TLDR: It’s great the Government has righted one of the wrongs of the ‘Mother of all Budgets’, but there were many, and the work has only started. It should have done much, much more with its pristine balance sheet and a torrent of literally free money sloshing around the world desperate to be invested in Government bonds.

The Government remains handicapped by the bond-vigilante-driven thinking from the early 1990s about keeping debt low, and is missing a giant opportunity to invest heavily in physical and social infrastructure to repair the underinvestment damage of the last 30 years.

Now it should adopt the rest of the WEAG recommendations to increase Working For Families tax credits and widen it out to non-working families. Then there’s the still-massive investment needed in housing, education, health etc.

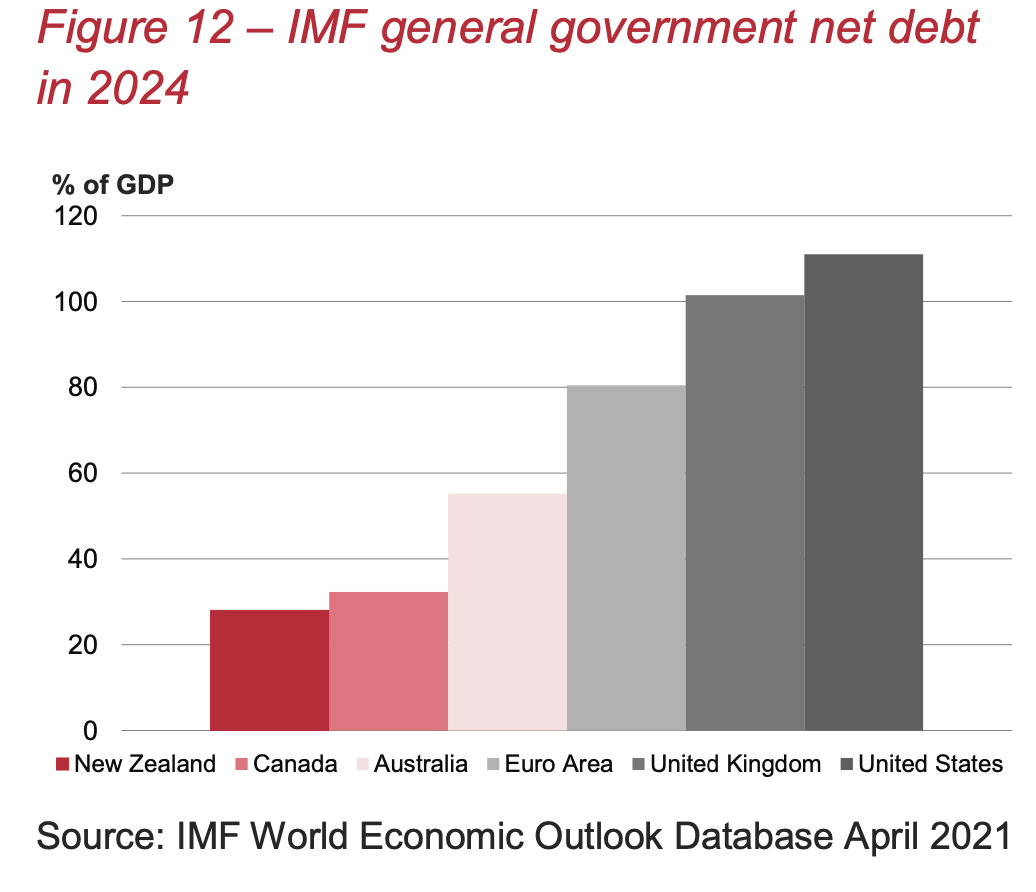

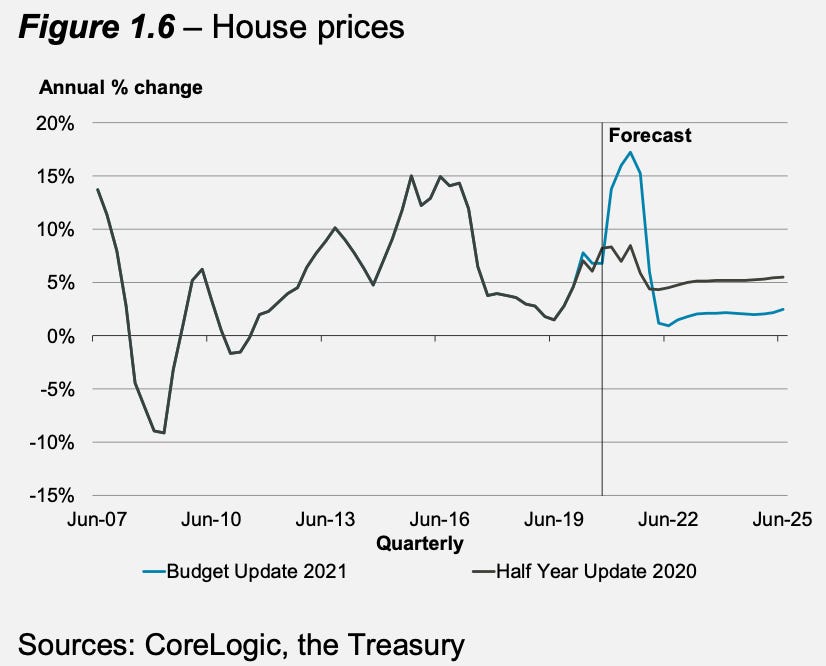

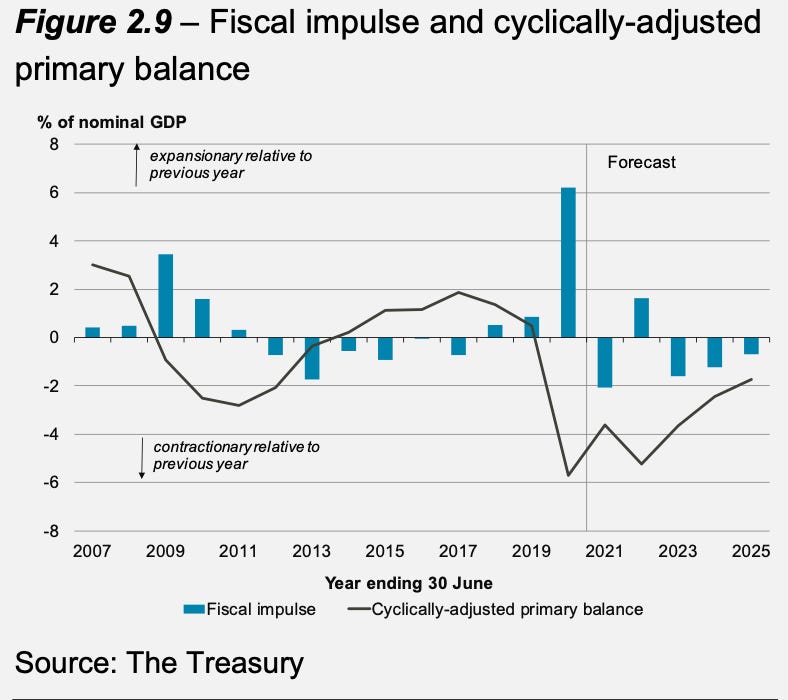

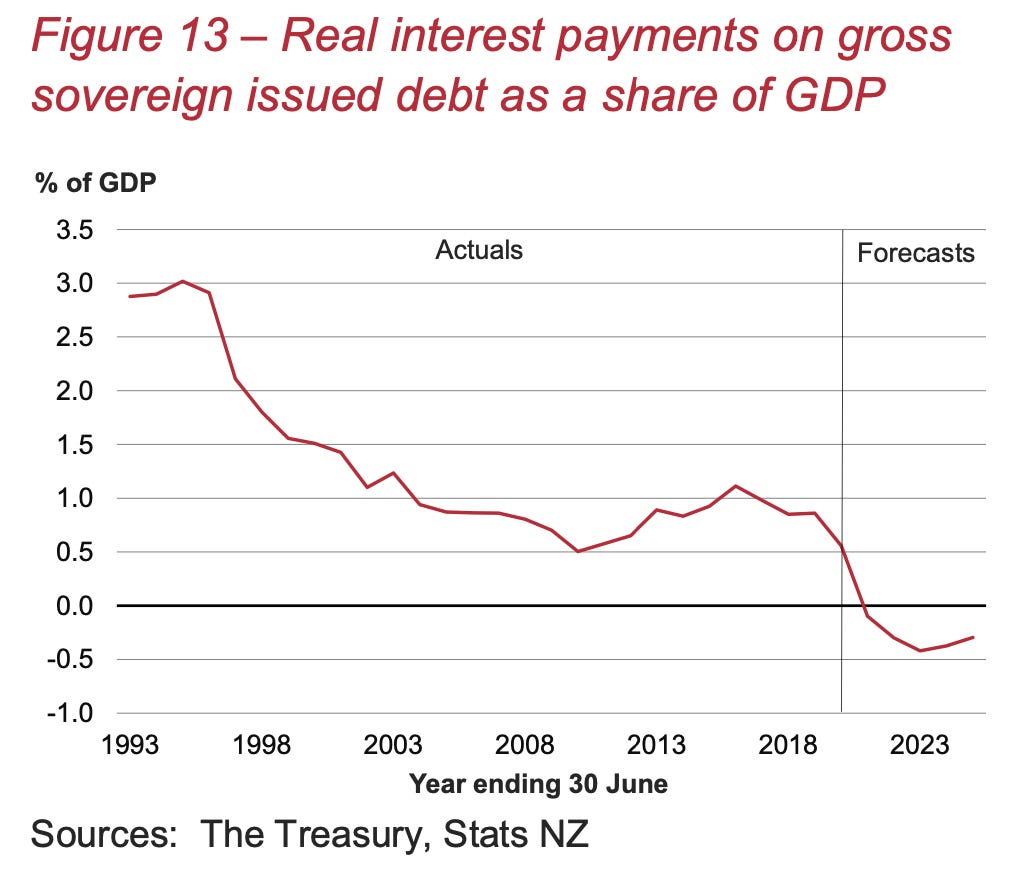

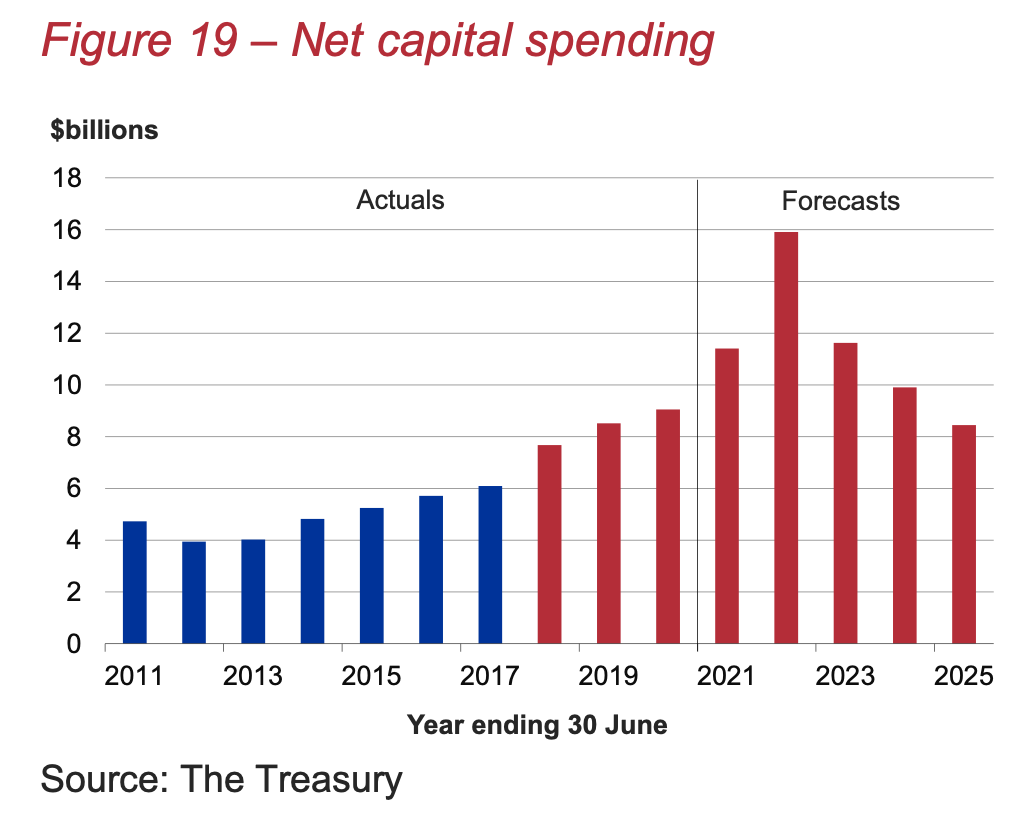

The tragedy is in the bottom four top charts showing the Government running a contractionary fiscal policy for three of the next four years and reducing infrastructure sending from 2022, even though real interest rates will be negative and our debt is miniscule relative to other AAA-rated countries. It will mean low interest rates for longer, high house prices for longer, and yet more delay and lost opportunity cost of reparing our infrastructure deficits.

