TLDR: European leaders are warning of a ‘Lehman Brothers moment’ in their financial markets because of the ten-fold increase in gas prices and a more-than-tripling of electricity prices caused by Russia’s decision to cut off the gas Europe depends on to generate power.

In the last 48 hours, the Swedish, Finnish and Swiss Governments have offered over €30b in loans and credit guarantees to their largest power generators and retailers as the European electricity industry faces €1.5t in margin calls linked to spiking prices.

Meanwhile, new British Prime Minister Liz Truss signalled overnight she was set to unveil over £130b worth of energy subsidies and tax cuts paid for by Government borrowing. Financial markets in Europe and the United States reacted by pushing wholesale interest rates sharply higher this morning.

Here in Aotearoa-NZ, Treasury is reported to be scrambling to find ways to pay for transport ‘mega-projects’ that somehow don’t involve higher taxes or much higher core crown borrowing. Also, the gang-linked security firm and ‘wrap-around’ service provider at the centre of this week’s Rotorua’s motel story is now under official investigation 1News.

In my view, all of the above are examples of short-term political and financial responses to the inevitable effects of the magical thinking that western democratic societies can ‘get away’ with consuming more resources than the planet can handle without much more long-run investment, and of piling up much more wealth in the hands of too few at the expense of low investment and self-defeating erosions of democracies caused by the inevitable stresses on the ever-poorer.

In geo-politics, the global economy, business and markets

Europe’s ‘Lehman moment’ - The Swiss, Swedish and Finnish Governments have announced emergency loans in the last 48 hours for their biggest electricity generators and retailers as the wider European electricity industry faces combined margin calls estimated by Equinor to be €1.5t1. Reuters Bloomberg-$$$ FT-$$$2

Liz’s magical moment - New British Prime Minister Liz Truss promised overnight to deal to looming spikes in winter energy bills and to cut taxes by borrowing an estimated £130b-plus or the equivalent of about 5% of GDP. She also promised to transform Britain into “an aspiration nation” by increasing its economic growth rate and massively increasing gas production from Britain’s dwindling North Sea reserves.

Not that magical financially - Financial markets, who worry about Truss increasing Britain’s Government debt-to-GDP ratio from over 100%, pushed up the 10 year British ‘gilt’ or Government bond yield by 16 basis points to 3.1%. That’s its highest point since 2014 and caps a 90 basis point rise in a month, the fastest rise in the yield since 1989. This represented financial markets calling bullshit on Truss’ magical thinking that tax cuts would both generate higher economic growth and keep interest rates low. Reuters

US bond markets having a moment too - Meanwhile, the US 10 year Government bond yield, which the financial world’s most-closely-watched long-term wholesale interest rate, rose 15 basis points to 3.34% this morning on fears the US Federal Reserve will have to hike more aggressively to contain inflation. This followed stronger than a stronger-than-expected US supply sector survey. All this helped strengthen the US dollar overnight, and saw the NZ dollar hit a low for the year of 60.35 USc. Reuters

Russia’s ‘Russian speaking’ moment - Be careful before learning Russian. It may mean Vladimir Putin wants to ‘protect’ you. Putin yesterday approved a new foreign policy doctrine based around the concept of a "Russian World", an idea used to justify intervention abroad in support of Russian-speakers. The 31-page "humanitarian policy" Russia should "protect, safeguard and advance the traditions and ideals of the Russian World." Reuters

Just briefly:

VW plans to float Porsche for up to €85b in the world’s biggest IPO in 11 years WSJ3

California power prices soar to highest since 2020 in heat wave Reuters

Xi’s Covid Zero Strategy Is Facing Make-or-Break Test in Chengdu Bloomberg

Russia buying millions of shells and rockets from North Korea AP

In Aotearoa-NZ’s political economy this morning

More magical thinking - Thomas Coughlan reports from official documents in the NZ Herald-$$$ this morning that Ministry of Transport and Treasury officials are wracking their brains for ways to pay for ‘mega projects’ such as ‘Lets Get Wellington Moving’ and the Auckland CBD-to-Airport railway without either increasing Government debt or tax rates. The options include congestion charging, public-private-partnership-style infrastructure bonds, increased fuel taxes and road user charges, value capture rates when land values rise and using emissions trading scheme revenues.

