Another looming housing crisis

Retirement Commissioner warns of doubling of retirees who have to rent by 2048 & many more retirees with mortgages costing over 80% of pension; She calls for better supplement access & more homes

TLDR: We know there is an existential housing crisis right now of young families forced to live in motels and paying the highest rents relative to incomes in the world, but there’s a fresh warning today of a looming housing crisis for the elderly too.

Retirement Commissioner Jane Wrightson published here once-every-three-years retirement policy review today with a warning that the number of retirees renting is likely to double to 600,000 by 2048 and that an increasing number of both renters and those with mortgages are spending more than half their pensions on rent and borrowing costs. This challenges the entire basis of our universally -available and non-means-tested NZ Superannuation system because it is based on providing enough income to live well, but only with the assumption the retiree owns their own home.

Wrightson recommended in the review:

the retention of the universally-available and wage-linked nature of NZ Super available from the age of 65;

an increase in the asset threshold for Accommodation Supplement access to $43,700 per person from the current $8,100, which is unchanged from 1993, and to look at inflation-adjusting the threshold;

finding ways to stimulate an increasing supply of affordable, healthy and accessible housing for pensioners, including smaller properties for downsizing and larger properties for multi-generational living;

removing barriers to building on collectively-owned Māori land; and,

researching whether to encourage the availability of hard-to-access reverse equity mortgages and home reversion schemes that would allow home owners to draw down on equity while living in their homes.

The review commissioned research that found the Accommodation Supplement (AS) was already being paid to 50,808 pensioners as of March 2022, up 14% from three years earlier, but that the share of the pension-aged population on AS had increased only marginally to 6% from 5.8%, in part because so many were ruled out by having KiwiSaver accounts and other assets worth more than $8,100.

The dominant narrative of retirees as people who own their own home outright is certainly not true for all. It has always been significantly more reflective of Pākehā than Māori or Pacific People. Retirement Commissioner

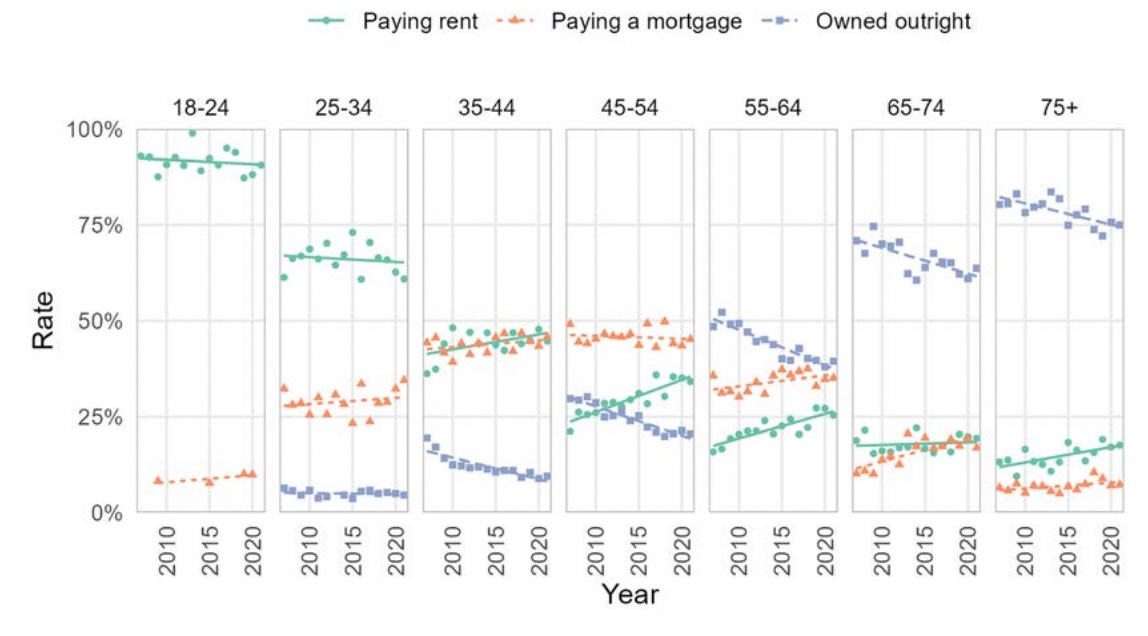

Overall, there are 66% of people aged over 65 who own their home outright, but this is the case for only 47% of Māori kaumātua and just 27% of Pacific matua. Overall, there are 13% of people over 65 have a mortgage, but that includes 18% of Māori kaumātua and 27% of Pacific matua.

There are 20% of over 65s who pay rent, but this increases to 35% of Māori kaumātua, and 46% of Pacific matua.

This is important because there has been an implicit assumption underlying NZ Super that by the time people become eligible, at age 65, they will own their own home outright or be in secure and affordable public housing. This is not explicitly stated in legislation, but reflects the dominant narrative of retirement as experienced largely by Pākehā. Retirement Commissioner.

The report also found a growing proportion of pensioners with mortgages that were consuming most of their pensions, although some may also have other incomes.

