Dawn chorus Weds Nov 4

TLDR: Morena. Fulton Hogan is keeping $33.3m of wage subsidies, despite paying an $83.8m dividend to its Rich List family shareholders. Westpac NZ’s CEO David McLean says the housing market is overvalued and worsening inequality, and too much capital is invested there instead of real businesses. He wants the Reserve Bank to do something about it, but only slowly and not right now. Meanwhile, Westpac NZ grew mortgage lending twice as fast as business lending over the last year…

Question for the minister: Why is Fulton Hogan still getting Govt contracts?

Seriously? Duncan Bridgeman reports this morning Fulton Hogan is keeping $33.3m in wage subsidies, despite increasing its annual profit this year by 27.7% to $211m and paying out $83.8m (!) in dividends to its family owners the Fultons and Johnstones (worth a combined $765m in NBR’s Rich List)

Fulton Hogan said it wanted to “maintain a conservative financial position amid global and local uncertainties.” (NZ Herald-$$$)

My reckons: This can’t stand. The ‘optics’ are awful and it again reinforces the ‘K’-shaped nature of the Covid-19 response. The rich are getting much richer and the poor are getting poorer because of the Covid-19 recession and the way Governments all around the world, including this one, have reacted. Both Governments and businesses risk losing their social licenses to operate as this goes on without a rewriting of the social contract to redistribute wealth and invest in housing, skills and infrastructure for all. There’s an election today that may show that…

Property owners are $300b richer since March because of the Reserve Bank’s $150b money printing programme to buy bonds from banks and fund managers, and because the Government’s $14b in immediate cash support went to businesses’ bank accounts in wage subsidies. Meanwhile young workers lost their jobs and income security, and renters saw their rents go up and prospects for home ownership evaporate.

The wage subsidy programme in particular was largely helpful and fast, but some companies clearly took the piss and the basic problem that individuals did not receive ‘helicopter money’ cash grants, as was seen in Australia and the United States, is unresolved. Once companies realised things hadn’t collapsed, the good ones repaid the money, but some are dragging their feet.

There is no way large companies with big balance sheets and reserves can pay big dividends (or any dividends) while also collecting the subsidy, especially at a time when wage incomes have fallen overall. Rightly, Rod Duke’s Briscoe Group repaid its subsidies last month, but only after a public outcry over his decision to pay himself an $20.3m dividend after earlier accepting $11.5m in wage subsidies.

Fulton Hogan is a major beneficiary of Government roading contracts and this will be the first question for the new Prime Minister and Deputy PM today: Will you continue to award contracts to a firm that is paying itself an $88m dividend after taking $33.3m of taxpayer money designed to prevent the firm collapsing?

Companies are effectively beneficiaries of a social contract: they benefit from the shared resources of a stable prosperous society and contribute their share to build that prosperity. This doesn’t pass the sniff test. Whoever is doing PR for Fulton Hogan needs to ensure those subsidies are repaid pronto. (By the way, the Herald article is paywalled. I’m a subscriber and it’s worth it, if only so this sort of reporting keeps being done and we can all keep Duncan in a job. :)

‘I know it’s bad, but I just can’t stop’

A conflicted view: Westpac NZ CEO David McLean told Tamsyn Parker that the latest housing boom was not healthy in the medium to long term and he seemed relaxed about the Reserve Bank reimposing LVR restrictions, which may be flagged as early as next Wednesday’s Monetary Policy Statement, and more likely at the bank’s Financial Stability Report on November 25. (NZ Herald-$$$)

"I think it is a bit of a sugar rush. I think it is not a bad thing at this time, when we are going through this Covid thing, because it does boost consumer confidence amongst people who own houses already.Short term, it is actually quite helpful because it does shore up confidence." David McLean

But he said house prices were out of whack in the medium to longer term.

"That is not healthy. That makes it very hard for people to get into houses. It increases inequality. The thing I worry about is, it means a lot of our capital is tied up in housing which is a deadweight asset whereas if people weren't investing in houses they might be investing in funds or equity markets where that money could get recycled into businesses who want capital for investment." David McLean

But he said now was not the right time to correct it.

