Dawn chorus: RIP RBNZ independence

The death of central bank independence is inevitable and justifiable in an era when interest rates are low forever and asset price inflation is as explosive as the global money supply.

TLDR: Put simply, the sort of true independence enjoyed by the Reserve Bank of New Zealand as it pioneered inflation targeting for the last 30 years is now over, and that’s a good thing.

The death of set-and-forget central banking is inevitable in a world where explosive growth in money supply from unfettered central bank money printing to buy Government bonds is turbo-charging asset values, widening inequality and creating moral hazards that will create decades to unwind without reform. The assumptions about ‘normal’ interest rates and inflation rates have been destroyed through a decade of very-low inflation of goods and services prices and the grind lower in interest rates to 0% and beyond.

The longer interest rates stay at or near 0% and the bigger the piles of cash grow in bank accounts and in asset prices, the bigger the problem gets. The only tool central banks seem comfortable using and can use without any financial or political limits is to print money and hand it over to already rich, old and risk-averse asset owners. It’s not working economically and it’s not sustainable politically.

Renting voters and more socially conscious asset owners will eventually demand their politicians retake control of central banks and the leverage being pumped into assets by private banks. That’s what we’re seeing increasingly overseas, and it’s happening effectively, and rightly, in my view, here too.

A reflexive hankering for independence

New Zealand’s financial and economic community harbour a lingering and I think unplaced pride in the Reserve Bank’s famed status as the founder and pioneer of independent and flexible inflation-targeting central banks.

The trouble is that era made sense when inflation was a dragon that needed slaying and there was room to use an official cash rate to ease or tighten monetary policy. When the OCR gets near the lower bound of 0%, as it has been for almost 10 years since it went below 2.5%, then central banks have to think about then start doing ‘unconventional’ things, such as ‘macro-prudential’ controls (restricting bank lending) and ‘Quantitative Easing’ (buying Government bonds and other assets).

It started in New Zealand’s case with then-Governor Graeme Wheeler introducing fairly blunt Loan to Value Ratio (LVR) controls in 2013. He had to get permission from the Government to do it. The-then Key-English Government felt blindsided at the time, but its ingrained preference for independence at first blush meant it reluctantly gave permission for the LVR rules. It wasn’t so charitable when the Reserve Bank asked a few years later for permission to use Debt to Income multiple controls. It blocked that request.

It hasn’t been independent for years

There’s been quite a bit of chatter in recent days about last week’s announcements from the bank and the Government about the Government becoming involved in decisions about macro-prudential controls, and the bank’s operation of monetary policy more generally.

This follows the proposals for a deposit insurance scheme and the kerfuffle last year around Finance Minister Grant Robertson’s request for the bank to take housing affordability into account.

This shouldn’t surprise anyone, or be a concern. The Reserve Bank has to ask permission anyway to impose lending limits on banks and the Government is well within its legal powers to be consulted once the Reserve Bank starts doing non-standard stuff, such as doing Quantitative Easing and imposing lending limits.

The Reserve Bank asked permission in March last year to start its Large Scale Asset Programme, in part because it needed an indemnity assurance from the Government over potential paper losses. It asked again and got permission when it increased QE from $30b to $100b. It has also asked for permission for a DTI tool, which the Government is understandably reluctant to grant without some clever targeting to avoid the collateral damage for first home buyers.

The solution is to get interest rates up

The assumption for those thinking the world has changed little in the last ten years is that inflation will soon resume its upward march and central banks will have to lift interest rates up to more ‘normal’ levels that stop the explosion of asset prices and give themselves the flexibility again to dial up and dial down monetary stimulus. At the moment the dial on the economic oven seems stuck permanently at zero and central banks are having to start fires by directing flame throwers inside the oven.

