Dawn chorus: Monetary conditions tighten

RBNZ sits still with OCR, LSAP and FLP, giving a tacit green light to further rises in wholesale interest rates and the currency; NZ$ rises to near-four-year high of 74 USc this morning

TLDR: The Reserve Bank left its own monetary policy settings unchanged yesterday, but effectively gave tacit approval to higher market interest rates and a stronger currency by doing nothing.

Governor Adrian Orr said the Reserve Bank was comfortable with where monetary conditions were now, giving the green light for overseas traders to push the NZ dollar up to 74 USc this morning, its highest level since July 2017.

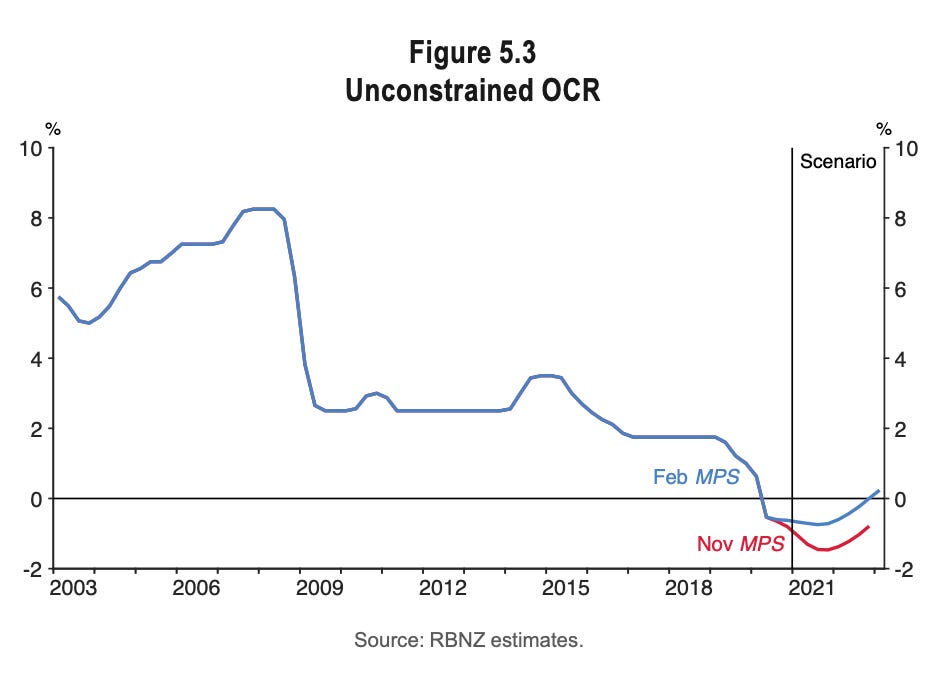

Most observers considered the Reserve Bank’s MPS stance and comments as confirming a dovish and stimulatory stance, but its own forecasts show it expects its ‘unconstrained’ measure of the OCR, which wraps in the effects of its cheap lending to banks and bond buying, as being 40-80 basis points higher in the next couple of years than it saw in November.

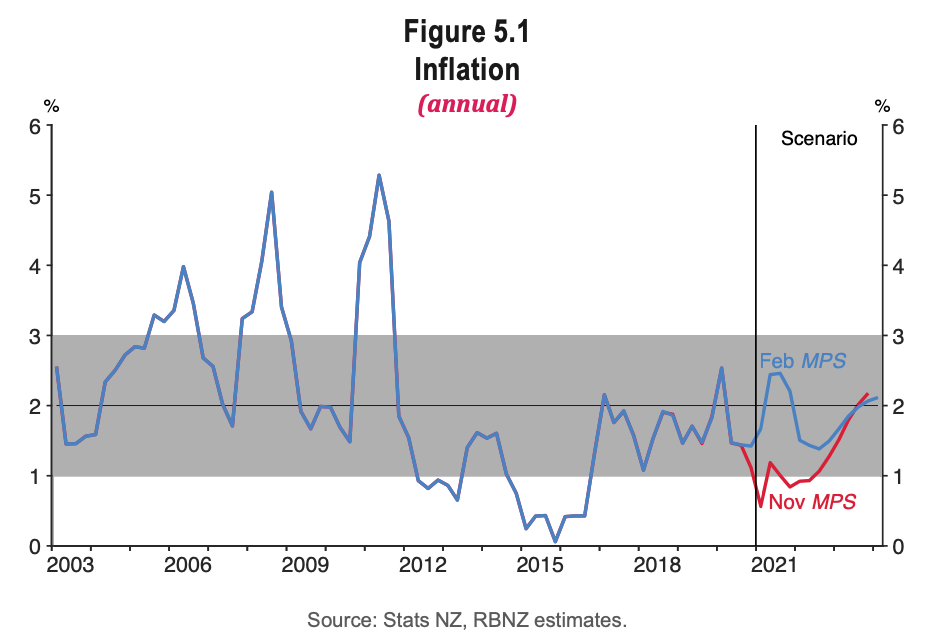

The Reserve Bank’s forecast for inflation only barely gets above 2% by the end of the forecast period, which means it isn’t pursuing as aggressive a pro-growth stance as the US Federal Reserve, Reserve Bank of Australia and European Central Bank, who want to push inflation clearly above two percent to reach ‘exit velocity’ and be sure average inflation will be two percent over the long run, given it has been below two percent for over a decade. Orr’s decision not to push back against the sharp rise in 10 year bond yields and the currency in in the last fortnight showed that he was less keen to push inflation as sharply higher.