McLean also told Rob Stock high housing prices were unhealthy, worsening inequality and starving the productive sector of capital. (Stuff)

“It’s something the Reserve Bank would be wrestling with.” David McLean

But just not now…

“There’s only one thing worse than rapidly-rising house prices, that’s rapidly-falling ones.” David McLean.

My reckons: McLean is right about the housing market being overvalued and that somehow a shift from housing into business needs to be engineered very, very slowly so as not to upset the apple cart (in particular the valuations underpinning the loans in his cart…)

He said two years ago he’d like to see zero house price growth for 20 or 30 years for incomes to gradually catch up. (Interest)

“(Those flat prices would “gradually ween New Zealanders off the conviction - which is entirely justified because it’s been reinforced by economic evidence over the last 50 years - that investing in the housing market carries by far the best risk/reward of any asset class.” McLean in 2018

Since then house prices have risen another 15% and are forecast to rise a further 16% over the next two years by Treasury.

It’s fair for McLean to bemoan the institutional incentives for property investment and lending, including the Basel banking capital rules favouring lending for homes, the large tax advantages (still) for investors relative to other assets, the lack of new housing supply, and the fastest population growth in the developed world in the last decade, thanks to migration of mostly temporary workers.

But what is he and other bank CEOs doing about it?

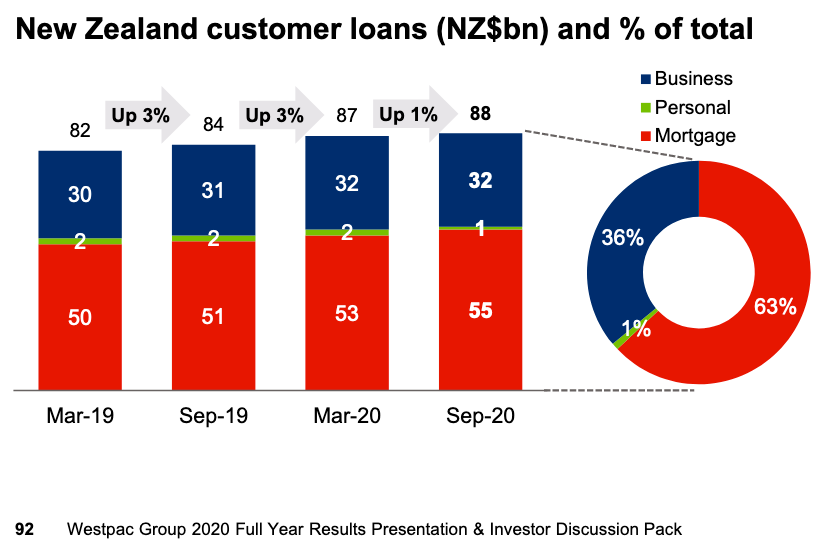

Westpac NZ’s September quarter results published on Tuesday showed Westpac grew mortgage lending by $4b or 8% over the last year to NZ$55b, while business lending rose 3% or $1b to $32b. That means the mortgage part of Westpac’s business here has risen from 60.7% to 63% of its business. Here’s the chart (page 92 of the September quarter result presentation pack) showing that.

If the big banks were really serious about bringing the housing market back down to earth, they should call on the Government and the wider business community to accept some form of wealth or capital gains taxes, and actively shift their own lending and activities towards business lending.

They would also look to reduce the leverage they themselves have pumped into housing values, which means putting aside more capital and paying themselves lower dividends from lower profits. The aggressive push-back last year from the banks, led by ANZ Chair John Key, against Adrian Orr’s drive for them to increase capital levels and therefore generate lower profitability, showed where the banks’ interests truly laid: with their Australian shareholders.

Since the first Covid-19 lockdown, New Zealand’s banks have increased total mortgage lending by $10b to $287b, reduced lending to businesses by $6b to $117b and reduced lending to farmers by $37m to $62.9b.

Since February, the banks have advanced $9.5b in new loans to landlords, $26.4b to non-first-home-buying home owners and $8.5b to first home buyers.

Orr has called on the banks to be more ‘courageous’ with their lending policies, but it seems they are doing exactly what the incentives and their shareholders are telling them to do, which is lend more to home owners with lots of equity because it’s easy, lower risk and more profitable.

