TLDR: As council voting papers go out today, the elections are shaping up as pseudo referendums reacting against Government edicts on urban densification, mode shift away from cars and co-governance of water infrastructure.

So far, the signs are councils are in full revolt mode with the risk of a wipe out of Labour and Green candidates by pro-car, anti-rate hike, anti-cycling, anti-townhouse and anti-Three Waters candidates who throw a whole tool box in the Government’s strategies to address housing shortages and climate emissions. Already, legal clashes are looming, along with the potential appointment of Commissioners, as was done in Tauranga.

Elsewhere in the news overnight, the NZ dollar hit a two-year low against a rampant US dollar, there was a report Air NZ is looking at reviving its Virgin Australia alliance through a potential takeover or merger and US mortgage rates hit a 14-year high.

Paying subscribers can see and hear more detail and analysis below the paywall fold and in the podcast above. They can also watch out later today for my weekly Ask Me Anything and ‘hoon’ webinar email invites at midday and 5pm respectively.

In geo-politics, the global economy, business and markets

Two-year low - The NZ dollar fell overnight to a two-year low of 59.6USc as US investors kept increasing their forecast peak for America’s version of the OCR to 4.5%, which would be above Aotearoa-NZ’s forecast peak of 4.1%. The US dollar’s strength is effectively exporting inflation to the rest of the world, including us.

Housing rate pain - The housing market in the United States is cooling rapidly because of higher interest rates and that pain will intensify. Last night, average 30-year fixed mortgage rates, the main ones Americans use, hit a 14-year high of 6.02%, up from 5.89% a week ago and 2.86% a year ago. WSJ-free

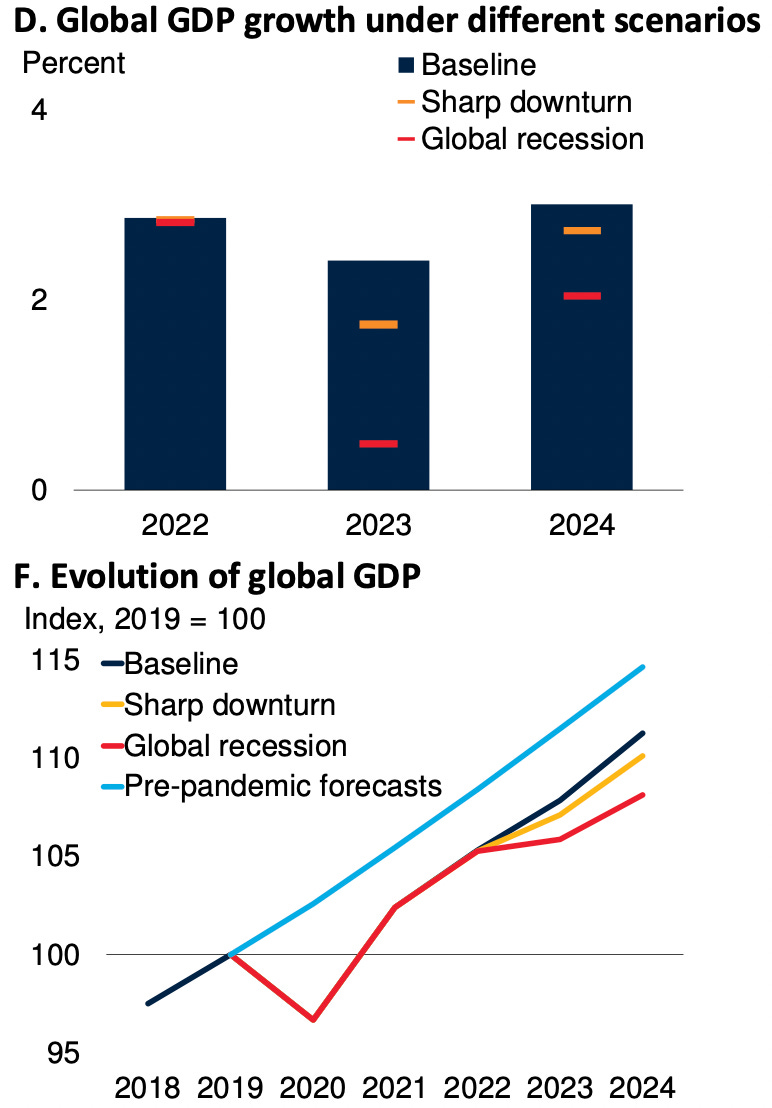

Too tight? - That spike in mortgage rates is mighty steep and it’s beginning to worry a few macro economists around the world. Last night, a paper via the World Bank asked if a global recession in per capita terms was imminent because of the fastest synchronous tightening of fiscal and monetary policy in 50 years. WSJ-free

