Dawn chorus: More money printing

RBNZ expected to detail $30-50b of new money printing in FLP for banks; Key question is whether or not strings are attached, and whether LVRs may be reintroduced; I argue for Helicopter Money instead

Morena: The Reserve Bank will release its Monetary Policy Statement at 2pm today and is expected to announce a Funding for Lending Programme (FLP) of near-zero-percent lending to banks that could be worth $30b to $50b. That would bring the total money printing to up to $150b over the next two years and potentially add another impetus to house prices.

The key question is whether the Reserve Bank attaches strings to ensure it is lent to businesses, rather than rental property investors, and whether the central bank flags the reintroduction of LVRs for landlords. I’ll be at the news conference to ask questions and welcome your suggestions. I’ll also do a ‘First scratch’ email soon after. I’d welcome your comments in that.

News breaking here this morning

"Moving income from being earned personally to being earned through an alternative vehicle is an option for taxpayers to consider. The 11 per cent difference between the top personal tax rate and the 28 per cent company tax rate may be irresistible to some high earners." Deloitte tax partner Robyn Walker

Previewing news due later today

In the global political economy

Chart of the night

Some useful longer local reads

Signs ‘o the times links

Aotearoa today: As a former director and co-founder and (still) shareholder, I’m proud this was published on Newsroom. It is a detailed first person account of life in and around the kiwifruit packhouses of Ōpōtiki.

‘Mum says working in the packing house is slavery. "Not just the Coconuts," she says, "but white slavery and the rest of us. We are all slaves." The Tongan and Sāmoan governments have contracts with the New Zealand government to bring workers in seasonally, and the kiwifruit workers think the Tongan packers have it worst of all. Mum’s Tongan friends have a contract with their government — their king and the royal family. They are hedged by restrictions: the furthest they are allowed to travel is Whakatāne, an hour’s drive away at most, and even on their days off they need permission to go.’ Catarina de Peters Leitãoe

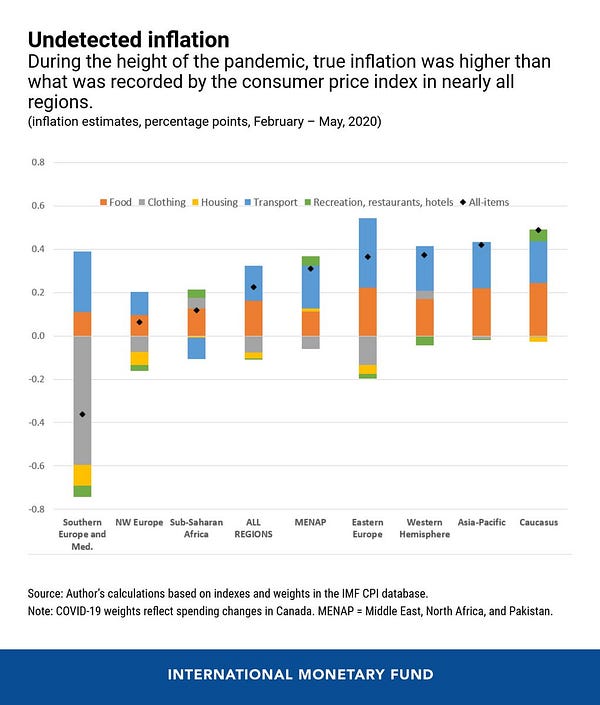

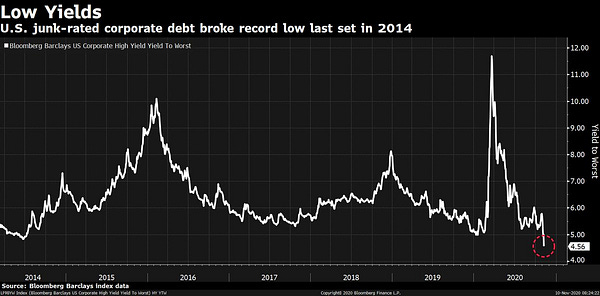

How does this make sense? US$27 trillion of money printing and bond buying by central banks over the last 13 years.

