TLDR: Wages and jobs figures out yesterday show the economy is actually driving weekly earnings up even faster than prices, while the Reserve Bank reiterated homeowners, businesses and banks are actually in rude health, despite all the sturm und drang1 around about the ‘squeezed middle’ being ‘under water,’ in ‘mortgage stress’ and fearing the arrival of bailiffs.

Nothing could be further from the truth. Weekly wage packets have been growing at double digit rates since the middle of last year because of hourly wage rate increases and many more hours being worked by (surprisingly) many more people. Those wondering why all the flights and hotels are booked out and why prices are still rising need only know two facts:

total weekly gross wage payments averaged $2.7b in the September quarter, up 10.4% from the same quarter a year ago; and,

the percentage of non-performing home loans from banks was 0.2%, just a sixth of what it was in 2009 when house prices last fell 10%.

Those warning of ‘mortgage mayhem’ from the ‘squeezed middle’ are just wrong.

Paying subscribers were able to see and hear more analysis, detail and charts below the paywall fold and in the podcast above earlier today. (It includes a longer version of the podcast. The original one was truncated and I have now re-recorded it. My apologies.)

There is no squeezed middle. Home-owners are just fine

Labour market running hot - Statistics NZ reported yesterday the unemployment rate was unchanged at 3.3% in the Sept quarter from the June quarter after 1.3% jobs growth in the quarter to 2.853m employed people and after the labour force participation rate rose 0.8 percentage points to a record high of 71.7%. The numbers were stronger than most expected.

