Dawn chorus: Bond yields jump

10 year Government bond yield up sharply to 1.64%, highest level since June 2019; S&P sovereign credit upgrade ignored by bond markets; RBNZ may have nudge long rates down again

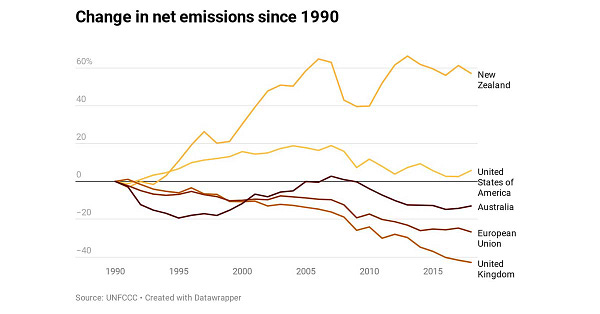

TLDR: Yesterday’s sovereign credit rating upgrade was lauded by Finance Minister Grant Robertson, but bond markets ignored it and escalated a selloff that pushed the 10 year Government bond yield — a proxy for borrowing costs — up sharply to 1.64%, its highest level since June 2019.

This is not what the Reserve Bank had planned and we’ll find out on Wednesday whether it pushes back against this by reversing its tapering of bond purchases over recent months.

Elsewhere, Leonard Hong over at the NZ Initiative has a very useful report on why changing household structures (more smaller households as an ageing population creates more empty nesters) mean we’re building way fewer houses than we need, even with zero net migration.

Also, many thanks to those who participated in yesterday’s ‘Hoon on interest rates’ with Jarrod Kerr with Kiwibank. Here’s the link to the recording.

In the local political economy

In the global political economy

Signs of the time news

Notable other views

Threads worth unravelling

Ka kite anō

Bernard

PS: Thanks to Zealandia’s Nature Images on Instagram