What was unveiled today

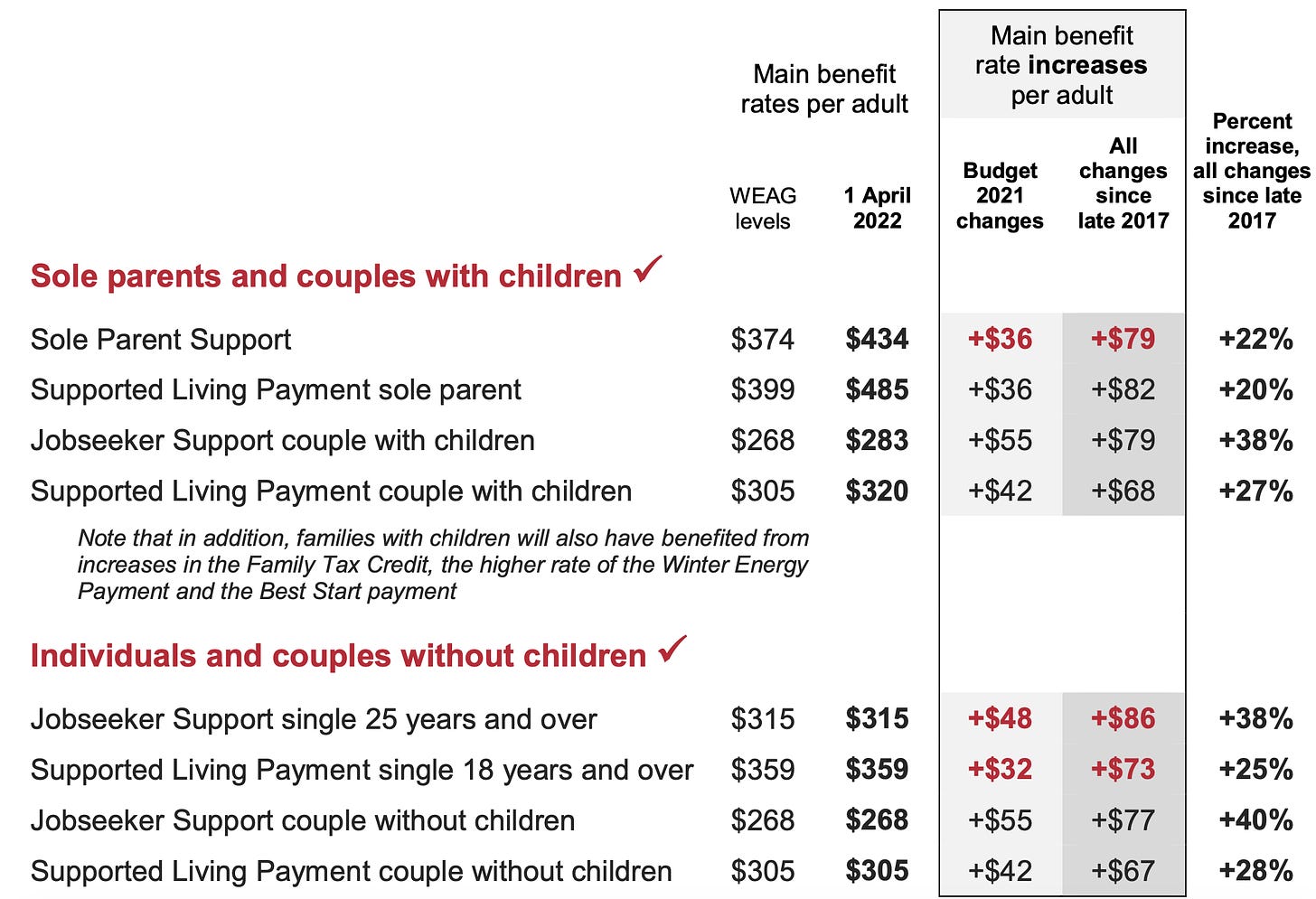

The Labour Government has unveiled an increase in main benefits of $32-$55 a week in Budget 2021 at a cost of around $700m a year, but has ‘banked’ via debt reduction about half the $20b of the projected improvement in tax receipts seen since the election because of stronger-than-expected economic growth.

Finance Minister Grant Robertson says the benefit hikes right the wrongs of Ruth Richardson’s benefit cuts of the ‘Mother of All Budgets’ in 1991, and deliver on one of the main the recommendations of its own Welfare Experts Advisory Group to reduce child poverty by simply increasing incomes for the poor.

However, the Government has not gone as far as many child poverty campaigners asked for, or the WEAG recommended, particularly around increasing incomes for those receiving Working For Families and removing some of the punitive sanctions for beneficiaries.

For example, the benefit increases are phased in with more than half of the benefit increases not delivered until April 1 next year. The first tranche start from July 1 this year.

