Dawn chorus: Bond vigilantes vs mass money printers

Investors worried about inflation push up wholesale interest rates, but central banks are pushing back by printing much more cash to buy bonds and create more inflation; RBA intervenes

TLDR: Keep an eye out this week for a potential Reserve Bank intervention in the bond markets to push long term bond yields back down. Australia’s central bank did just that on Friday. Our Reserve Bank is among of group of central banks now in a fight with investors over the inflation outlook and the direction of longer-term market interest rates. The markets are ‘fighting the Fed,’ and every time in the last decade the Fed has won.

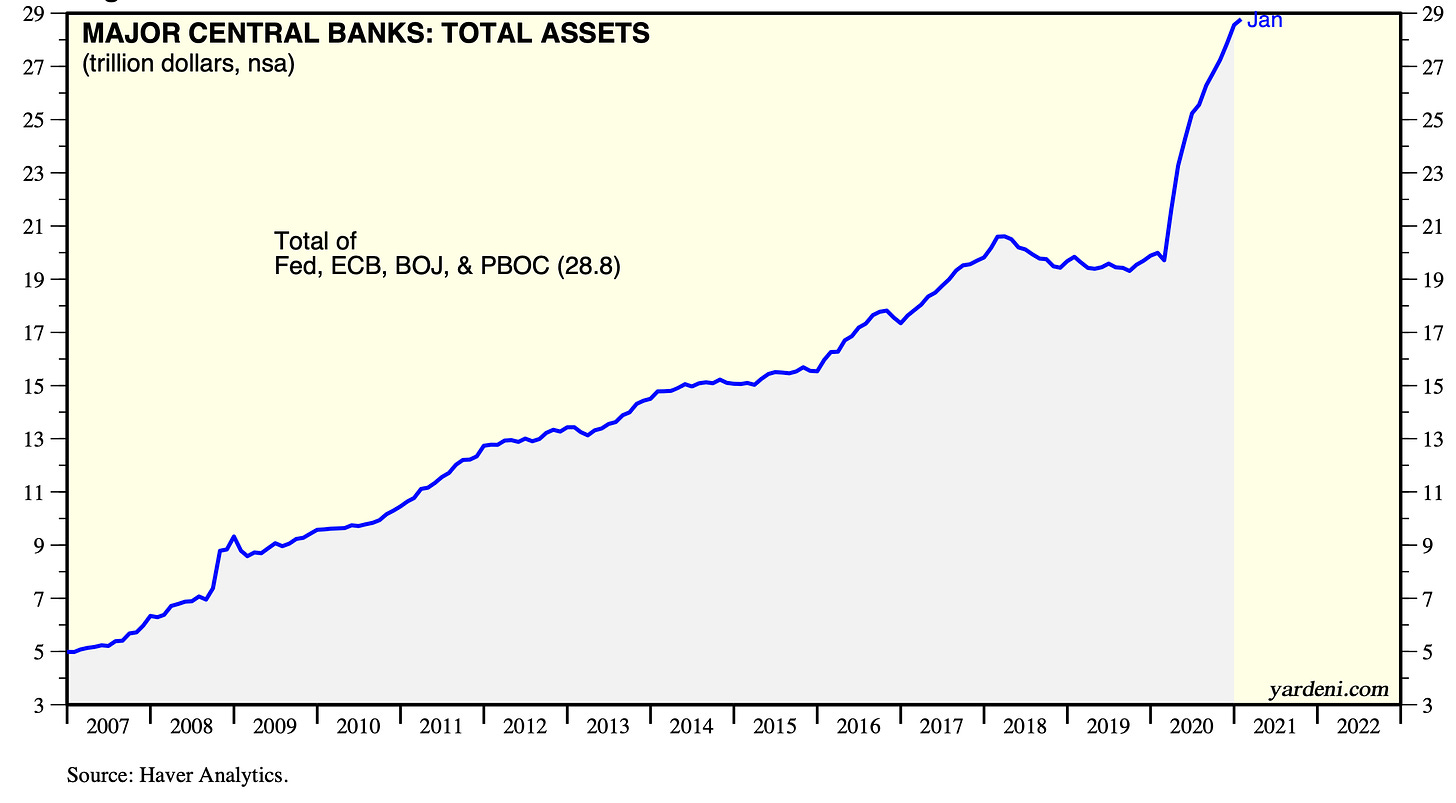

The trouble for markets is central banks have unlimited power to print, as this chart below showing their combined printing of US$29t since 2007 shows. One adage in markets is ‘don’t fight the Fed’. There have been many bond market selloffs over the last decade where people argued ‘inflation and a bond market meltdown is coming and there’s nothing central banks can do to stop it’. The ‘Fed’ has just printed and ‘hosed down’ that talk with more printing and bond buying every time for over a decade. Now, the Fed fightback may just have started in our part of the world. (More on that below)

Markets vs Fed

Markets worry central banks are stimulating too much and won’t be able to control inflation when it takes off. That’s why we saw a massive selloff in global bond markets last week that saw long term interest rates spike higher. But central banks are still worried there’s not enough inflation and that a market ‘tantrum’ will derail their plans to stimulate economies and inflation.

