Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, October 31:

US and European GDP growth figures overnight show the world’s largest economies, along with that of our nearest neighbour Australia, are still growing solidly because of ongoing Government investment. Meanwhile, New Zealand’s economy is slumping into a deeper recession because of budget cuts described by Treasury as the most severe per-capita in our history, done without any signs of a fiscal or debt crisis that prompted Ruth Richardson’s less-severe ‘Mother of All Budgets’ in 1991.

Scoop of the day: Marc Daalder reports for Newsroom this morning that Te Whatu Ora-Health NZ employs no one to deal with Long Covid, despite the hundreds of New Zealanders debilitated by Long Covid.

Deep-dive of the day: Max Frethey takes a closer look via RNZ’s Local Democracy Reporting on how Tasman District Council doesn’t have a single councillor under the age of 30.

Solutions news: The Wellington City Mission will open its new $50 million building today, which includes 35 transitional housing apartments, a medical centre, dental surgery, social supermarket, chapel and cafe. RNZ

Quote of the day: Tauranga cardiologist Dean Boddington, who is quitting because of burnout, says Health NZ Commissioner Lester Levy is ‘living in La-La Land’ if he thinks the system can cope with $1.5 billion of spending cuts, telling RNZ’s Nine to Noon yesterday: “The whole system relies on people overworking."

