TLDR: New PM Chris Hipkins looks set to loosen migration settings to buy the Government a surge of cheap economic growth that keeps interest rates and inflation low and tries to restart house price growth, along with winning Labour re-election.

Median voters love this kind of growth, as do businesses and Treasury. National and ACT really love it and we face a type of ‘race to the bottom’ competition in the next nine months to see who can offer the loosest migration settings, the lowest inflation and the lowest interest rates — all to fire up house prices again.

But is it good in the long-run for everyone born here who cannot hope to get help with a home deposit from family, or who can’t marry into a home-owning family? Or does it just enable the re-firing up of the ‘churn’ economy where the main game is keeping interest rates and infrastructure investment low to take advantage of leveraged tax-free gains on land prices?

For 20 years, both main parties have used this tactic of accidentally-on-purpose pulling the cheap migration lever to buy fast growth without the necessary infrastructure investment. In the end, it simply increases the ‘churn’ rate where young New Zealanders have to leave for Australia to be able to afford their own homes, and are replaced by temporary workers who see life here as preferable to life in China, India, the Philippines or South Africa.

At what point does the ‘churn’ rate become unacceptable to the median voters who decide election results? We’re not there yet, and won’t be until older home owners in the suburbs and provinces get sick of having to help their kids with deposits and/or have to watch their grandkids grow up in Australia via Whatsapp.

Australia’s imminent opening up of a fast pathway to ‘first-class’ Australian residency for New Zealand residents (including the recent arrivals) could be that moment of truth. It would be a moment when the ‘escape valve’ for the pressures in our political economy of residents emigrating starts blowing so loud that everyone hears it whistling. Right now, it can’t be heard over the immediate noise of calls from median voters for lower inflation, lower mortgage rates and higher house prices.

Paying subscribers can see more detail and analysis on this below the paywall fold and hear more in my daily podcast above. Also FYI to paying subscribers, I’ll be on deck for the weekly Ask Me Anything session at midday today, and and I will co-host the weekly ‘Hoon’ webinar at 5pm today for an hour. The link to get in is with my sign-off at the end.

Hipkins eyes more migration to fire up ‘churn’ economy

New PM Chris Hipkins was open in his first meeting yesterday to calls from business leaders for an urgent opening of the low-wage migration tap, while he was also cautious about committing to another significant hike in the minimum wage.

Hipkins will decide within weeks how his new Cabinet will fire up economic growth without high inflation and try to win a third term on October 14. He looks set to opt for the cheapest and fastest way to win back the confidence of small-to-medium business owners, which is to enable them to grow by adding cheap labour that resumes downward pressure on wages.

It is the simplest way in the short run to reassure median voters the Government is focused on what they and Treasury officials want:

a faster return to Budget surplus through extra GST and income tax receipts from population and employment growth;

the flow-on short-term benefits of lower Government debt to take pressure off interest rates and mortgage rates in particular; and,

the resumption of a strangling of infrastructure spending to ensure the return of low mortgage rates and population growth combines with residential land shortages to generate another surge in untaxed and leveraged capital gains on land values.

We’ll find out over the next couple of weeks if the new PM, who said yesterday he agreed with businesses that the ‘rising tide of economic growth lifts all boats,’ opts for the usual bi-partisan approach of fueling nominal GDP and land price growth through high population growth that is:

not debated or agreed to by the public;

not planned for or invested in by councils and infrastructure operators; and,

does not have the permission or endorsement by future voters, who will have to bear the housing, infrastructure, climate and lost-productivity-growth costs of this endemically short-term and median-voter-focused approach.

The key moments and decisions to watch over the coming weeks are:

Hipkins’ naming of his Cabinet early next week (probably Tuesday), and who he appoints as Immigration and Workplace Relations Minister (currently the 15th ranked Michael Wood);

what announcements or changes are made to immigration settings; and,

what projects and spending are ‘reined in’ to focus on the ‘bread and butter’ issues for median voters, which are getting mortgage rates and inflation back down while arresting the decline house prices. That ‘reining-in’ of non-essential spending could include delays in housing and public transport investment.

