Dawn chorus: NZ housing rocket ship

Corelogic reports 7.1% NZ house value inflation in last three months and 2.1% in Jan; Christchurch surges in 3.1% in Jan; Reserve Bank of Australia extends money printing a further A$100b

TLDR: If this was an email on #WallStBets, I would headline it with at least three rocket ship emojis and a couple of diamond hands, given that’s what New Zealanders think about the housing market — it’s going to the moon thanks to massive central bank money printing and political guarantees of support for asset prices, and homeowners are all holding on for dear life. Renters are pained spectators.

Meanwhile, rents keep rising here, wealth inequality worsens and fiscal stimulus is being withdrawn as politicians globally worry that Government spending might push up interest rates and unravel the whole shebang for asset owners, who vote more than renters. For example, a sleepout in Carterton without plumbing is being advertised this morning for $400/week and a two-bedroom toilet-less flat in Wellington was listed for $495/week and compared to the dungeon from the movie ‘Parasite’.

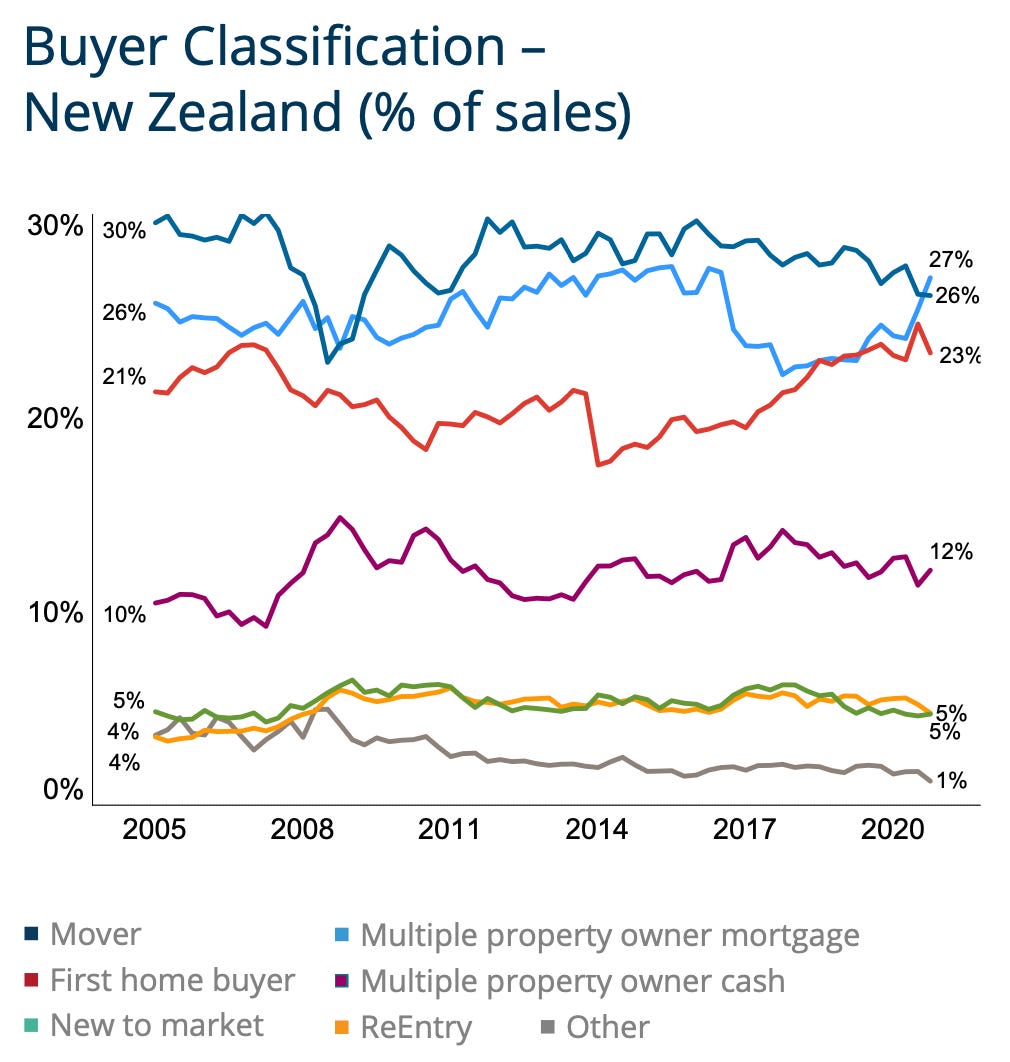

CoreLogic reported last night that annual house price inflation was firmly in the double digits in January across the nation and over 20% in many provincial cities, thanks to buying from landlords, who are now the biggest buyers, falling mortgage rates and the Government’s implied guarantee for the market.

Meanwhile, the money printing and central bank support for asset prices globally in the absence of sufficient fiscal policy support from Governments was emphasised in Australia last night. The Reserve Bank of Australia announced a further A$100b of ‘Quantitative Easing’ just as PM Scott Morrison signalled a fiscal tightening.

Overseas overnight, Gamestop shares plunged 50%, silver prices slumped, Russia’s ‘Sputnik’ vaccine was judged 91.6% effective, Uber bought booze delivery service Drizly for US$1.1b and the Eurozone economy fell back into a double-dip contraction.

In our political economy

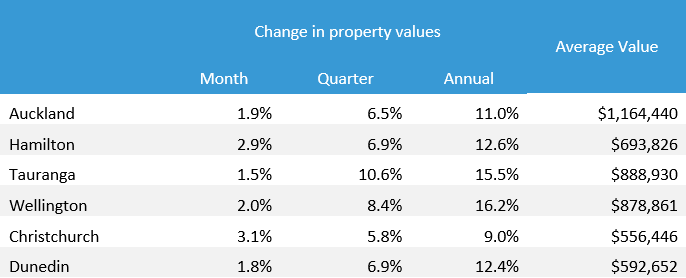

CoreLogic reported house values rose 2.1% nationally in January and were up 7.1% in the last three months. Inflation across the nation rose 12.8% for the year, which was the highest level since March 2017. Annual inflation rates rose above 20% in Gisborne, Whanganui, Palmerston North, the Kapiti Coast, Rotorua and Invercargill.

CoreLogic’s Head of Research, Nick Goodall, noted a particular surge in Christchurch in January and that demand nation-wide for mortgages in January was already unseasonally above levels in December as landlords increased their share of purchases to 27%, higher than other categories of buyers.

“The outlook is for further growth, assisted by political commentary regarding the need to protect property wealth,” Goodall wrote.

“Nationwide demand for mortgages through January has already risen above the levels seen at the end of 2020 as buyers take advantage of low interest rates and act with urgency in the competitive market.”

In the global economy

Signs o’ the times news

Longer reads and listens worth your time

Threads worth unravelling

Have a great day

Kia kite ano

Bernard

PS: Thanks again to Marc for another cracking pic from Zealandia.