TLDR & TLDL: Interest rates look set to stay low for even longer globally after very weak US jobs figures over the weekend quashed talk of an early end to US money printing. The Reserve Bank’s decision on Friday to propose another tightening of LVR rules from October 1 also took some heat out of calls for rate hikes here.

Meanwhile, Cabinet will decide today whether to lower the rest of New Zealand from level three restrictions to level two-point-something after lower Covid case numbers in Auckland and none infectious in the community elsewhere. That could include indoor mask wearing and keeping bars, gyms and churches closed.

Coming up: NZ Covid case numbers due at 1pm; Fresh NSW Covid modelling due at 1pm NZT; PM to reveal Cabinet decision on level changes at 4pm presser.

News this morning

In Covid news:

There were 20 new cases in NZ on each of Saturday and Sunday, reassuring epidemiologists that the level four lockdown in Auckland is working (MoH),

Cabinet will decide this afternoon how much more freedom people outside Auckland will get, including whether a tougher level ‘2.5’ is needed,

Otago University’s epidemiologists said over the weekend level 2.5 should include mask-wearing indoors, limiting events to 25 indoor and 50 outdoor, and keeping closed all high-risk venues such as bars, gyms and churches.

Almost half a million extra Pfizer doses were flown from London to Sydney last night. Australia did a deal with the UK late on Friday to be sent 4m doses.

Britain has millions of spare doses due to expire within weeks and is swapping them for Australian doses later this year when Britain starts booster jabs (ABC),

PM Jacinda Ardern said early last week she was likely to announce ‘within days’ how to deal with a looming shortage of doses because of strong demand. That could include an Australian style ‘swap’ and/or restricting jab bookings.

Deputy PM Grant Robertson said yesterday he was “quite positive” about the chances of a deal for more Pfizer doses, but would not say when the deal was due.

Premier Gladys Berejiklian is expected to reveal modelling today showing NSW’s Covid hospitalisations will get even worse over the next month, although she still plans to loosen Covid rules for the state, which had 1,485 new cases yesterday (SMH)

In the global economy:

US data out on Saturday morning NZ time showed the world’s largest economy added just 235k jobs in August vs 1.1m in July. Economists had forecast 735k jobs growth,

Economists said this would shift US Federal Reserve’s likely tapering its US$120b/mth of money printing out to November from September (CNBC),

Financial markets will watch Thursday night’s meeting of the European Central Bank for signs the ECB will start tapering its €80b/mth money printing programme. Economists also see it delaying the slower printing until December (CNBC),

The Reserve Bank of Australia is expected to decide tomorrow at 4.30pm NZT to continue its A$5b/week money printing programme after the NSW and Vic outbreaks worsened. It had previously been expected to cut it to A$4b/week. Westpac even suggested the RBA could increase the printing to A$6b/week (AFR-$$$).

In our economy:

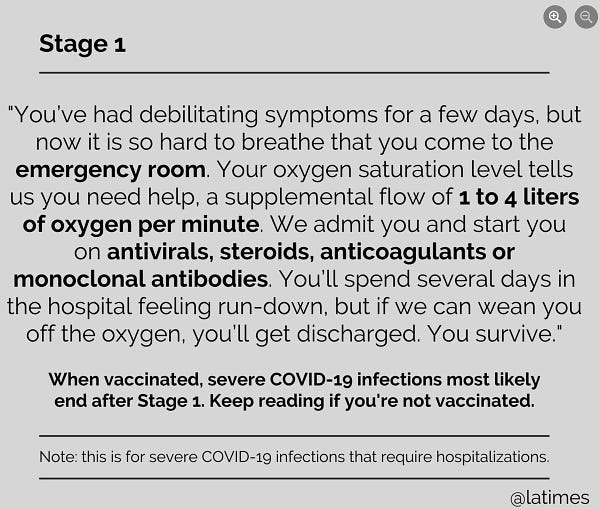

The Reserve Bank announced on Friday morning it wanted to tighten LVR restrictions for owner-occupiers, including first home buyers, back to 2017 levels from October 1,

It said house prices were at higher-than-sustainable levels and it wanted to reduce the financial risks of a fall in house prices for new borrowers and banks,

