TLDR: Vacuums can be dangerous things if you don’t fill them fast enough.

CTU Economist Craig Renney has estimated National’s tax cut proposals would reduce Government revenues by $11.1b over four years, with at least half of that going to the top 10% of earners and landlords. However, National denies this, saying it has yet to release all the details, although it has promised to repeal the taxes valued at $11.1b.

Elsewhere in the news this morning:

National Finance Spokesperson Nicola Willis has launched a direct attack on Reserve Bank Governor Adrian Orr, CoreLogic has looked at forecasts of an 18% fall in house prices and US President Joe Biden is threatening oil companies with a windfall profits tax.

In Aotearoa’s political economy

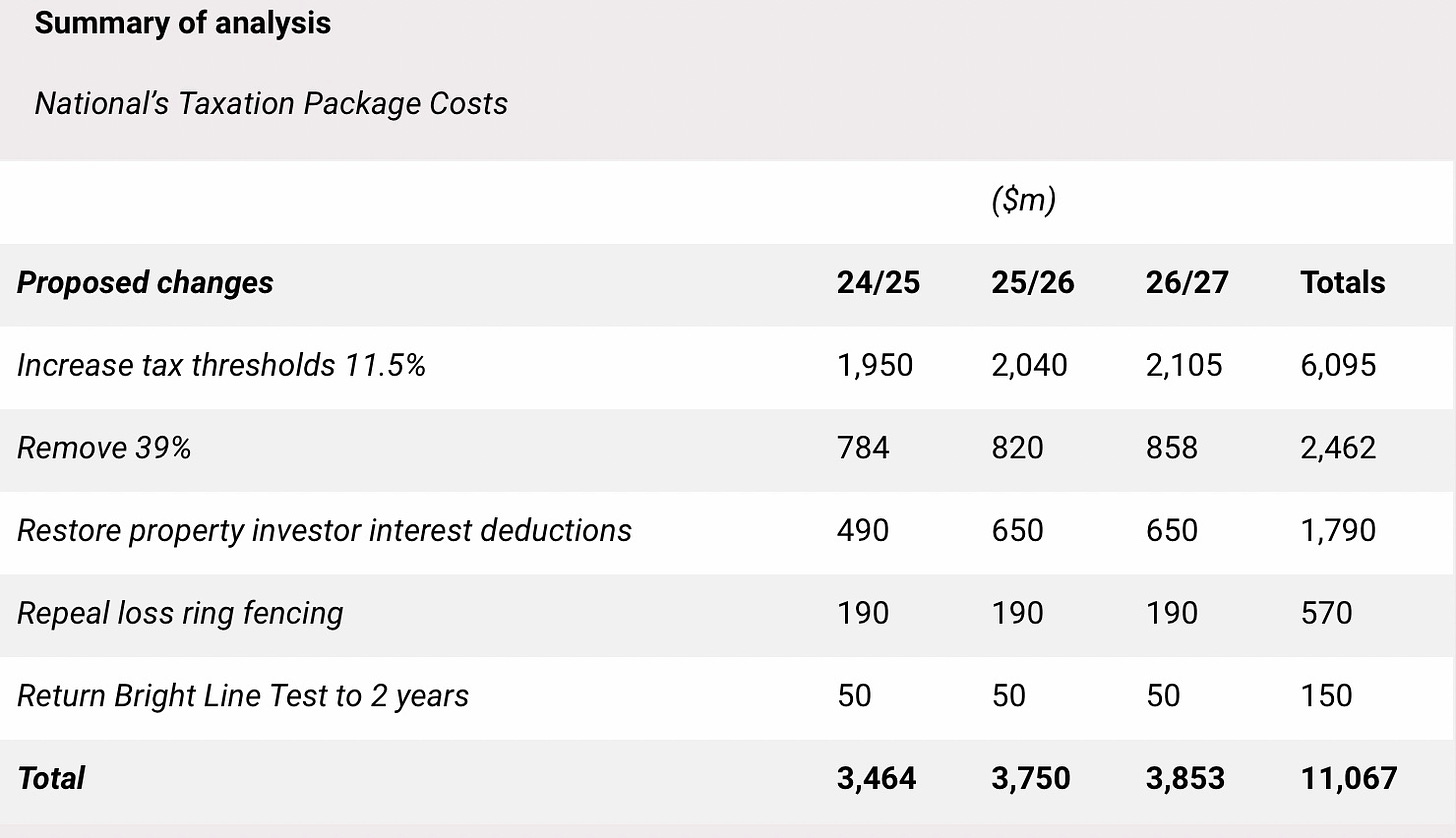

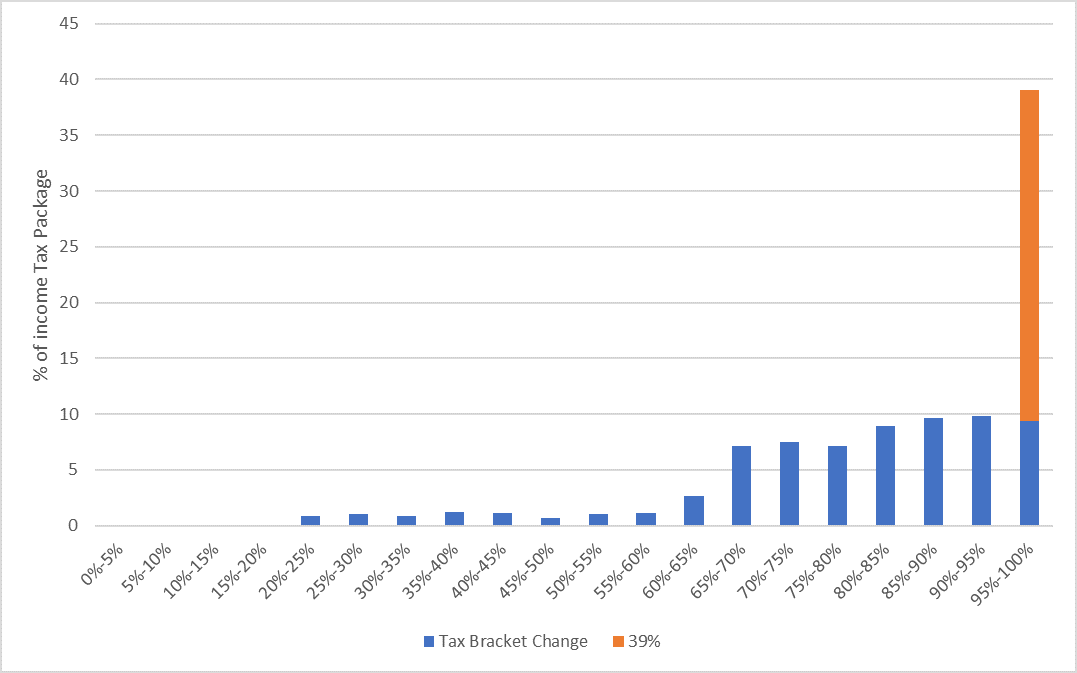

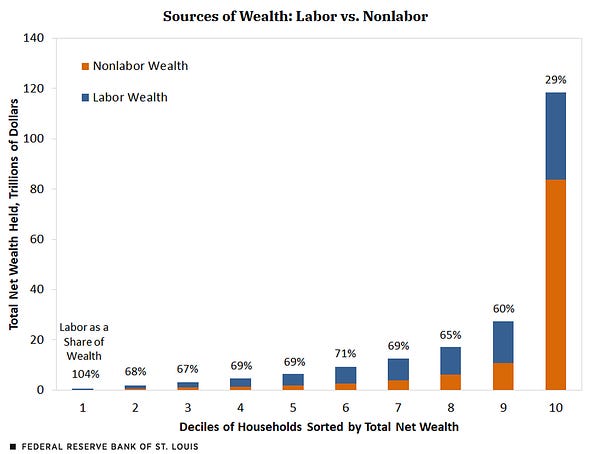

Aspirational for the top 10% - CTU Economist Craig Renney published an analysis this morning of how big National’s proposed tax cuts would be and who would get them. He estimated total tax cuts of $11.1b over four years through higher income tax thresholds, the removal of the new 39c rate and various reductions to new taxes on landlords. He estimated the top 10% of income earners would receive almost half of the $8.5b worth of PAYE income tax cuts, while the bottom half of taxpayers would get just 6%. Landlords would receive a further $2.5b.

“It’s hard to understand why in a cost-of-living crisis that disproportionately harms the poorest, you would design a package that is so heavily skewed to those who need it the least. More than half of taxpayers would receive either $2 a week or nothing at all.” CTU Economist Craig Renney in his analysis.