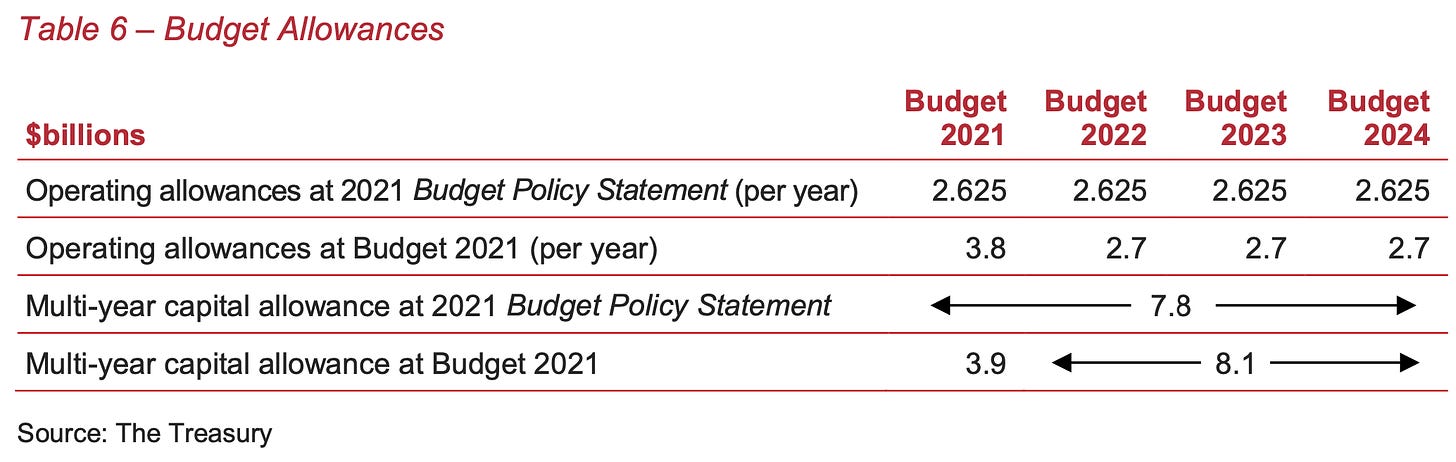

The Government chose to increase its allowance for new operational spending from its December and February view by around $1.2b in 2021/22 to $3.8b, but only nudged it up by around $75m to $2.7b for the following three years. The plan for new capital spending was increased by around $4b to $12b for the next four years.

The key details in Budget 2021 are as follows

Main benefit increases of $32-$55 a week at a cost of around $700m each year for the next four years

$380m for 1,000 new Māori homes and repairs to 700 Māori owned homes

$350m of the already announced $3.8b Housing Acceleration Fund to be ringfenced for Maori (seen leading to 2,700 homes)

Indexation of child care assistance thresholds to wage inflation to help 1,000 families,1500 kids and extra 3,300 places in out of school care at a cost of $22.3m over 4 years)

Social insurance tripartite working group (Govt/BusinessNZ/CTU) to design social insurance to have 80% of income after losing their jobs.

Training incentive allowances reinstated for 16,000 retraining workers of up to $114/week for course costs at a cost of $127m over four years

Hypothecation of Emissions Trading Scheme revenue for Emissions Reduction Plan

An extra $200m a year for Pharmac to $1.4b

Spending of $486m to begin transition for DHBs to the new nationalised health system

An extra $2.7b of spending for DHBs over four years as they transition to the new national system. Operational spending via DHBs to rise by $675m/year and capital spending increased by $700m over four years

Extra 320 cochlear implants by 2025, almost double current rate

A extra $516.6m for health infrastructure, including a national health information platform

The resumption of rail wagon assembly at Hillsdale in Dunedin to build 1,500 wagons, creating 145 jobs there. Railways to receive 60 new trains and 1,900 new wagons.

The creation of a new rail maintenance hub at Waltham, Christchurch, creating 300 jobs, plus 150 new jobs for IT, maintenance and renewals for NZ Rail

Spending of an extra $131.8m for RMA reforms via the Department for the Environment.