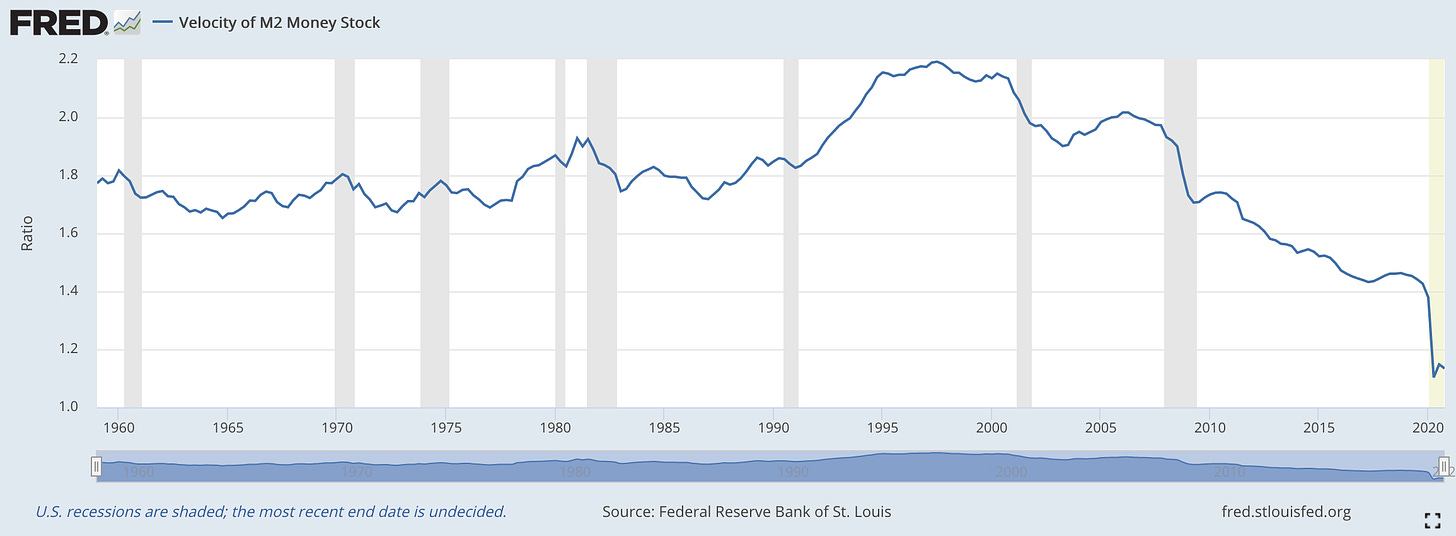

The trouble is the evidence is growing that inflation and interest rates are stuck down here for much longer and at much lower levels than seems ‘natural’. In my view, that’s because central banks and economists have yet to understand the deeply deflationary nature of the globalisation of services being driven by the app economy and the way most of the bond buying is simply building up piles of cash in vaults, paintings and bitcoin. Rather than stimulating spending and investment that would push up goods and services prices and wages, central banks are just pumping up asset prices that worsen inequality. The money is not circulating.

