Here's the detail in the housing package

Bright line test up to 10 yrs; Landlords' ability to claim interest for tax purposes to be phased out over 4 yrs; Price & income caps lifted for First Home Grants;New $3.8b infrastructure fund

(Updated below the tables)

The Government has detailed its long-awaited and hyped housing demand and supply package, but it was underwhelming as it appeared to add no new specified housing supply and gives landlords four years to adjust to the removal of interest as a taxable expense. There appears to be no increase in borrowing for Kāinga Ora to build beyond its existing plan for 14,400 new homes by 2024.

The Government also increased price and income caps for first home buyers, which will add to demand and put upward pressure on prices. The only major new spending is the creation of a $3.8b fund to help councils and developers with infrastructure, and to buy more land for housing. The last Housing Infrastructure Fund ($1b) announced by the Key/English Government in October 2016 stopped making grants in late 2018 and was underspent by around $100m.

The moves included:

A doubling of the bright line test for taxing trading income of landlords to 10 years from five years, as expected;

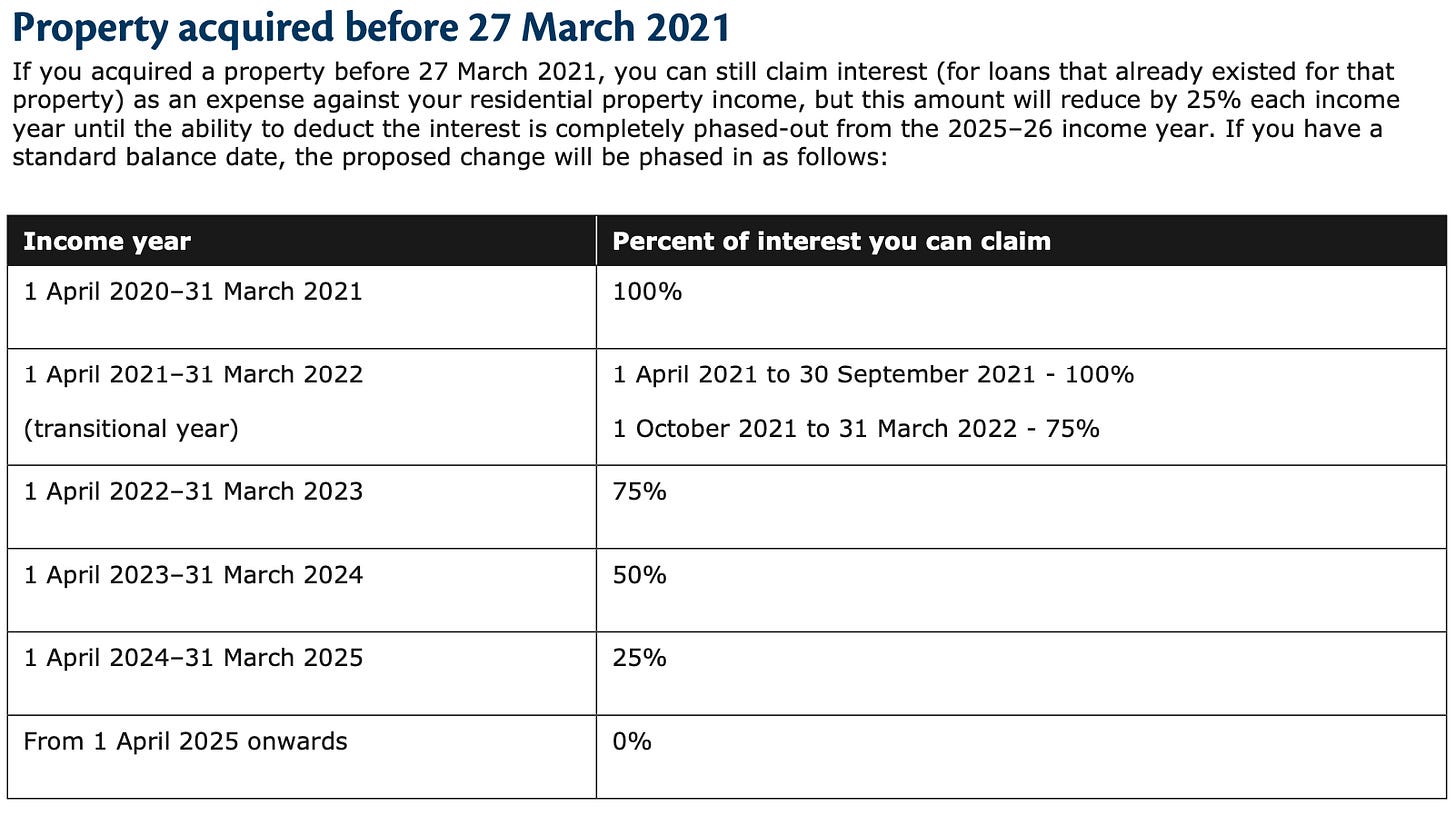

The phased removal over four years of interest as a taxable expense for landlords, except for property developers and for buyers of new homes. The removal of the ability to claim all interest begins from March 27 for new purchases, but is phased in for existing purchases (see detail in the table below), which was not widely expected, although the phasing in will blunt the impact;

The provision of $2b extra borrowing for Kainga Ora’s land purchase programme, although that borrowing was signalled in last year’s Budget and by Kāinga Ora itself here. There was no mention in embargoed documents of increasing Kāinga Ora’s debt cap from the $7.1b set in January 2020 or increasing the new build target of 14,400 new social homes by 2024. Kāinga Ora has only borrowed $2.3b so far and its borrowing rate of $100m a month is not forecast to increase later this year.

The creation of a new $3.8b Housing Acceleration Fund to fund private and council infrastructure for housing, and to increase purchases by Government of land for housing;

