Dawn chorus: Govt not borrowing enough

RBNZ forced to scale back bond buying as Govt borrowing dries up; Monetary policy load falls on further lowering mortgage rates via cheap RBNZ loans to banks; Carter Holt stops supplying timber to ITM

TLDR: The Reserve Bank announced a $200m reduction in its plan for money-printing and bond-buying this week to $430m late on Friday as the Government’s own borrowing programme slows sharply because of improving Crown finances. Essentially, the Government is not borrowing enough for the Reserve Bank to keep using quantitative easing at the pace it needs to run a loose-enough monetary policy.

The background here is the Reserve Bank is just over half-way through ($52b) its plan to buy $100b of bonds by June next year. To achieve the total, it would need to keep buying at a rate of almost $800m per week. The Reserve Bank could keep buying at that rate, but would soon hoover up more than 60% of the bonds on issue, which is the limit it has set itself to avoid drying up liquidity in the bond market, which is a key part of the infrastructure underneath our financial markets and banking system.

This is all because the Treasury has reduced its bond issuance to around $300m to $350m a week, as detailed in its April borrowing programme announcement. This is all because the economic rebound is healthier than expected, which is bolstering GST, PAYE and corporate tax inflows, and the Government’s own capital and operational spending is less than forecast. Essentially, fiscal policy is not loose enough to be enough of a ‘mate’ to monetary policy.

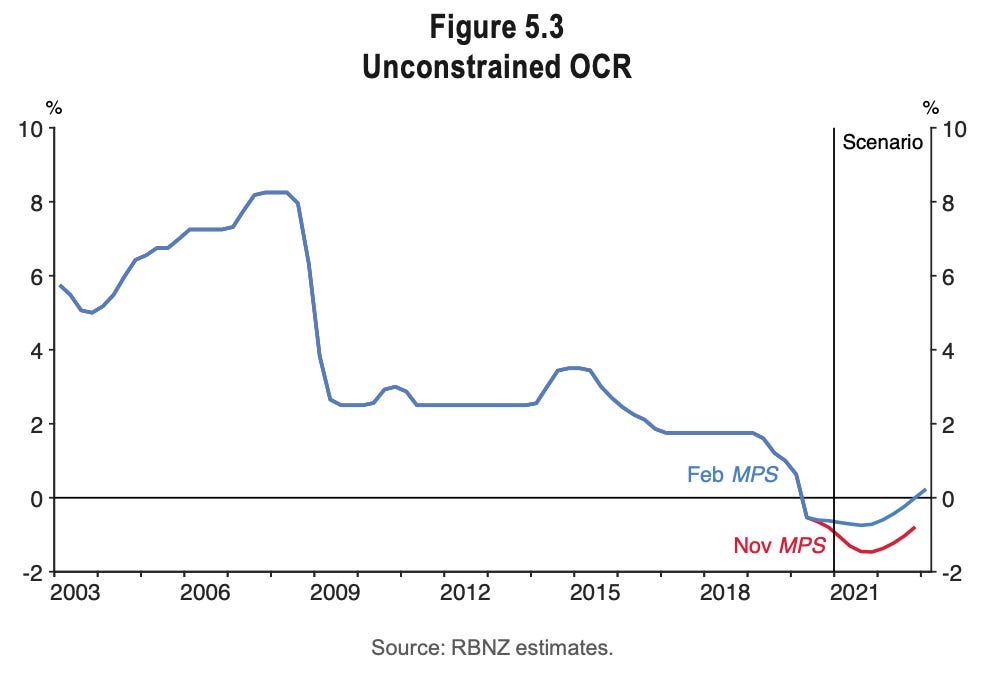

That may force the Reserve Bank to use its remaining tools to keep monetary conditions loose. They include cutting the Official Cash Rate into negative territory from its current 0.25%, which means it could then lend directly to banks at a negative rate through its Funding for Lending Programme (FLP) in the hope the banks would further cut mortgage rates. The banks are already under scrutiny for not passing enough on in lower rates. Reserve Bank Governor Adrian Orr told the banks to pass more of the official rate cuts of 2020 onto customers with even lower mortgage rates in the February Monetary Policy Statement news conference.

The Reserve Bank’s measure of the ‘unconstrained’ Official Cash Rate, which takes into effect the $100b money printing and bond buying programme, dropped 170 basis points over 2020, while the two-year fixed mortgage rate has fallen only 100 basis points. That means the banks have either offset other funding and operational costs with the higher net interest margins, or simply pocketed higher profits. Orr said in February he wanted them to pass more on. So far, the FLP programme has been barely used by the banks. It is designed to be very attractive once the OCR goes negative. Then, the Reserve Bank will be paying the banks money to lend to banks, to then lend more to homebuyers and further inflate the housing market.

Monetary and fiscal policy not loose enough. Really.

The (perhaps) irony is that the Government’s tight fiscal policy is driving mortgage rates even lower and therefore house prices higher. The Government needs to be more of a ‘mate’ for monetary policy by loosening fiscal policy, which is something Finance Minister Grant Robertson is showing no signs of doing, having set unchanged operational spending allowances in his Budget Policy Statement in February.