Astonishing amounts of money printing

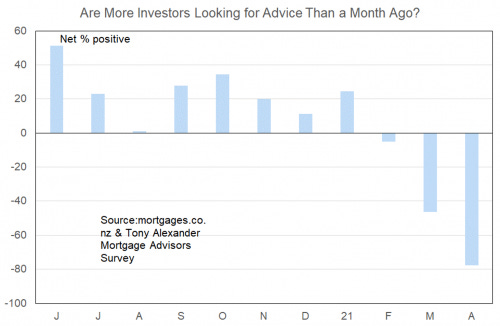

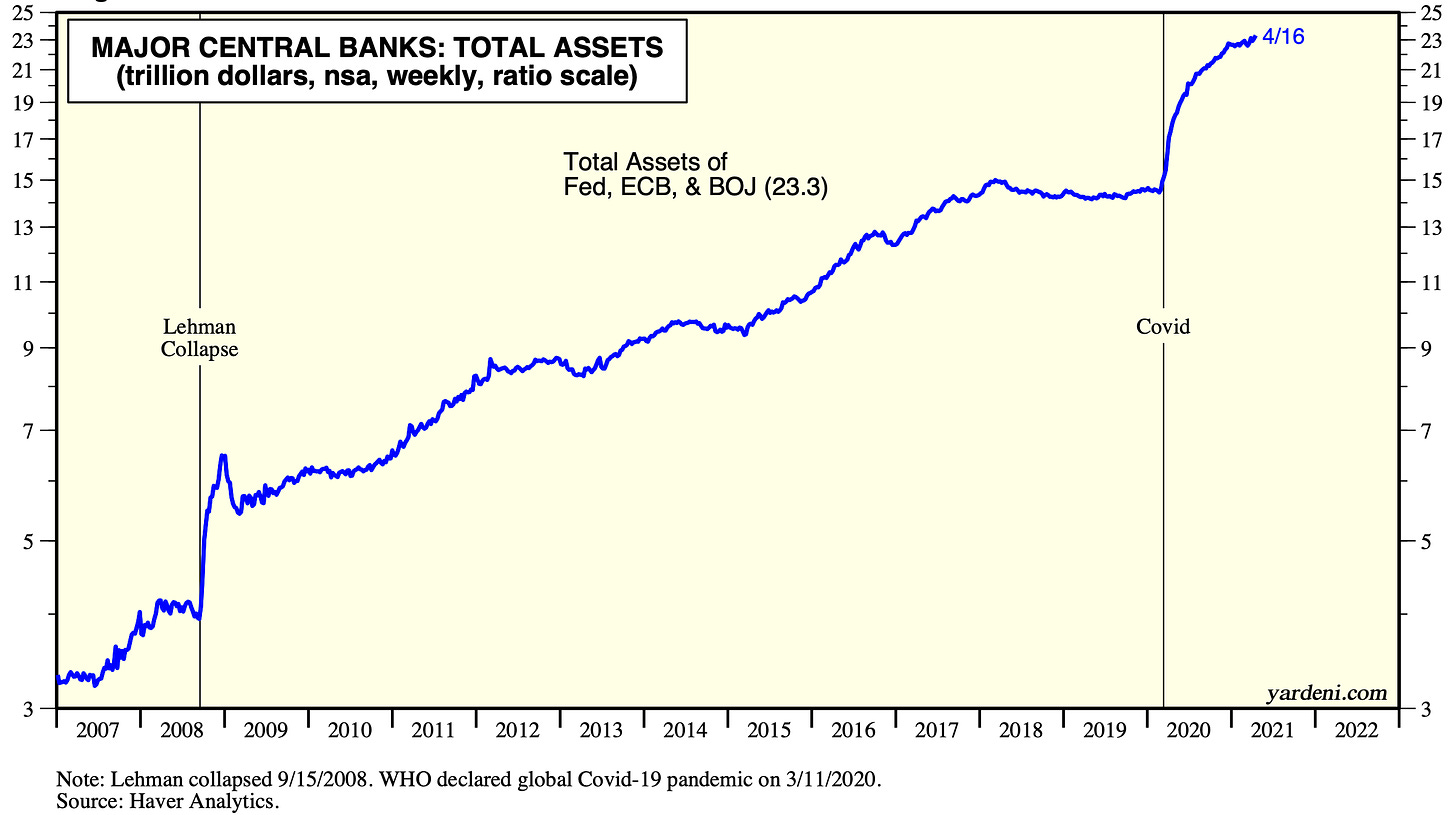

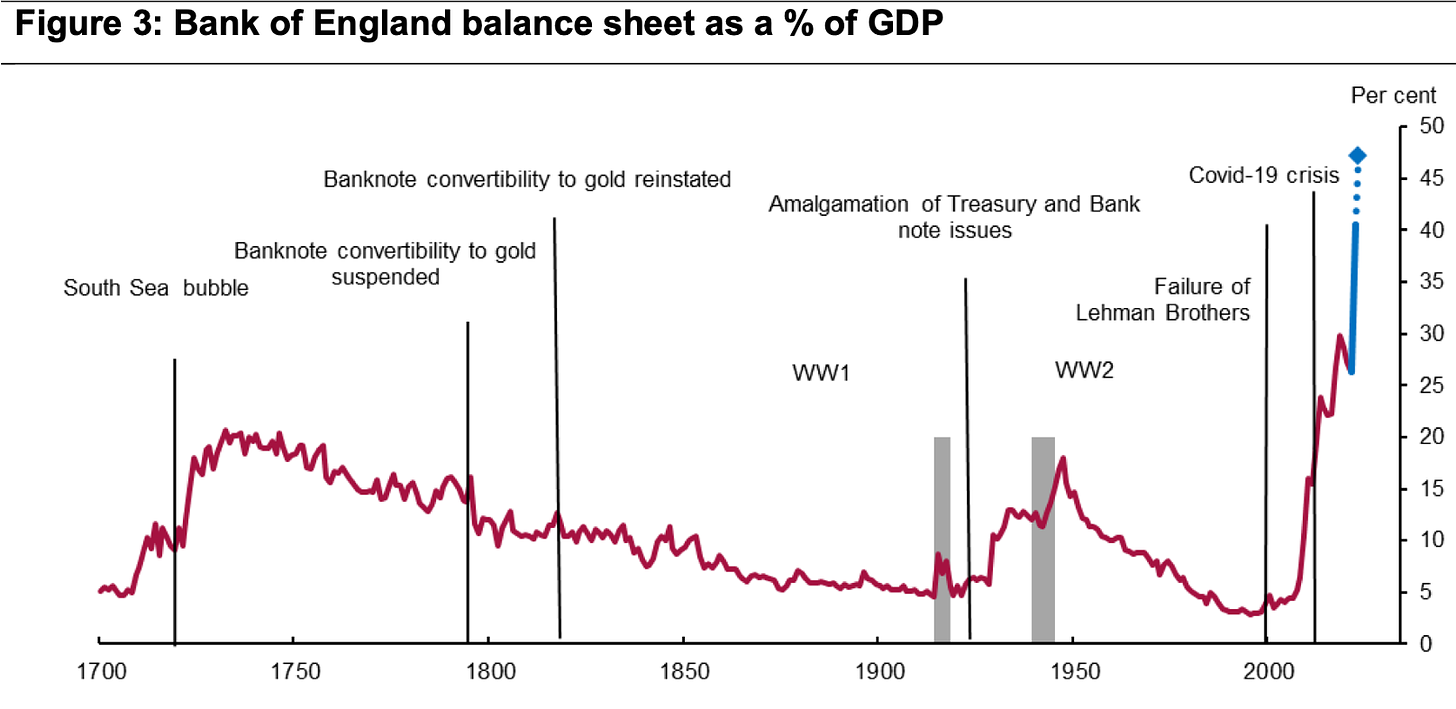

Here’s a collection of charts to illustrate the point. The first shows how the big four central banks (US Fed/ECB/BoJ and PBOC) have created US$19t (about 100% of US GDP) worth of money to increase their asset piles since the Global Financial Crisis through Quantitative easing programmes. The one below that shows the scale of the money printing by the Bank of England over its long history. The Covid printing is multiples larger than it did during the last two world wars.

But the money’s not circulating

This Federal Reserve chart shows the pace of money circulation in the US economy and how it has slowed dramatically over the last 20 years as older and risk-averse investors and savers without the need to spend it or invest it put their money back in bank accounts or Government bonds.

The money is being stashed away

Asset prices are rising as the money handed over to savers by central banks for their bonds is put into other stores of value, rather than invested or spent in the real economy on goods, services or wages.