Or soft landing? - However, the economic noise from the United States is still…well…noisy. Last night, we also got fresh signs of a ‘soft landing’, with lower than expected jobless claims and higher than expected retail sales.

China stimulating - China’s state-run banks cut their deposit rates overnight for the first time since 2015 as Beijing grapples with an economic slowdown driven by Covid lockdowns and a property development implosion ahead of a key leadership meeting next month. Nikkei Asia

Just briefly:

Damaging US rail strike averted at the last minute. CNN

Adobe to buy Figma for US$20b. CNN

In Aotearoa-NZ’s political economy

Back to the future? - Air NZ is in early talks to buy or merge with Virgin Australia, The Australian’s Bridget Carter is reporting behind a paywall this morning from unnamed sources.

Sources say that discussions have been held between New Zealand’s national carrier and Virgin in recent weeks, although they do not suggest that the pair have necessarily progressed towards a deal at this stage.

But DataRoom understands that the plan would involve a back door dual listing here and across the Tasman of Virgin into Air New Zealand, providing an expansive trans-Tasman network for both groups in what would be somewhat of a move back to the future.

So what? - This would be something of a return to the future for Air NZ. It owned a 19.9% stake in Virgin Australia and had an alliance with it until 2016, when it was sold under then-CEO Christopher Luxon. Air NZ then shifted its alliance to Qantas. Doing this new deal under current CEO Greg Foran would unravel that Qantas alliance and require approval from our Government and Commerce Commissions on both sides of the Tasman.

Ansett 2.0? - Also, the history of Air NZ deals with those across the Tasman is…er…chequered. Air NZ’s purchase of Ansett 22 years ago almost killed the-then privately owned Air NZ and forced its nationalisation.

Water contractors - Jason Walls is reporting for NZ Herald in front of the paywall this morning that DIA paid consultants $16.3m for work on Three Waters.

The problem(s) with Tiwai Point - The Tiwai Point smelter’s continued operation is problematic for our climate emissions reduction plans. Until we know if and when the smelter closes, power generators won’t be confident about investing in new renewable capacity. Europe is closing smelters because of high power prices, which makes it even more profitable for Rio Tinto to keep it going.

Revoke the consents? - That means the future of our climate plans is hostage to the whims of overseas shareholders. Unless the smelter’s consents were revoked. And why wouldn’t you when finding out it is still polluting and cleaning it up could cost $1b. Here’s detail via RNZ yesterday from an Environment Southland report.

Report the delays - Small Business Minister Stuart Nash is set to announce plans later today to make companies with revenue of over $33m per year and Government departments and agencies report publicly on how long they take to pay invoices. Jenee Tibshraeny has the story in front of the paywall at the NZ Herald this morning.

Council says no to tiny homes - The number of homeless people being put up in Rotorua’s ‘MSD mile’ of motels has dropped 10% recently, outgoing Mayor Steve Chadwick has told Felix Desmarais via RNZ. But it’s still obviously dominating the election campaign there. Former NZ First MP Fletcher Tabuteau is running to be Mayor and wants to build tiny homes on unused airport land to house the homeless, instead of the motels. The council is saying no because there are airport noise control issues...

Quietly quitting on densification - Here’s more passive aggressive ‘quiet quitting’ from a council in response to the government’s urban densification laws. Tina Law reports for The Press this morning that the Christchurch City Council wants to charge developers extra if their development has less than 20% tree cover. Outgoing Mayor Liane Dalziel told RNZ yesterday she thought the Government might appoint a Commissioner to force the changes through.

