First scratch: RBNZ brings forward LVRs

Central bank tries to cool housing market it heated up by bringing back LVRs 2 mths early; No word if first home buyers will be exempt; Bank capital upgrade delayed 1 yr; Dividends ban stays til March

TLDR: The central bank has responded to a chorus of calls to reintroduce LVR controls to hose down a raging housing market, but has only bought them forward by two months to March. It also hasn’t said if first home buyers will avoid restrictions. This gives rental property investors time for a summer of frantic house buying and outbidding of first home buyers without the equity stocks of existing homeowners.

To placate the banks who will have to cool their lending, the Reserve Bank has delayed its plans to force them increase their capital levels (and reduce profitability) for another year until July 2022. However, it has kept its dividend ban for the banks in place until next March at the earliest.

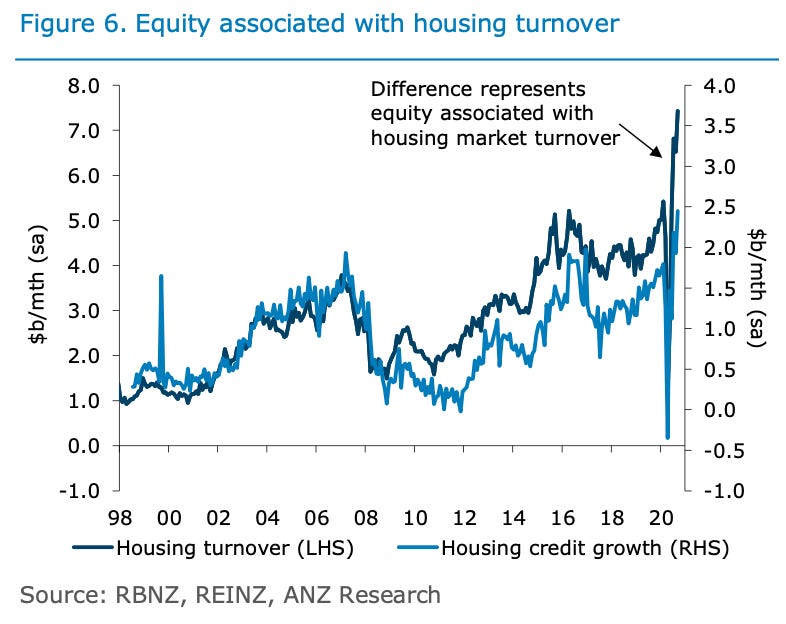

The Aussie banks will not be happy and neither will shareholders. Mortgage brokers and real estate agencies should probably cancel their summer holidays now. They will be frantic dealing with the rush to get in before the boom comes down. House sales boomed to over $3.5b in September, including nearly $2.5b of fresh loans and about $1b of equity stored up by owner-occupiers and rental property investors. (See chart below)

By the way…the Reserve Bank has also warned the big Australian insurers, IAG and Suncorp, against paying dividends. Governor Adrian Orr should not expect too many Christmas cards from Australian bank and insurance shareholders this year.

The news this morning…

The Reserve Bank announced at 9am it will consult next month on reintroducing loan to value ratio (LVR) controls for risky lenders from March 1, rather than the May 1 deadline it set itself when it suspended them because of the Covid-19 shock.

Since then, lending to rental property investors and owner occupiers has surged, driving a near 5% rise in house prices since the Covid-19 lockdowns and surprising many economists who had expected prices to fall 10-20% this year.

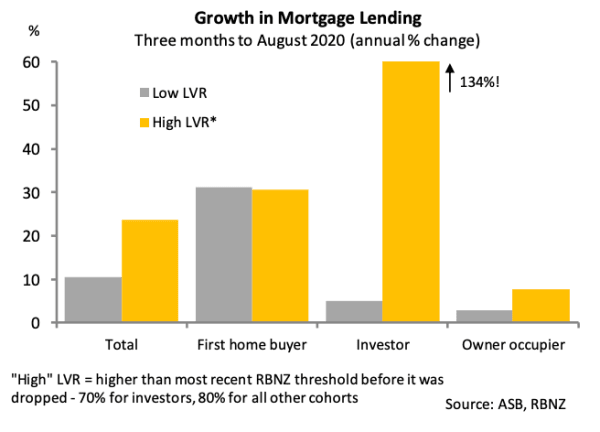

Calls have grown in recent days for the reintroduction of the LVR controls as the housing market has heated up, in particular on rental property investors, who have doubled their high-LVR lending this year (see chart below). The Reserve Bank was not expected to comment or take action until its Financial Stability Report on November 25, but clearly wanted to get these questions out of the way before its 3pm Monetary Policy Statement news conference.

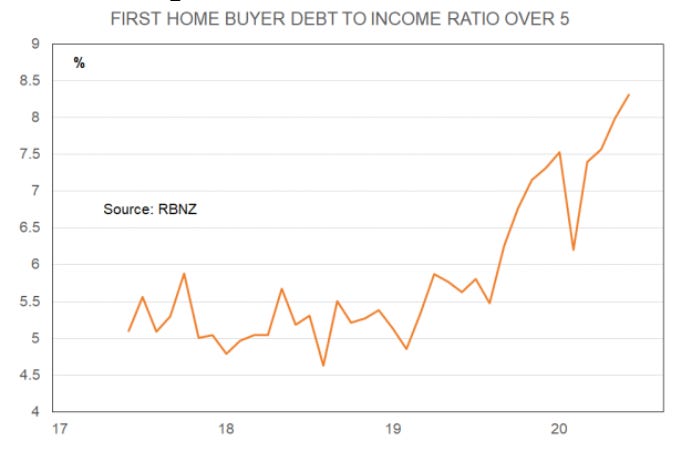

However, the bank did not specify whether the LVR controls would be reintroduced only for rental property investors. Some are concerned first home buyers, who have also been increasing their borrowing and debt to income ratios since May (see chart below), would be restricted again as well.

Capital upgrade and dividend delay

Also, the Reserve Bank announced it had delayed higher capital requirements for banks for another year until July 1, 2022 and extended its ban on banks paying dividends until March 31 next year at the earliest. It announced the first delay and dividend ban in March when Covid-19 hit to ensure banks kept strong capital levels. It will release more details on November 17.

It is estimated it will increased bank capital in the New Zealand units of the big four Australian-owned banks (ASB, BNZ, Westpac, ANZ) by up to $6b this year, which is helping our current account deficit, but is not popular with Australian shareholders.

Insurers in the capital spotlight too

The central bank also regulates insuers and told them to "only make dividend payments if it is prudent for that insurer to do so, having regard to their own stress testing and the elevated risks in the current environment."

That will surprise and disappoint the likes of Australian-owned IAG (State, AMI, NZI, Lumley), Suncorp (Vero, AA Insurance and Asteron Life) who regularly receive hefty dividends from their New Zealand units, especially in the last three years after big increases in premia.

I welcome your comments and questions for the news conference later today.