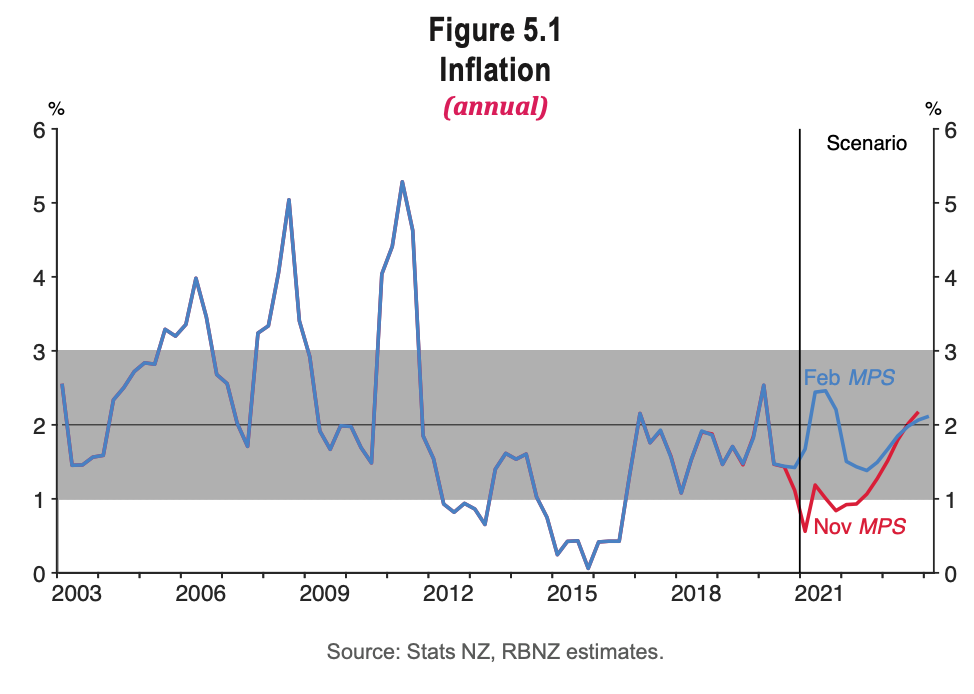

For those wondering why anyone would say that either monetary or fiscal policy are not loose enough, it pays to have a closer look at the Reserve Bank’s own forecasts in February for inflation and the unconstrained OCR (below). They show the bank actually sanctioned a slight tightening of policy in its February statement by lifting its unconstrained OCR forecast track (albeit to a slightly less negative level) and by actually lowering the end point of its inflation forecast (a bit).

The Reserve Bank is forecasting inflation will only just get back above 2.0%, which is actually much more conservative and ‘tighter’ then what other central banks are doing. The Reserve Bank of Australia, the European Central Bank and the US Federal Reserve have all moved to ‘average’ inflation targeting, whereby they compensate for the last decade of sub-2% inflation by running their economies hotter than they otherwise would to allow inflation to be above 2%, and therefor ‘average’ 2% over the long run. New Zealand’s inflation rate has been sub 2% for a decade. It means they will be slower to lift rates as the global economy recovers, and keep printing and buying bonds for longer. They will be less trigger happy about inflation.

What a looser monetary policy would look like

If the Reserve Bank here was doing the same as others overseas, it would be running much more stimulatory policy, which would involve a cut in the OCR into negative territory or more bond buying in tandem with a looser fiscal policy with more bond buying. The unconstrained forecast would be lower than in the chart below and the inflation forecast above would be higher at the end of the forecast period.

But that’s not what we’re seeing. I suspect that’s partly to take some of the heat off the housing market, which the Government has now told the Reserve Bank to consider when making monetary and prudential policy. Another possible result of this extra pressure on the bank to lower mortgage rates, is the Reserve Bank being even more determined to use prudential policy to take the heat out of the market. That would imply a more aggressive approach on interest-only lending and going hard for a debt to income multiple limit, particularly for rental property investors.

It may also explain why the Government went harder than many expected with its interest deductibility shock last week, which will help the Reserve Bank run lower interest rates without further increasing demand from landlords.

Elsewhere in our political economy

The big story today is Carter Holt’s decision to stop supplying timber to the independent ITM chain of hardware outlets because of what is says are shortages. This was reported first on Friday by BusinessDesk-$$$. Also, Grant Robertson told Q+A he would look to take further unspecified action if rents spiked. The Opposition said that sounded like talk of rent controls.

In the global political economy

Signs o’ the times news

Threads worth unravelling

Other notable views

A question was asked on twitter that didn't get a proper answer: it was claimed that corporate property owners can and still will be able to claim interest expenses against tax, and that one reason why most property investors don't run their operations as registered businesses is to avoid capital gains tax. Is that correct? Secondly, does IRD regard purchasing a property with negative cash flow as an intention to make capital gains?