The churn economy

Choosing the low-wage, high nominal GDP growth, high population growth, low interest rate and low investment option is consistent with the approach of Governments of both the centre-left and centre-right in the last 20 years. It’s what median voters want, but the pressure on the disposable incomes and wellbeing measures of those in the renting class of families is showing through the ‘escape valves’ of surging health, housing subsidy and justice costs for the Government, along with an escalation in emigration by those locked out of home ownership. It’s sustainable as long as the ‘churn’ rate of cheap migrants replacing exiting residents can be held high and those residents left here are comfortable commuting to and from Australia for family events and crises.

A loosening of migration settings and a tightening of investment spending is the Government’s likely tactic for the next six months, largely because it fears median voters will prefer the even louder calls for a bigger use of the churn lever by the Opposition. But it’s only a tactic, albeit unconsciously adopted and agreed to by most voters and bureaucracies alike.

It’s definitely not a strategy that is sustainable in the long-run, even for those median voters who own their own homes and benefit through the spectacular growth in tax-free capital gains on land values. They may be sitting on assets valued in the millions, but they face decades to come of having to withdraw or risk that equity by helping their kids with deposits for homes, or having to watch their grandkids grow up by Whatsapp/Facebook/Facetime/Zoom in Australia.

A moment of truth looms

In my view, a key challenge to this churn strategy will come on April 24 this year when Australia’s Labor PM Anthony Albanese is on track to promise full and fast citizenship rights to the 600,000-plus New Zealand residents already in Australia, and another million or so New Zealanders with valuable skills wanting to take advantage of cheaper housing costs relative to their disposable incomes and the chance of building a life for their families with their own homes, without the fear of being a second-class citizen.

At that moment, the escape valve will be able to open right up on Aotearoa’s churn economy. It will be a moment of truth for those employers desperate to keep and win staff, and for those median voters and their politician servants who had hoped the churn could go on.

How could it be different?

One thing I’m constantly surprised at is how little we hear from employers, chambers of commerce and business lobbyists about the need to massively increase housing supply and removing the tax advantages of housing investment to ensure housing costs are attractive enough to retain and attract young staff.

I spoke about that this week in an interview with WellingtonNZ CEO John Allen for my weekly ‘When The Facts Change’ podcast via The Spinoff.

Business leaders are constantly calling for more cheap migrants, more tourists, more conferences and more opportunities to grow volume with their existing capital and technology bases, rather than calling on the Government to increase its necessarily-tax-funded investment in underlying public infrastructure that would enable much more climate-friendly housing and transport (medium density housing and more buses, busways, cycle-paths and walking corridors.)

In my view, a much more interesting set of calls from business leaders would be for:

long term public investments in poverty reduction that increase the productivity of workers now and into the future, and that lower the growth of future health and justice costs for all taxpayers;

removing the existing tax incentives for investments in leveraged gains in residential land values, rather than investing in pension funds, shares and new businesses (which is perfectly convention policy everywhere else in the developed world); and,

for a public debate and bipartisan plan for the infrastructure growth needed to cope with high and agreed population growth over the next 70 years, which is an age when Aotearoa will be a climate change refuge (whether we like it or not) that at least 100m mostly-rich residents of India, China and southeast Asia want to live in.

To do that, many in business would have to acknowledge that the current ‘churn’ strategy can’t keep working, and that they will have to change their business models from having jobs and businesses that aren’t focused on productivity growth or high profitability, but are actually focused on regular, bankable cash incomes to support leveraged residential land ownership. It is a housing market with bits tacked on that only keeps going because we keep pumping it full of leverage and people.

So what actually happened yesterday?

I attended the first public meeting new PM Chris Hipkins had in Auckland, which was with a tightly-packed group of small and large business leaders in the Auckland Business Chamber (formerly known as the Chamber of Commerce).

It was carefully choreographed and designed to send a signal that Hipkins went first to business leaders and was open to their suggestions.

Hipkins and Auckland Business Chamber CEO Simon Bridges reported after the meeting that it had focused on calls for looser migration settings for lower-wage workers.

