Dawn chorus: Housing inflation raging in provinces

CoreLogic says annual inflation hits 20%-plus in provincial cities; Values up 15.3% in 3 months in Whanganui; Annual rate hits 30.6% in Gisborne; Yet RBA & RBNZ threaten more money printing

TLDR: This truly is a fantastic time to be a property owner and an awful time for younger first-home-buying hopefuls that are most affected by Covid-19 income stress and seeing house prices recede further into the never-never land. This is the K-shaped recovery writ large.

Despite all the talk of politicians that house price inflation is unsustainable and the central bank must ‘do something,’ we got fresh data this morning showing house values rising at annual rates of over 20 percent in the provinces. Also, the Reserve Bank of Australia and the Reserve Bank of New Zealand pressed ahead in the last 24 hours with threats to print yet more tens of billions of dollars to fire up goods and services inflation to meet their targets.

CoreLogic reported this morning the housing market fire was still raging in February, particularly in the provinces. Gisborne’s annual inflation rate hit 30.6 percent and Wellington City’s average house values hit a record $1m in February, having risen 7.2% since November. I realised this morning a house I’d bought in 2013 in Wellington has doubled in price in less than eight years.

Whoar in Whanganui

Property values rose at an annual rate of 14.5 percent across New Zealand in February and were in the lower teens in Auckland, Hamilton and Tauranga. CoreLogic’s Head of Research Nick Goodall said there were signs of a slowdown looming as the Government pushed back against rental property investors, although there was also evidence of a last-minute rush in February to apply to smaller banks for loans before new loan to value restrictions kicked in.

Values in smaller provincial cities surged in February and Dunedin values accelerated again. Annual inflation ran at rates of more than 20 percent for Napier, Hastings, Palmerston North and the Kapiti Coast. Values rose 15.0 percent in the last three months alone in Whanganui. The only city to see a fall in the month of February was Tauranga, with values down 1.5 percent, although annual inflation was still 14 percent.

But the printing won’t stop

Those thinking, including Grant Robertson, that the Reserve Banks of the world might take some pressure off asset value inflation are sadly mistaken, even after a grumpy letter asking them to ‘take the housing market into account.’ Central banks are determined to fire up inflation to reach ‘exit velocity’ and that includes both central banks in our part of the world.

The Reserve Bank of Australia threatened inflationistas with yet-more massive money printing and bond buying to keep longer term interest rates low late yesterday, having doubled its daily bond-buying to A$4b on Monday. The RBA said in yesterday’s monetary policy decision statement that it had only completed A$74b of its first A$100b programme and was yet to start the new A$100b programme it announced last month, “and the Bank is prepared to do more if that is necessary.”

‘Just ignore Grant’

Our Reserve Bank also again pushed down on market talk the Government’s ‘take housing into account direction’ would stop it from easing monetary policy further if it had to. Assistant Governor Christian Hawkesby said in a Bloomberg interview published around midday yesterday that the central bank could increase its bond buying if needed to deal with ‘market dysfunction’ and reminded markets it could still also cut the Official Cash Rate into negative territory.

“We are watching markets very closely, we’re very aware of what’s going on and we do have that ability to adjust the size of our LSAP operations from week to week,” Hawkesby told Bloomberg. “We absolutely have the flexibility to adjust those purchases down or up,” he said.

“The message that we’re giving along with other central banks is that stimulus is going to be in place for a long time, that we need to have a very high degree of confidence that we’re going to achieve our mandate and that will take time and patience to occur. We have to ability to lower the official cash rate, and we need to keep reminding markets that we have that ability.”

Governor Adrian Orr is scheduled to speak to the NZ Economics Forum in Hamilton tomorrow at 9.30 am. I’ll be there for that. The Reserve Bank is not backing down on monetary policy, although it may yet take some action on LVRs and Debt to Income limits that could take some heat out of the rental property buying lust.

Elsewhere in our political economy

In the global political economy

Signs of the times news

Notable other views

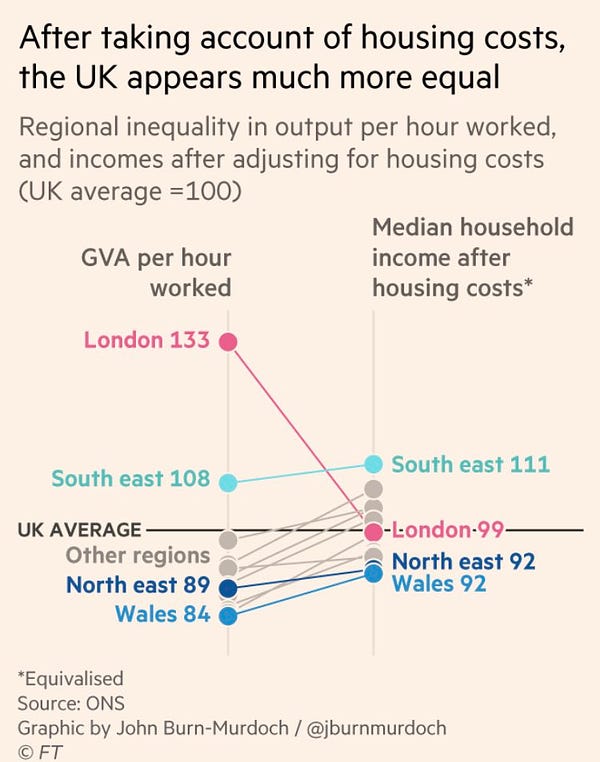

Chart of the day

Thread worth unravelling

I cant imagine that prosperity in Whanganui or Gisborne spiked last year enabling lots of people in these regions to massively boost house inflation by trading houses amongst each other. So sales coming from Auckland migrants (some returning people from COVID locations), and (my guess) mostly investors looking for rental yield due to cheap bank loans. the first home buyers in Whangaui and Gisborne end up not buying but paying investors mortgages. The upward cycle on this is limitless, as renters pay investors equity and investors reinvest in further inflation of their asset class. Its so obvious that there will be no intervention from govt or RBNZ, this will be a collateral damage situation. the govt and RBNZ rate consumption above the house inflation issue, so we will see long run low interest. NZ's real problem will create more issues next couple of years, low productivity and low income growth, lower than average company profits! Once COVID is manageable in the world, other countries will enter a boom, the new shoots of which are emerging all other the world, and NZ will not as we sat back bought houses and "stayed too safe"