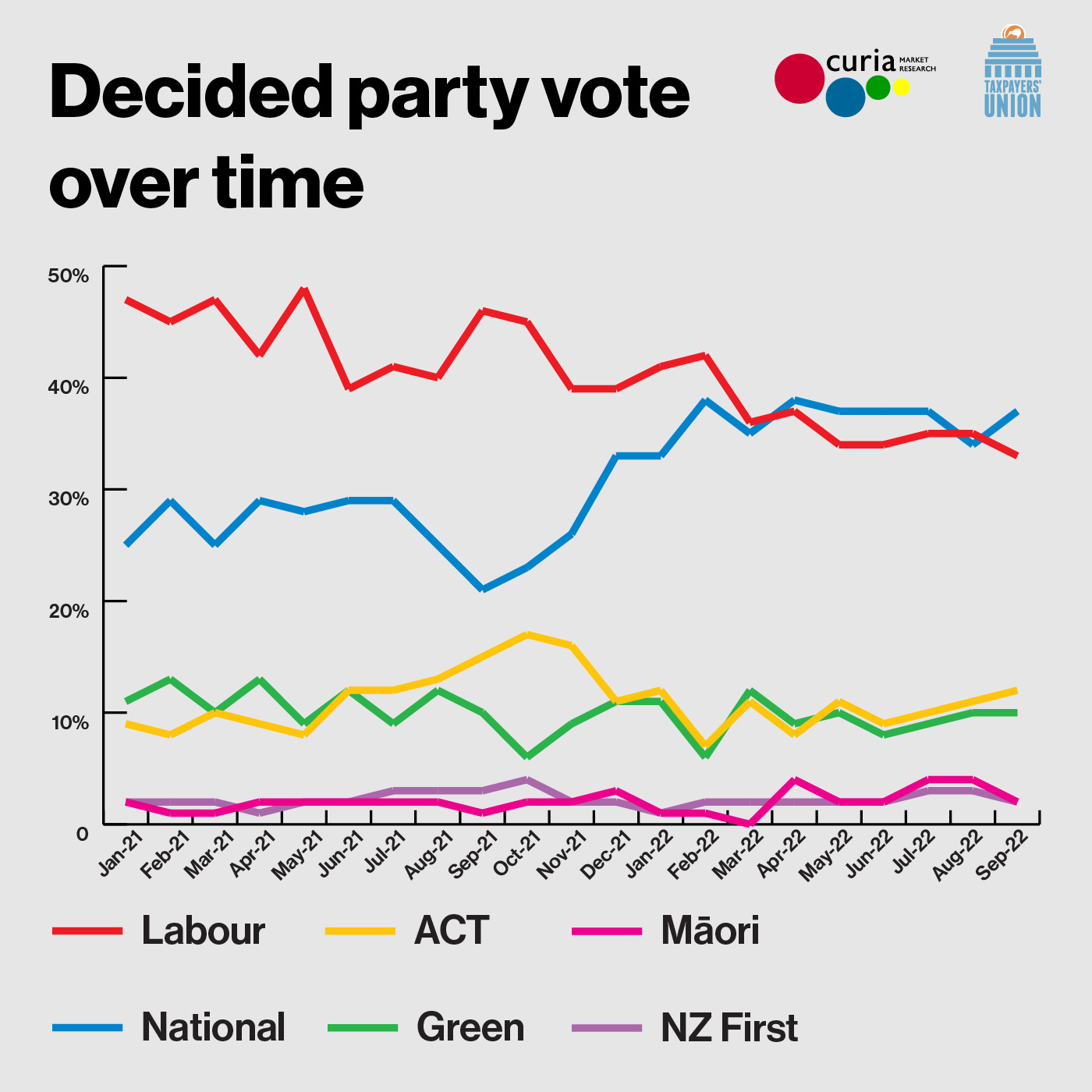

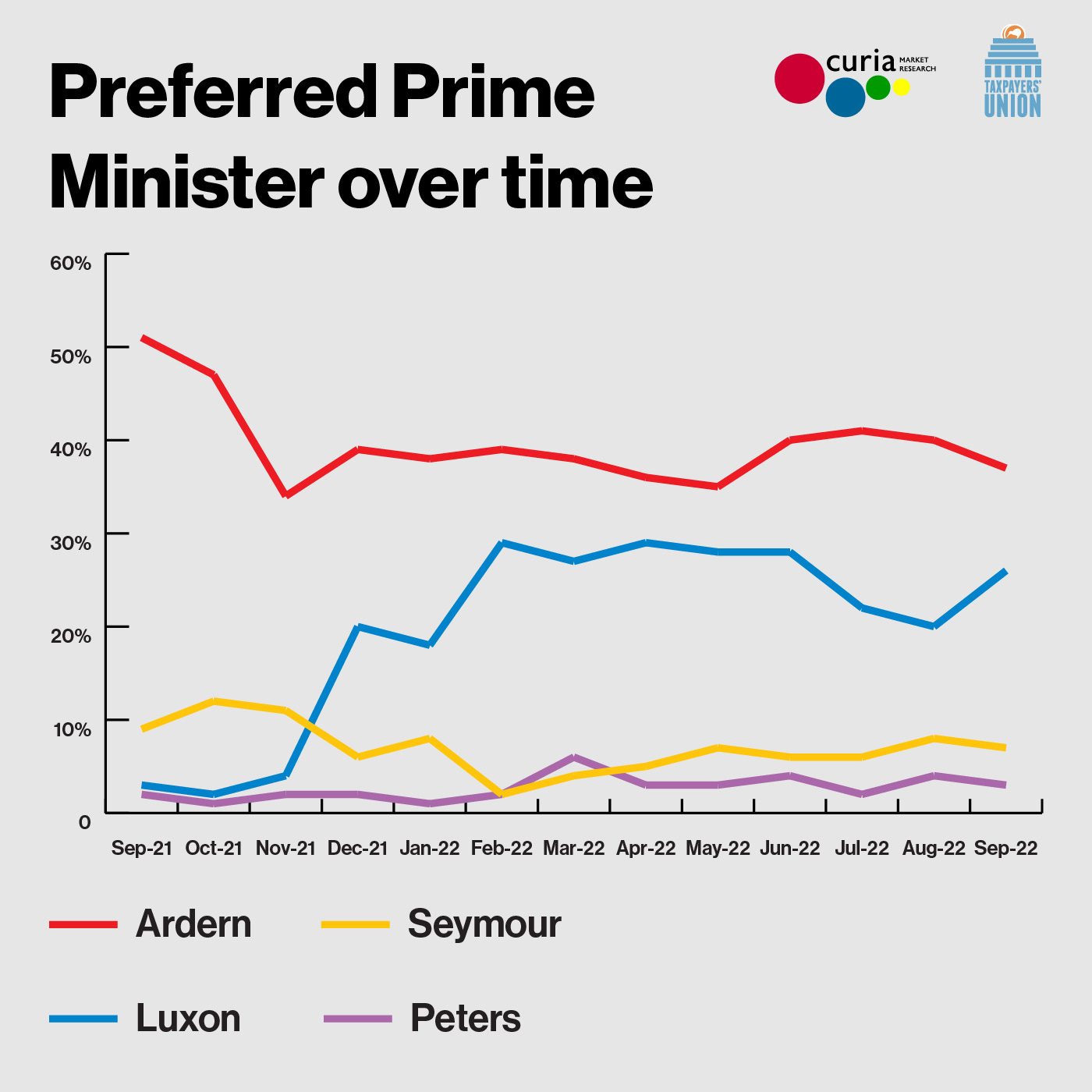

National ahead again - FYI on the political side, the latest Taxpayer Union-funded poll taken by Curia in the first nine days of September found National back above Labour (again and Christopher Luxon catching up to Jacinda Ardern as preferred PM again). National rose three percentage points to 37%, Labour fell 1.8 points to 33.4%, ACT rose 1.9 to 12.4% and the Greens fell 0.4 to 9.9%. Te Pāti Māori fell two points to 1.5%. On these numbers National and ACT could govern alone (just) with 63 seats in a 120 seat Parliament.

