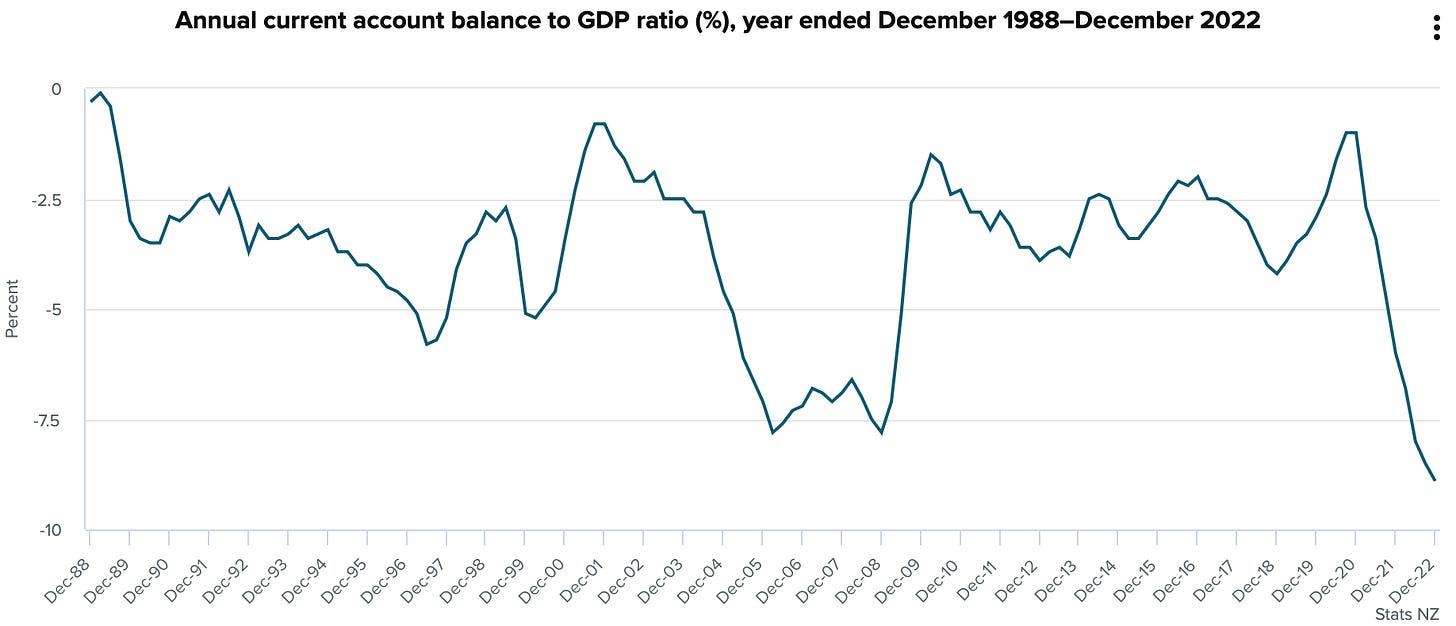

A scary number in a data series few watch anymore

Quote of the day

Paul Keating is meanest and most interesting politician alive today

I had the privilege of being sneered at in a news conference by then-Australian PM Paul Keating in 1994. I worked for two years for Reuters in Parliamentary Press Gallery in Canberra from 1992 to 1994 and enjoyed asking him questions about fiscal and monetary policy. By the end, he didn’t enjoy my questions and resorted to trying to belittle the questioner. I wore it as a badge of honour and he was always friendly in person after the match. Australian politicians play hard and enjoy a beer at the after match function.

Here’s Keating in top form at yesterday’s National Press Club event in Canberra.

“Signing the country up to the foreign proclivities of another country – the United States, with the gormless Brits, in their desperate search for relevance, lunging along behind is not a pretty sight.” Paul Keating at a National Press Club event in Canberra yesterday via 9News

Here’s the full set of exchanges in all their glory. Enjoy.