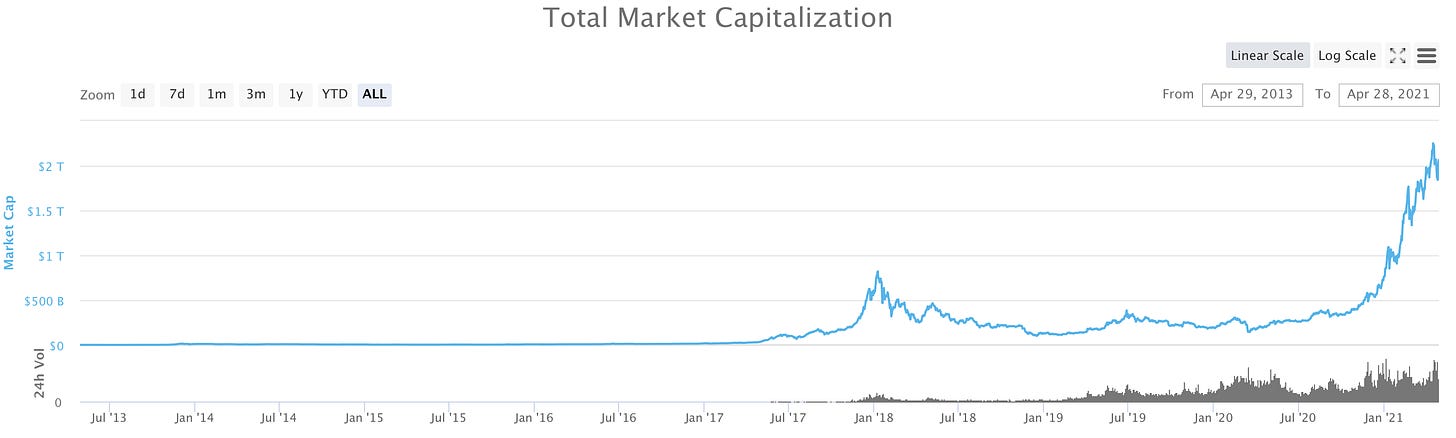

Here’s a chart of the market capitalisation of bitcoin and the other cryptocurrencies as an example. It has risen virtually nothing to US$2t in five years.

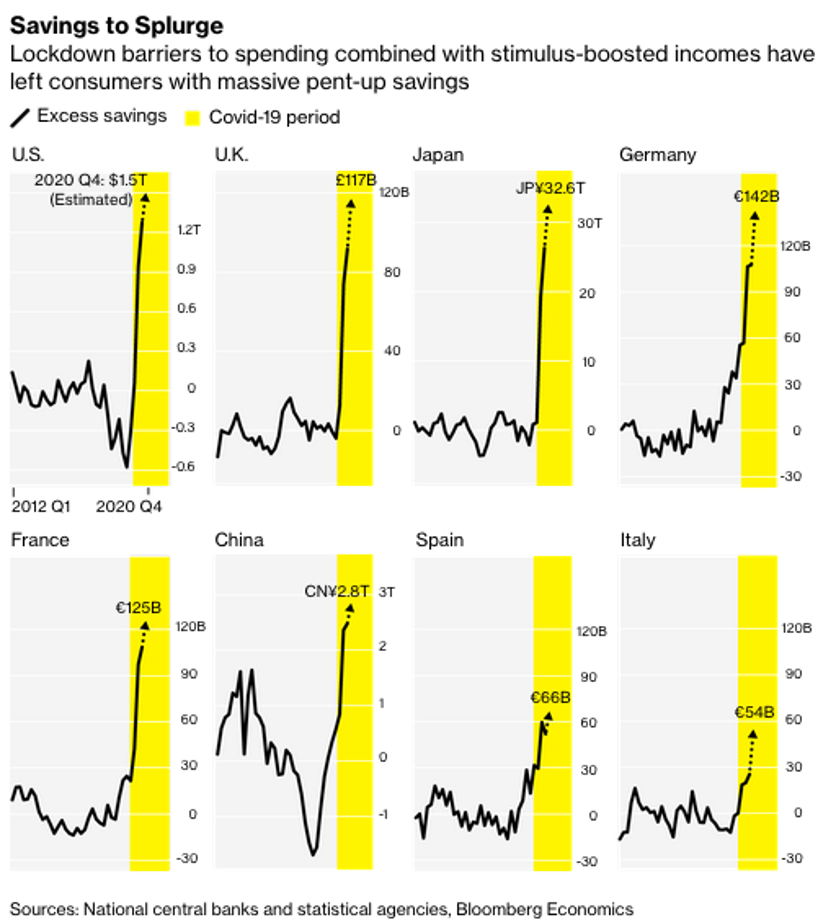

Here’s a chart showing how cash has grown in bank savings accounts as well.

Ensure the printed money is spent and invested

Eventually this is all politically and economically sustainable when poor renters who vote realise their Governments and central banks are enabling massive increases in wealth for the already wealthy.

The sensible thing would be for central banks to engineer an increase in inflation that allows interest rates to get back to more normal levels. That would involve printing money and making sure it was distributed to people who need it and want to spend it or invest it, rather than save it.

