TLDR & TLDL: Built at a cost to the public of at least $1.25b, Wellington’s four-lane Transmission Gully highway finally opened to motorists today, locking in place $7.8b worth of tax-free capital gains for land owners in the Kapiti Coast and Horowhenua District Council areas in the last five years of its construction.

It is the biggest example in Aotearoa-NZ’s history of the financial cost of a public infrastructure project being borne by the public at large, but the collective financial benefits accruing to landowners without those benefits being taxed. In effect, renters will pay at least $180m worth of GST and income tax for each of the next 25 years to build and run the motorway, while economic benefits worth billions have already accrued to land owners.

Transmission Gully was the main reason for land prices escalating on the Kapiti Coast and Horowhenua by $2b over the last three years. Renters and land owners will pay taxes of at least $1.25b over the next 25 years. In return, land owners have already banked the $2b in land price escalation benefits. Without paying a cent in taxes on these unearned capital gains.

(Paid subscribers can see more of my financial analysis of the wider costs and benefits of Transmission Gully below the paywall fold and in the podcast above, including my questions to Jacinda Ardern and Grant Robertson at the opening. Please hit ‘like’ on the article if you think it should be opened to the public.)

Update: I have now opened it to the public after requests from paid subscribers.

Elsewhere in the news today:

The Labour Government and the Auckland Council are disappointed the privately-owned Team New Zealand decided to take their America’s Cup defence to Barcelona, despite over $250m worth of public money being invested in the last defence and $99m more promised for the next one, and despite team boss Grant Dalton ordering a $3.7m leisure boat with a $5,200 wine fridge in the last year;

The Government is stumping up another $1.6b in shares and loans to keep Air NZ alive through a capital issue of equity and debt worth $2.2b in total, including a rights issue of new shares issued at a 60% discount to yesterday’s market price; and,

Germany and Austria announced overnight they were preparing to start rationing gas to favour households over factories in case Russia stops gas supplies;

Germany’s council of economic advisers warned a halt in Russian energy supplies would create a “substantial” risk of a recession and unleash double-digit inflation in Germany; and,

Spain’s annual inflation rate hit a 40-year high of 9.8% in March, well above expectations for a 8.4% rise.

The true costs and benefits of Transmission Gully

Lynn and I drove out to Paekakariki yesterday at 6.30 am for the formal opening and ribbon-cutting ceremony for the 27-km-long Transmission Gully, which opened today to Wellington’s motorists. I asked PM Jacinda Ardern, Finance Minister Grant Robertson and Transport Minister Michael Wood questions at the standup just after the ribbon was cut in front of a couple of hundred dignitaries, which included local iwi leaders and former MPs. My questions and answers are in the podcast above, including on who really paid for the road and who really benefited.

You may wonder why so many have been so intensely focused on this one project.

If you’ve not lived in Wellington, you may be surprised with the apparent obsession with what seems like just another road, albeit a particularly big and expensive one.

This is not just another road to Wellingtonians. It has been a dream for 103 years, we were told by the PM yesterday, who referenced a 1919 call by a local MP for a new faster road from Paekakariki to the capital. There’s even a much-believed myth (but not proven) that the US Marines offered to build the motorway in 1942 to get their troops to and from Wellington Harbour and their training camps on the Kapiti Coast. Over 15,000 practiced their Pacific Island landings there during World War Two.

For many Wellingtonians, it has appeared to be a pathway to a much brighter future for at least a couple of decades. It has become the region’s proxy for ‘progress,’ a type of cipher to identify who you were and what you wanted. Wellingtonians mired in cold winds and overcast days dream of driving ‘up the coast’ to calmer and sunnier and flatter climes. Owning a ‘bach’ on the Kapiti Coast or the Horowhenua or moving your parents into a retirement unit there is an indicator of wealth and progress and a ‘better life.’

If only you could drive there faster and safer, and then get back without being stuck in a Sunday night queue for hours as you drive back into the gloom of Wellington. If only you could live on the coast and commute to the city for work.

If only…

Transmission Gully was the project Wellingtonians have been dreaming of and scheming about for as long as I can remember. One of the first conversations I had when I started as the Dominions Post’s Business Editor in 2003 was with then-Editor Tim Pankhurst, who told me it was one of the paper’s main campaigns.