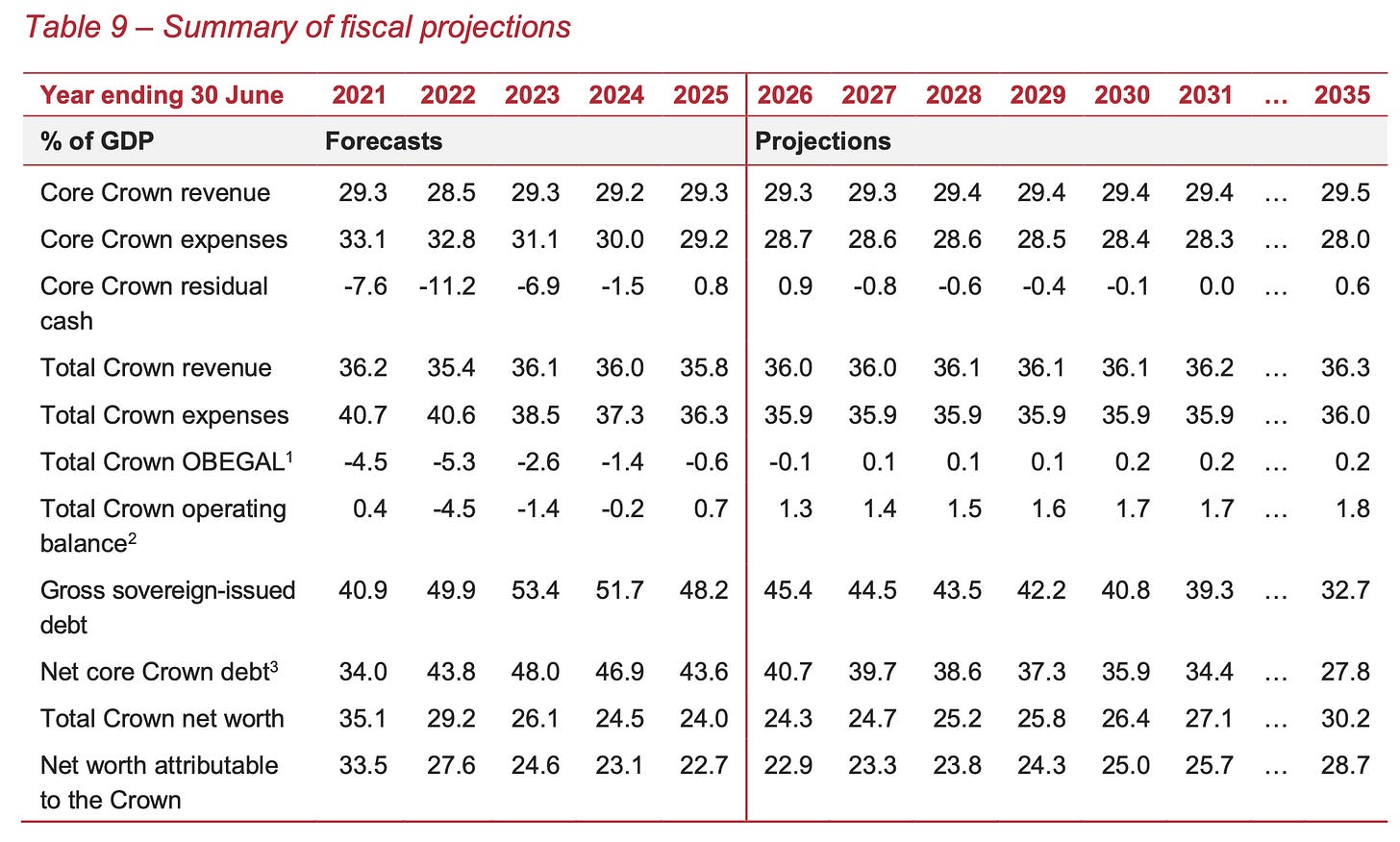

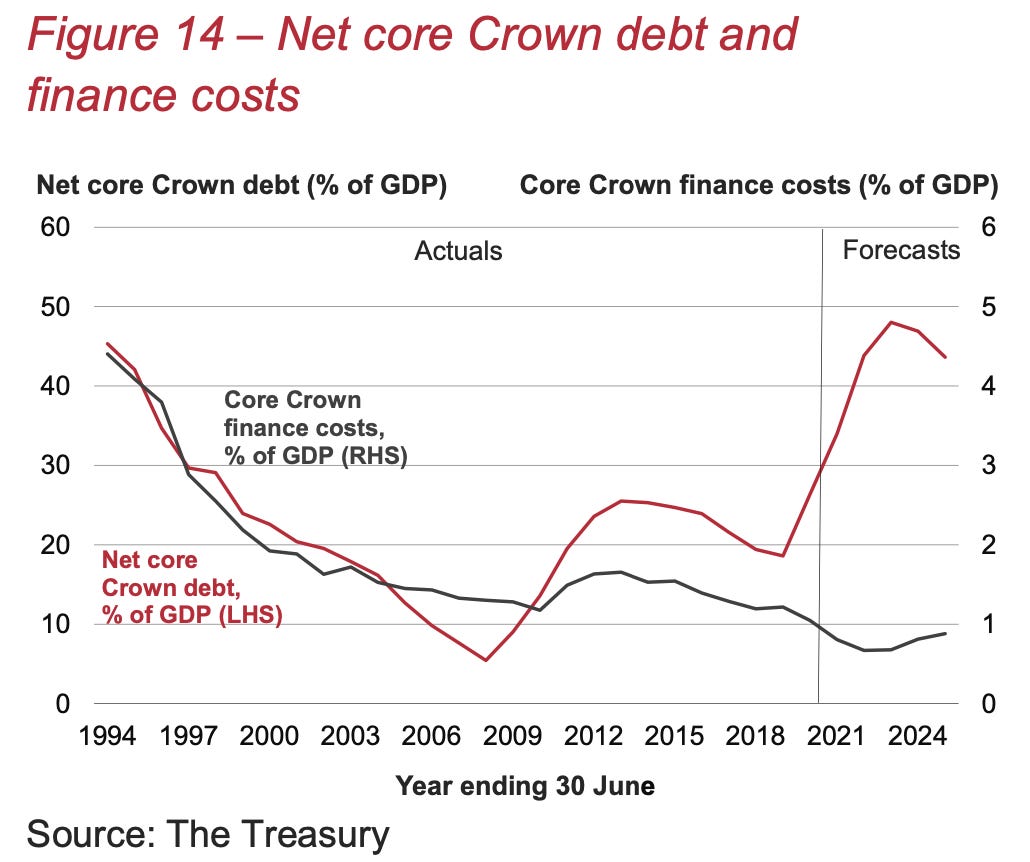

Budget expected to be in surplus by 2026/27, with net debt topping out at around 41.5% of GDP in 2025 vs forecasts of net debt of 55% by 2023 in last year’s Budget.

