Dawn chorus: An invidious and unfair debt lid

Wellington Council should lift its self-imposed debt 'lid' from 225% of revenue to at least the LGFA's self-imposed limit of 300%; Councils also need more revenue linked directly to population growth

TLDR: The central Government and ratepayers have put themselves and Councils in an invidious and unfair position where out-of-date and arbitrary rules about debt are stopping councils from addressing their massive housing affordability and climate change challenges.

All over the country, the pressure of decades of under-investment in infrastructure, much faster than expected and planned-for population growth, and these debt limits, are putting councils in the growth cities (Auckland, Hamilton, Tauranga, Wellington, Queenstown and Christchurch) under enormous financial and social pressure. Some of these limits are self-inflicted and ideological, but often councillors, Mayors and ratepayers simply haven’t been advised about how the worlds of bond investors, interest rates and central bank bond-buying have changed dramatically since those limits were set.

Understandably, councils are cracking at the seams under that pressure. Tauranga’s Mayor Tenby Powell resigned and called in a commissioner after the scale of the infrastructure building overwhelmed the Council, forcing it to prepare for double-digit rates increases. Councillors elected on rates restriction platforms rebelled and chaos ensued, in part because councils don’t have the same party, parliamentary and cabinet disciplines that voters are used to on the national stage.

Auckland is the biggest and also under pressure as Covid-19 hit its revenues and therefore reduced its ability to borrow up to the 300% of revenue limit set by the Local Government Funding Agency, which borrows in bond markets on behalf of 91 Councils. Only Napier and Dunedin don’t use the LGFA. Auckland has launched a ludicrous round of austerity and cost-cutting because it fears its revenue to debt ratio might trigger a credit rating downgrade. It fears that might cause a sovereign downgrade, which would in turn push up longer term interest rates.

That assumption is questionable in various ways, but espcially now that Standard and Poor’s has just upgraded New Zealand’s sovereign rating to AAA.

Now the focus is on Wellington today where the Mayor Andy Foster pushed to sell or lease half the library and cancel some new cycleways just so the Council could keep under its own self-imposed debt limit of 225%. The Council should at least lift that limit to the 300% limit set by LGFA and then start challenging the entire focus on debt limits and debt affordability.

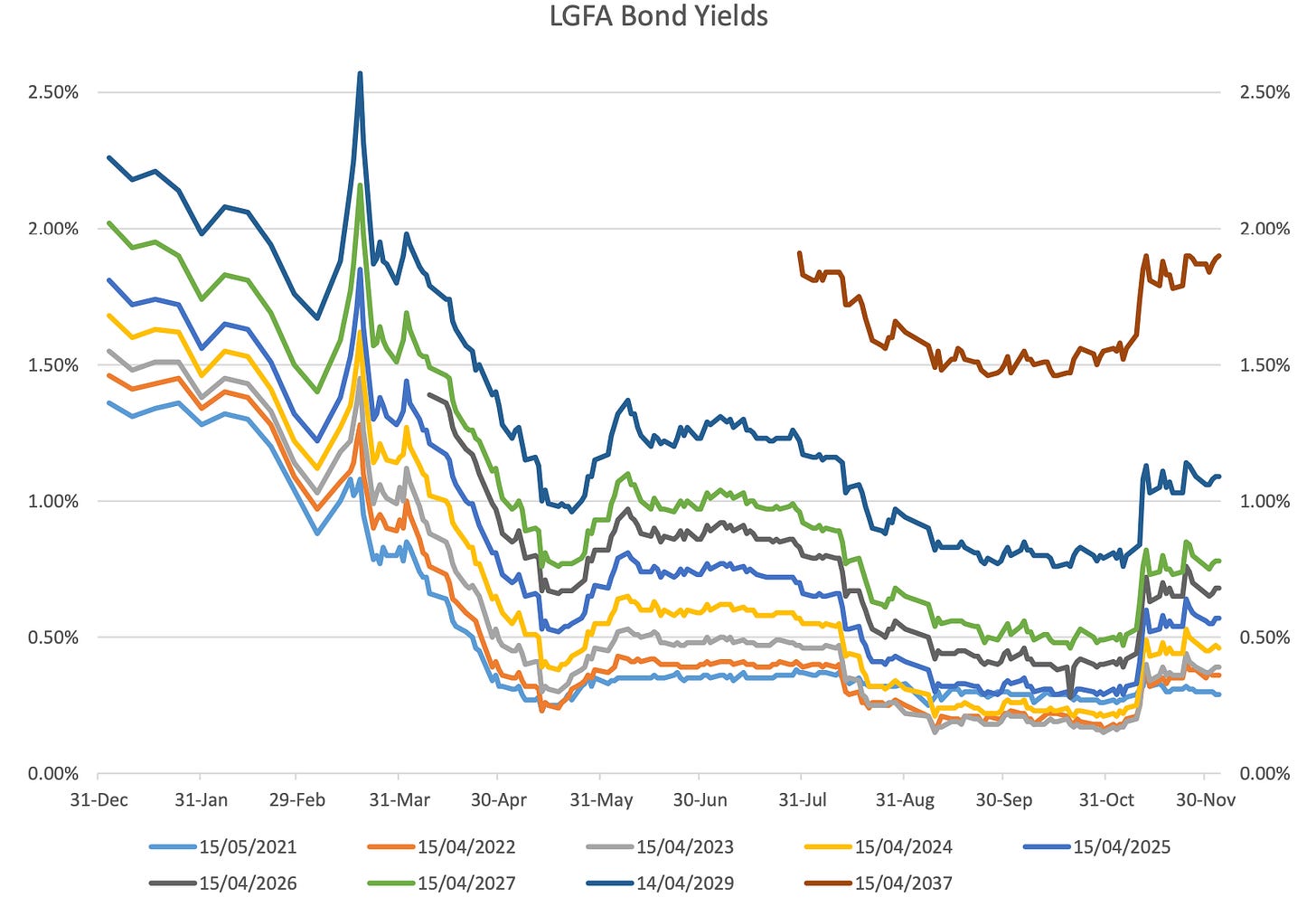

The reason: LGFA has raised about $2b on behalf of councils since the onset of Covid-19 with an average interest rate of 0.99 percent, and the Reserve Bank bought $1.75b worth of those and other LGFA bonds at an average interest rate of 0.76%. The Reserve Bank actually needs councils to borrow a lot more than they are, and it has their back. Here’s what its intervention in March did to borrowing costs.

Wellington Council should lift its self-imposed debt 'lid' from 225% of revenue to at least the LGFA's self-imposed limit of 300%. Councils also need more revenue linked directly to population growth, potentially through GST rebates on rates and building materials, and forcing Government agencies to pay rates.

Elsewhere in our political economy

In the global political economy

Signs o’ the times news

Charts of the day

Weekend reads or listens

PPS Some fun things