Number of the day

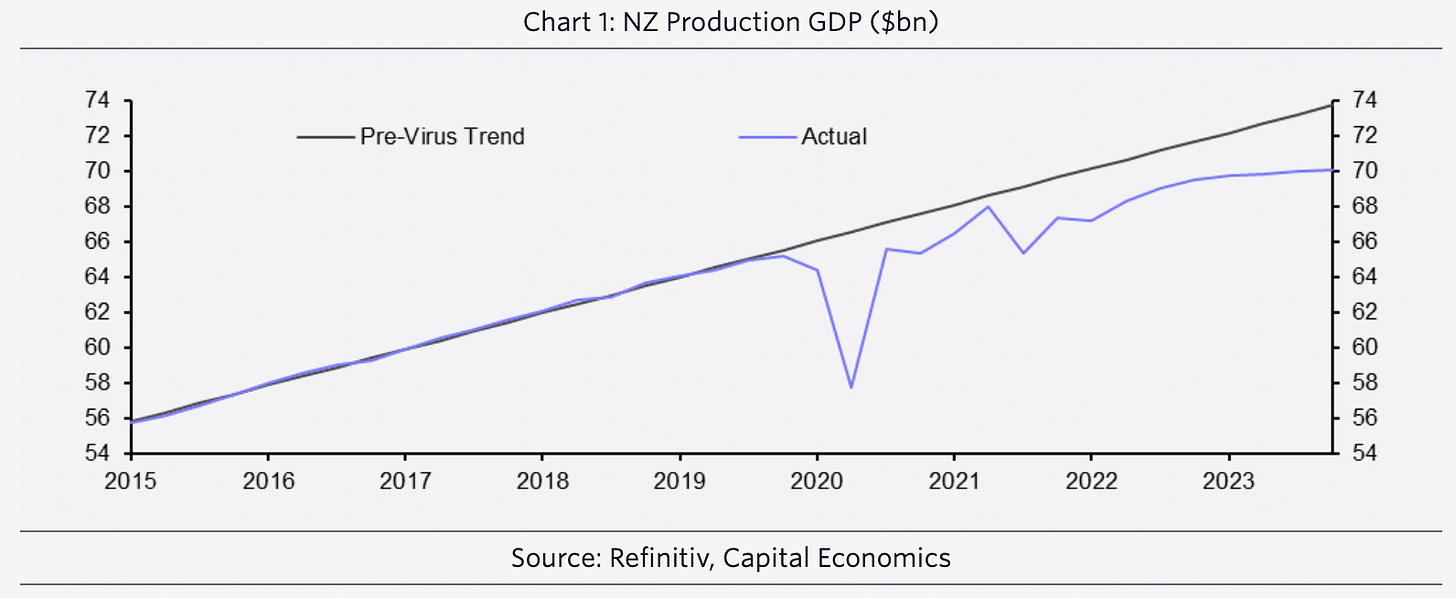

1.7% - Aotearoa-NZ’s real GDP growth in the June quarter from the March quarter was 1.7%, Statistics NZ reported yesterday. That was better than most economists forecasts for around 1.0% and just below the Reserve Bank’s forecast last month of 1.8%. ASB increased its forecast peak for the official cash rate by 25 basis points to 4.25%, but the rest were unchanged. Transport and hospitality were the star performers as the Covid restrictions eased.