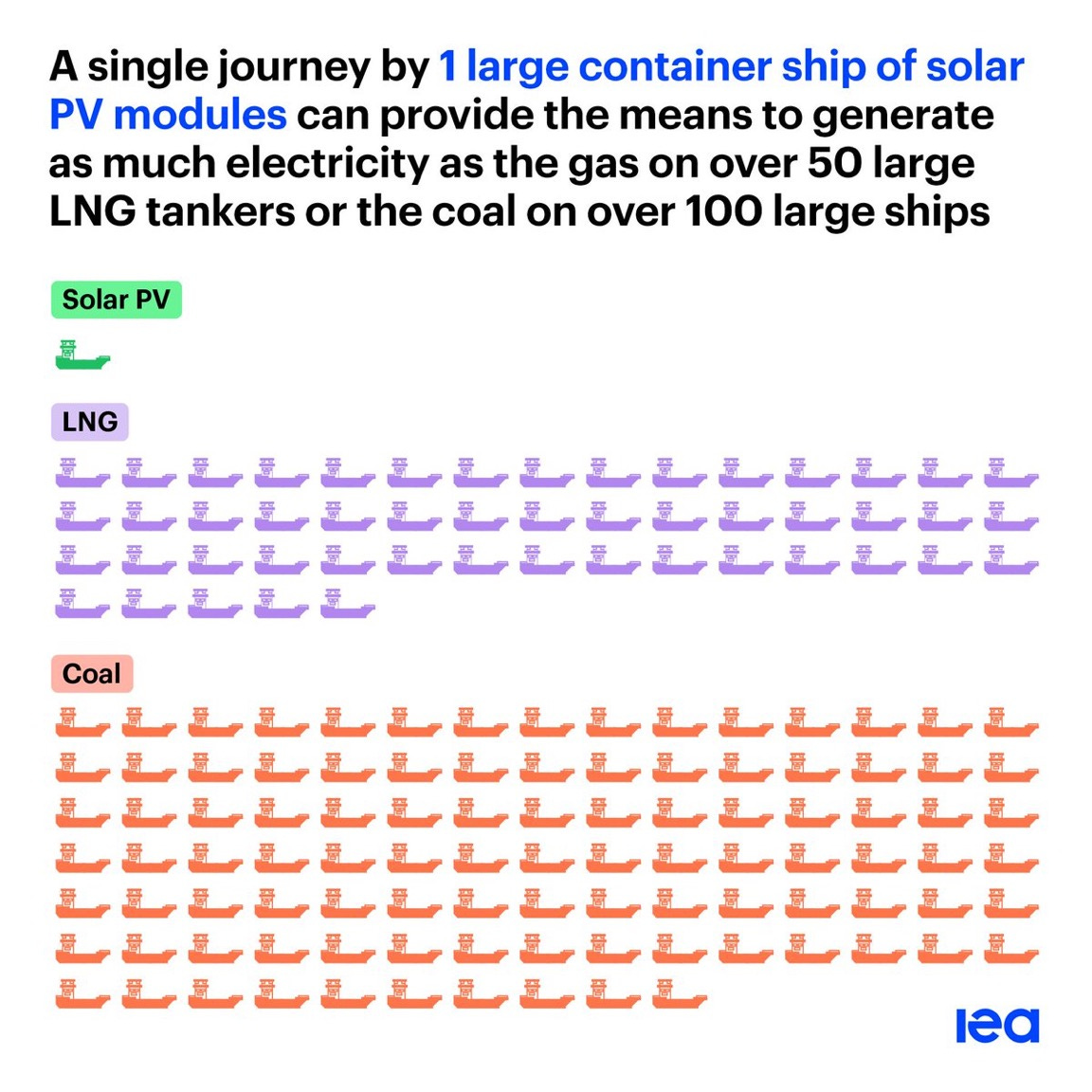

Chart of the day: A single container ship of solar panels can provide as much electricity as more than 50 large LNG tankers of gas or 100 large coal ships, the IEA says in its Energy Technology Perspectives report for 2024 published overnight.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes we’ll open it up for public reading, listening and sharing.)

New Zealand’s self-inflicted economic crash landing

NZ slumps deeper into recession as rest-of-world lands softly

New Zealand’s economy is now well into a third year of economic stagnation and recession that is already deeper in per-capita terms than the 2008/09 recession after the Global Financial Crisis (GFC). Back then, the Key-English Government of 2008-2017 could rightly argue that recession was caused by a drought, the very-global GFC and finance company collapses here, which was why they chose not to deliver tax cuts in their first Budget and instead avoided knee-jerk Government spending cuts.

That National Government was reluctant to repeat the experience of cutting Government spending hard for the poorest in the teeth of a recession, as happened in 1991-1993 because of threatened credit rating downgrades and dangerously-high Government foreign debt and borrowing costs in foreign currency. Then-Finance Minister Ruth Richardson could credibly (although still contested) argue the cuts were needed to keep foreign investors happy and avoid some sort of currency collapse and accelerated blowout in Government interest costs.

There can be no such justification now. New Zealand’s Government debt-to-GDP ratio is less than two-thirds its peak levels of 1991 and the interest costs are less than a quarter of their levels back in 1991, relative to GDP.

Where is the crisis?

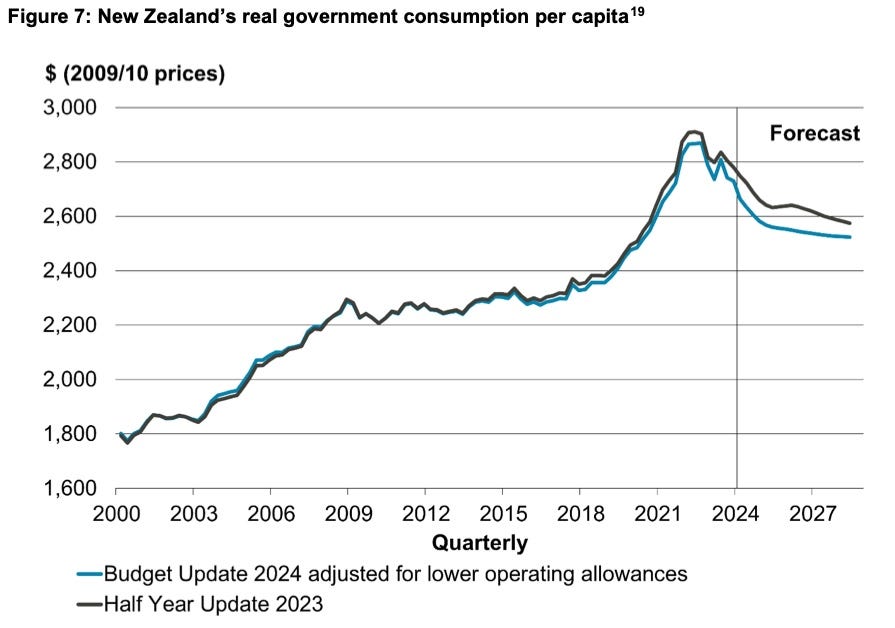

The austerity has only just begun, as Treasury’s Chief Economic Adviser Dominick Stephens pointed out in a speech in late September, which included this chart.

