TLDL & TLDR: It seems everyone except renters and aspiring home owners are winners from the housing boom, even the Government, which in theory is supposed to be making housing more affordable.

All the political and financial incentives in front of the Government are designed to keep residential land prices rising, and never to let them fall. That was reinforced yesterday in the latest Government financial report showing the biggest winner from the 30% rise in house prices over the last year was the Government itself, both from higher land valuations and surges in tax revenues from an economy driven by the wealth effect in the housing market.

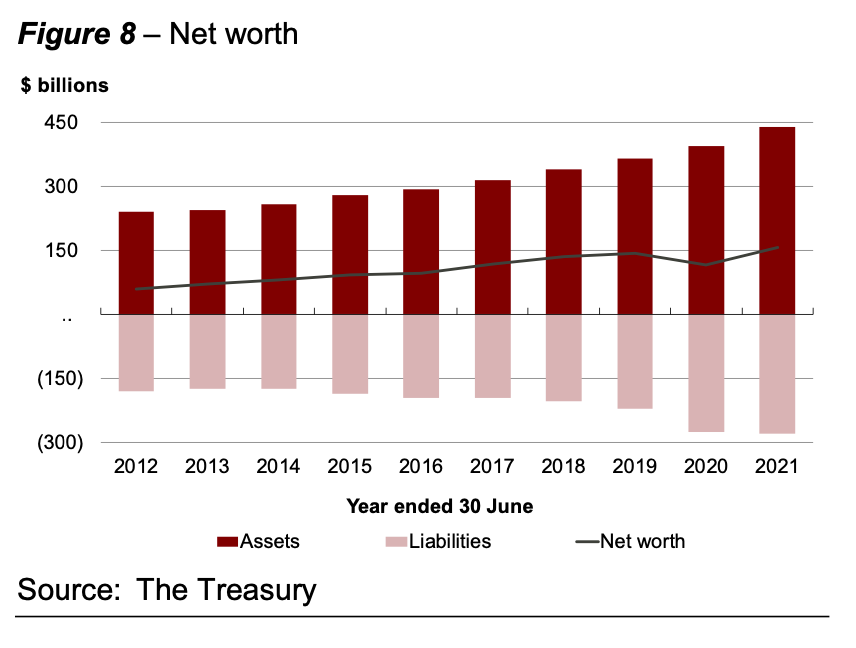

Treasury reported the Crown Accounts for the year to June 30 yesterday, showing the Government’s operating balance after gains and losses was a surplus of $16.2b, including $12.2b from revaluations higher in land values. State housing land revaluations totalled $5.8b.

(I’ve opened this one up for all given the public interest, and to remind the free subscribers about what they get daily as paid subscribers. Subscribe to support my accountability and explanatory journalism on housing, climate, politics, economics and business.)

Before gains and losses, the Government’s deficit of $4.6b or 1.3% of GDP, which was less than a third of that forecast in the May Budget and a massive turnaround from last year’s $23b deficit. Tax revenues were $6.5b higher than expected at $98b and a whopping $18b up on the previous year.

However, capital spending remains anaemic, increasing just $3.3b to $12.7b. It was almost matched by the Reserve Bank’s lending of $3.1b near-zero-interest-rate loans to banks through its Funding for Lending programme, which was almost all pumped back into the housing market.

All this meant net core crown debt at $83.4b was $11.6b below the May 2021 Budget forecast. As a percentage of GDP, net debt was just 30.1% of GDP, down from the 34.0% expected in May. That means Aotearoa-NZ’s net debt is less than half that of its AAA-rated peer Australia and less than a quarter of peers such as Britain and the United States.

So what does that all mean?

Finance Minister Grant Robertson was asked yesterday if he was pleased the Government had been the single biggest beneficiary of the latest jump in house prices. He said he took no pleasure and the Government still wanted to make house price inflation more sustainable. He has stopped using the phrase ‘affordable’.

Note however, he did not say he wanted house prices to be more affordable. He was only saying that an inflation rate of 30% was too high. PM Jacinda Ardern has said an inflation rate of around 4% per year was preferable, which means the Government has no desire to improve housing affordability by seeing house prices and rents fall. That would be the only way now to see any significant improvement in the ratios of house price to income multiples and the share of disposable income going to rent. Both are the highest in the OECD now.