So much hoping and planning and spending and working for an 11 minute time saving. It was a political-life-long ambition for Ohariu MP Peter Dunne, who included it in his 2002 and 2005 supply and confidence agreements with the-then Labour-led Government, and his 2008 agreement with the then-new National Government.

Days before the announcement of the date for the 2014 election, then Transport Minister Gerry Brownlee trumpeted the NZTA’s signing of the Public Private Partnership deal with Wellington Gateway Partnership, a consortium of CPB-HEB Consruction and Ventia, who are controlled by Spain’s CIMIC, to build the motorway and then operate it for 25 years. The private funders included ACC and the global InfraRed Capital Partners.

11 minutes costing $1.25b in today’s money

The deal was designed so the Government, which was trying to get its post-quake and post-GFC debt down, didn’t have to borrow money from 2014-2020 to pay to build the road.

When first agreed in July 2014, the net present value of the 25 years worth of $125m payments each year was estimated at $850m. NZTA said at the time this was $25m less than using the usual procurement and maintenance costs.

Here’s then-NZTA CEO Geoff Dangerfield saying in July 2014 that the Transmission Gully PPP would provide the best value for money and the most certainty of delivery.

“Not only do we have certainty that the project will be built to a strict deadline that will see it opening in 2020, but the PPP contract also requires that the project is designed, constructed, operated and maintained to achieve a high standard of performance in the areas of safety, journey times, reliability, and customer satisfaction.” Geoff Dangerfield in a July 2014 statement.

Since then though, disputes and cost overruns linked to earthquakes, bad weather, covid and various design and construction problems and delays have seen the cost rise to an NPV of $1.25b. That means annual payments of at least $180m, although the exact final cost or annual amounts haven’t been disclosed yet.

Over $200m has already been paid to the consortium to compensate for the extra costs and ensure the delays were ‘only’ two years. An initial review of the PPP process for Transmission Gully done last year found it was consented on a non-PPP basis and therefore was also going to see cost overruns, and the original budget set for it was too skimpy. The Infrastructure Commission is doing a bigger formal review, now that the road is finished and open.

11 minutes worth billions in today’s wealth

The road will save motorists an average of 11 minutes for the trip between the CBD and the Kapiti Coast, and in theory reduce each driver’s petrol usage by even more because of more efficient engine performance at higher speeds and straighter roads. However, carbon emissions may be substantially more in net terms because the motorway is expected to encourage more people to drive the route because it will be faster and safer, and because fewer people are expected to use public transport.

The PM talked yesterday about the productivity benefits from the road with (in theory) more people spending less time travelling and instead working or relaxing. It certainly will make trucks and their drivers more productive were hour worked and litre of diesel burnt. Those benefits will accrue to the trucking companies in higher profits, and/or lower transport prices than would otherwise be the case.

But the biggest crystallisation of the societal benefits is in land values.

Boom time on the Coast

Real estate agents and land owners on the Kapiti Coast and Horowhenua have been the most aware of how these benefits are pumped into land values.