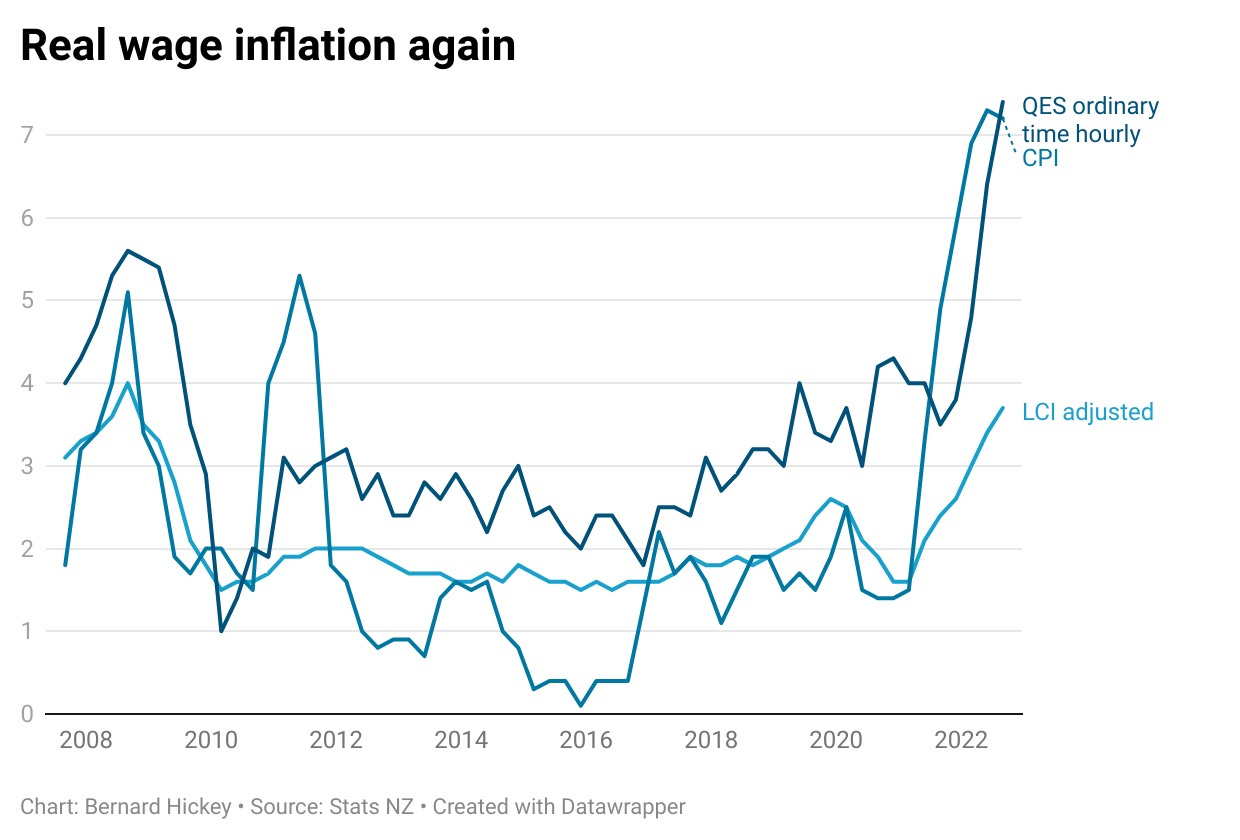

Wages rose faster than prices - Average ordinary time hourly earnings rose 2.4% in the quarter and were up 7.4% from a year ago, meaning there was real earnings growth after annual CPI inflation in the Sept quarter of 7.2%. Private sector average ordinary time hourly earnings rose 8.6% from a year ago to $36.09/hour, which was stronger than expected. Private sector average weekly earnings, which include overtime for full time equivalents, increased by 9.1%, to $1,409, while public sector average weekly earnings rose 4.5% to $1,738. Just imagine if the Government had not ‘frozen’ wages last year. That pay freeze is currently under review as Government departments keep losing staff to the private sector.

Double-digit weekly gross wage growth - Gross total seasonally adjusted weekly earnings rose 10.4% from the same quarter a year ago to $2.684b. These gross earnings, which it could be argued are inflated by one-off bonuses, extra hours worked, people shifting from part-time to full time and more work done at higher over-time rates, have been growing at annual rates of between 10.4% and 12.3% in every quarter since the June quarter of 2021, except for the June quarter.

Not-so-squeezed middle - Anyone surprised by the ongoing strength of consumer spending need look no further. So many claims about the ‘squeezed middle’ and ‘real wage deflation’ are made without checking the weekly gross pay numbers, and without understanding just how much extra money and buffers homeowners have stashed away in home equity and savings since Covid. Homeowners are still over $550b richer than they were before Covid, with net worth of $2.35t2 as at the end of June, even after a sharp fall in house values and stocks this year.

Asset owners not shaken, let alone stirred or collapsing

Not so vulnerable balance sheets - Also yesterday, the Reserve Bank reiterated in its half-yearly Financial Stability Report that homeowners, businesses and banks are actually in rude health with record-low mortgage default rates, record-high capital levels and oodles of cash to pay for higher interest rates.

Te Pūtea Matua (RBNZ) did what it was supposed to do yesterday and told borrowers and banks and businesses to brace for financial stress that would "test resilience." It talked about dark clouds on the economic horizon and "risks skewed to the downside" in its half yearly stock-take of how our financial system is coping with spiking interest rates.

An alien arriving from another planet might think most home owners were deep under water with negative equity, drowning in high debt and were on the verge of being kicked out of their homes after the fastest spike in mortgage rates in living memory. Actually, nothing could be further from the truth. New Zealand's households, businesses and banks are all in rude health, with default rates at infinitesimally low levels and capital buffers stocked the gunnels.

You wouldn't know it by reading today's headlines. "Dark clouds over NZ's economy," warned Newshub. "Rising interest rates will test financial resilience," wrote 1News, cribbing from the Reserve Bank's own news release on its November half-yearly Financial Stability Report titled: "Global financial stress will test resilience." The NZ Herald heralded: "Negative equity warning for home buyers," while Stuff focused on a "growing number of households struggling financially" because of higher mortgage payments that were about to get much worse.

Yikes. Dark clouds. Negative equity. Financial stress. Struggling households. Things must be really bad. On top of the risk of nuclear armageddon, an unprecedented and ongoing global pandemic, and Taylor Swift having all ten of the top ten most popular songs all at once this week. Whatever next? A wave of mortgagee sales and young homeowners being turfed out onto the streets in a vortex of forced sales, triggering skads of mortgagee sales, bank losses and ghost developments?

