Dawn chorus: Cullen wants RBNZ reform

Former Finance Minister says Reserve Bank is in direct conflict with Govt on inequality; He suggests the bank print and fund Govt spending on infrastructure and housing directly, as it did in 1935

TLDR: Morena: Former Finance Minister Michael Cullen, who has the ear of the PM and the Deputy PM, has called for a monetary policy rethink. He says the Reserve Bank’s money printing that has sparked another housing boom is in conflict with the Government’s attempts to reduce inequality.

He says the bank should instead directly fund Government investment in infrastructure by buying bonds on the primary market. Currently the Reserve Bank buys bonds on the secondary market and is targeting lower interest rates, rather than trying to fund the Government directly. The central bank did this for the first Labour Government in 1935.

However, Cullen stopped short of saying the Reserve Bank should fund ‘‘helicopter money’ direct payouts to all. He also didn’t comment on whether the bank should either cancel the bonds or simply hand the cash over to the Government to ensure there is no debt to repay, a process known as monetisation. Grant Robertson ruled this out before the election.

Also, there’s more great vaccine news overnight.

Breaking this morning in our political economy

Overnight in the global political economy

Signs ‘o the times news

Worthy longer reads

Useful reports

MFAT commissioned ImpactEcon to analyse the benefits of RCEP to New Zealand in this report. It reckons the benefits could be 0.3-0.6% of GDP ($1.5-3.2b pa), but only if India rejoins. It sees the benefits nearer the bottom end of the range at around $2b if India does not rejoin.

BNPL regulation is coming: Here’s one for The Commerce Commission, the Reserve Bank, new Minister David Clark, the banks and the ‘Buy Now Pay Later’ (BNPL) sector to read closely. ASIC published a 33 page report yesterday showing 30% of Australians now have BNPL accounts and they’ve doubled their borrowing through them in the last year. It found 21% had missed payments in the last year, incurring missed-payment fees of A$43m, up 38% in a year.

ASIC is now preparing to regulate (page 21 in the report) from October 2021. It looked at data from Afterpay, BrightePay, Humm, Openpay, Payright and Zip Pay, but not New Zealand’s Laybuy.

“From our research we also found that some consumers who use buy now pay later arrangements are experiencing financial hardship, such as cutting back on or going without essentials (e.g. meals) or taking out additional loans, in order to make their buy now pay later payments on time. There is also a risk that consumers may be paying inflated prices for some goods and services when using a buy now pay later arrangement.” ASIC

Chart of the day

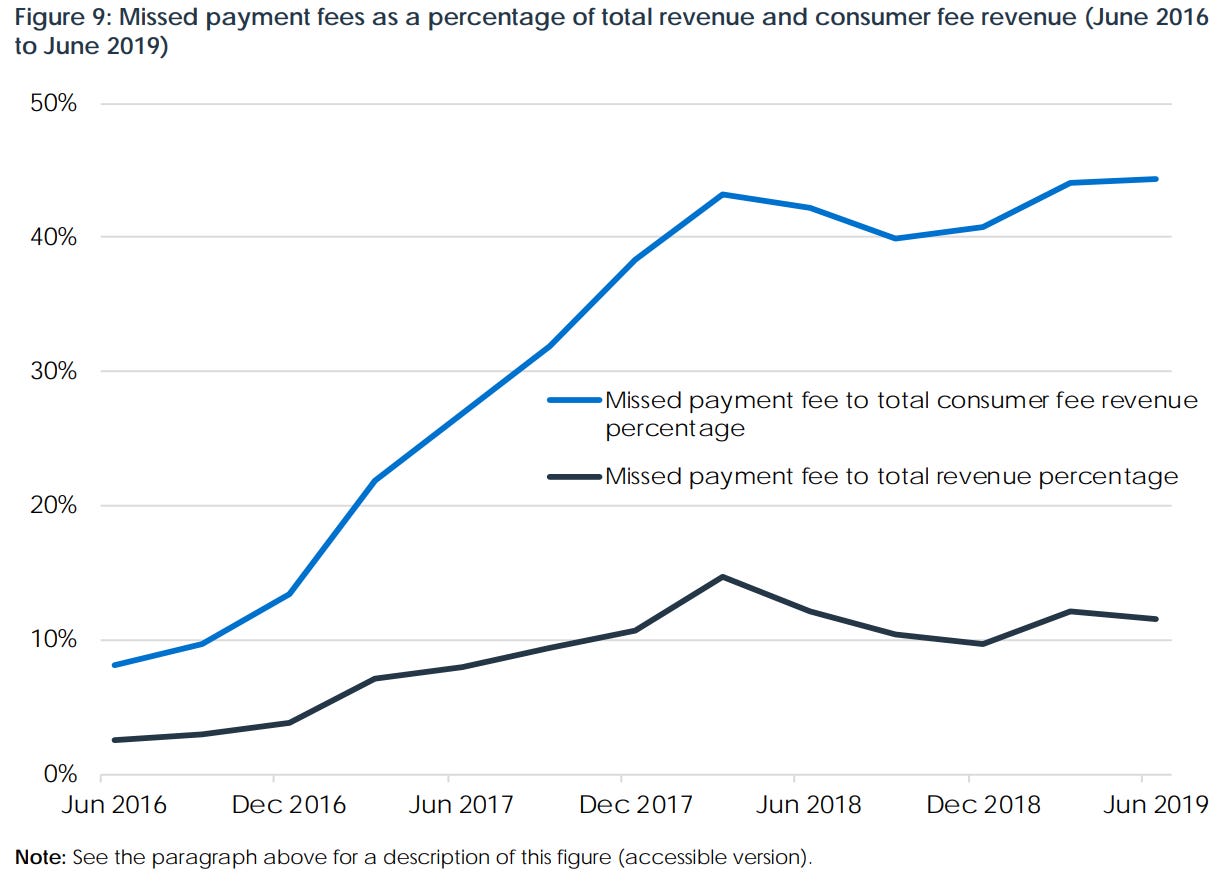

Here’s ASIC’s measure of how BNPL have steadily ramped up their fees from consumers. Some merchants are also adding a surcharge for BNPL customers.

Coming up…

Today: The Labour caucus will meets in Parliament around 10am. I’ll ask Grant Robertson and Jacinda Ardern about Cullen’s comments.

Wednesday Nov 18 - PM Jacinda Ardern gives speech at Infrastructure NZ conference in Auckand

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds Nov 25 - 2pm - Reserve Bank to publish six monthly Financial Stability Report (FSR) . Expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Weds Nov 25 - Opening of Parliament for 53rd term, including swearing in of new MPs

Thurs Nov 26 - Speech from the throne in Parliament outlining Government’s agenda

Weds Dec 9 - Parliament rises for the year.Tuesday: Labour caucus

Ngā mihi

Bernard