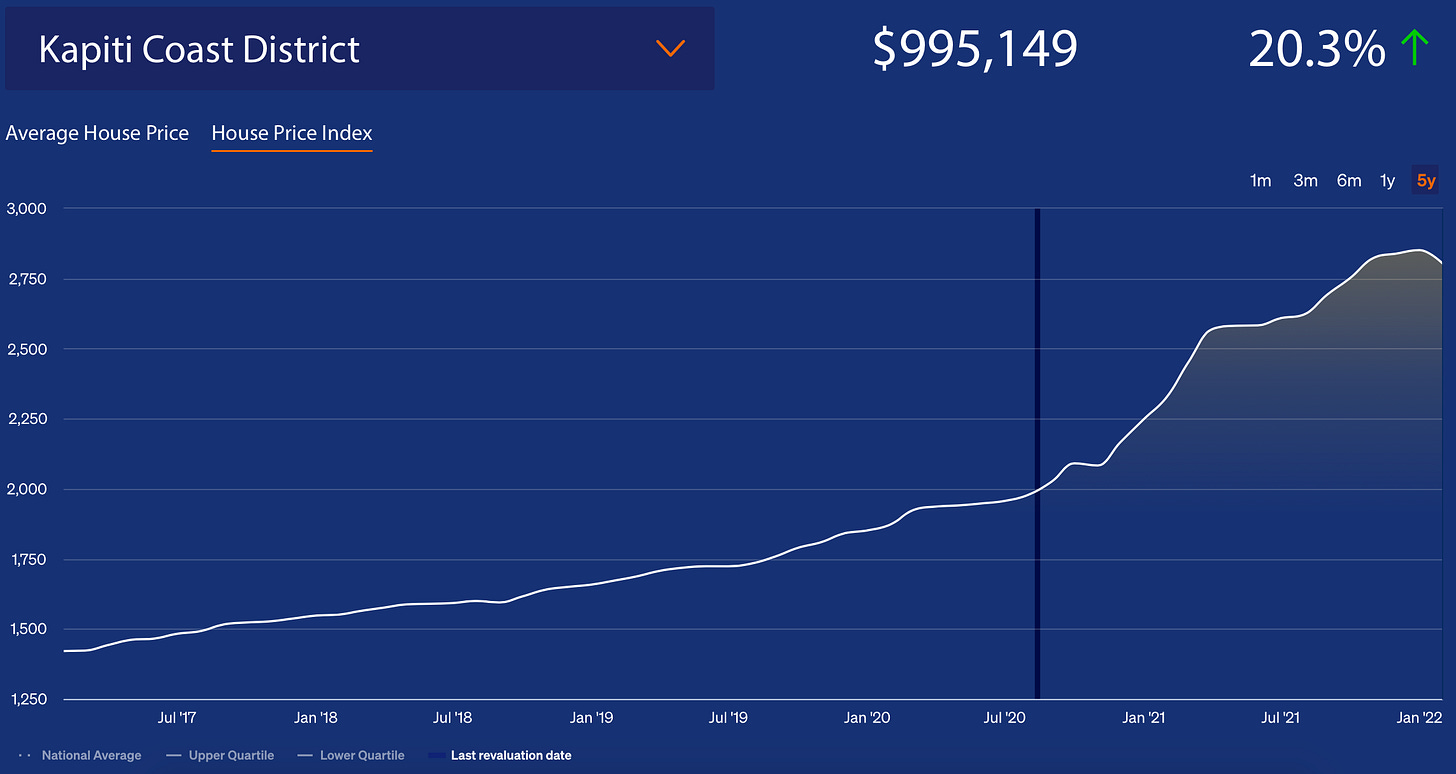

House and land prices have risen substantially more at the northern end of the motorway over the last five years than even in Wellington, which has been among the best-performing regions in New Zealand over the last five years. Construction started in earnest after 2017, especially once it was clear the new Labour Government would honour the contract signed just before the 2014 election. This Infometrics chart shows landowners at each end of the motorway have done versus the rest of the country.

That’s evident in the latest ratings valuation changes noted by area in the Kapiti Coast district. The ‘LV’ refers to the Land Value change between council valuations over the three years to mid-2020, while the CV refers to the Capital Value change.

Tommy’s Real Estate Sales Director Nicki Cruickshank said in July last year there had been “terrific growth with the anticipation of Transmission Gully making the area almost more accessible to the city than many parts of the eastern suburbs in terms of time to get into the city.”

“The appeal of slightly better weather, the anticipation of the ease of travel and good public transport into the city have made the Kapiti Coast more appealing across all age groups whereas previously it was known for being more of a retirement destination.

“But now it is definitely harder for retirees to buy up the coast with competition from all age groups at the moment, in particular first home-buyers.

“A lot of young people are happy to make their lives up the coast, and because of the more affordable prices, compared to the city, we have seen large numbers of first-home buyers looking to establish themselves.” Nicki Cruickshank