There’s a tougher standoff going on in the US bond markets, where markets are pushing up long term interest rates, and the Fed is trying to talk them down. Long-time observers of these sorts of ‘taper tantrums’ and bond market revolts know it’s dangerous to fight the Fed.

The US Federal Reserve Chair Jerome Powell did his best this morning to hose down that revolt, saying the world’s most powerful central bank would keep printing US$120b a month until it had successfully pushed inflation well above 2 percent. US stock markets recovered earlier losses on reassurance the ‘Powell Put’ was still in place. He said he wanted to “see actual data” showing any inflation breakout and the Fed’s quantitative easing hose would keep pumping until “substantial further progress” had been made.

Overseas, overnight, there was more good vaccine news. The FDA declared Johnson and Johnson’s Covid-19 vaccine was also safe and effective, paving the way for four million doses to be distributed in America from next week.

Thanks to all those who dialled/zoomed in to our ‘Hoon’ on the demographics of housing demand with the NZ Inititive’s Leonard Hong. Here’s the recorded version.

In our political economy

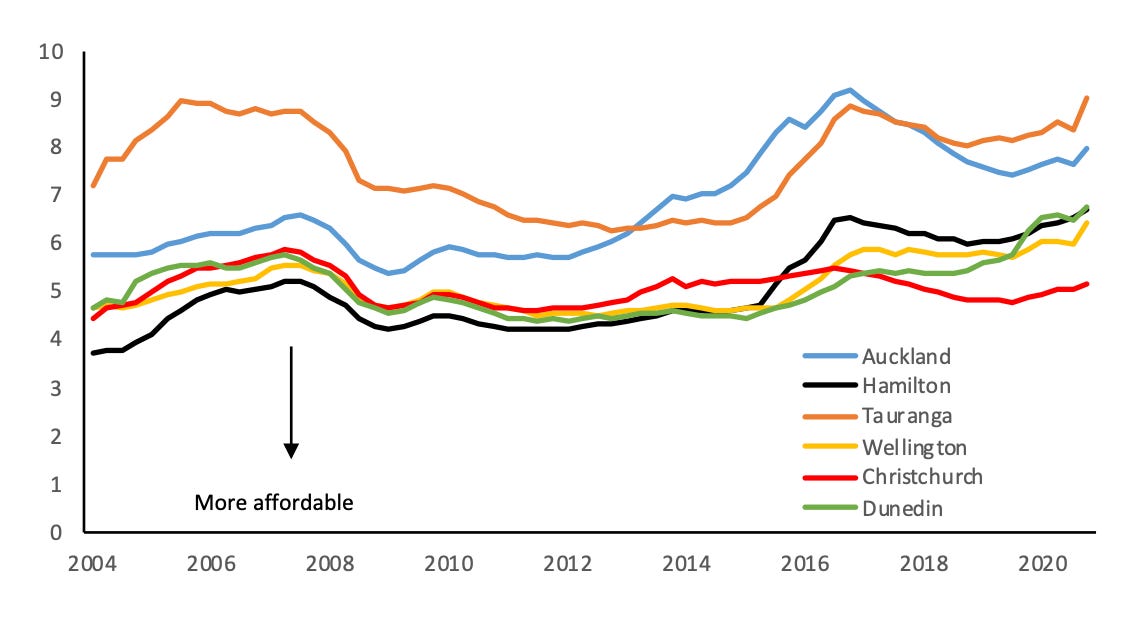

Worst housing affordability ever: CoreLogic reported housing affordability returned to its 2016 worst levels in the December quarter of 2020, with some areas hitting their record worst levels. The nationwide measure of house value to income ratio rose to 6.8 from 6.5 in the September quarter (see chart of measures for cities below). It now takes an average 9.0 years to save a deposit, just below the 2016 record high of 9.1 years.

“The net result is that housing affordability has begun to deteriorate again on each of our four measures, and the growing ‘divide’ between the wealth of existing homeowners and those that are struggling to get their first home has quickly become a very hot political topic,” CoreLogic Senior Property Economist Kelvin Davidson said.

In the global political economy

Sign of the times news

Notable other views

Ka kite anō

Bernard

PPS Some fun things