Here’s a few details from Thomas’ piece quoting officials hunting for ‘other’ ways than simply using the Crown’s balance sheet or higher core Crown debt. Remember that is an unstated but very real bipartisan '30/30 rule’ that core Crown tax revenues and net debt not increase over 30% of GDP, which effectively stops the Government from even considering using the balance sheet simply or increasing income or GST rates, or even taxing wealth.4

"[T]he direction of travel is for a beneficiary pays model, which does not presume that the Crown should fund a significant portion of the costs," the official said.

The official suggested different wording, which stressed the risks to the Crown rather than the benefits. "[T]here is a significant risk that the Crown may have to fund a large proportion of the costs if local authorities or alternative funding tools such as value capture and IFF [Infrastructure Funding and Financing] are not used," they said.

The official also suggested removing entirely the idea that fuel taxes would need to rise to fund the cost of these projects. "[T]here's very few worlds where FED and RUC don't need to increase," the official said.

Treasury officials weighed in with their own advice. They said that questions over funding and revenue would be resolved elsewhere, including two pieces of policy work: one on transport revenue and the other on the funding of "Mega Projects".

The Government has commissioned a "Revenue Review" to look at options for replacing fuel tax and road user charges, the current way most transport projects are funded. Findings are due next year. One of the early results of the review is a separate work programme on "Mega Projects", led by Treasury.

In the context of these projects, the reviews could look at things like congestion pricing and value capture and the way the revenue from those tools is split between local government and central government to fund large projects. Thomas Coughlan reports from official documents in the NZ Herald-$$$ this morning.

Framing the problem away into the future

The key questions here are how this ‘Mega Project’ work is being framed. What are the limits set for Treasury on what it can (or can’t) do with core tax revenues and debt in the long run? Who is setting those limits? How is the Public Finance Act being interpreted in setting those self-imposed and un-debated limits?

So what? - All this displacement activity and hunting for magic money trees to build these projects without increasing taxes or debt are a symptom of decades of inter-generational wealth transfer engineered by the 30/30 rule over the last 30 years. Under this effective bipartisan policy, insufficient Government and Council investment in infrastructure allied with defacto fast-population-growth-with-low-wage-temporary migration created the conditions for low interest rates, continued budget surpluses and low Government debt to create $1t of leveraged tax-free capital gains for home and business asset owners.

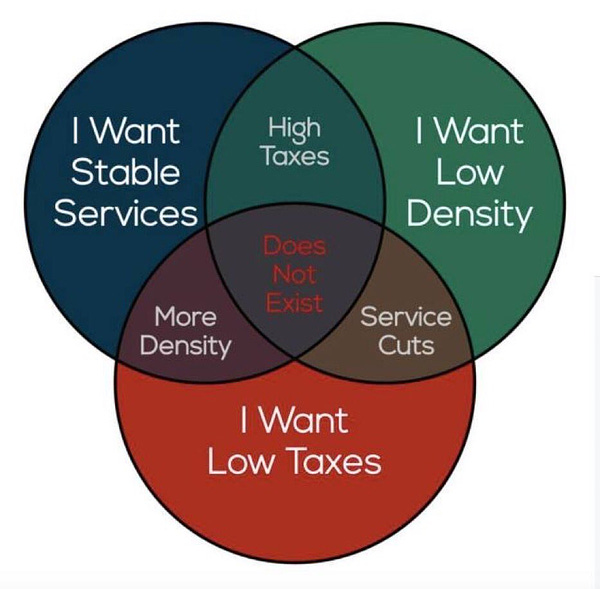

The bottom line - The magical thinking inherent in Truss’ crude version of trickle-down economics on show this week is not that different from the low-tax and low-investment default setting of both Labour and National Governments over the last 30 years. This magical thinking says voters in a property-owners’ democracy can have:

low taxes, low debt, low interest rates and rising asset prices into infinity;

without having to invest much in repairing or preventing the damage to the environment, or in new technology to use energy more efficiently;

or having to invest in affordable housing or transport for the generations of youth sentenced to live as renters on precarious wages for decades to come;

or don’t have to worry about election revolts from those unborn generations who will have to pay both rent and taxes for the publicly-funded pension and healthcare costs for today’s asset owners;

that democracies can easily survive the social stresses and lower economic growth rates caused by widening inequality, over-consumption of physical assets without paying for externalities, and unaddressed climate change; and,

that autocracies competing for those resources with democracies will not take advantage of this dysfunction to protect and grow their own share of those resources.

The bottom bottom line - None of this really computes in the long run and it’s beginning not to compute in the short run either as climate change accelerates into growth-sapping events in the near-to-now future.