Currently, the Reserve Bank has banned the big four banks from paying dividends to their Australian shareholders, to help them preserve capital. Orr cut them some slack in March and April by suspending the capital increase orders for a year and releasing the shackles of the high LVR restrictions for a year. He will likely have to reimpose LVR restrictions for landlords at least.

But when will everyone - bankers, home owners, landlords, politicians and shareholders - decide they really want to kick the habits of a lifetime? Labour’s actions in again ruling out a wealth or capital gains tax showed it could not do it, and its acquiescence to the Reserve Bank’s plan to print $150b to lower mortgage rates shows it really is not willing to stop pumping sugar out to home-owning voters.

There’s no point in hangwringing about how bad it is, when you can’t kick the habit.

Sign ‘o the times news links…

Bernie is right: With over 20,000 people on the national housing waiting list and an out of control housing market, the new government has to act, Monte Cecilia Housing Trust chief executive Bernie Smith says. (RNZ)

‘Go to the VAR now’: Calls are growing for an urgent review of New Zealand’s Managed Isolation and Quarantine system after a second worker at the Christchurch Sudima tested positive yesterday for Covid-19. Now Nick Wilson from Otago Uni is saying one is needed, joining

Wilson wants a more permanent. Ohakea-style separated facility where staff can be isolated with those in quarantine. (RNZ)

“We've had now six border failures since the start of August - and that includes the large Auckland August outbreak - so things are definitely not working properly. This is an area that needs an urgent review. It's not adequate that workers are being placed at risk. We've had a nurse infected, a maintenance worker, a port worker. These are system failures because we should be stopping all cases at the border.” Nick Wilson

Drivers vs pedestrians and cyclists: The NZ Herald’s Bernard Orsman reports Grey Lynn and Ponsonby residents are outraged the Auckland Transport has started ticketing residents who park in their driveways across footpaths and cycle-ways. AT has issued 13,531 tickets across the city for parking over driveways in the last two years.

My reckons: Councils are doing this sort of thing a lot more, partly because it rightly protects pedestrians, but also because it’s one way to raise money aside from rates. Growth councils are under enormous pressure from ratepayers on one side not to raise rates, and developers etc on the other to fund infrastructure for population growth. Parking tickets are a great way to square that circle. We’ll see a lot more of this stuff.

One of the great clashes of the next 50 years will be between car-driving home owners and renting pedestrians and cyclists over the use of public space like this. It’s another consequence of growing inequality that squashes solidarity and drives a ‘them’ vs ‘us’ approach. Again, it’s all about housing affordability and climate change action.

Coming up…

Today (NZ time) - US Presidential election results start coming through

Weds Nov 4 - Stats NZ scheduled to release labour market figures at 10.45 am showing unemployment rose to around 5.5% in the September quarter from 4% in the June quarter.

Thurs Nov 5 - PM Jacinda Ardern expected to deliver a luncheon speech to a business conference outlining her new Government’s agenda for “accelerating the recovery”.

Thurs Nov 5 - Ant Financial shares start trading in Hong Kong

Friday Nov 6 - Official final NZ election and referendum results announced after counting of special votes.

Friday Nov 6 - Ministers to be sworn in at Government House.

Friday Nov 6 - New Cabinet to hold first meeting in 2020-23 term.

Monday Nov 9 - Finance Minister Grant Robertson to meet Reserve Bank Governor Adrian Orr for a regular briefing (bought forward a day or two) to talk about monetary policy.

Weds Nov 11 - Reserve Bank quarterly Monetary Policy Statement (MPS) and news conference at 2pm. Details expected of the Reserve Bank’s $30-50b Funding for Lending Programme (FLP) of Reserve Bank money printing and lending to banks at or around the Official Cash Rate (currently 0.25% and expected to fall to minus 0.5% next year).

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds Nov 25 - Reserve Bank six monthly Financial Stability Report (FSR) scheduled for release. Central Bank expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Ngā Mihi

Bernard

PS: And remember Vote Team Kaka! #skraarkflutetseep

Also. Hope you enjoyed the pic above from my former Newsroom colleague Mark Daalder, who has a wonderful Instagram channel chock full of native birds. Send me your Kākā pics if you have them for wider appreciation.