“The Treasury’s latest forecasts assume that most of the return to surplus will be driven by declines in per capita government consumption. The implied speed and size of this decline is generally unprecedented in recent history in New Zealand. “ Treasury’s Chief Economic Adviser Dominick Stephens

I also spoke to Stephens about this for When The Facts Change here:

The Government is betting the private sector will step up to replace the $40 billion or so in spending cuts forecast over the next three years, either through foreign investment to buy assets or households taking on extra debt against an even more inflated housing market.

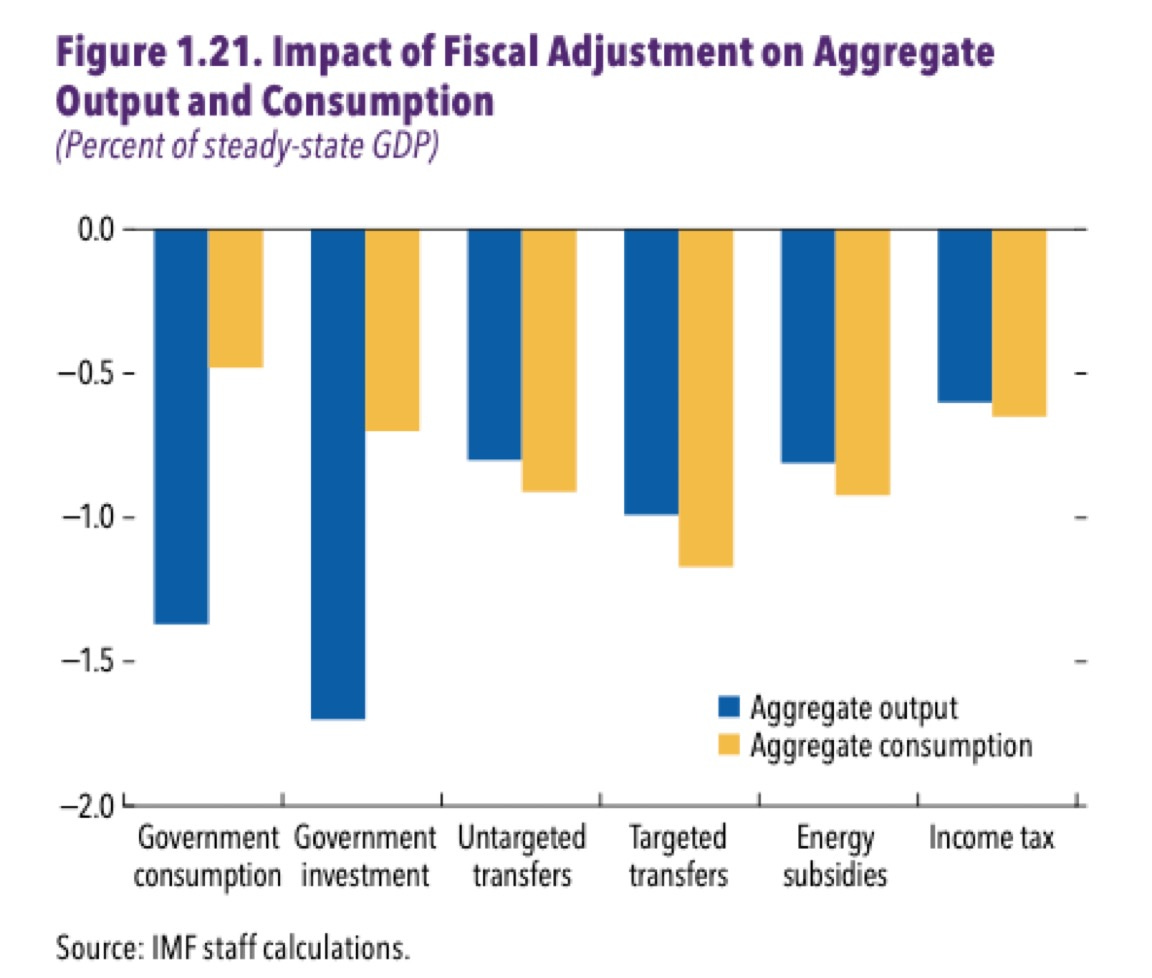

But IMF and other studies show a multiplier effect from Budget cuts that reduces GDP by almost three times more than the Budget cuts, and that the economic effects are worse than improving the Budget position through tax increases, which generate a one to one reduction (rather than a three to one reduction).