A $1.25b road that made the land worth $2b more

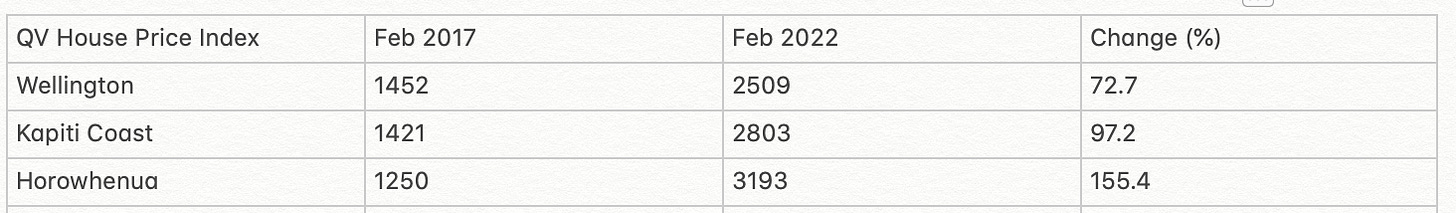

That time saving and the increased possibility of commuting saw prices double on the Kapiti coast over the last five years, while residential property prices rose 155% in the Horowhenua District. Both were faster than the 72.7% seen in Wellington City.

House and land values rose by a combined $10.3b for Kapiti and Horowhenua to $30.6b in their last three-year ratings valuation cycles to 2020 and 2019 respectively (the black line in the QV chart above is the point of the last council ratings valuation). Their land values rose over those three year periods by $7.8b or 80.4% to $17.5b, including rises of $5.4b for Kapiti and $2.4b for Horowhenua.

If land values in these two districts had risen at the same rate as values for the rest of the country (ie as if there was no motorway) over the last three years, then land values would have risen by 51.4% or $5.8b. In effect, Transmission Gully was the major reason for the $2b outperformance of Kapiti and Horowhenua land values over that period. This chart below shows Kapiti’s house price index with the dark line being the 2020 ratings valuation snapshot.

Why aren’t the beneficiaries paying?

These unearned capital gains over the last three to five years are of course yet to be taxed, and then only partially and lightly through the 10 year brightline tax on rental property owners. Owner occupiers and landlords who hold on for enough years won’t have to pay tax.

However, in other countries with capital gains taxes, at least some of those gains are captured. Many cities also use the capital gains more directly to pay for the projects through special land value capture uplift rates. This tax would be imposed by a council on the landowner benefiting from the publicly funded infrastructure such as a road or railway to pay for that infrastructure. It is one of the ways the current Government wants to pay for the Auckland Light Rail line.

National opposes the use of value capture uplift rates and a capital gains tax, while Labour has ruled out a capital gains tax for the political lifetime of the current Prime Minister.

Inflation ‘moon bound’