The best vehicle to do that fairly and sensibly is the Government, either through direct grants to everyone, which is what has been done in America, and direct investment in infrastructure, funded through so-called ‘monetisation’ of defict spending, or at least direct purchases of bonds at fixed 0% interest rates, rather than through a secondary market.

Most in New Zealand think we can get buy for a few years and then go back to normal. Central bankers and politicians realise that’s unsustainable, and that’s why Grant Robertson and Governor Adrian Orr are now talking regularly. That’s how it should be.

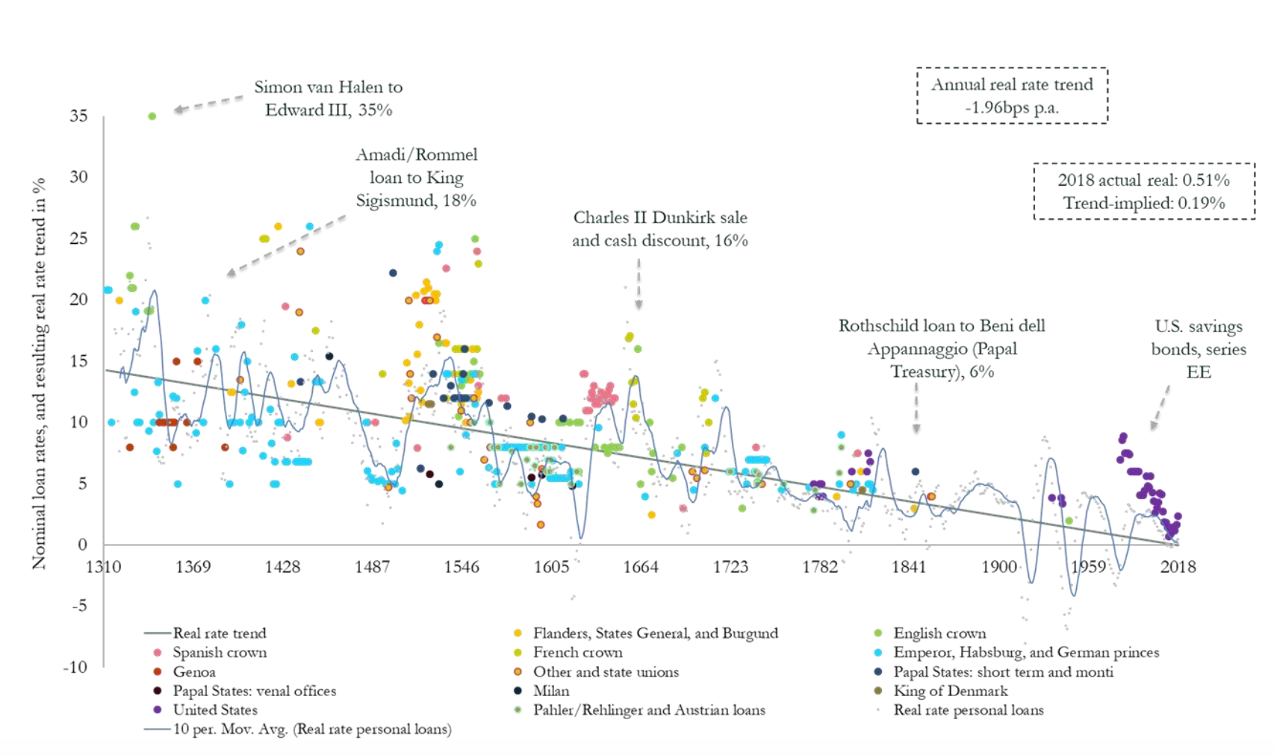

To emphasise the point about low interest rates for longer, here’s the long term trend for interest rates, as measured by the Bank of England.

Briefly in our political economy

In the global political economy

Sign o’ the times news

Notable other views

Chart of the day

Some fun things

The sun rose in Wellington today at 7:04 am and will rise tomorrow at 7:05 am. Many thanks to Nic and Leonie Wise for today’s amazing pic.

From an emailer: "This has an interesting perspective on Grant Robertson’s move to have more control of the reserve bank monetary policy....,he’s in favour of it."