“He got it, and got it straight between the eyes. There's a real sense that this isn't just about skilled work. It's not just about rocket scientists or surgeons or anything like that. It's also workers at the bottom of the rung.

“If we're not competitive against in Australia or Canada or something, we're not really in the game. He got that message, and he was listening.” Simon Bridges in the standup with reporters after the meeting.

‘The rising tide lifts all boats.’ Really?

Hipkins made clear he wanted to work closely with businesses, and said something I haven’t heard from a centre-left politician for a long time — that the rising tide of economic growth lifts all boats. That’s simply not true, but most in business still believe that. Hipkins agreeing to that was a surprise to me.

“I think the relationship between business and government is a really important one. It is integral to the economy.

We have shared interests here and making sure that we create a good well paid jobs for New Zealanders because that's how Kiwi families are going to be getting ahead. We all want to see the economy continue to grow.

“The rising tide will lift all boats. And that's that's actually the spirit in the business community as well. So I think we've got a real interest in working together.” Chris Hipkins speaking to reporters after the meeting.

He confirmed the Government was considering further loosening migration settings. There have been at least three rounds of loosening since mid-2022 under new Immigration and Workplace Relations Minister Michael Wood.

“We have always kept immigration on the table as an issue that we'll continue to reconsider as the pressure that we face as a country changes.

“We've had significant population growth in recent years, and that has created a set of pressures. We've had to catch up in terms of extra housing in terms of extra infrastructure and so on. And so that has been one of the factors that we weighed when we've made decisions around immigration.

“We also acknowledged that there's a significant skilled labor shortage. There's a significant labor shortage that we're dealing with across the country.” Hipkins.

Earlier last year the Government tried to restrict population growth by restricting migration growth in the hope of squaring the population growth-infrastructure deficit circle. That lasted about three months before the pressure from employers forced the various loosenings, including

the reopening of the skilled migrant and parental residency categories;

an historic increase in the Registered Seasonal Employer scheme quota; and,

increases in backpacker and student work rights.

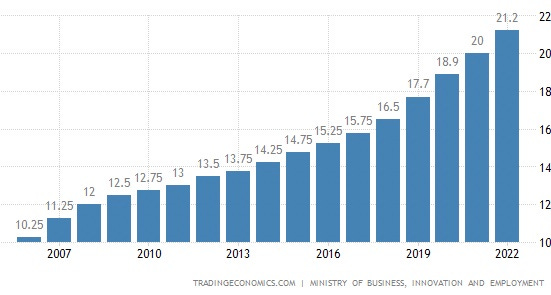

Will the minimum wage increases be slowed?

Another big decision in front of Cabinet in the next couple of weeks will be what the minimum wage will be increased to from April 1. Since 2017, the current Government has lifted the minimum wage by 39% or an average of 6.5% per year to $21.20/hour. Employers and the Opposition have called for slower increases, arguing that would allow more people to be employed and avoid the wage increases being passed on as price increases in a new ‘wage-price spiral’. Recent research globally has shown such minimum wage increases have barely slowed jobs growth and have not been as big a factor in inflation as profit margin expansion.

Hipkins was cagey about whether the next increase in the minimum wage would be as fast as the ones seen since Labour’s election in 2017. Unions have called for an increase of 11.5% to the current living wage of $23.65/hour.

“We've got to acknowledge that our lowest paid workers, minimum wage workers, are really feeling the acute pressure from the rising cost of living.

“With all of these things, there's a balance to make sure that we're supporting people whose budgets are squeezed, to make sure that their incomes are rising so that they can keep up with the rising cost of living.” Hipkins.

The ‘balance’ framing has been repeatedly used by Grant Robertson to justify restricting Government spending and debt to keep interest rates low, instead of borrowing and spending extra on benefits and infrastructure. ‘Striking a balance’ that favoured employers and profits would mean a lower minimum wage increase.