Charts and tables of the day of Budget 2021

The benefit increases

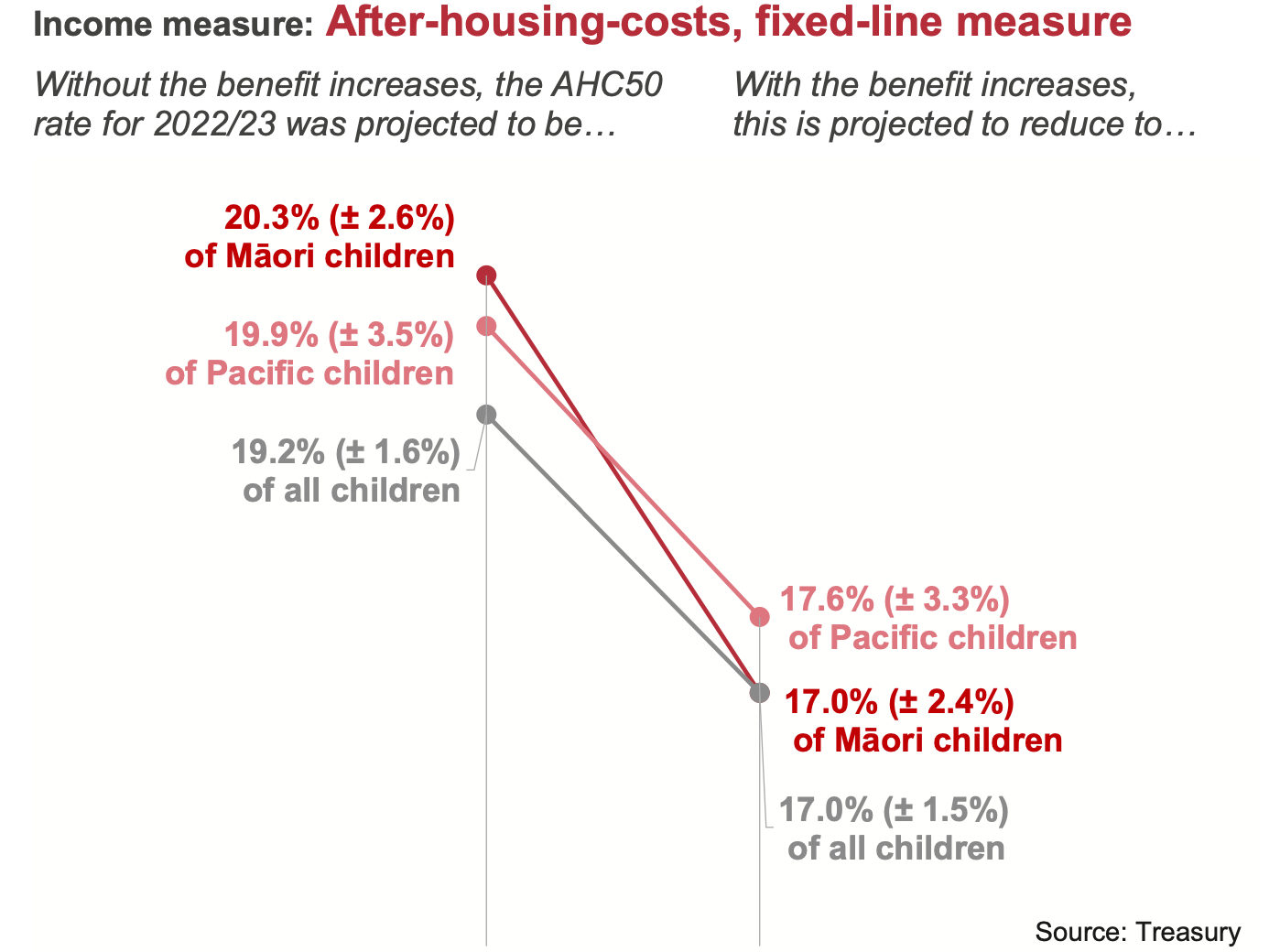

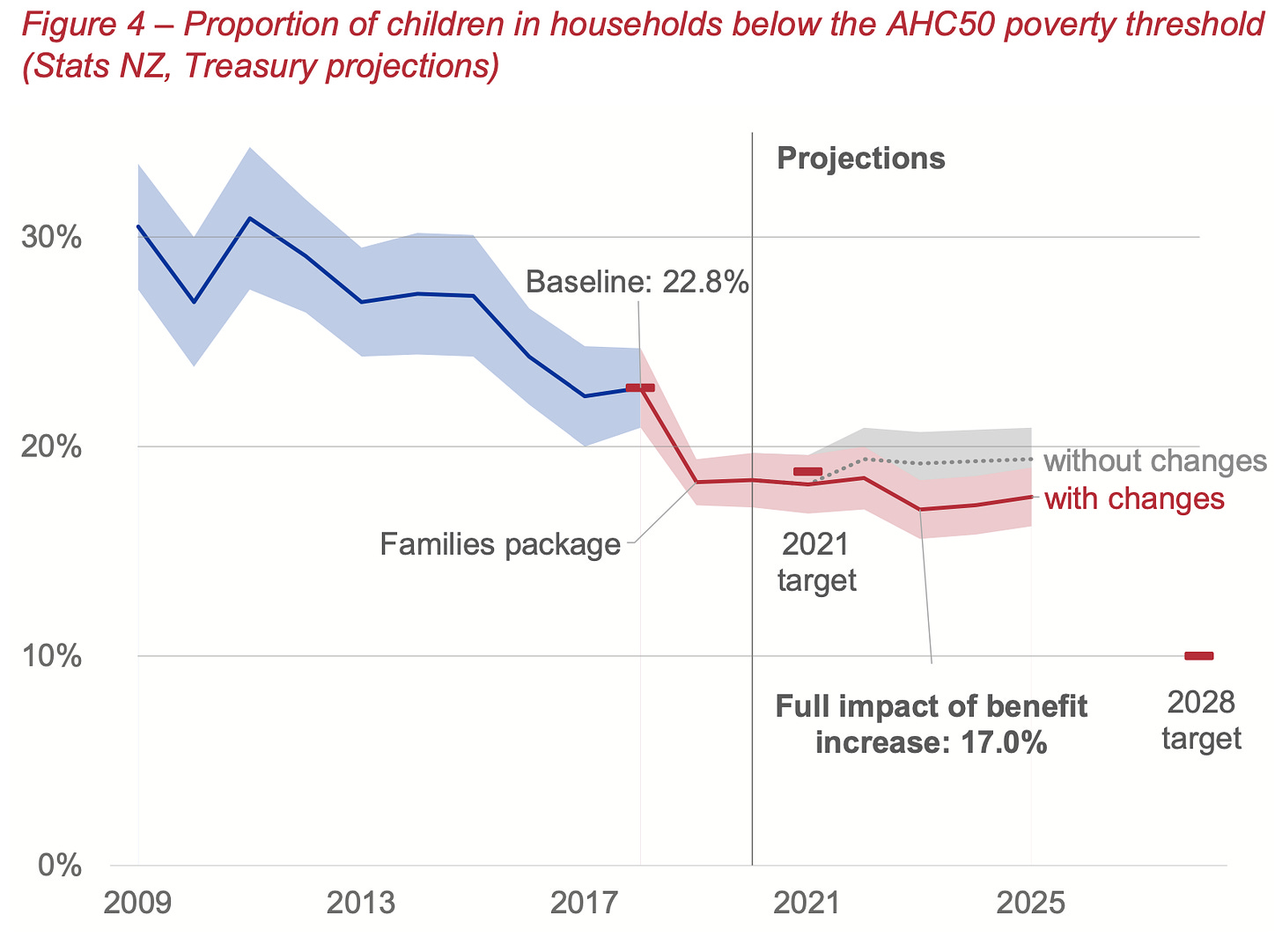

The benefit hikes will reduce child poverty a bit

But there’s a lot more child poverty reduction to go

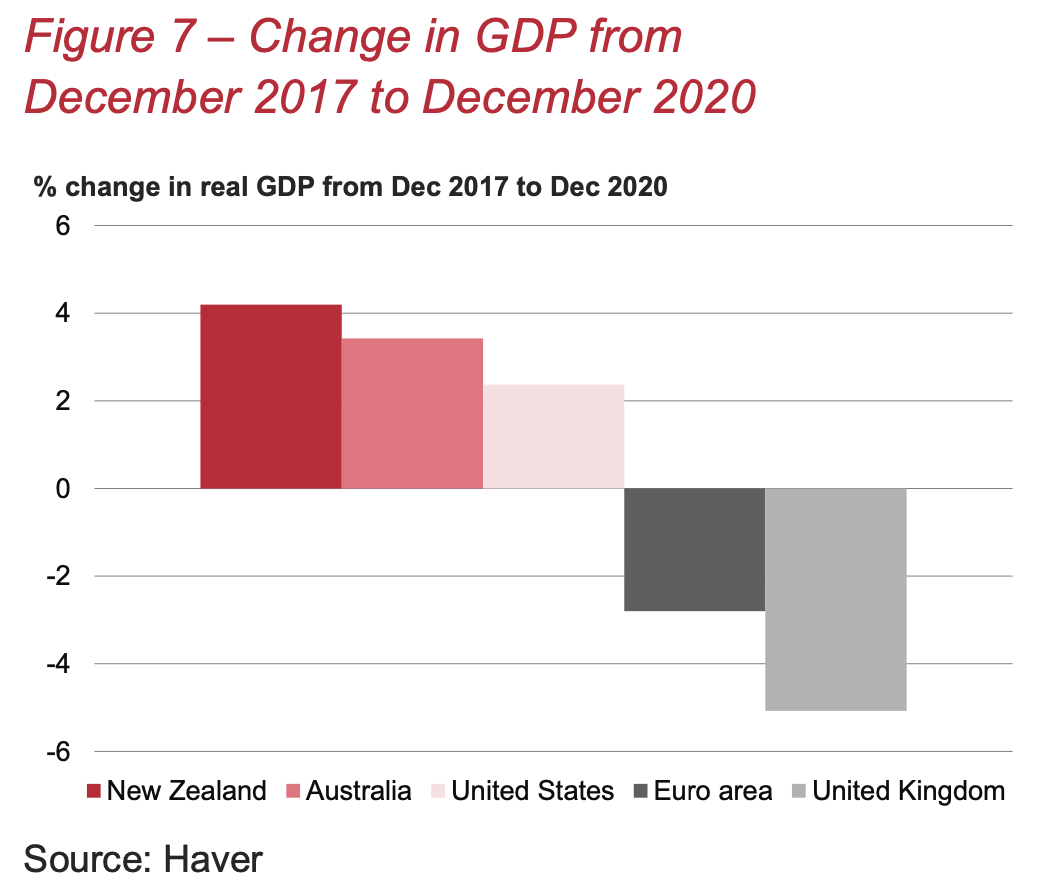

NZ’s economy has outperformed since the 2017 election

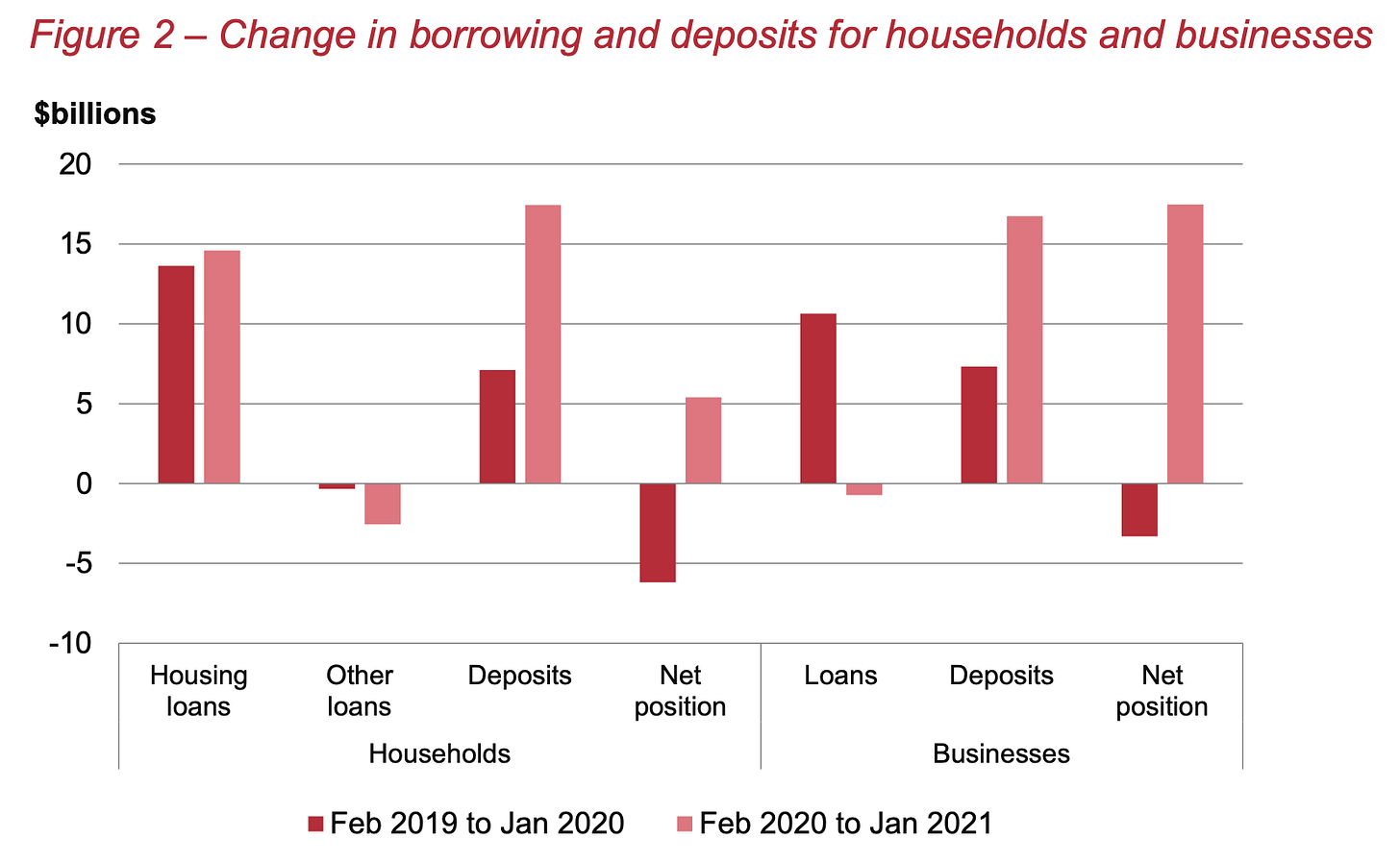