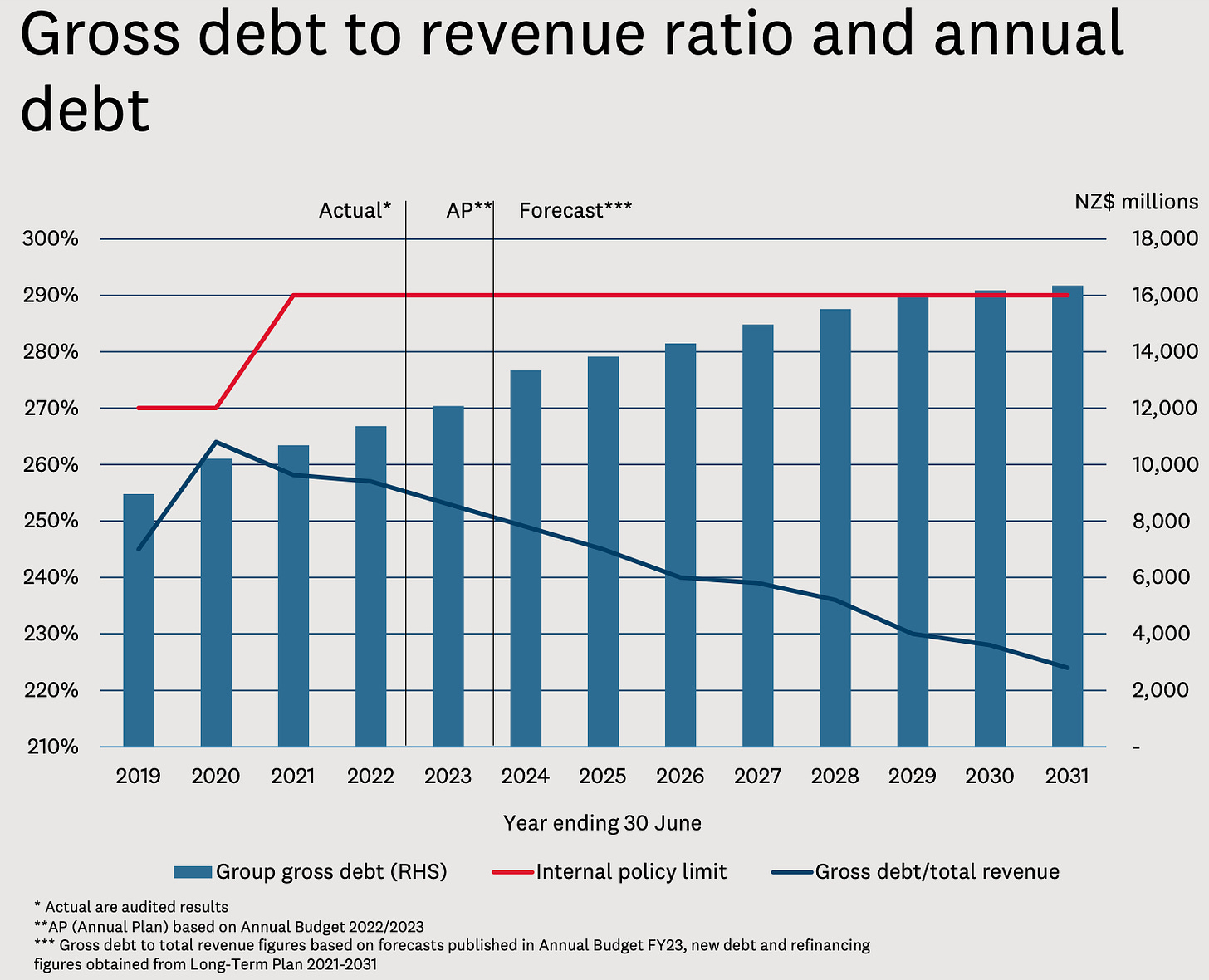

Chart of the day

At least $3b of borrowing headroom in Auckland Council’s Budget

Scoops and useful longer reads and listens elsewhere

A fun thing

Ka kite ano

Bernard

Christina Hood is the former head of the International Energy Agency’s Climate Change Unit and now runs her own climate consultancy advising on climate change, energy policy and carbon markets.

That 42.5m tonnes is the equivalent of 10 years worth of emissions reductions in the budgets agreed to under the Carbon Zero Act, according to this paper from Ministry for the Environment.

The use of capitals is one way to express how you feel in text communication...

Share this post