Nicola Willis unhappy about big minimum wage hikes

National Finance Spokeswoman Nicola Willis jumped into the debate yesterday by saying that the higher minimum wage increases since 2016 were “the great shame.” National’s minimum wage increases between 2008 and 2017 totalled 35.6% over nine years and averaged 3.9% per year. That’s just over half the growth rate under Labour in the last two terms.

"We are very conscious that lower-income New Zealanders are being absolutely smashed by inflation.

"The great shame is that Labour increased the minimum wage so much in previous years, but what you've seen has happened is that they have not been able to increase it as much in these inflationary years because they know it will be passed on.

"Now, every year National was in government we increased the minimum wage - we think that is the right thing to do - but how much you do that by is a very careful balance.

"Because what we don't want is workers on the one hand being paid more, but on the other hand having to pay so much more in costs at the supermarket, on rent and other things that their wages just get eaten up."Nicola Willis on RNZ yesterday.

‘Careful balance’ is the code for favouring employers over workers.

Do paying subscribers want me to open this one up publicly? Please vote in this poll and/or comment below.

The Chart Pack

In the global economy, geo-politics and our political economy in the last 24 hours:

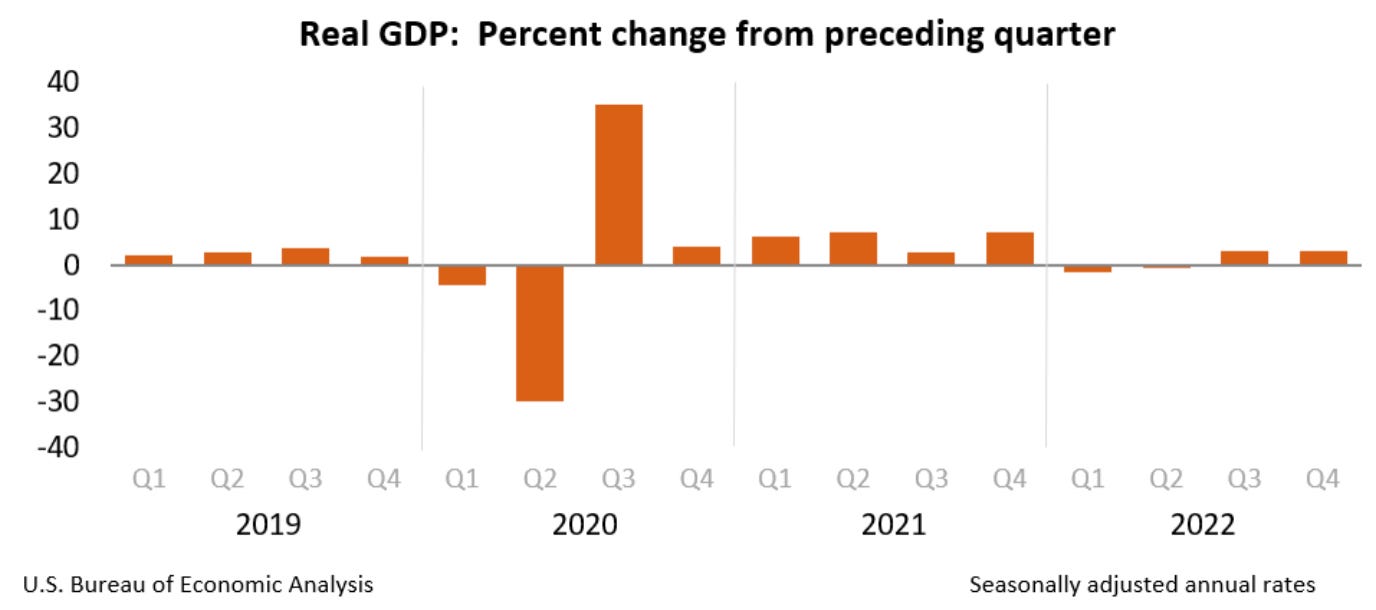

Soft landing? US economic growth slowed a bit in the December quarter to an annualised rate of 2.9% from 3.2% in the September quarter, but this was better than the consensus expectation for growth of only 2.6%. US Bureau of Economic Analysis data