Yeah...nah

Actually, we should all just step back from the edge of the headlines and take a few deep breaths. We all need to take a class in financial stability and macroeconomic policy yoga. 'Namaste', Governor, rather than 'brace for it.'

Almost all of us will be absolutely fine, and even those who bought homes last year and are beginning to hyperventilate at the prospect of a 7%-plus mortgage should just take a chill pill, as the kids probably never said. Those with relatively high debts who paid prices that have now slumped 10-20% in the pixels of the valuation websites they check daily should remember that they were only able to borrow after passing their banks' seemingly ludicrously high test rates at the time of over 7%. They were put through the wringer last March or April with the assumption that they were able to handle a seven point something mortgage rate.

It seemed a pain in the proverbial at the time, but now it feels like prudent bankers operating prudently for the good of themselves, their shareholders, their customers and the economy. Anyone still in work won't be kicked out. It is only the dead and the divorced who need to worry, and they have other things to worry about.

The calculations showing they face paying more than 50% of their disposable incomes also assume their incomes have not changed. Most in this position will have seen double-digit disposable revenue growth since they took out their mortgages. It will hurt and the local purveyor of flat whites may not make so much money, but the world is not going to end.

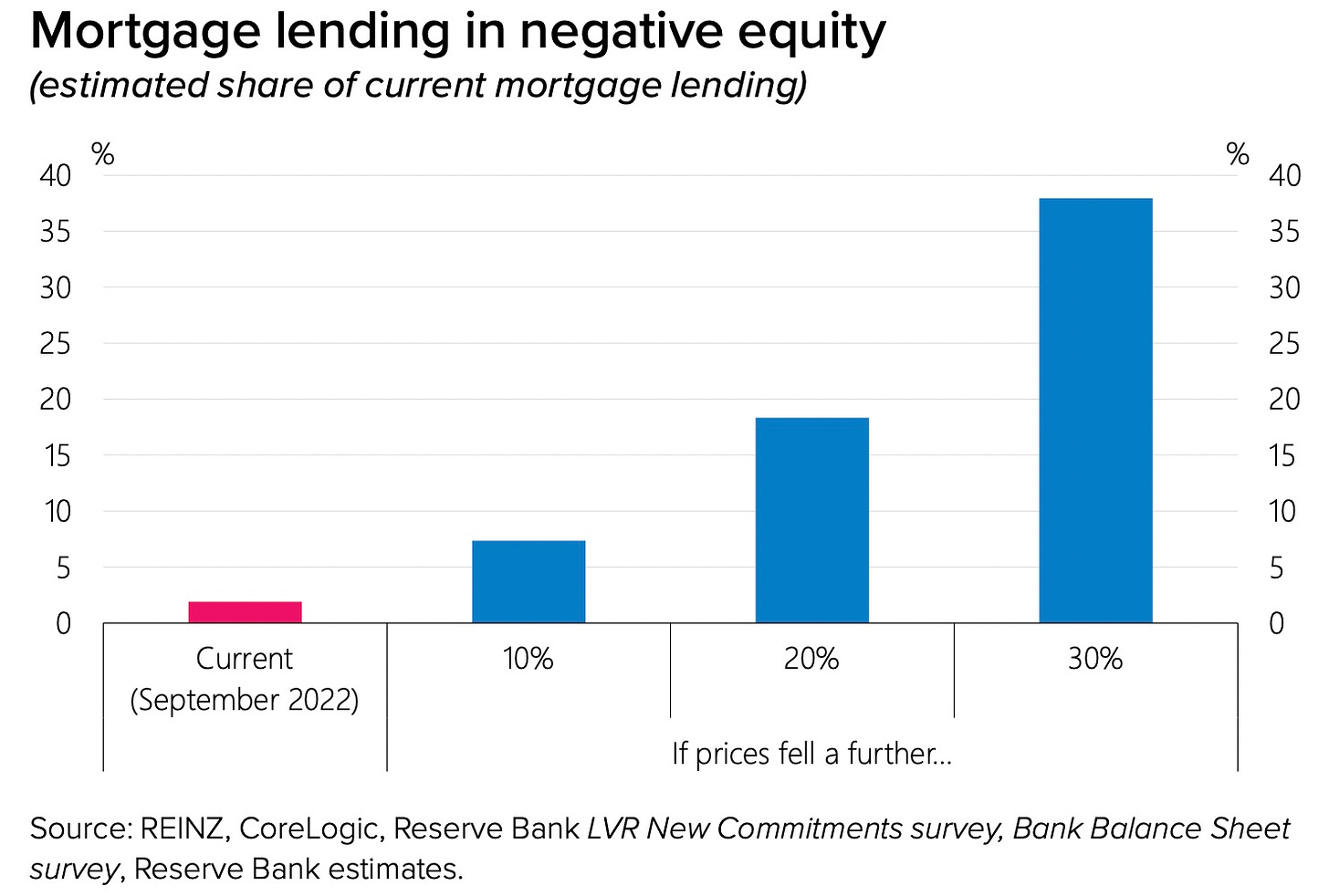

The same prayers of thanks should be said for the high LVR rules reintroduced in early 2021, and then tightened in late 2021. All but a few buyers were forced to hold at least 20% equity before buying, with the investors having to hold at least 40%, and often a lot more.

Hardly any in negative equity or default

That means the share of buyers who are likely to get into negative equity once house prices have fallen the 20% forecast from peak to trough by the Reserve Bank is actually very low. What might have seemed to be a giant exercise in pointless party-pooping at the time, now feels like the grown-ups were in charge after all.

No one liked the LVRs when they were introduced in 2013. The banks, the brokers, the buyers, the sellers, the voters and the politicians all hated the LVRs, bitching and moaning all the way down the Terrace and across the road to the Beehive. Previous Reserve Bank Governor Graeme Wheeler even lost his job (well, didn't get a second term) because he introduced LVRs and then tightened them in the face of a fair amount of bitching and moaning from across the road. The ninth floor was livid before the 2011 election.

Take a closer look at the actual risk