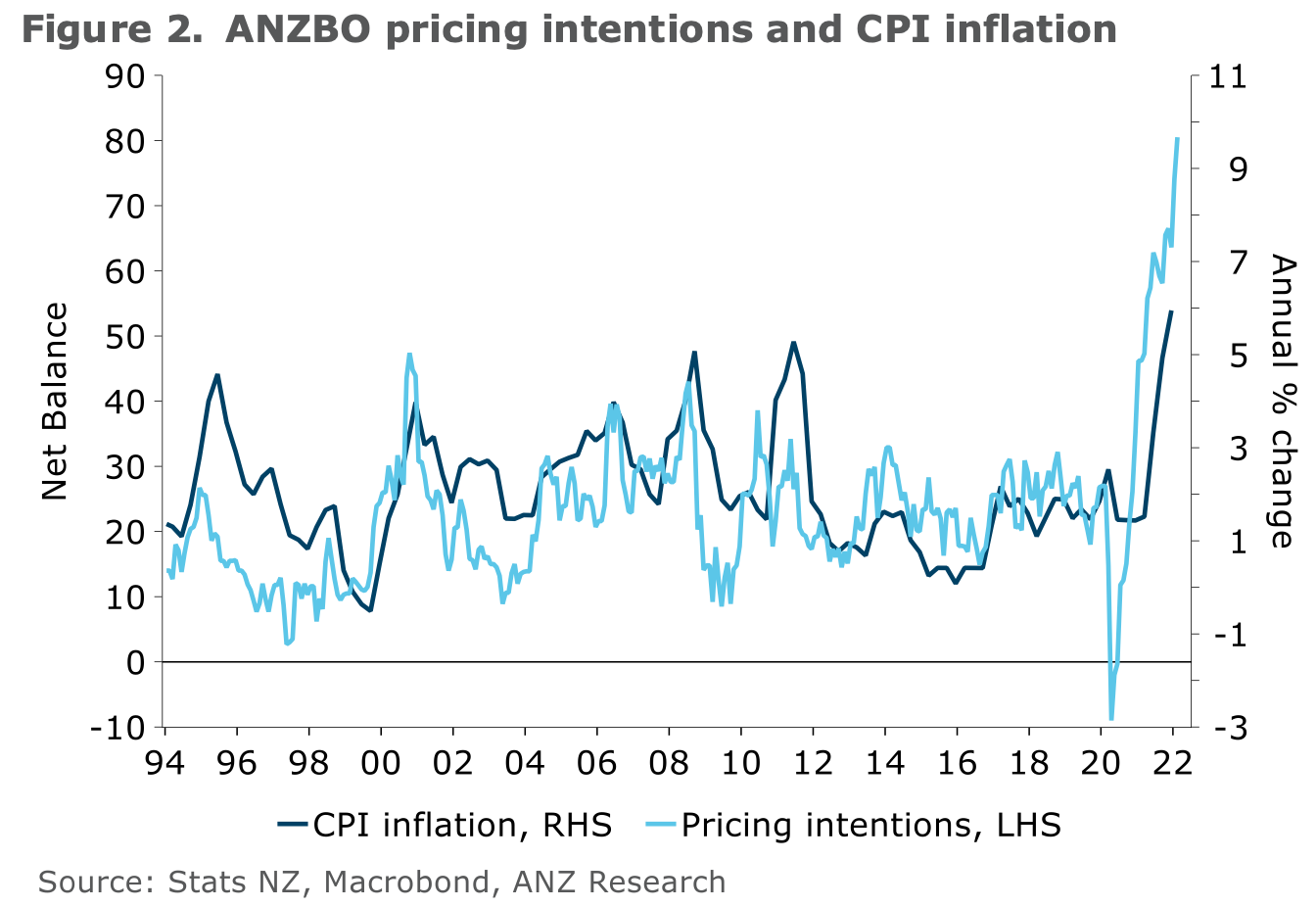

ANZ published its Business Outlook survey of business confidence in March yesterday. It found a slight improvement from very poor levels in February for confidence about the wider economy and respondents’ own businesses. Here’s the main chart to show that.

But the real action was in the second-tier questions about prices, wages and investment confidence. The survey found firms’ pricing intentions were currently in line with CPI inflation of over 9%, which no economist is forecasting, but still…

ANZ Chief Economist Sharon Zollner pointed out inflation expectations over the next year rose another 0.3% to 5.5%, while pricing intentions rose to find a net 81% expecting to raise their prices.

“Indeed, the latter suggests CPI inflation is moon-bound. A remarkable net 96% of firms report that they expect higher costs. Can’t get much more broad based inflation pressure than that.” Sharon Zollner in the Business Outlook note.

Also, ominously for a Government dependent on increasing housing supply to both grow the economy and take pressure off house prices and rents, there was a slump in residential investment confidence over March as the housing market cooled.

The survey also showed that wage growth has yet to take off in response to the recent inflation.

“There’s little evidence of a wage price spiral here, insofar as most firms are anticipating similar wage lifts next year as those delivered in the past 12 months, with the biggest anticipated increase in wage settlements being in the services sector (around 1% higher than in the last 12 months). The retail sector is alone in intending to give smaller wage increases.” Sharon Zollner

Parliamentary exchange of the day

This exchange yesterday (Question 1 via Hansard) between the two deputy leaders and finance spokespeople, Nicola Willis and Grant Robertson, is a vivid illustration of the attack and defence right now in the political economy. National is focused laser-like on cost-of-living issues, but not for the ‘bottom feeders’. It’s much more interested in middle income earners and dangling the prospect of a threshold indexation tax cut. Labour is hitting back by saying National’s tax cuts wouldn’t help the people who need it most, and would have to be paid for with cuts to health and education.

ANZ’s ‘Moon bound’ Business Outlook survey commentary gets a mention too, and David Seymour chips in for good measure.

I’d also recommend their two general debate speeches (Robertson and Willis) for a bit more oomph and two ovations from their MPs behind them.

Ka kite ano

Bernard

PS: Apologies for the length and time. I wanted to do a deep dive. It turned into more of a splashy bomb from a height. It still stings.

A Transmission Gully to $7.8b of tax-free capital gains