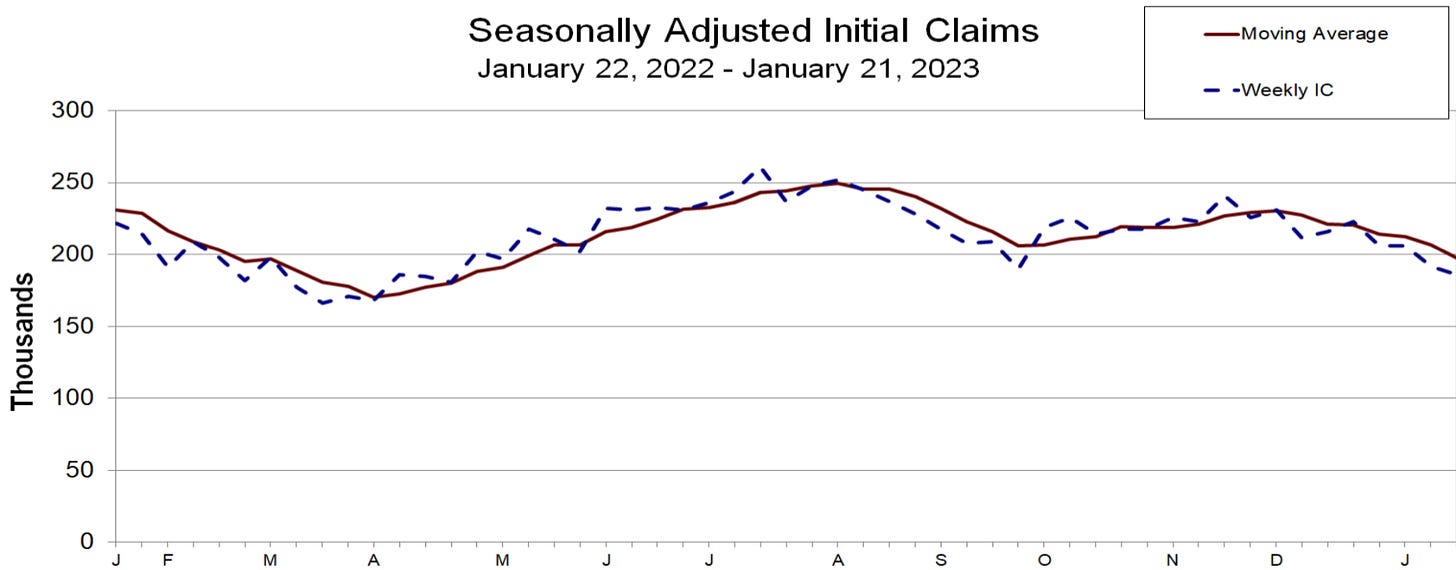

Job hoarding? - In another sign the world’s largest economy might be set for a soft landing, US jobless claims fell to a nine-month low of 186,000 in the week to January 21 from 192,000, which was also better than the economists’ consensus forecast for jobless claims of 205,000. US Department of Labour data