“New IMF Fiscal Monitor provides estimates showing that fiscal consolidation measures always reduce output and consumption - cuts in public investment are particularly detrimental. "If taxes are progressive, raising them leads to smaller output losses." Philipp Heimberger, Macroeconomist at the Vienna Institute for International Economic Studies via X

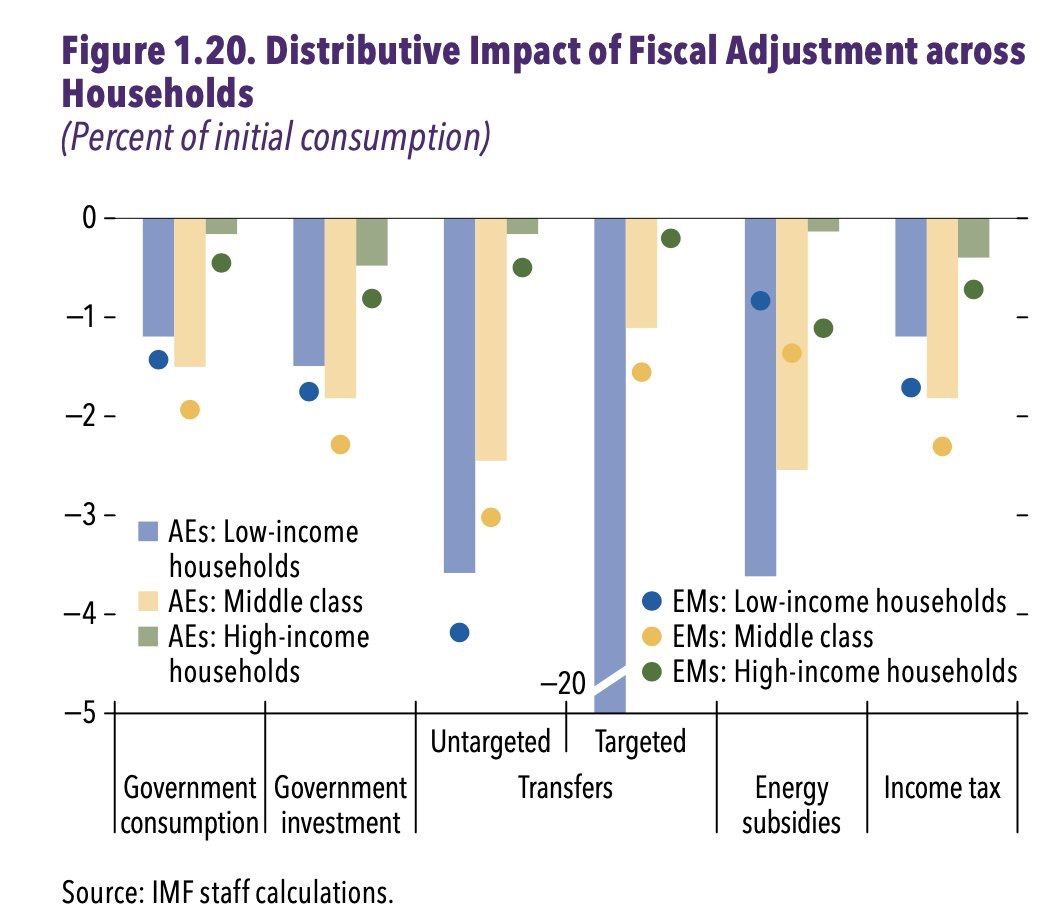

This week’s IMF Fiscal Monitor report released also showed untargeted Government cuts hit the poorest the hardest, and by more proportionally than the cuts themselves.

Meanwhile, other countries with higher debt ratios, including Australia and the US, are not deliberately crunching their economies with unnecessarily harsh budget cuts. They are all running looser fiscal policy with higher levels of public investment.