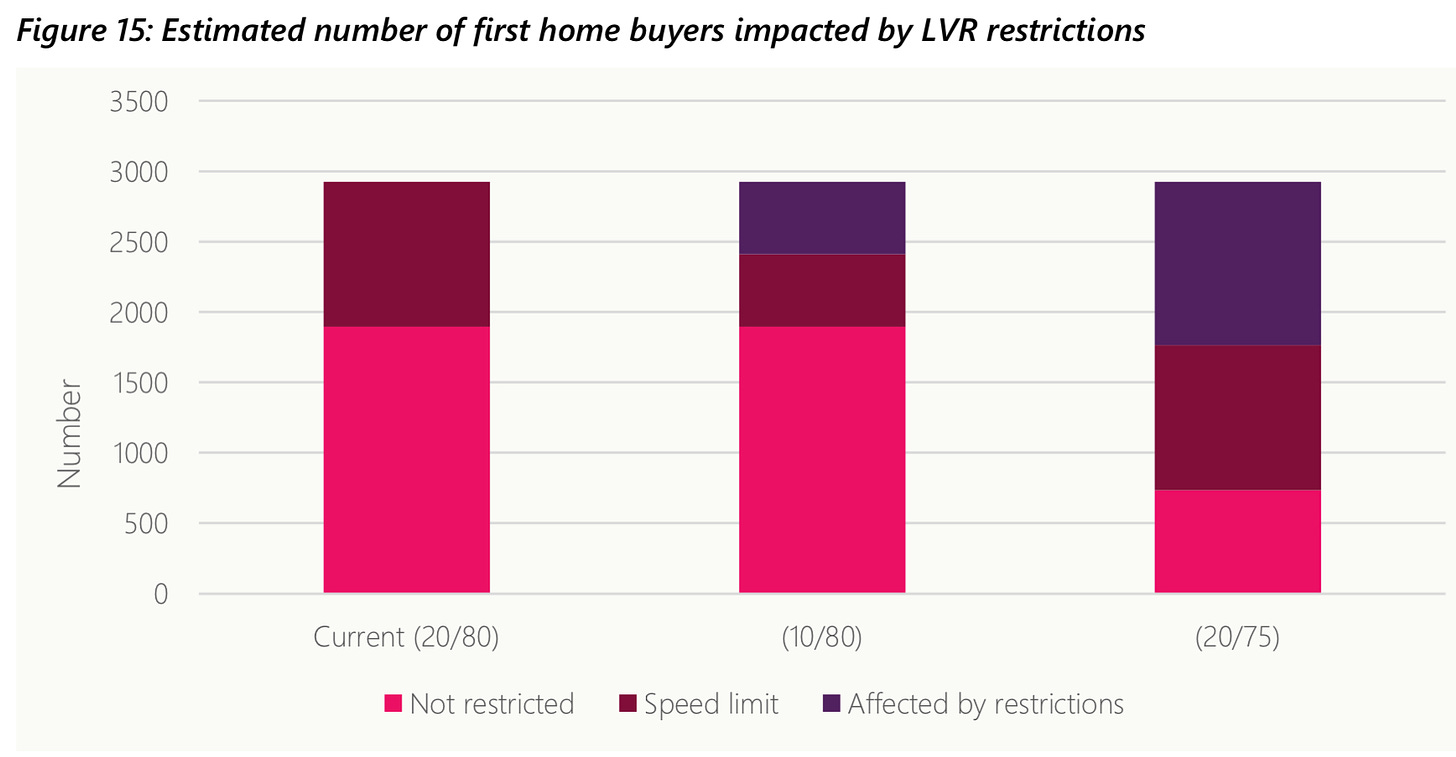

It estimated the halving of the allowable high LVR (>80% of a house’s value) lending to 10% of new lending would hit first home buyers the most, but was better than the alternative of reducing the LVR threshold to 75%,

The bank estimated the move would reduce the number of first home borrowers by around 500 to just under 2,500, while the 75% option would reduce that number by more than 1,000 to about 1,750,

It said the restriction would reduce the amount of house price inflation, but the effect would be only small.

Here’s the core of the Reserve Bank’s argument (the bolding is mine):

“We also note that most of the speed limit is currently allocated to first-home buyers. Therefore, a reduction in speed limit will mean that some first home buyers will need a larger deposit and may take longer to enter the property market. This would also be the case if the threshold was lowered.

“We expect both options would lead to lower house price growth by removing some marginal buyers from the market, compared to a counterfactual where the LVR restrictions are left unchanged. Because of this, over the longer term tightening the LVR settings should improve affordability for first-home buyers that do enter the market, relative to a counterfactual in which LVR restrictions remain at current levels. However, based on past experience we expect the impact on house prices to be small.” Reserve Bank analysis for proposed tightening of LVR settings.

Threads worth following

Useful longer reads

Other places I’ve written

Some fun things

Ka kite ano

Bernard

Dawn Chorus: Low interest rates for longer