So we have a classic stand off. The market is ‘fighting the Fed’ by betting on higher inflation and higher interest rates. The ‘Fed’, which is a proxy for the US Federal Reserve and other central banks, is continuing on with its money printing and bond buying, which is designed to push down long-term market interest rates.

We’ve been here before. In 2013, the Fed suggested it might have to stop money printing at some stage. The markets had a ‘taper tantrum’ and pushed interest rates sharply higher, before eventually settling down when they realised the US Federal Reserve was not going to stop printing and that inflation wasn’t getting out of control. Since then, the US Federal Reserve and other central banks have printed a further US$15t.

The question now is how the ‘Fed’ fights back, and whether it will win. Ultimately, the ‘fed’ has unlimited firepower. It can keep printing as much as it wants for as long as it wants. The actual Fed pledged last week to keep printing US$120b a month to buy bonds. The European Central Bank also pledged to keep printing to its €1.85t target. The way for these central banks to ‘fight back’ is to increase their rate of money printing and bond buying to push rates back down. So far, the big ones haven’t done that.

It started in Australia

But on Friday, the Reserve Bank of Australia bought A$3 billion of bonds unexpectedly, adding to A$3b it bought on Thursday and A$1b on Monday. The RBA has pledged to keep interest rates low until 2024, but the 10 year Australian bond has spiked from 1.2% to 1.8% over the last two weeks. This surprise bond buying was a factor pushing both the New Zealand and Australian dollars down late on Friday. (Adrian Orr’s reiteration of monetary policy independence in the face of Grant Robertson’s ‘take account of the housing market’ directive was also a factor.)

Here’s a Bloomberg article from this morning about how the RBA is at the frontline of this battle at the moment. More RBA push-back is expected in its monetary policy decision announced at 4.30pm tomorrow NZ time. There’s also talk the European Central Bank is about to use its ‘whatever it takes’ bazooka of money printing to push down market yields in Europe later this week.

Will the RBNZ intervene too?

But our own Reserve Bank has a problem too. The NZ 10 year Government bond yield has risen from 1.31% to 1.91% over the last two weeks, while the NZ dollar rose as much as 4.0%. That represents a significant tightening, and was caused partially by Finance Minister Grant Robertson’s intervention last week suggested the central bank might tighten monetary policy to take pressure off house prices. Governor Adrian Orr hosed that down on Friday, saying the bank was determined to get inflation up, but the 10 year bond yield still closed on a high of 1.91% on Friday.

The question is whether the Reserve Bank wants to do more to get those bond yields down again. On Friday afternoon it announced plans to buy $570m of Government bonds this week, which was the same as for each of the last four weeks. So no immediate sign of a fight back.

But the bank has the flexibility to change those plans. The markets are now watching closely for an intervention. “Talk of the ECB stepping up its bond purchases and a degree of market dysfunction here may draw the RBNZ out too, which would also weigh on the Kiwi,” ANZ’s market market economists said this morning.

So we’ll all be watching to see if the Reserve Bank expands its bond buying this week in its three auctions on Monday, Wednesday and Friday, and also how the markets vs the Fed battle plays out in bigger markets. My money is on the ‘Fed,’ and has been for at least a decade.

I’m with the ‘Fed’

My view is globalisation of services via smart phones (invented in 2009) and rising inequality (more cash stashed in banks, rather than being spent or invested) will keep inflation very, very low and force yet more trillions of money printing. Central banks are independent for now and can fend off politicians worried all the money printing is worsening inequality. There would need to be a major political change to stop it.

Voters would have to vote in parties who want to take back control of monetary policy and use the money printing to reverse widening inequality, rather than exacerbating it. I see no signs of that yet. That’s why it’s safe for now to always bet on the bailout of financial markets, banks and asset markets by independent central banks. Moral hazard may be dead, but it won’t ‘live’ again until the politicians and laws behind the current regime have changed.

Elsewhere in our political economy

In the global political economy

Hi Bernard, I think your example proves your own argument wrong. The Fed said it wanted to tighten, the bond market threw a tantrum and the Fed retreated by turning on the printing machine again.