Households and firms saved $22b more than they borrowed in 2020

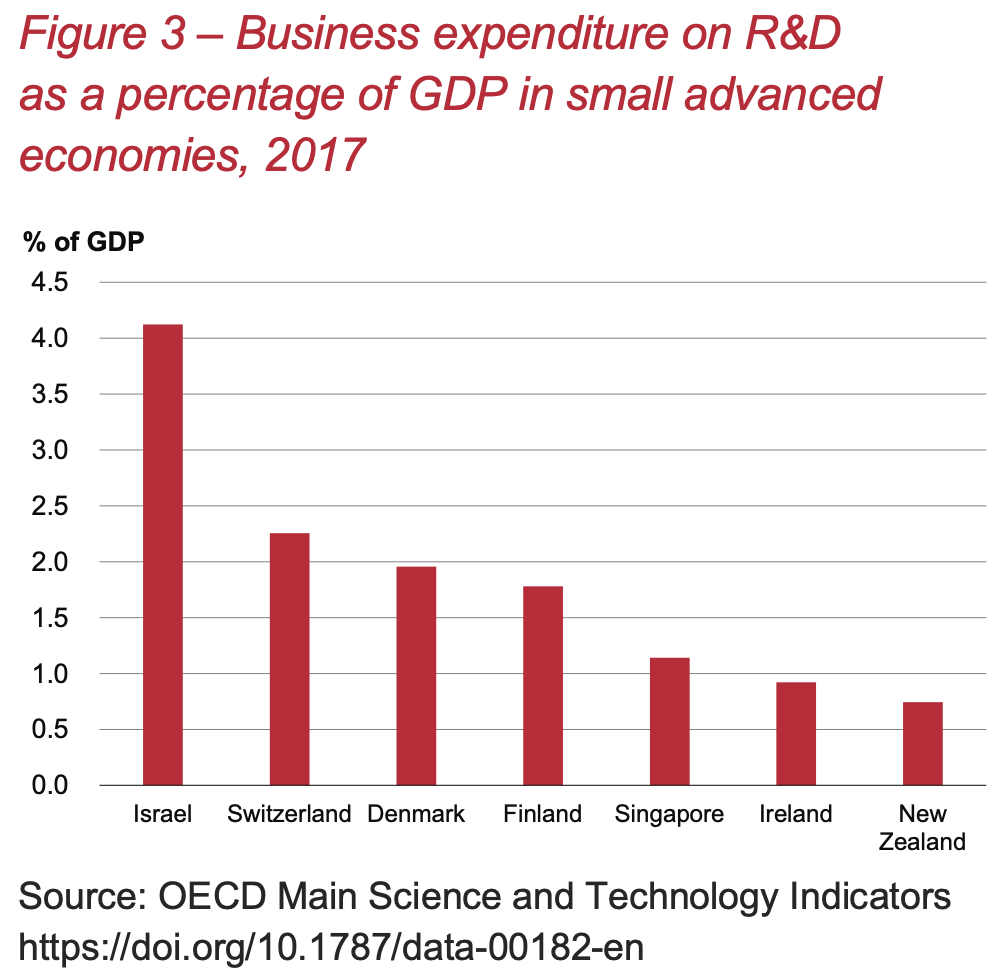

NZ Inc is awful at investing and researching

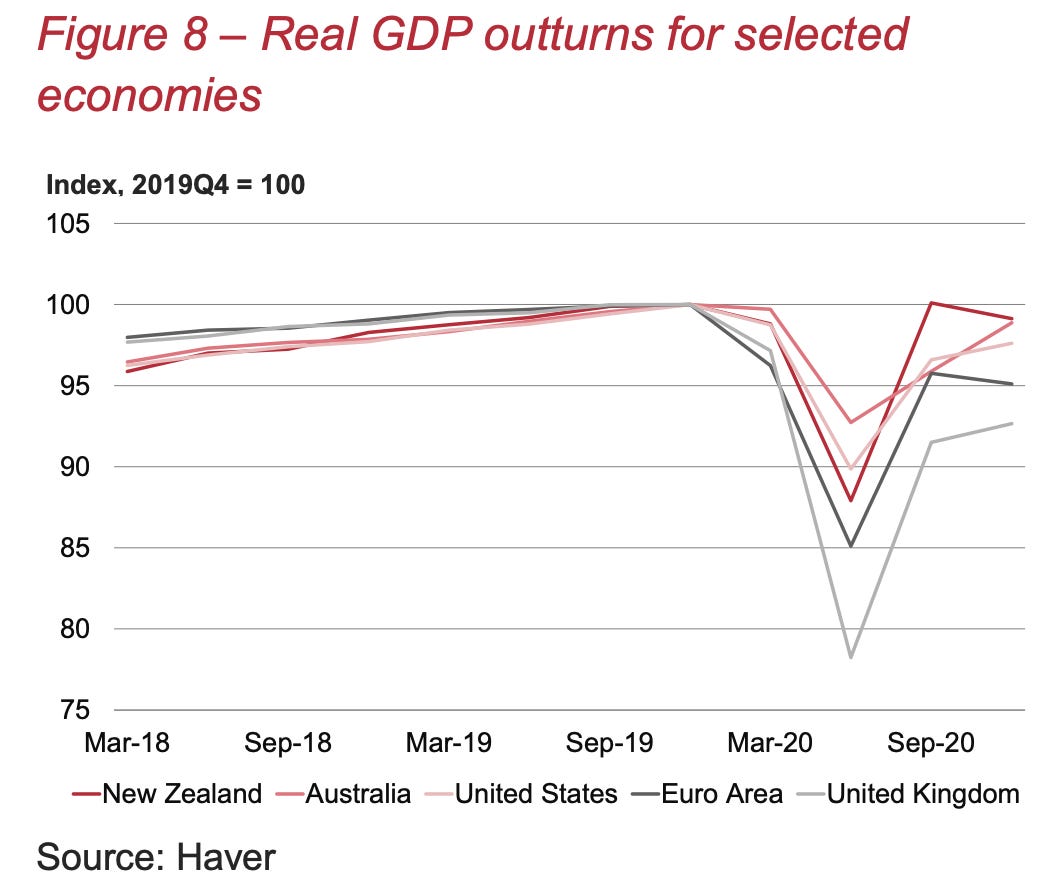

Most of the world has yet to recover to pre-Covid levels

Our public debt is way, way less than other borrowers

What was different today from December 2020

The big picture in the long run: small govt and low debt

Low debt means low interest rates and high house prices

Not a monetary policy mate: A contractionary fiscal policy

The debt costs hardly anything to service

The real cost of public debt is actually negative

Yet we’re not borrowing to fix our infrastructure deficits

We’ll have more reaction and detail tomorrow.

Ka kite ano

Bernard

Budget 2021 special: Righting some wrongs. A bit.