Dawn chorus Thursday Oct 29

Markets fall 3-4% on new European lockdowns and record US Covid-19 cases; Tribunal finds Air NZ must refund fare cancelled during Covid-19; Reti for deputy National leader and Bridges for finance

Markets slump on new European lockdowns and US spikes

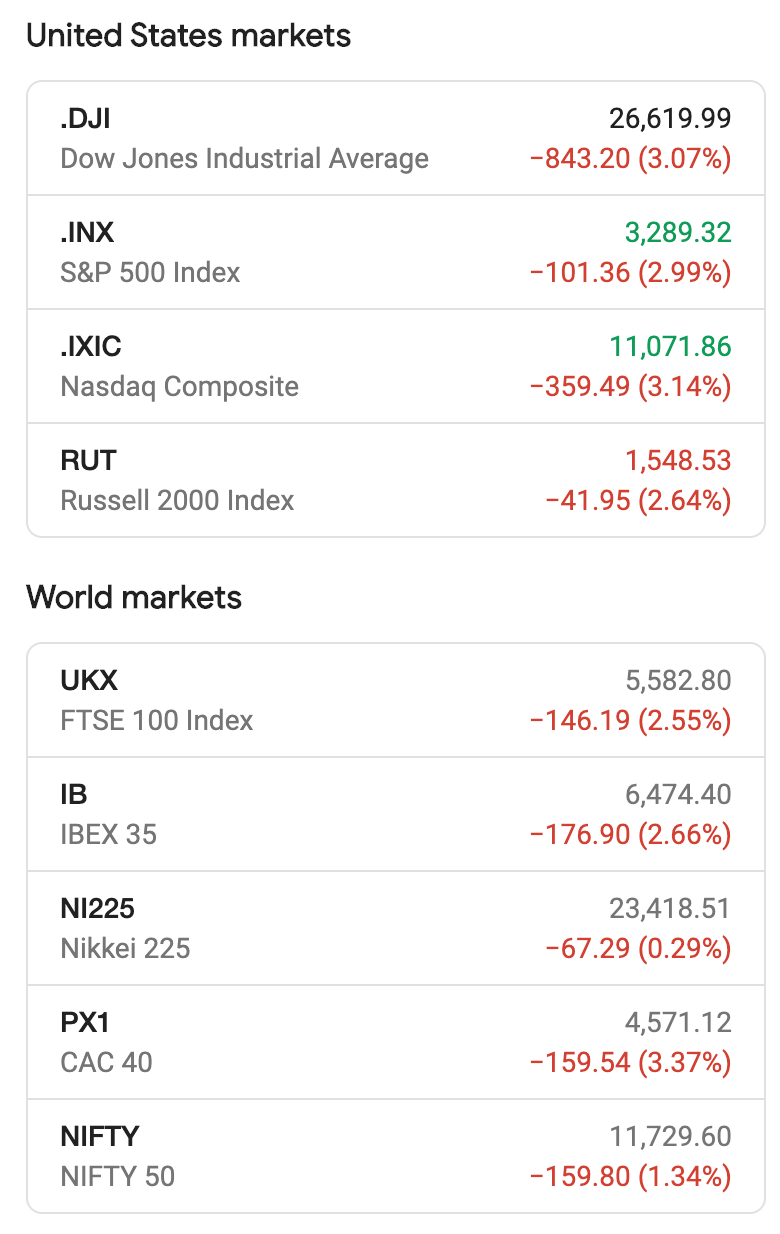

European and US stock markets fell 3-4% this morning as fresh waves of Covid-19 infections forced authorities to tighten social distancing controls across continental Europe. Germany decided to shut bars and restaurants for a month and France is also about to launch new controls. The oil price also fell 5% this morning.

The S&P 500 was down nearly 3% at 8am as investors worried about further slowdowns in the global economy happening at the same time that fiscal stimulus is drying up as politicians talk about debt reduction.

But not everyone is too worried, especially those depending on central banks to take up the burden of stimulus with yet more money printing to pump up the value of existing assets.

“We believe investors should seek to put further COVID-19-related restrictions in perspective and see market setbacks as an opportunity to build exposure in the winners from the next leg up,” Mark Haefele, chief investment officer for global wealth management at UBS, via CNBC

Air NZ’s awkward decision

Air New Zealand faces the potential for a flood of claims from customers who lost their money on flights cancelled during the Covid19 lockdowns after a Disputes Tribunal ruling on one claim that the 51% state-owned airline had to pay a $1,699 refund.