For example, just overnight:

offices closed and data centres were flooded in the global outsourcing capital of Bangalore after record-setting torrential rains allied with poor water infrastructure investment; (ABC)

California, the world’s fifth biggest economy, is in severe drought and faces power blackouts and water shortages because of climate change Reuters;

a third of Pakistan, which is being bailed out by the IMF, is under water and it’s trying to widen a breach in its biggest lake to avoid it overflowing even more Reuters; and,

Shenzen, the globalised supply chain’s component assembly centre, is locked down with a disease (Covid) initially transmitted zoonotically on a planet that transmits more diseases zoonotically as it warms Reuters.

The unpriced-and-unpaid-for externalities generated by over-consumption, under-investment and deliberately widening inequality over the last 30 years appear to be coming together in a poly-crisis moment. The bill feels as if it’s coming due all at once in a series of climate events and wars that accelerate each other into a series of feedback loops into yet more crises.

Just a thought - Maybe it’s time we stopped with the magical thinking and instead consumed less, invested more, shared more with those most in need and slowed down a bit.

Quote of the day

The ‘L’ word that makes bankers’ blood run cold

“Here were all the ingredients for the energy sector’s version of Lehman Brothers.” Finnish economy minister Mika Lintilä announcing overnight a €2.35b loan package for the state-controlled Fortum, which is Finland’s biggest power generator and its biggest company by revenues. This package was on top of a €10b loan package for the wider industry announced on Sunday. Reuters

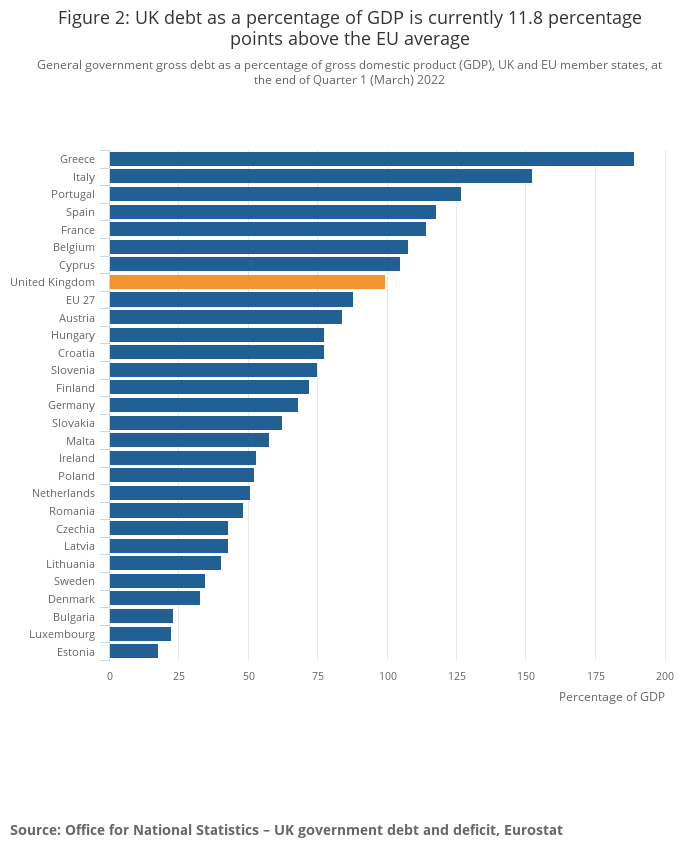

Chart of the day

If you think NZ’s 30% debt-to-GDP ratio is a problem…

Number of the day

The bill shock heading Europe’s way

€2t - Energy bills for European households will rise by two trillion euros by early next year, Goldman Sachs forecast in a research note released on Sunday. At their peak, these energy bills will represent about 15% of European GDP. This is why European governments are scrambling to intervene in energy markets to cap household and some business energy bills, paid for in part by windfall taxes on energy companies profiting from the higher wholesale prices. Bloomberg-$$$

Long read of the day

Substack of the day

The Craic

A fun thing

Ka kite ano

Bernard

That’s ‘t’ for trillion. €1.5 trillion is worth NZ$1.65 trillion NZ$2.47 trillion which is about six 12 times Aotearoa-NZ’s annual GDP. Corrected. Thanks to Phil for the heads up in the comments.

This is a gift link from me as an FT subscriber to you as a subscriber to The Kākā that can be opened three times. If you’re not one of the three lucky ones who got in first, I can put more in the comments below.

This is a gift link from me as a WSJ subscriber to you as a subscriber to The Kākā. It can be opened once per person.

Heaven forbid taxing capital gains or land values generally.

Magical thinking hits the physical and financial buffers