A chorus: Racing to the bottom

West Coast & Gisborne shine in REINZ's landlord league table for capital gain & yield; France stops British trucks at Dover; Global markets shudder on virulent new strain; US finally agrees stimulus

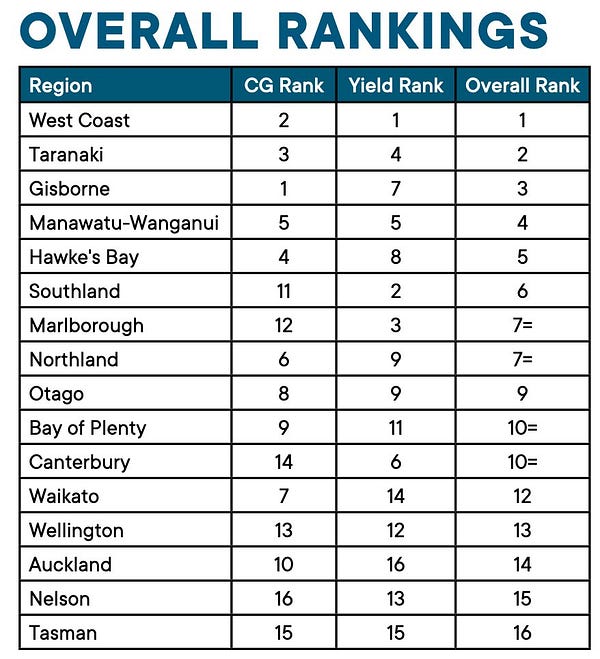

ICYMI: Morena. To emphasise the all-encompassing dominance of rental property investing and the hunt for yield, REINZ highlighted the stellar performances of West Coast and Gisborne in its latest Capital Gains and rental yield report.

Overnight overseas, British stocks and the pound fell sharply after France blocked the arrival of thousands of trucks at Dover for at least 48 hours to stop the spread of a virulent new strain of Covid-19. About 20% of Britain’s food and medical supplies arrive via truck through the Channel Tunnel and via ferries from France. (BBC)

The US Congress finally agreed a US$900b stimulus plan overnight. It includes US$166b in direct cash payments of up to US$600 per adult and child, for individuals making up to US$75,000 a year, and $1,200 for couples making up to $150,000 a year. (Reuters)

In our political economy

In the global political economy

Signs o’ the times news

Longer reads worth your time

Some useful reports

Notable alternative views

Ngā mihi

Bernard

PS: Many thanks to Glenn Jones via Instagram for today’s pic.

PPS: Some fun things

irretrievable house price situation in NZ now. Watch, the government, RBNZ and the banks collectively set policy to remove any possibility of a major house correction in the future. Unfortunately the resources that pay for these houses, renters incomes and incomes in general will be under pressure in NZ for the foreseeable future despite the common view that Covid has not hurt NZ very much! NZ can not prosper by moving funds around that are already in NZ, look outside right now, does the govt believe that NZ's GDP is going to increase with the disruption that is growing in 2021! Based on NZ's comfort with new domestic house debt, the answer is yes! The RBNZ has destroyed any possibility to raise interest for savers, they have created a medium term (at least 5 years) future of very low interest. NZ's growth will most likely come from NZr's returning with new funds back to NZ and join the house buying frenzy.