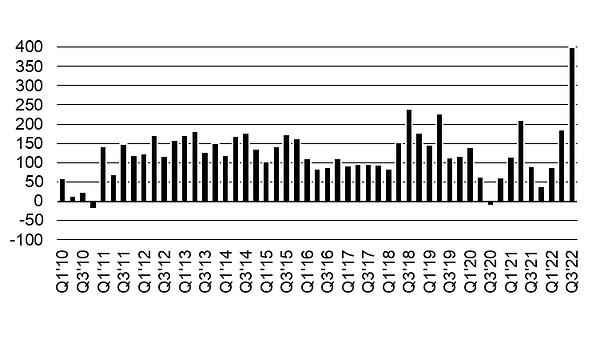

Here’s a summary of that analysis in table form, and the distribution of the benefits from the PAYE tax cuts below in bar chart form:

Yeah…Definitely Nah - National Finance Spokeswoman Nicola Willis was quoted as rejecting the analysis, saying National had yet to release the exact detail of its policies. She also questioned Renney’s motivations, given his previous job as an adviser to Finance Minister Grant Robertson.

‘And there’s this too’ - Elsewhere, Willis said Te Pūtea Matua (RBNZ) Governor Adrian Orr may have breached the Reserve Bank’s charter by giving a public speech on September 30 after receiving briefing papers on September 29 for a Monetary Policy Committee decision on October 5, but Reserve Bank officials said there had been no breach as Orr hadn’t read the papers before speaking, given he had been offsite during the previous day, the NZ Herald-$$$’s Thomas Coughlan reported this morning. Here’s Christopher Luxon this morning on Newshub as well.

Nearly there - CoreLogic released its estimates of house values in October, saying its House Price Index was down 0.6% in October from a year ago and has fallen 4.5% over the last three months. That was more than the previous record quarterly fall of 4.4% seen by the end of August 2008. CoreLogic included commentary about an assumed 18% fall in nationwide prices from the peak late last year. It noted Wellington values were already down 13% on an annual basis, including a 16.8% fall in Lower Hutt.

“All banks have revised their house price forecasts down in the wake of the latest data and if we assume an -18% fall from peak-to-trough, that would take the average price to $855,000, still a lot higher than March 2020. The average value prior to the pandemic hitting our shores in Feb 2020 was $723,000. To get back to that value would necessitate a -31% fall – not something anyone is forecasting, yet.” CoreLogic Head of Research Nick Goodall in his October report.

Just briefly:

Dozens of communities at risk of floods - RNZ

Parker’s Tax Principles Bill may slip past election - Stuff

In geo-politics, the global economy, business and markets

Slow runner - The Reserve Bank of Australia hiked its official cash rate for a seventh consecutive time yesterday afternoon, but looks to have finished the most aggressive part of its tightening. It lifted its rate by 25 basis points to 2.85%, as most economists had expected, despite hotter-than-expected inflation figures last week and despite the central bank increasing its forecast peak for inflation to 8%. Economists and the markets now expect Australia’s rate to rise to a peak of just below 4% late next year.

Ahead of the pack - These slower Australian rate hikes mean Te Pūtea Matua (RBNZ), which started sooner than other central banks, is now well ahead and still racing. Our OCR is already at 3.5% and is expected to be increased as much as 75 basis points to 4.25%, which is its last opportunity this year for a change. Economists here also expect our peak to go towards or even over 5%, well ahead of Australia on 4%.

Losing in translation - Britain’s Security Minister Tom Tugendhat said overnight Britain planned to close over 100 Confucius Institutes, which have been accused of being vehicles for China’s political influence programmes overseas, and are seen by new UK PM Rishi Sunak as a security risk.

Windfall profits tax - The British government should impose a windfall profits tax to help reduce its fiscal deficit, former Bank of England Deputy Governor Charlie Bean said overnight. Bloomberg

Just briefly

Biden set to threaten oil majors with windfall profits tax - White House Press Office via Twitter.

Musk considering charging US$8/month for Twitter’s blue tick WSJ1

China moves Covid lockdowns to ‘stealth mode’ - Bloomberg

Russia orders wider evacuation of southern Ukraine - Reuters

Quote of the day

British political life

“They’re already coming for me, Kwasi.” Former UK PM Liz Truss, in tears on Oct 14, as she was about to sack her long-time friend Kwasi Kwarteng, as the Sun reported in a blow-by-blow account of her final days.

Chart of the day

Fiat currency creators like gold

Scoop of the day elsewhere

Profundities, curiousities, spookies and feel goods

Useful longer reads and watches

The Craic

Fun things

Ka kite ano

Bernard

Gift link that opens for free.

Share this post