A closer look at the actual levels of negative equity, mortgage servicing stress and mortgagee sales in New Zealand's housing market, banking system and corporate balance sheets shows the nation in a rude state of health and easily able to handle a 7% mortgage rate, let alone a higher unemployment rate.

This week's FSR came out with a fresh stress test of our banking system showing even a 47% fall in house prices with a 9.3% unemployment rate and a cyber-attack couldn't bring down our banks. They were even profitable in all but one of the four years of the stress test timeline and their capital reserves remained more than twice the minimum levels.

Reserve Bank Deputy Governor Christian Hawkesby was also careful to point out in yesterday’s news conference that it was his job to put his serious hat on and warn against home buyers getting too indebted or bankers becoming too loose. But, he said, we shouldn't lose sight of the strength of the base we have.

"Just a reminder, this is our financial stability report, so this is the one where we put the gloomy hat on, deliberately. We benefit from a financial stability perspective from the strong, strong starting point that we have.

We have very high levels of employment. We have high levels of income, job security. And so all of those things benefit financial stability in the near term. We are conscious that in a rising interest rate environment that will slow the economy down, or that will result in a weaker labor market.” Christian Hawkesby.

'Praise be to the LVRs'

The central bank's manager of financial systems analysis, Chris McDonald, was also clear about the strength in our system.

"When you look across the household sector, households are in a good position. And that's because the house prices have increased over the past couple of years prior to the peak that we saw in the last year.

"And so the equity that they have has increased, so they have that buffer for potential price declines. In addition, we had the LVR settings that were in place since 2013. And that, again, is credited with increased buffers for households.

"Now, while in aggregate households are in a strong position, they're always going to be pockets of risk, And so we've put some numbers in the report that shows that right now, even with the 11% decline, only 2% of households are in negative equity. And partly that's just because house prices have only really fallen back to the level that they're at in May last year. So they're still high relative to where they weren't pre-pandemic.” Chris McDonald

'Keep talking to your banker and they should keep talking to you'

Governor Adrian Orr also pointed out banks were in a strong position to help customers that they (by definition) they had already put their trust in.