My view: These figures show again why it is so hard to reverse the ever-ratcheting-higher nature of house values. Median voters ‘lock in’ the gains in their house values as soon as they happen, and politicians refuse to say they would encourage or accept lower prices. Now the Reserve Bank is using the housing market as a ‘wealth effect’ monetary policy tool, both the major players in the economy are both guarantors and beneficiaries of the unearned gains in land prices.

Our economy and society truly is a housing market with bits tacked on. No matter where you turn, the fortunes of the Government, businesses, families and institutions depend on house prices rising constantly, or at least not falling.

For example, the ratcheting up of land prices and the rules in the Public Finance Act (1989) forcing the Government to run surpluses and reduce debt in all but the most extreme situations, have created an institutional bias towards never freeing up public land for mass house building. Any attempts to sell land to developers or to account for its use in house building means that land prices keep ratcheting higher. Eg. Treasury won’t sell land to developers to build affordable houses at below market rates because it’s not allowed to under the PFA, which perpetuates land shortages that drive prices ever higher. This was a major factor hobbling KiwiBuild.

Those rising prices benefit the personal (and often small business finances) of home owners who vote, the Government’s finances, and the Reserve Bank’s monetary policy aims. None of them are actually serious about improving housing affordability because it would stop the politicians from meeting their political aims (to win more median voters than the other main party) and stop the officials from meeting their legislative obligations (to keep debt low, interest rates low and Crown net worth rising)

Hence, rinse and repeat.

So what would break this doom loop?

My view is the Public Finance Act (1989) needs to be repealed and replaced with directions on the use of the crown’s balance sheet to take into account the intergenerational needs of the population. That would include changing the focus from public debt reduction and effectively reducing the size of Government to around 30% of GDP, and instead focus on investing in infrastructure that would benefit future taxpayers and the future Government finances by reducing housing, health cost, justice cost, climate cost and education cost liabilities, while also increasing productivity and ultimately the Crown’s own balance sheet.

Currently, the PFA, (see note 24 on page 115 of the Crown Accounts), specifies the Treasury and Government must at all times (bolding mine):

reduce total debt to prudent levels so as to provide a buffer against factors that may impact adversely on the level of total debt in the future by ensuring that, until those levels have been achieved, total operating expenses in each financial year are less than total operating revenues in the same financial year

once prudent levels of total debt have been achieved, maintaining those levels by ensuring that, on average, over a reasonable period of time, total operating expenses do not exceed total operating revenues

achieving and maintaining levels of total net worth that provide a buffer against factors that may impact adversely on total net worth in the future

managing prudently the fiscal risks facing the Government

when formulating revenue strategy, having regard to efficiency and fairness, including the predictability and stability of tax rates

when formulating fiscal strategy, having regard to the interaction between fiscal policy and monetary policy

when formulating fiscal strategy, having regard to its likely impact on present and future generations.

That last one is honoured more in the breach than by the action, otherwise we have invested heavily in public infrastructure for housing, renewable energy and transport to ensure affordable housing costs and a pathway to carbon zero — neither of which we are anywhere near.

PFA not fit for affordable housing and carbon-zero world

For example, the Infrastructure Commission today estimated in its draft report to Government that our infrastructure deficit at $75b and that 115,000 new houses are needed to fix our housing crisis. It recommended doubling infrastructure spending to around 10% of GDP.

I asked Robertson yesterday how much fiscal headroom he saw to address the climate change issues, for example. He has already previewed Budget 2022 as a climate Budget and the Government is still (!) going through the process of deciding its policies to achieve carbon zero by 2050, or even faster reduction as seems necessary to achieve new climate goals being determined at the Glasgow conference next month.

He would only say he and Climate Minister James Shaw were revisiting aspects of the PFA that currently made it difficult to budget for spending across ‘clusters’ of departments. Both have been reluctant to shy too far away from the orthodoxy around permanent debt reduction towards effectively having the lowest level of Government debt possible, while still keeping the bond markets liquid. This is seen at around 20% of GDP. There have been suggestions of changes for over a year with no detail.

My view: The PFA needs to be rewritten to emphasise the longer-term view on climate and societal liabilities, rather than simply keeping short term debt low to ensure interest rates stay low and house prices stay high.

Scoops and news breaking overnight

Signs o’ the times news

Dawn Chorus: Govt biggest winner from housing boom