Of those people still paying off mortgages, 80% were spending the equivalent of more than 40% of NZ Super on housing costs, and more than half were spending the equivalent of more than 80%.

Of those people paying rent, two-thirds of those aged 65-74 were spending 40% or more of NZ Super on housing, as well as over a third of those aged over 75. Some were paying more than 80% of NZ Super on housing costs, including 40% of those aged 65-74 and 16% of those aged over 75.

Those who own their homes outright much lower housing costs. About 80% of outright homeowners spent less than 40% of NZ Super on housing costs and more than half spent less than 20% of NZ Super on housing costs.

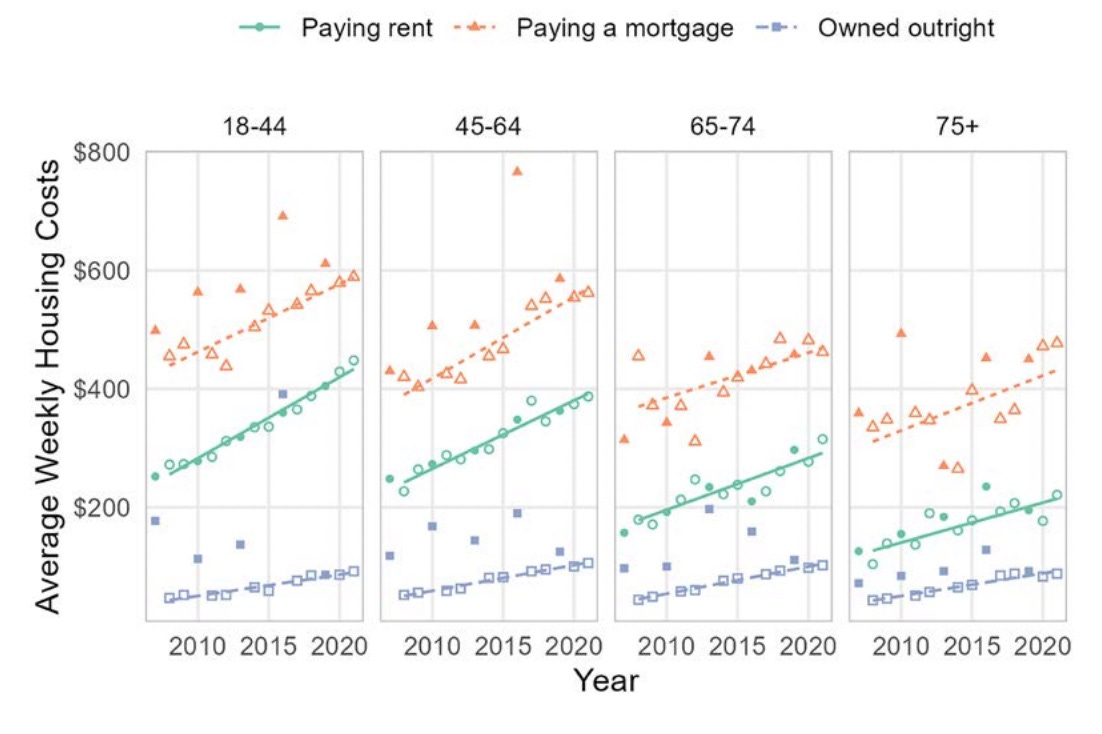

Treasury found that mortgage and rent costs had risen faster than outright ownership costs, with rents increasing at a higher rate than mortgage costs.

The Commission also recommended a closer look at the assumptions about living costs for those on their own, as opposed to couples.

The numbers have changed dramatically since NZ Super’s current settings were locked in place in the early 1990s. In 1986, 87% of those in their 60s were homeowners, with mortgages paid off, and for the most part were not in paid work. In 2018, 80% of those in their early 60s were homeowners, but 1 in 5 were still paying off mortgages, 20% paying rent, and many still in paid work. The balance of home ownership is expected to shift to 60% homeowners and 40% paying rent by 2048, equating to up to 600,000 people.

Scoops of the day

Ka kite ano

Bernard

I stopped reading the recommendations at “increase the accommodation supplement”. The last few decades have proven, categorically, that the “free market” will always fail to deliver on housing needs (particularly for low income households).

When you look at why renting costs have increased faster than ownership costs the accommodation supplement is the reason.

It sets a floor under rental prices and pushes up rents for those who aren’t receiving the accomodation supplement. This pushes up the price of all housing, as the increased rents allow investors to out bid potential home owners. It doesn’t get new housing built, as until recent tax changes, investors have overwhelmingly chosen to buy existing housing stock over building.

The solution is to BUILD social housing instead of funnelling tax payer funds into the hands of investors, who only make the problem worse

And of course unless like Maslows hierarchy of needs if people (not numbers or data) don’t get their formative and other needs met they’re not going to be productive or contributing are they? And the criminals will win by exploiting them. How low will they go , just look around at the state of crime and abuse. There is no bottom line for how low these (usually) men will go to rob others of their rights and oppress others especially women, children and the elderly even in Government by neglect of their duties of cars and family obligations (in law)