Scoop du jour: No one for Long Covid

Marc Daalder reports for Newsroom this morning that Te Whatu Ora-Health NZ employs just a tenth of a full-time equivalent employee to deal with Long Covid.

Jenene Crossan, co-founder of Long Covid Support Aotearoa and a co-founder of the ministry-funded Long Covid Registry project, told Newsroom the gap in attention was harming New Zealanders.

“In Aotearoa New Zealand, we’re known for our responsiveness in critical care, yet we fall short when it comes to supporting those with chronic health conditions – a category that’s rapidly expanding and affecting a significant number of New Zealanders,” she said.

“Each year, around 25,000 people are diagnosed with cancer, a condition that receives substantial resources and direct oversight at the ministerial level (as it should). In 2023 alone, 400,000 New Zealanders contracted Covid-19, and conservative estimates indicate that 5 percent of these individuals – around 20,000 people – will develop Long Covid. We believe about 200,000 people currently are experiencing the realities of Long Covid in NZ.”

“While cancer and Long Covid differ in mortality rates, they share a profound impact on quality of life. We resource cancer comprehensively, not only in treatment but in long-term support, yet there is no comparable commitment for Long Covid. This raises a critical question: why aren’t we valuing the lives of those with Long Covid by resourcing it appropriately?”

A Long Covid Expert Group was set up in 2022 but was disbanded later that year. The Ministry’s Long Covid work programme webpage doesn’t list any documents or advice released more recently than November 2022. Marc Daalder for Newsroom

Quote of the day: ‘Living in La-La Land’

(The focus on budgets was) “going to cripple the system. The whole system relies on people overworking.” Tauranga hospital cardiologist Dean Boddington, who is quitting because of burnout. Via RNZ’s Nine to Noon

Solutions News: Good news for Wellington

The Wellington City Mission will open its new $50 million building later today.

The light, airy building stretches five floors and 5500 square metres. Every one of those is carefully considered. Behind every door, around every corner, there's a special space. A suite of showers, washing machines and dryers is tucked behind the cafe.

"If you haven't got anywhere to live, if you're living rough, or if you're staying in a house - and there's many of these in the community - where they don't have hot water, then this is a privilege," said Wellington City Missioner Murray Edridge.

There is a dental surgery, a medical centre, meeting spaces, a chapel - which is already booked for a wedding next month - and on the top two floors, 35 long-term transitional housing apartments, for those who need "a bit of extra support.”

A social supermarket is stocked with quality goods, and runs on a points system, with points allocated depending on the size of a whānau. It is just like walking into a supermarket, and there are even tills - but no cash. RNZ

Chart of the day: So why does NZ want LNG?

The Kākā’s Journal of Record for Thursday, October 31

Health & poverty: The Office of the Chief Coroner released annual suicide statistics finding that Māori remain disproportionately affected by suicide, with Māori 26-44 year olds 2.6 times more likely to commit suicide than non-Māori in the same age group. Ministry of Health deputy mental health director Geoff Short said improving suicide prevention efforts will involve addressing the structural determinants of health. RNZ

Education & poverty: An Education Review Office report found that the number of students chronically absent from school doubled in the last decade, with 55% of students citing mental health as a reason. The report recommended schools take action earlier to identify poor attendance, and work with parents and students to remove barriers to attendance. NZ Herald

Health & Safety: 61 companies including Vector, Air New Zealand, and Fonterra made a joint submission on the Minister of Workplace Relations and Safety’s health & safety review. The submission argues NZ's health & safety system lacks regulatory clarity, and calls on the Government to improve the capacity for inspections and establish a national health & safety data centre.

Health: University of Canterbury lecturer Dr Kseniia Zahrai’s study of 389 social media users found that implicit attitudes, in contrast to deliberate thoughts, drive impulsive use of social media. Zahrai recommended mindful and intentional engagement techniques to reduce potential harm.

Justice & poverty: Erica Stanford announced that survivors of torture at the Lake Alice Child and Adolescent Unit can now lodge a claim with the Ministry of Health for additional reimbursement. The Crown reached a $6.5 million settlement with 95 survivors in 2001, but the payout was reduced by $2.6 million in legal fees. The Government has set aside $2.6 million to address this. RNZ

Climate: NIWA said that its use of machine learning to forecast potential flooding in Westport can reduce prediction times from 24 hours to 1-2 minutes. NIWA produced a 'StoryMap' explaining how the system works.