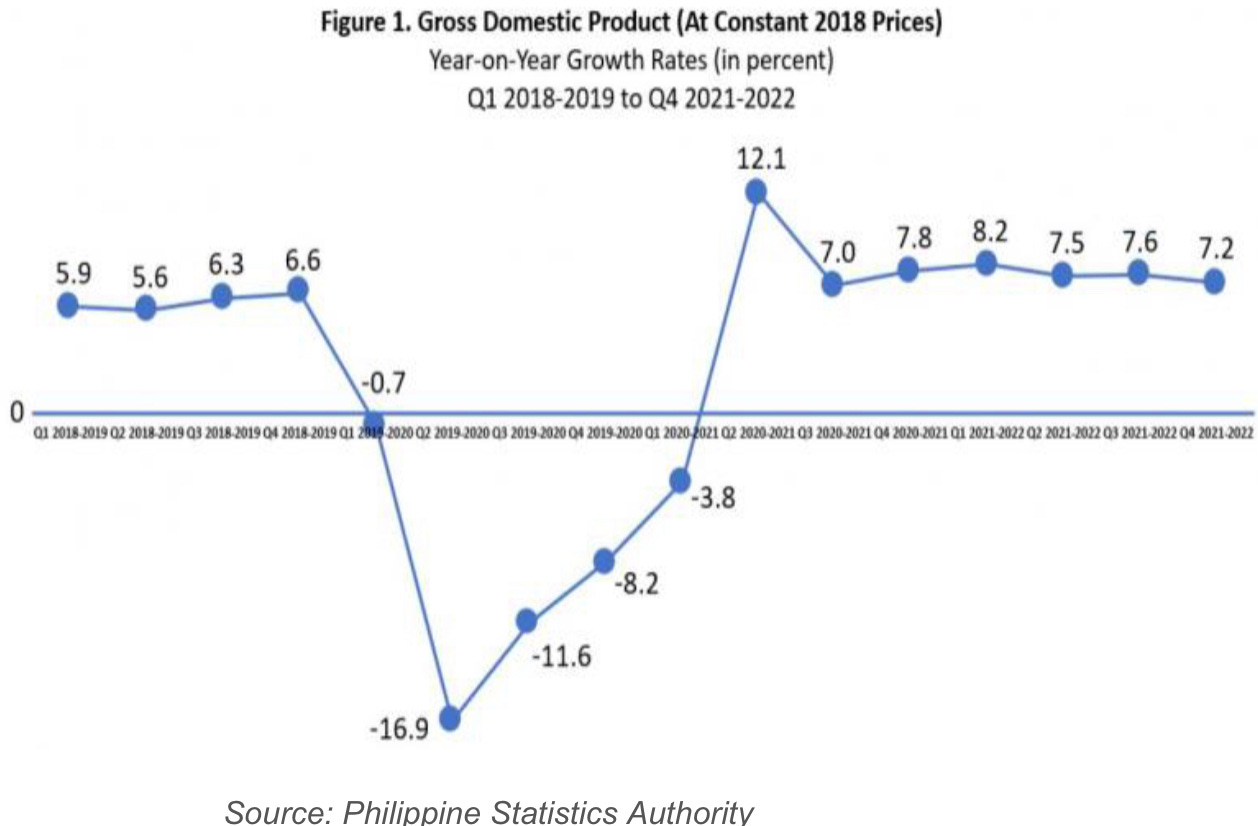

What recession? - The Philippines reported its GDP grew at an annual rate of 7.2% in the December quarter and annual GDP rose 7.6% in 2022, which was its fastest annual growth since 1976.