A Northland customer successfully took the airline to the tribunal earlier this month and it ruled the airline should have repaid the fare, rather than simply cancel and offer a credit. (NZ Herald)

"The flights could have proceeded. The reason why they did not proceed is that Air New Zealand made significant operational changes after March 2020 to respond to the drastic drop in demand for flights.

"Those changes were essential for the financial survival of Air New Zealand, and the direct cause of the drop was the Covid-19 pandemic.

"However, it would not be accurate to state that those flights were cancelled due to circumstances beyond Air New Zealand's control. They were cancelled because of operational decisions made by Air New Zealand in response to market conditions." Disputes Tribunal referee Nicholas Blake

Heads up: Anyone with a flight cancelled by Air NZ and not refunded, which included most domestic fares. Air NZ’s CEO Greg Foran, lawyers, executives shareholders and bankers. itself. Jetstar. Treasury officials and Finance Minister Grant Robertson, who will have to negotiate how to replace the high-interest $900m convertible loan that Air NZ is now chewing through. If the Government converted it to shares, the Crown’s stake would rise dramatically. Air NZ is also planning an equity capital raise for early next year.

Questions therefore: How much would Air NZ owe customers if it was deemed to have to repay all those cancelled flights? How much were customers ‘used’ as cheap financiers by turning those flights into credits? How many have used those credits? How many just ‘gave up’ and assumed the money was lost? Should the Government take advantage of Air NZ’s parlous state to lift its stake, as a more ruthless private shareholder might do? Where is the Commerce Commission on all of this?

Apropo of not that much in politics

National’s West Coast list MP Maureen Pugh looks set to have to go back home after only a short stint as MP for a third time with National likely to lose one of its list spots after the counting of specials. Final results are due here on the Electoral Commission website next Friday. National has lost one seat after the counting of the specials every election since 2005. Pugh had to leave after short stints in 2014 and 2017, and was only made ‘permanent’ after Bill English retired as a list MP in 2018. (NZ Herald)

Questions therefore: Will National list higher-ups Gerry Brownlee and Nick Smith step aside from their list seats, having lost their electorates? Both have indicated since the election they plan to stay, but Brownlee potentially faces a contested vote for National’s Deputy Leader spot next Thursday. If Brownlee goes, Pugh could stay, although she also may miss out again if Shane Reti, at 5 on the National list, loses his Whangārei seat, which he won by just 164 votes on the night.

Claire Trevett reports there is talk of replacing Brownlee with Reti and putting Simon Bridges into the Finance role for National in place of Paul Goldsmith.

The Māori Party voted to replace John Tamihere with Rawiri Waititi, pending the results of special vote counting in the Waiariki electorate, where Waititi won on election night over Labour’s Tamati Coffey. (RNZ)

Other bits and bobs of news overnight

Auckland Mayor Phil Goff has called all four America’s Cup teams into a crisis meeting this morning to resolve the location of race courses after last week's decision to drop the two courses with the best views for spectators. (TVNZ)

Moving ahead of the Government, Ports of Auckland is demanding this morning that foreign crew flying in to work on international ships must go into managed isolation for two weeks. (RNZ)

Coming up…

Today – ANZ Group annual results. It issued a profit warning on Tuesday night.

Friday - Electoral Commission to release preliminary results of referendums at 2pm.

Friday - Discussions between Labour and Greens due to be completed. If some form of agreement is proposed, 75% of Green members would need to approve it in group teleconference.

Friday – The Reserve Bank is scheduled to release overall bank lending figures for September at 3pm.

Friday – Port of Tauranga and Tourism Holding AGMs due.

November 3 - Reserve Bank of Australia expected to ease monetary policy

November 3 - US Presidential elections (Nov 4 NZ Time)

November 6 - Official final NZ election and referendum results announced after counting of special votes.

November 11 - Reserve Bank quarterly Monetary Policy Statement (MPS) and news conference at 2pm

November 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

November 25 - Reserve Bank six monthly Financial Stability Report (FSR) scheduled for release

Ngā Mihi

Bernard

PS: Today’s kākā pic of the day is courtesy of Marc Daalder via Flikr.