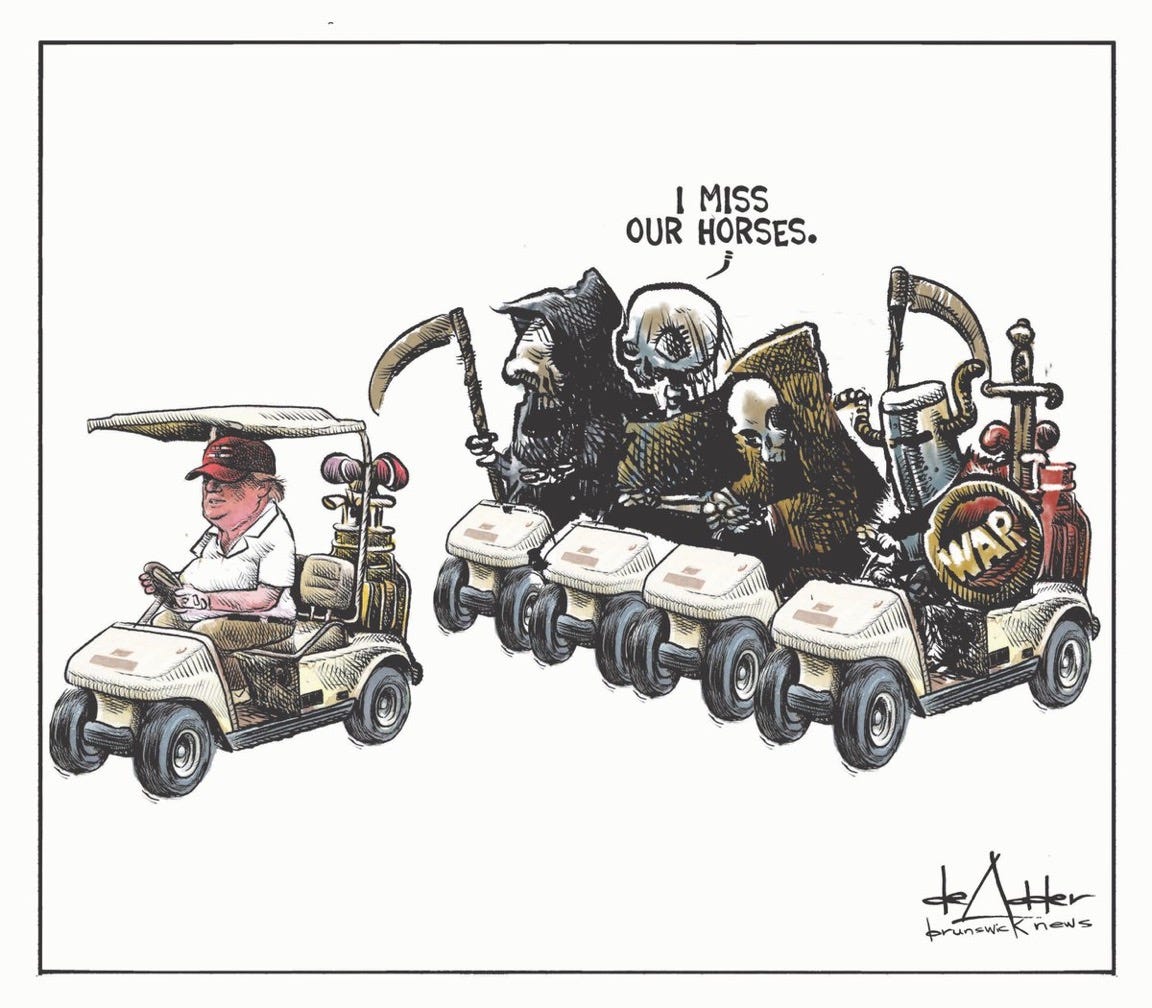

Cartoon of the day: Apocalyptic golf carts

Nature pic of the day: A big feed for our Kereru

Ka kite ano

Bernard