Dawn chorus: Buying frenzy fears

Fears (or hopes) grow of a house buying frenzy before the RBNZ reimposes LVR limits in March. Wellington approves 350 homes at Shelley Bay, but Christchurch pushes back against the densification NPS.

TLDR: The debate about the housing boom is raging. Both Stuff and NZ Herald lead this morning with fears (or should that be the hopes of the real estate ad sales departments and homeowning readers…) that the Reserve Bank’s March reimposition of LVR restrictions will unleash a buying frenzy before then. They also report the Reserve Bank is bouncing responsibility for the latest boom back at the Government.

July’s National Policy Statement stopping Councils from blocking six-storey apartment blocks near city centres is also now hitting Council chambers and the NIMBYs don’t like it. Christchurch Council rejected the NPS as ‘Auckland Rules’ overnight. The housing market pressure from all sides is intensifying.

Especially as the money printing pumping up asset prices is marching on. The European Central Bank hinted overnight it could print an extra €500b to €1.8 trillion. The Kiwi dollar has actually risen two cents to almost 69 USc in the last week because our central bank is viewed as not printing as fast as the others.

News this morning in our political economy

It’s all about supply: There was one step forward on housing supply overnight, and one step back. Wellington Council approved the Shelley Bay development after what it seems like decades of stuffing around. But Christchurch’s Council channelled the NIMBYs by rejecting the Government’s pro-density housing policy. The Press led this morning with the Council’s rejection of ‘Auckland Rules’.

It's about time we had this debate nationally. NIMBY boomers vs the next generation. And the next generation should win.

Tony Alexander argues the Reserve Bank should have immediately reimposed the LVRs. The RBNZ’s Geoff Bascand and Adrian Orr said yesterday they had to consult the banks first and that lenders would know they were being watched. We’ll see.

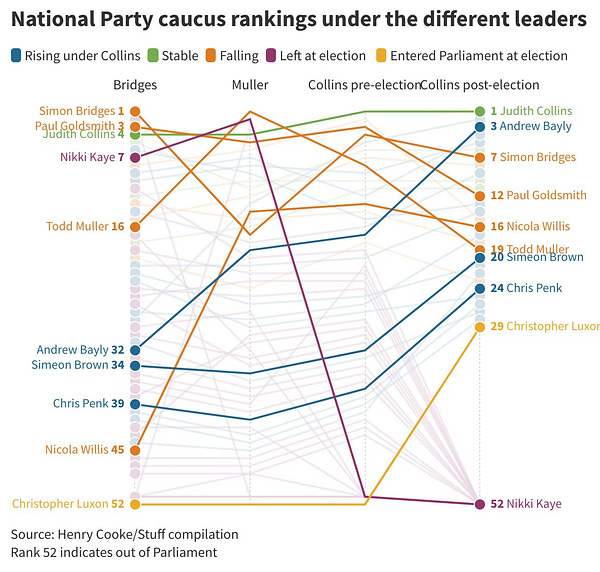

Claire Trevett reports that Simon Bridges rejected the half-Finance role offered by Judith Collins. (NZ Herald-$$$)

News overnight in the global political economy

Just keep printing: The European Central Bank signalled overnight it would expand its money printing programme as second waves of Covid-19 lockdowns sweep across the continent. (CNBC) Meanwhile, OPEC slashed its oil demand forecast in another sign the global economy is struggling.

News overnight in business and markets

Tech stocks bounced back overnight and the NZ dollar was solidly higher after our Reserve Bank was not as dovish as some expected. Here’s the latest numbers as of 7 am.

Chart of the night

Signs ‘o the times links

Thought leadership

''There are still those in my sort of position, and some who are equity investors, who will assert that the sole responsibility of the company is pursuit of profit for the shareholders. That is not a view I share and if some shareholders or fellow directors want to remove me for having the belief and acting on the belief that my duty is rather to the company as an entity and to its full range of stakeholders, then they are welcome to try to remove me.’’ SkyCity Chair Rob Campbell

Some fun things

Coming up…

Today - 10.45 am - Stats NZ to publish travel and migration data for September.

Today - 8.30 am - Sanford to publish full annual results to NZX, but it gave an early indication on Nov 5 of a 46% fall due to Covid-19.

Today - 10 am - Infratil will brief investors, analysts and media on its half year results and strategy in Wellington.

Today - 6pm - Epidemiologist David Skegg to deliver Frank Holmes lecutureon Covid-19 at Old Government Buildings, Lecture Theatre 1 in Wellington

Fri Nov 13 at 10 am - Business NZ-BNZ Purchasing Managers Index for October

Fri Nov 13 at 10.45 am - Stats NZ to publish rental price indexes for October.

Mon Nov 16 at 10.45 am - Stats NZ to publish wellbeing statistics for September quarter.

Sat Nov 21 - National Party AGM due to vote on re-election of President Peter Goodfellow.

Weds Nov 25 - 2pm - Reserve Bank to publish six monthly Financial Stability Report (FSR) . Expected to warn of re-imposition of high LVR lending limits from May 1, 2021.

Weds Nov 25 - Opening of Parliament for 53rd term, including swearing in of new MPs

Thurs Nov 26 - Speech from the throne in Parliament outlining Government’s agenda

Ngā Mihi

Bernard