"My advice to people is to talk with their financial advisors and stay close to the bank. House prices falling don't create a financial crisis in and of themselves, it just means that you're living in the home.

"The servicing of mortgages is where you need to stay very close to the banks. If they have lent wisely, then you are the wise person they have lent to, and they should be able to work with you through through good times and bad," he said.

"So stick close to your banks and banks stick close to your customers, would be my suggestion. We are in a strong position to weather this international challenge." Adrian Orr

Hawkesby emphasised that mortgage servicing, rather than equity, was the key, and that delinquency rates were extraordinarily low.

"The really important part of servicing mortgages is your income and your participation in the labour market3. So that's why having a strong economy and this strong starting point puts us in a good position.

"So that's a really key feature of your ability to service your mortgage, regardless of where the level of your house price is. And it's why when we think about financial stability and the types of stresses that we worry about, it is the ones where unemployment is high for a prolonged period."

But even then, a 9.3% unemployment rate and a 47% fall in prices aren't enough to take down the banking system. Not even close.

Adrian Orr quietly pointed out in this discussion that his much-criticised push before Covid to force banks to hold capital was now paying dividends in financial resilience terms.

"The resilience of the financial sector is is strong and open to an enormous amount of buffering. Is it infallible? No. So there's always that balance between levels of capital and efficiency versus security and precaution. And New Zealand sits at the more conservative end of that, because of the capital work we've been doing.” Orr

Some politicians talked yesterday of a looming catastrophe.

Non-performing loan ratios are at record lows. Unemployment is at record lows. Incomes are growing at double-digit rates. The middle is not squeezed.

Elsewhere in the news this morning:

In geo-politics, the global economy, business and markets

Pivot pointer? - The US Federal Reserve just hiked its key Federal Funds Rate range by 75 basis points to 3.75-4.0%, as expected, but it also noted it was now watching the ‘cumulative effect’ of its previous hikes and the lags involved in slowing growth and activity. Some saw that as signs it would start slowing its rate hikes from next month, which initially boosted stock and bond prices, although trading has been volatile in the first hour after the announcement. Reuters

Bluff called - Russia recanted overnight on its weekend cancellation of Ukraine’s grain export deal after the UN and Turkey defied Russia’s blockade, effectively calling Russia’s bluff.

Red lights - Maersk’s CEO Søren Skou warned overnight that recessions were coming in developed countries because every leading indicator the world’s second largest shipping container company could see was “flashing dark red.” Fortune

Incoming - The US accused North Korea overnight of secretly supplying artillery shells to Russia. Reuters

‘Turns out I’m free after all’ - UK PM Rishi Sunak tweeted overnight he would attend this weekend’s COP27 climate summit in Sharm el-sheikh in Egypt after all. He had earlier said he was too busy with domestic issues, but was criticised, especially after his predecessor Liz Truss blocked King Charles from going.

In Aotearoa’s political economy

Going empty handed - Our Climate Minister James Shaw is going to the COP27 summit, but wasn’t able to take an updated Paris summit pledge to reduce emissions, despite demands from the UN for even more emissions pledges to try to keep global temperatures from rising more than 1.5 degrees celcius.

Hurry up and wait… The UN said last week the current global policies were pumping in enough emissions to increase the warming to 2.8 degrees and more pledges were needed. Even if the current pledges were delivered, temperatures would rise 2.4 degrees by 2100, the UN warned, which could trigger unstoppable warming because various tipping points are near.

..for a High Court ruling - Shaw told Stuff’s Olivia Wannan he couldn’t take a new bigger pledge because the Government was waiting for a High Court ruling on the Lawyers for Climate Action case put in February that the current Climate Commission emissions reduction budgets breached the Carbon Zero Act because they were insufficient. It’s been eight months since the hearing before Justice Jillian Mallon and there is no ruling yet.The Craic

A fun thing

Ka kite ano

Bernard

Storm and stress. German sometimes captures the mood better. The phrase comes from a German literary and music movement from the late 1700s.

That’s ‘t’ for trillion by the way. That’s 1,000 billion. You feeling it?

‘Participation in the labour market’ means having a job in Reserve Banker language.

Share this post