Useful reports

The Auckland study: Here’s the latest report from the Auckland Uni longitudinal study of 8,000 babies born in Auckland and the Waikato in 2008/09. They’re now eight and the report shows nearly 40 percent are living in cold, mouldy and damp homes.

About a third are obese. About 20 percent of the families surveyed did not have enough money to eat properly. Nearly 15 percent of the eight year olds had already moved school twice, largely because of having to move from one rental property to the next.

Some fun things

Coming up…

Today - Judith Collins is expected to name a new shadow cabinet, including changing out Finance spokesperson Paul Goldsmith, possibly for Simon Bridges and/or Andrew Bayly. (Stuff)

Today at 9am - Contact Energy AGM

Today at 9am - Reserve Bank quarterly Monetary Policy Statement (MPS) and news conference at 2pm. Details expected of the Reserve Bank’s $30-50b Funding for Lending Programme (FLP) of Reserve Bank money printing and lending to banks at or around the Official Cash Rate (currently 0.25% and expected to fall to minus 0.5% next year).

Thurs Nov 12 at 10.45 am - Stats NZ to publish travel and migration data for September.

Thurs Nov 12 around 8.30 am - Sanford to publish full annual results to NZX, but it gave an early indication on Nov 5 of a 46% fall due to Covid-19.

Thurs Nov 12: Epidemiologist David Skegg to give speech on Covid-19 at Old Government Buildings, Lecture Theatre 1 in Wellington

Fri Nov 13 at 10 am - Business NZ-BNZ Purchasing Managers Index for October

Fri Nov 13 at 10.45 am - Stats NZ to publish rental price indexes for October.

Mon Nov 16 at 10.45 am - Stats NZ to publish wellbeing statistics for September quarter.

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds Nov 25 2pm - Reserve Bank to publish six monthly Financial Stability Report (FSR) . Expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Weds Nov 25 - Opening of Parliament for 53rd term, including swearing in of new MPs

Thurs Nov 26 - Speech from the throne in Parliament outlining Government’s agenda

Ngā Mihi

Bernard

Banks struggle to channel this QE to productive activities (SME's) because of low risk appetite and being poorly organised towards this activity. Aussie has seen massive growth in non-bank or specialised banks like JUDO to take on the specialised activity of productive lending based on the activity risk. This has not happened here in NZ because there is almost no non-bank credit lines to tap into for non-banks to target SME's. See the link, this is what the RBNZ should look at

https://www.aofm.gov.au/sfsf

The Interest free loans form Govt here are good, but there needs to be a more sophisticated distribution capability to annalyse and distribute larger sums to meaningful businesses that can thrive in next 24 months. Not constrained by the limitations of the SME's assets as security (as in the bank model)

David writes: It would be great if there was a place to go to get reliable answers to questions such as-

How does NZ housing affordability compare to other cities / countries ??

Can you quantify the difference that a CGT would make in housing prices in NZ? By how much more expensive are NZ houses compared to Aust houses because we don’t have a CGT?

What is happening with immigration? Shamubeel Eaqub said the other day that there was no longer a net migration gain but one argument for the housing spike is that cashed up returning Kiwis are buying ?

I guess both can be true

How do NZ electricity prices compare to prices elsewhere in the world? Given our grandparents paid for the hydro they should be cheaper than most

How do NZ wages compare to other places in the world? Used to be shit compared to Australia which is why so many working people, me included, have lived in Australia. Kiwis left for better pay in Australia, NZ kept immigration going so as not to turn the lights off.

How much do/did Kiwis spend annually on overseas travel? How much do/did foreign tourists spend annually in NZ?

Cost benefit analysis for Tiwai Point not producing energy for aluminium production – what if we had more electric cars using the energy and less oil imports? Cost to get the power to the North Island

Basic information about Money Printing, Central Banks & MMT. Public versus private debt, Debt to GDP ratios etc.

Taxing the FANGS

Solutions for the supply of housing in NZ

The affect of asset price inflation on housing costs for renters.

Welcome any suggestions from readers. Cheers Bernard