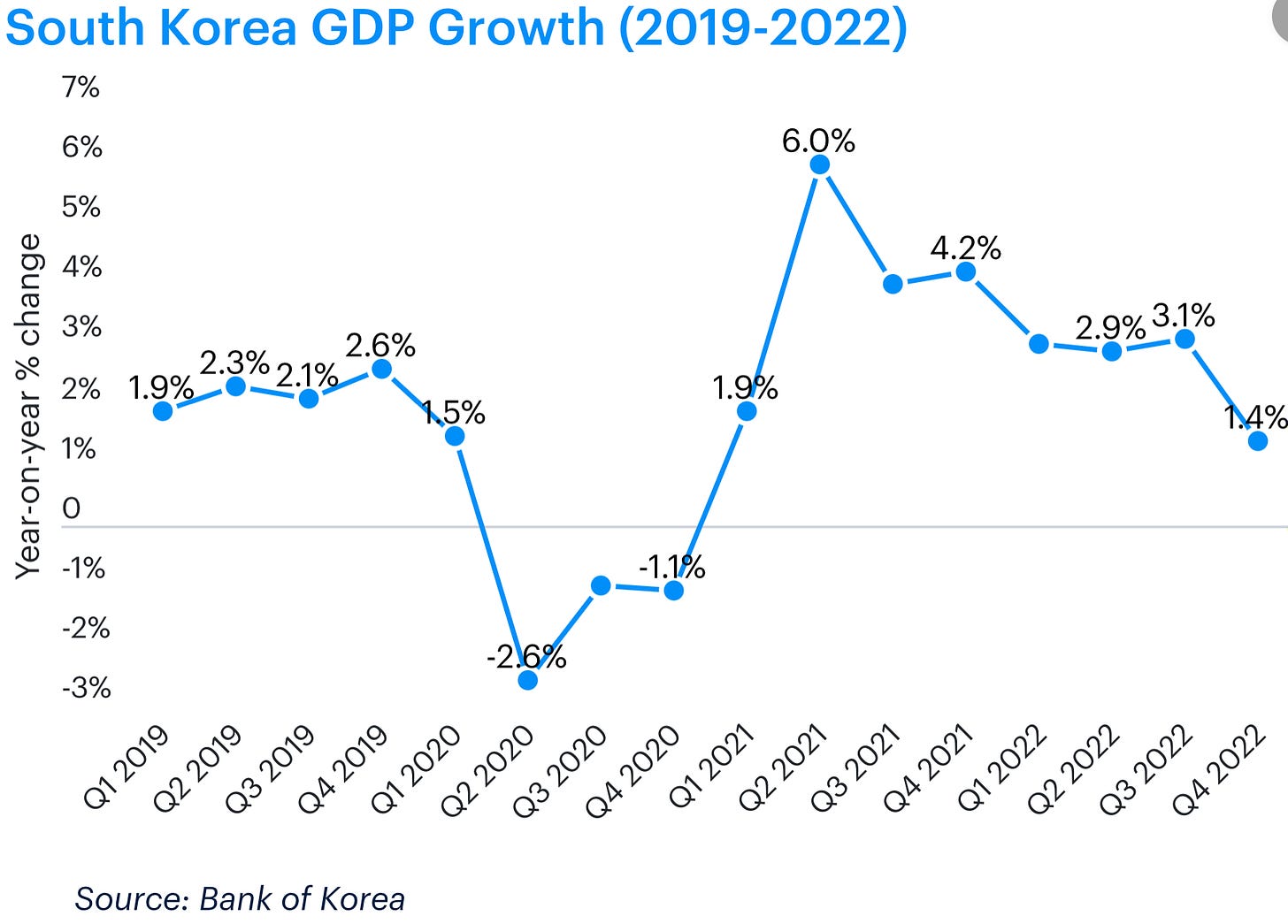

The chips are down - South Korea’s economy contracted 0.4% in the December quarter, but was GDP was still up 1.4% from the same quarter a year ago. The result matched expectations and was partly driven by slow growth in China, which buys a lot of South Korea’s tech exports, including chips and screens. Bank of Korea data

The Data Points

A growing waiting list - Te Whatu Ora/Health NZ reported there were 30,000 people waiting longer than the four-month target for their planned surgery at the end of October, up from 27,500 in May. RNZ

The chicken comes first. - The Poultry Industry Association warned yesterday Aotearoa is still 400,000 laying hens short and would not have enough chickens grown into laying hens until May at the earliest. RNZ

A restructurer restructures - Global business software group, SAP, announced plans overnight for a ‘targeted restructure’ that will will sack nearly 3,000 workers, or 2.5% of its workforce.

The Milestones

A matriarch passes - A tangi for legendary Maori activist Titewhai Harawira was held yesterday at the Hoani Waititi Marae in West Auckland. Many spoke, including new PM Chris Hipkins, who passed on a tribute from Jacinda Ardern. 1News

"I first met Titewhai at Te Tii Marae as a young opposition member of Parliament... but our relationship only really took place at my first Waitangi as Prime Minister. I knew Titewhai had my hand and I knew that it would be all right." Jacinda Ardern’s tribute to Titewhai Harawira, as read by Chris Hipkins.

A grandson goes - Toyota announced last night its CEO of the last 13 years, Akio Toyoda, will step down as CEO and become Chairman. Toyoda, 66, is the grandson of the company’s founder and will hand over to Koji Sato, who has been with Toyota for 30 years. CNN

Ka kite ano

Bernard

PS. Here’s the link to today’s ‘hoon’ webinar at 5pm

Share this post