Chart of the day

Up, but still 3.5% below the pre-Covid trend

Climate record of the day

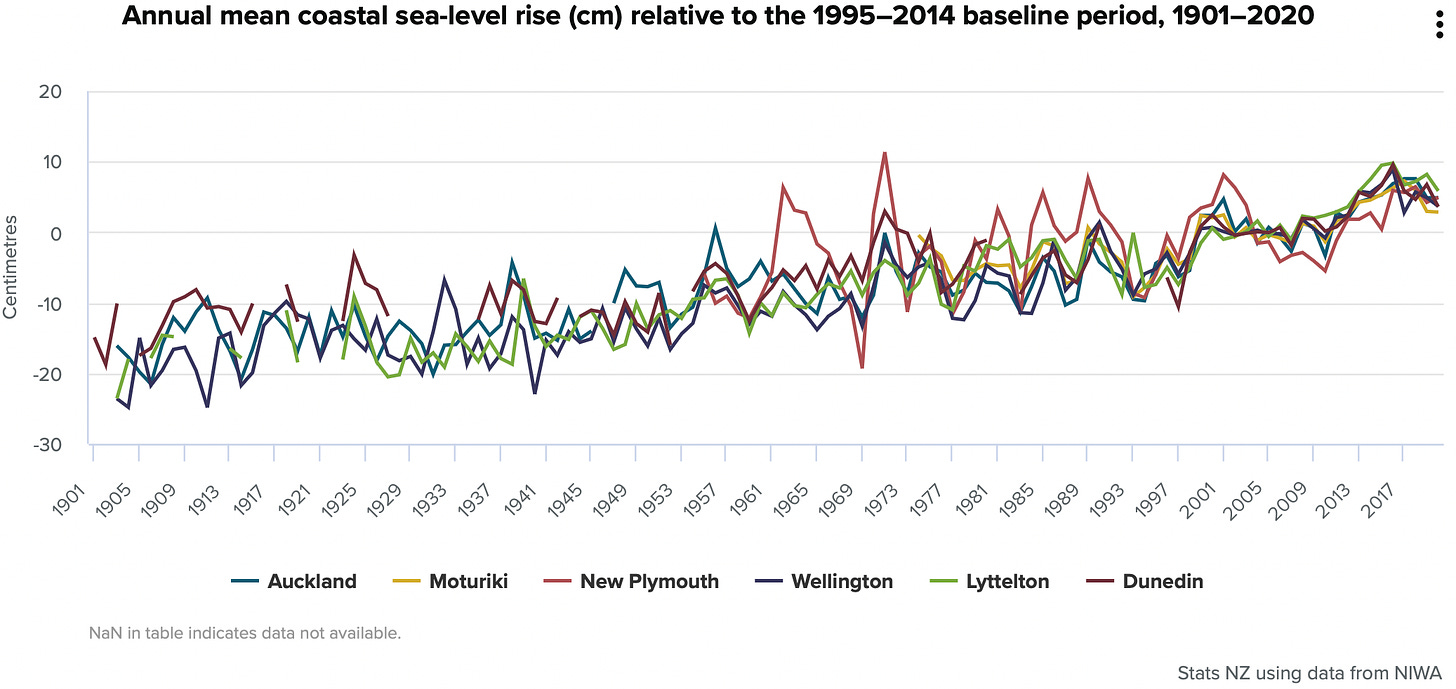

The rate of sea-level rise around Aotearoa-NZ doubled in the past 60 years, Statistics NZ reported yesterday.

Quotes of the day

Why Patagonia’s founder gave his US$3b company away

“I was in Forbes magazine listed as a billionaire, which really, really pissed me off. I don’t have $1 billion in the bank. I don’t drive Lexuses. ” Patagonia founder Yvon Chouinard quoted in the New York Times exclusive yesterday revealing his plans to give away the company to a charity to fight climate change.

Chouinard actually threatened to sell the company if his staff couldn’t find a way to create the charity.

“One day he said to me, ‘Ryan, I swear to God, if you guys don’t start moving on this, I’m going to go get the Fortune magazine list of billionaires and start cold calling people.’ At that point we realized he was serious.” Patagonia CEO Ryan Gellert

However, he has competition. Barry Seid, an US electronics manufacturing mogul, just gave his US$1.6b company away to a charity to promote conservative causes, including efforts to stop action on climate change and ban abortion.

Unlike Seid, Chouinard structured his deal so he and his family paid US$17.5m in taxes on the gift.

“Hopefully this will influence a new form of capitalism that doesn’t end up with a few rich people and a bunch of poor people.” Chouinard

Some fun things

Ka kite ano

Bernard

PS: Here’s the link for today’s ‘hoon’ zoom webinar with Peter Bale and myself discussing the week’s events in geo-politics, the global economy and the local political economy, often with special guests. It starts at 5pm and goes for an hour. We aim to have Otago University Foreign Affairs Professor Robert Patman and Kiwibank Chief Economist Jarrod Kerr on today.

Friday’s Dawn Chorus: Councils quiet quitting on urban densification