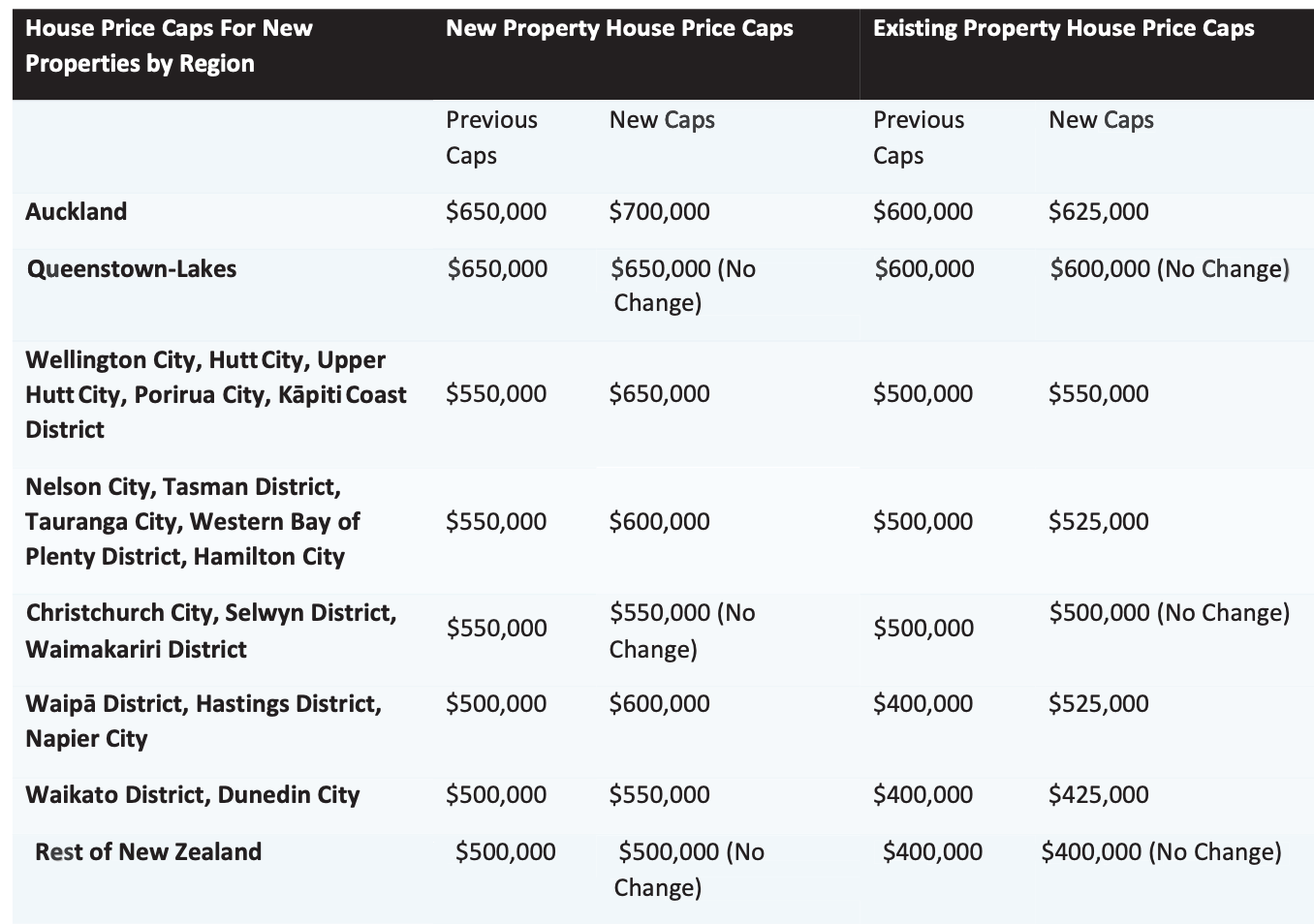

The increase of price and income caps for First Home Grants and loans. Income caps will be lifted from $85,000 to $95,000 for single buyers, and from $130,000 to $150,000 for two or more buyers. The price cap changes are in the table below.

From the news conference

Asked about his having ruled out a bright line extension before the election, Finance Minister Grant Robertson said he had been too specific with his answer. PM Jacinda Ardern said the Labour Party had made no committment other than not to introduce new taxes before the last election. She denied having broken a promise.

Ardern said the package would make a difference to affordability and price inflation, but there was no silver bullet and she would not specify details on the likely impact on new house builds, house price inflation or rents. She said the Government was using every lever it had to attack the issue, although she did not mention the Capital Gains Tax beyond the family home, which she has ruled in her political lifetime.

Housing Minister Megan Woods said the broad advice was that the package may increase the number of houses built by 80,000 to 130,000 over the next 30 years, largely by making available more greenfields and brownfields land for the private sector to build on. She confirmed there was no increase in the state house building target and that the extra funds were designed for Kāinga Ora to buy more land.

Ardern again restated the Government’s preference for a stabilisation of house price inflation and reiterated the Government did not prices to fall. Asked if the Government would reverse some of these policies if house prices started falling, she said the Government was committed to the package.

Ardern would not divulge advice on what the package would do for house prices and rents, saying only there was ‘contestable advice’ and a range of views.

Ends

Bernard, there is simply no tolerance for a correction in assets that store value since the GFC. Banks learned that if you own enough leverage to be a macro economic risk, govt and central banks will provide liquidity. The bank system will not allow houses to correct to any degree that creates risk, so they keep capitalising the buyers (whatever category they are) to keep houses trading. Govt, RBNZ and the banks will need to keep finding buyers, this is the cycle they have created. Look for the positioning of the next migration policy to the warmed up.

I'm looking forward to your take on this Bernard. I simply do not understand the commentary on Stuff and interest.co.nz along the lines that will have little effect and will not address the housing crisis. On the face of it, the tax changes could see a significant change in buyers starting from Friday and a noticeable effect on the trend of median prices in a month or two.

Kind of surprising how many commenters of Stuff are landlords who charge below market rent, but now, regrettably, will be forced to increase rents. Could the landlords charging above market rent please come forward?

Also, is there any data on the effect of the bright line test so far - how many sales were liable, what the effect of the increase from 2 to 5 years was?